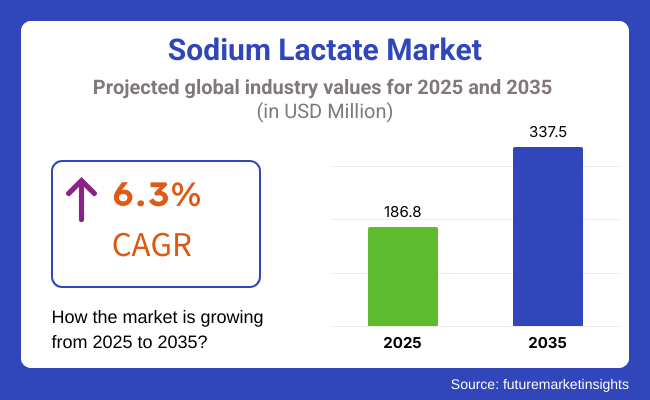

The sodium lactate is expected to grow at a mid to high growth rate in tonnes as demand increases with the food and beverage, pharmaceuticals, personal care, and industrial applications industries. Sodium lactate is having multifunctional properties such as humectant, buffering as well as antimicrobial which is increasing its usage in food preservation, medical and cosmetic applications. The market is expected to expand from USD 186.8 million in 2025 to USD 337.5 million by 2035, reflecting a CAGR of 6.3% over the forecast period.

The sodium lactate market is witnessing significant growth due to increasing demand across various industries, particularly in food preservation, pharmaceuticals, and personal care. Since it is multifunctional acting as a retainer of moisture, with antimicrobial and pH regulation properties it quickly became a black egg of an ingredient.

Consumers today have an increased awareness of clean-label and natural products, and this is driving the demand of sodium lactate, which means a healthy market growth for the overall market accelerated by rapid technological developments and changing industry standards.

Market growth is largely driven by the growing inclination towards natural preservatives in the food sphere, and the increasing adoption of sodium lactate in pharmaceuticals such as intravenous fluids and dialysis. Also, its ability to act as pH regulator, and moisture-retaining agent has led to high demand in cosmetics and personal care products. The expansion of the pharmaceutical industry, combined with an increase in health awareness, is also driving market demand.

The major driving these are increasing utilization of sodium lactate as a natural preservative agent in food processing, pharmaceuticals, and cosmetics. In food, it increases the shelf life, while in medical applications, it is essential as a component of IV fluids and dialysis solutions. Furthermore, its moisturizing and pH balancing properties increase demand in skincare and personal care. Several factors drive clean-label to become more widely adopted across sectors.

Explore FMI!

Book a free demo

The sodium lactate market is dominated by North America, owing to the established food processing, pharmaceutical, and personal care industry. Demand is led by the USA, where sodium lactate is widely used within packaged foods, IV fluids and skincare products.

Upheld by demanding FDA regulations on food safety and pharmaceutical standards, the market is further propelled. Consumer preference for clean-label food and natural preservatives is expected to drive adoption in processed meats and ready-to-eat meals. Moreover, the growing demand for hydration therapy and dialysis solutions in the healthcare sector is beneficial for healthy market growth, causing North America to be a crucial revenue contributor in the global sodium lactate market.

Sodium lactate is another commercially produced salt of lactic acid, and Europe holds the largest market share as the market there is driven by strict food safety regulations and a high consumer demand for natural ingredients. Countries such as Germany, France, and the United Kingdom are at the forefront of sodium lactate consumption in food preservation, personal care, and pharmaceutical use.

An increasing emphasis on clean-label and organic products in the region is accelerating consumer acceptance of sodium lactate in the processed foods and cosmetics market. Moreover, a strong pharmaceutical industry provides demand for IV solutions and medical applications. The expansion of sustainability initiatives with a swing towards bio-based raw materials also fuels innovation and expansion of the market in Europe.

Asia-Pacific leads the sodium lactate market as the fastest growing market, owing to the factors such as rapid industrialization, developing food processing industry and socio-economic factors including enhanced consumer awareness. Countries such as China, India and Japan are the main contributors of this trend the increasing demand for processed and convenience foods, pharmaceutical and personal care product.

Urbanization and the rise of the middle class have driven up packaged food consumption, where sodium lactate is a common preservative. The growing healthcare sector in the region also fuels the demand for IV fluids and medical applications. The increasing demand for natural skincare and clean-label cosmetics all across Asia-Pacific is further driving market expansion.

he Rest of the World (RoW) sodium lactate market, comprising mainly Latin America, the Middle East, and Africa, is witnessing stagnant growth owing to an increasing food processing sector, growing pharmaceutical investments, and rising awareness among consumers. Brazil and Mexico are seeing a surge in demand for preservatives in meat & dairy, while adoption in cosmetics and personal care rises in the Middle East.

