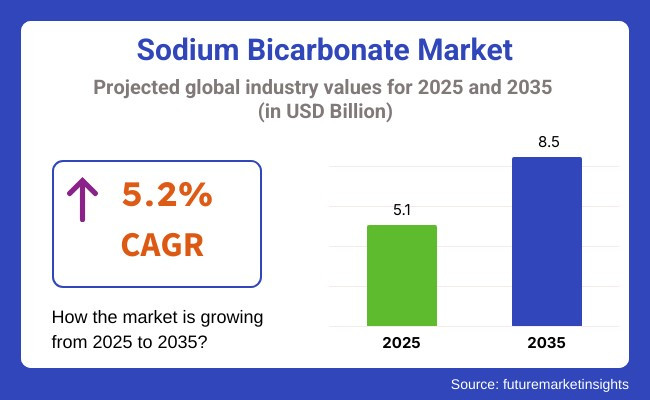

The sodium bicarbonate market is likely to advance gradually, its estimated value being USD 5.1 billion in 2025, anticipated to reach around USD 8.5 billion by 2035, growing at a CAGR of about 5.2%. The growth is driven due to its extensive use across sectors like food, pharma, agriculture, and environmental solutions.

Food and beverage is one of the largest users of the industry. It is widely used as a leavening agent in baked products and as a pH adjustment agent in processed foods and soft drinks. Increased demand worldwide for packaged and convenience foods continues to propel steady consumption in this industry.

The product is also critical in animal feed blends. It supports maintaining healthy pH stability in animal feed for livestock and poultry, enhancing nutrient absorption and performance. With increasing consumption of meat and dairy products around the world, demand for feed-grade sodium bicarbonate is on the rise, particularly in North America, Europe, and emerging Asian industries.

Technical advancements have provided the means of producing high-purity grades suited to specialized industries. These have included electronics manufacturing, laboratory chemicals, and synthesizing pharmaceuticals. Fine ultra-pure forms of sodium bicarbonate products are assisting in their wider application for precision and high-spec industries.

Explore FMI!

Book a free demo

The industry is expanding at a fast pace due to the expansion of demand in many sectors such as food & beverage, pharmaceuticals, and environmental application. The progress is being driven by requirements such as the speeding up need for functional and cost-effective alternatives, stringent government regulations, and the development of usage in emerging industries. The industry is dominated by a vast portfolio of product types specialized by application, end-use industry, and regional distribution.

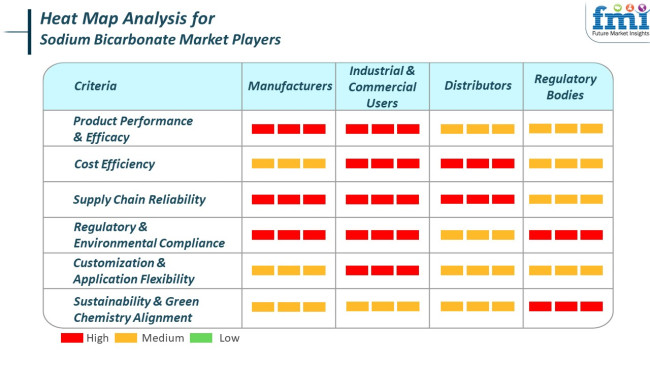

Producers are keen on producing high-performance products that satisfy the high standards of industrial and commercial customers. They invest in environmentally friendly production processes and strive to provide a secure supply chain to meet the increasing global demand.

Regulatory authorities enact environmental and safety regulation compliance, triggering the use of green and eco-friendly solutions. Regulatory Authorities can play a key role in the industry through regulations that spur the application of green technologies and reduce the environment's footprint in industrial activities.

From 2020 to 2024, the consistent demand growth in all industries, such as food and beverage, pharmaceuticals, animal feed, and flue gas desulfurization, was recorded in the industry. The pandemic accelerated the demand in the health and hygiene sectors, further enhancing usage in antacids and cleaning agents.

The food industry also had a considerable impact on the industry as bakery and packaged food consumption increased. Nevertheless, concerns about the environmental effects of CO₂ generated by value-added processes started to pressure the food and beverage industry to move toward more sustainable business practices, particularly in countries with strict climate policies.

From 2025 to 2035, the industry will undertake a more strategic transformation and will be catalyzed by sustainability, diversification of industry & regulation. Green manufacturing processes such as carbon capture integration into factory plants are gaining traction. Besides, Urbanization and the growing air quality regulations will promote new industries for water treatment and flue gas desulfurization consumption.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Cosmetics, pharmaceuticals, silicone elastomers, coatings. | Electric vehicles, nanotechnology, 3D printing, sustainable drug delivery and cosmetics. |

| Improved thickening efficiency and dispersion in formulas. | Green manufacture, nanostructuring , and development of high-purity grades. |

| Early-stage environmental issues and restricted green synthesis routes. | Transition to green manufacturing practices and circular economy inclusion. |

| Compliance with industrial safety and product development regulations. | Stringent eco-regulatory standards favoring biocompatibility and clean labeling. |

| Use in conventional applications including coatings and sealants. | Use in newer technologies like lithium-ion batteries and medical-grade devices. |

| Asia-Pacific demand concentrated for production purposes. | Anticipated growth globally, with North America and Europe focusing on sustainable and high-performance applications. |

The industry, which forms an essential segment of food and beverage, pharmaceutical, personal care, and environmental applications industries, is anticipated to undergo steady growth. However, it has certain current and future risks that could influence its trajectory.