The growing healthcare infrastructure in Africa is fuelling demand for IV solutions and medical applications. Challenges such as the lack of regulatory frameworks exist, and growth could be seen in the form of high foreign investments and technological innovations.

Challenges

Availability of Alternative Preservatives

Sodium lactate is facing tough competition from other preservatives alternatives like sodium acetate, potassium lactate, and other synthetic additives in the sodium lactate market. Many food and beverage manufacturers turn to alternatives because of cost, formulation, and consumer-desired aspects. In addition, increasing use of natural preservatives like vinegar and rosemary extracts is hindering the sodium lactate market.

With clean-label and organic formulations taking the cake, suppliers has to step outside the box to communicate the benefits of sodium lactate multifunctionality, mild taste, superior antimicrobials desirability in order to maintain a position in the market and ensure demand for the long term.

Fluctuations in Raw Material Prices

Sodium lactate is made from lactic acid from the fermentation of natural sources like corn and sugar beets. Prices of these raw materials can also vary, driven by climate conditions, agricultural yields, and supply chain disruption, which impacts the overall cost of sodium lactate production.

Moreover, geopolitical influences, trade barriers, and increasing transportation costs also add to the volatility of prices. manufacturers find this makes it more challenging to keep profit margins and competitive pricing. To address this, companies are asking what sustainable sourcing strategies, production efficiency improvements, and alternative feedstock’s might stabilize costs and help ensure consistent supply.

Opportunities

Growing Demand for Clean-Label and Natural Ingredients

The rising popularity for clean-label, natural and minimally processed ingredients as consumers seek more health-conscious foods is creating a substantial opportunity for sodium lactate. Food makers are in a growing number switching from synthetic preservatives to natural ones, and sodium lactate’s capacity to increase shelf life, hold in moisture and control pH make it a clear option.

Moreover, growing organic food and beverage industry also contributes to the expansion of sodium lactate. Brands can take advantage of this trend by marketing sodium lactate as a natural, multifunctional ingredient, as well as by investing in certifications, such as going vegan, and sustainable sourcing to make it more appealing in the market and increase trust to consumers.

Expanding Applications in Pharmaceuticals and Personal Care

With the growing use of sodium lactate in several pharmaceutical and personal care applications, we have a big opportunity for growth. Sodium lactate plays a key role in the medical field across interventional and irrigation fluids, dialysis solutions, and supplementary electrolyte replacement, and demand is expected to rise between now and the future against an increasing aging population and healthcare infrastructure.

In cosmetics and personal care, it is widely sought for its moisturizing, pH-balancing and antimicrobial properties used in skin care, hair care and hygiene products. On a global scale, with gentle and skin-friendly formulations already being the order of the day, sodium lactate will witness significant incorporation as a hydrating and stabilizing agent, which will further benefit the growth of the sodium lactate market.

The sodium lactate market has witnessed steady growth from 2020 to 2024, with demand primarily stemming from food and beverage, pharma and personal care application industries. Sodium lactate has appeared in quite a few roles as a multifunctional ingredient and has gained some traction as a humectant, pH regulator, and antimicrobial agent.

Market growth has also been driven by regulatory approvals and the increasing demand for natural and bio-based preservatives. Looking ahead to 2025 to 2035, the market is expected to see significant advancements in production efficiency, further sustainability initiatives and broader applications in new industries.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Approval by FDA and EFSA for use in food preservation. Stringent guidelines in pharmaceuticals and cosmetics. |

| Technological Advancements | Better fermentation methods for highly pure production. |

| Industry-Specific Demand | Food industry for moisture retention and preservation, pharmaceuticals for IV solutions, and cosmetics for hydration. |

| Sustainability & Circular Economy | Early adoption of bio-based production. Limited focus on carbon footprint reduction. |

| Production & Supply Chain | Reliable on traditional fermentation methods, regional sourcing of raw material tests. |

| Market Growth Drivers | Growing need for natural food preservatives, increasing implementation in medical and skincare applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent sustainability requirements, regulations on synthetic preservatives, and increasing use in clean-label products. |

| Technological Advancements | AI-driven process optimization, bio-based innovations, and reduced carbon footprint production. |

| Industry-Specific Demand | Diversification towards plant based food products, biotech products & skin care formulations. |

| Sustainability & Circular Economy | Focus on sustainable chemistry, zero-waste manufacturing processes, and circular supply chain strategies. |

| Production & Supply Chain | AI-based supply chain management, diversification of sources for lactic acid sourcing, and local production hubs. |

| Market Growth Drivers | Increasing demand for plant-based, organic food products, innovative medical formulations, and sustainable packaging solutions. |

The USA sodium lactate market is driven by its widespread use in the food, pharmaceutical, and personal care industries. Increasing need for natural preservatives in processed foods and hydration solutions in medical applications is driving market growth. Also, the growing acceptance of clean-label ingredients is sustaining growth in the market. Strict FDA regulations further ensure product quality and safety, leading to consistent growth. Improvements in fermentation technologies also contribute to greater process efficiencies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

In the UK, sodium lactate demand is rising due to increasing consumer preference for natural food additives and sustainable preservatives. The pharmaceutical and personal care industries add significantly, with sodium lactate present in IV solutions and some skincare formulations. The demand for sodium lactate with high quality is driven by regulatory framework so as to say by the FSA (Food Standards Agency). Emphasis on clean labels, plant-based and functional offerings drives continued market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

The EU sodium lactate market is expanding due to stringent food safety regulations and increasing demand for natural preservatives in the food and beverage sector. European Food Safety Authority (EFSA) advances clean-label solutions, it fuels sodium lactate adoption. Market growth is also driven by increasing demand in the cosmetic and pharmaceutical industries, especially for skin hydration products and medical applications. New opportunities for manufacturers will also emerge from sustainability initiatives supporting bio-based chemicals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan sodium lactate market is driven by the key focus areas of pharmaceutical and food industries of the country. Sodium lactate is gaining more uses as a pH regulator and a humectant, therefore it becomes a useful ingredient in the processed food and cosmetics industries.

The growing elderly population also is increasing the need for the medical-grade sodium lactate in IV solution and dialysis treatments. Innovation, especially in fermentation technologies, further enhances production efficiencies and supports market growth in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The sodium lactate market in South Korea is steadily growing owing to the expanding food processing and cosmetic markets. The demand for natural and functional ingredients in skincare products is particularly strong, given South Korea's leadership in the global beauty industry. In addition, the sodium lactate is increasingly used in the food industry to be used as a specific preservative in meat products & ready-to-eat meals. Government support of bio-based chemicals also continues to drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Liquid Sodium Lactate Dominates Due to Its Versatility and High Demand

Liquid sodium lactate is the most widely used form due to its ease of integration into various applications. It serves as essential ingredient across the food and beverage sector, it functions as a pH regulator, humectant, and preservative. Its isotonic property is relevant to electrolyte balance in clinical nutrition and dialysis solutions.

The liquid is preferred in personal care products and cosmetics as it has much better solubility and potential skin hydration. Rising need for natural preservatives and sustainable food additives are also enhancing the liquid sodium lactate market, particularly in North America and Europe.

Powder Sodium Lactate Gains Traction for Its Stability and Extended Shelf Life

Sodium lactate is also delivered in powder form which is becoming increasingly popular as it is very stable, has a long shelf life and is convenient for storage and transportation. It is commonly utilized in dry formulations such as food preservation, nutritional supplementation, and drug utilization. The powder is commonly used for industrial applications, such as with cleaners and detergents, due to its favourable properties for controlled solubility.

Demand for this segment is driven by the increasing focus to reduce liquid transportation costs and improve product stability under harsh conditions. Sodium lactate powder are also increasingly employed in cosmetic formulations, including anti-aging and moisturizing products, which has supported the growth of its market sales.

Food & Nutritional Supplements Drive Market Growth Due to Preservative and Health Benefits

In food and nutritional supplements, sodium lactate is extensively used as a natural preservative and moisture-retaining agent. Its antimicrobial properties are used to preserve the shelf life of processed meat, dairy and baked goods, while keeping them fresh. Sodium lactate widely used in sports and clinical nutrition plays an indispensable role in hydration and electrolyte balance, with inclusion in supplements aimed for performance enhancement.

With an increased demand for clean-label and natural food additives, its use in organic and minimally processed foods is on the rise. High growth regions like Asia-Pacific (China and India), with increasing demand of processed food, is a prominent factor in the growth of healthcare food service market.

Clinical Nutrition Emerges as a Critical Application for Electrolyte Balance

The clinical nutrition sector is a vital driver for the expansion of the sodium lactate market, due to which its importance in intravenous solutions and parenteral nutrition. Which is widely used for patients requiring electrolyte replacement (e.g. acidosis, dehydration) in hospitals.

Because of the role of sodium lactate in buffering blood pH levels, it is a necessary part of medical treatments. As chronic disease prevalence, surgical procedures, and intensive care treatments rise, clinical applications of sodium lactate are in higher demand. This segment is dominated by North America and Europe owing to the advanced healthcare infrastructure and rising hospital admissions.

The sodium lactate market is primarily driven by its use in the food, pharmaceutical, and personal care industries. Sodium lactate (lauryl lactate) the sodium salt of lactic acid, acts as a natural preservative, humectant, and buffering agent. The surging demand for clean-label and natural ingredients among consumers has driven its acceptance, especially in processed foods and beverages.

In addition, it plays a huge role in many intravenous (IV) solutions and medical applications, which truly makes it a priority in health care. Sodium lactate is also used in the cosmetic industry, where it serves as a humectant and acidifier capable of attracting moisture into the skin.

Faced with tighter regulations and rising expectations, market players are also implementing sustainable production methods and pursuing innovative formulations. The sodium lactate market is about to grow to meet the increasing technological and consumer demand in industrial and commercial applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Corbion N.V. | 15-20% |

| Jungbunzlauer Suisse AG | 12-16% |

| Galactic S.A. | 10-14% |

| Merck KGaA | 8-12% |

| Jindan Lactic Acid Technology Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Corbion N.V. | Major producer of sodium lactate for food preservation, medical, and personal care applications. Strong focus on sustainability and biobased solutions. |

| Jungbunzlauer Suisse AG | Specializes in high-purity sodium lactate for pharmaceutical and cosmetic use. Invests in eco-friendly production methods. |

| Galactic S.A. | Sodium lactate offers food and beverage customers an organic solution with clean-label properties. |

| Merck KGaA | Manufacturer of pharmaceutical-grade sodium lactate used in IV solutions and medical applications. |

| Jindan Lactic Acid Technology Co., Ltd. | Leading supplier for industrial applications, focusing on cost-effective production and worldwide supply chain presence. |

Key Company Insights

Corbion N.V.

Corbion N.V. is a market leader in sodium lactate production, catering to food preservation, pharmaceutical, and personal care sectors. The company undertakes extensive research and development, spurring innovation in biotechnology and fermentation-based production methods. Corbion is sustainability-driven, axial biobased solutions in centuries of its product lines reduce the environmental impact.

Corbion is also extending its reach around the world through targeted acquisitions and alliances that strengthen its supply chain and portfolio. Corbion; Corbion is uniquely positioned with its clean-label solutions to meet the growing demand for natural and high-purity sodium lactate in many industries.

Jungbunzlauer Suisse AG

Pharmaceutical and high-purity sodium lactate for medical and personal care applications. It spends a considerable amount each year on low-carbon, sustainable production processes and void realising restrictive environmental regulations. These facilities, combined with its competitive edge in product innovation and high-quality standards, are ultimately what have given Jungbunzlauer a strong foothold in both European and North American markets.

Its commitment to eco-friendly production to a more cost-effective process, with particular reference to their position as a key supplier to pharmaceutical manufacturers and food producers seeking clean-label solutions.

Galactic S.A.

Galactic S.A. is a major player in the food and beverage sector, providing sodium lactate for preservation and flavour enhancement. As health-conscious consumers and regulators seek natural ingredients, the company has developed clean-label and organic solutions.

Galactic works closely with food manufacturers to create unique formulations that provide extended stability and an improved shelf life. The company maintains the leading edge in sustainable and ethical production techniques, thanks to its worldwide supply network which enables consistent quality and availability across markets.

Merck KGaA

Merck KGaA manufactures and markets pharmaceutical-grade sodium lactate, which is primarily used in IV solutions and dialysis. The company has a strong focus on regulatory compliance and quality control, allowing its products to meet the highest medical requirements.

Merck KGaA has established itself in high-end pharmaceutical, and research markets by utilizing its wealth of experience in the fields of chemical and life sciences innovation. As a trusted supplier to hospitals and scientific institutions around the world, Merck KGaA invests in state-of-the-art technologies Set up a global distribution network.

Jindan Lactic Acid Technology Co., Ltd.

Jindan Lactic Acid Technology Co., Ltd. is a key supplier of industrial-grade sodium lactate, catering to diverse applications in chemical, textile, and materials industries. The company has strong production processes that keep costs down, as well as a large export presence, especially in the Asia-Pacific. Jindan continually improves its supply chain efficiency to address increasing demand while keeping prices competitive.

As it prioritizes both scalability and the cutting-edge sodium lactate technology, Jindan provides worldwide access to sodium lactate for large-scale industrial applications with a significant contribution to the global sodium lactate market.

The global Sodium Lactate market is projected to reach USD 186.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.3% over the forecast period.

By 2035, the Sodium Lactate market is expected to reach USD 337.5 million.

The liquid segment is expected to dominate the market, due to its high solubility, ease of formulation, extended shelf life, and widespread use in pharmaceuticals, food preservation, and personal care applications.

Key players in the Sodium Lactate market include Corbion N.V., Jungbunzlauer Suisse AG, Galactic S.A., Merck KGaA, Jindan Lactic Acid Technology Co., Ltd., Cargill.

In terms of Product Form, the industry is divided into Powder, Liquid

In terms of Application, the industry is divided into Beverages, Food & Nutritional Supplements, Clinical Nutrition, Dialyses Solutions, Personal Care & Cosmetics, Cleaners & Detergents

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.