One of the significant current risks is the raw material price volatility, namely soda ash and ammonia. Price fluctuations of such materials may influence production cost and profitability levels to manufacturers. The industry is also vulnerable to supply chain interference through geopolitics and transport difficulties, resulting in inconsistency of supply and price instability.

In the future, the industry may be under threat from environmental regulation and sustainability trends. With governments around the world imposing stricter emissions controls and preferring green products, manufacturers are able to be compelled to invest in cleaner technology and sustainable raw material sourcing.

Even though the industry is abounding with prospects for growth, stakeholders will have to surmount risk threats stemming from raw material price volatility, supply chain outages, regulatory pressures from environmental concerns, and competition from replacement products. Forethought measures in response to such risk threats will be the ingredients for long-term success in such a dynamic business.

The industry has been segmented into different grades: food grade and technical grade; these are two of the leading segments. Food-grade sodium bicarbonate is expected to account for a 35% share of the industry as of 2025, while technical grade is projected to account for 30%.

Food-grade sodium bicarbonate is mainly used in the food and beverage industry as a leavening agent, acidity regulator, and pH buffer. It is extensively used in bakery food items such as cakes, cookies, and breads, where it helps in the dough rise and improves texture. The compound is also used in effervescent beverages to balance the flavor.

The growing demand for convenience food and the increasing industry of baking worldwide has successfully led to strong growth in this segment. Companies such as Church & Dwight Co., Inc., Tata Chemicals, and Solvay produce and supply food-grade sodium bicarbonate under well-known brands, such as Arm & Hammer, which is trusted in both retail and industrial baking.

In addition to that, technical-grade caters to various industrial applications, including flue gas treatment, leather tanning, textiles, rubber, and chemical manufacturing. It is a mild alkali and buffering agent, especially in pollution control systems, wherein acidic emissions from power plants or industrial facilities are neutralized.

Technical grade is found in products such as detergents and fire extinguishing powders. Some soda ash manufacturers in this category are the CIECH Group, AGC Chemicals, and Tosoh Corporation, which provide custom grades to fulfill certain industrial applications.

The industry has been largely delineated in terms of its form. Thus, powder and pellets are the main forms by which sodium bicarbonate is classified. The powdered segment is expected to grow strongly in the lead-up to 2025 and command a large 60 percent share of the industry, while pellets are expected to enjoy a smaller 20 percent allocation.

Powdered form is recognized for its versatility, very fine particle size, and ease of handling. It finds uses in baking, pharmaceuticals, fire extinguishers, flue gas treatment, and personal care products. The powdered composition can easily dissolve in water and immediately react, allowing for the greatest use in food-grade and medical-grade applications, such as antacids and toothpaste formulations. For food, health, and environmental applications, demand for the powdered form is huge. Big producers, such as Solvay, Tata Chemicals, and Church & Dwight, supply powdered form in extremely high grades for these end users.

The less popular pellet form has nevertheless been finding acceptance in other industrial applications. These are mainly used in processes needing controlled rates of dissolution or minimal dusting, such as some pharma manufacturing and industrial cleaning applications. The pellets to be stored and handled masse would also suit large-scale industrial applications. CIECH Group and Natural Soda LLC industry pelletized mainly for technical and industrial applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| UK | 3.7% |

| France | 3.8% |

| Germany | 3.9% |

| Italy | 3.7% |

| South Korea | 4% |

| Japan | 3.9% |

| China | 4.1% |

| Australia | 3.8% |

| New Zealand | 3.7% |

The USA industry is projected to register a CAGR of 3.9% during the period 2025 to 2035. The growth is due to sustained demand in pharmaceuticals, food processing, treatment of flue gas, and domestic use. The buffering capacity of the compound, its multifaceted uses, and its low cost guarantee its central role in applications between antacids and air pollution control.

Companies such as Church & Dwight Co., Solvay Chemicals Inc., and Tata Chemicals North America control technical-grade and food-grade production. Ongoing environmental regulation to control SO₂ emissions from power plants further drives demand in industrial applications [Source: USA Environmental Protection Agency].

UK is anticipated to have a CAGR of 3.7% over the forecast period. Major demand industries are pharmaceuticals, food additives, and wastewater treatment. Use in effluent neutralization and animal feed formulas contributes to uniform consumption levels.

Suppliers like Natrium Limited and local distributors across the globe are maintaining supply flow by strengthening distribution networks and meeting British Pharmacopoeia and food safety requirements. The use of the material in scrubbing emissions and environmental protection supports national decarbonization efforts [Source: UK Department for Business and Trade].

France is expected to grow at a CAGR of 3.8%. The compound has a stronghold in its wide application in bakery, dairy, and health supplements. The pharmaceutical and healthcare sectors also make significant contributions due to the compound's application in effervescent tablets and antacid preparations.

Producers such as Novacarb (Seqens Group) are leading product differentiation with high-purity grades used in medical and specialty food uses. National emphasis on reducing industrial waste and maximizing clean manufacturing practices forms the basis for the long-term future of the industry adoption [Source: European Chemicals Agency].

Germany's industry is also set to increase at a CAGR of 3.9%. Strong environmental applications such as flue gas desulfurization and chemical manufacturing are among the driving reasons. Demand from the end-use in food and personal care is also strong because of the customer preference towards mild and non-toxic substances.

Solvay and CIECH Soda Deutschland are industry leaders investing in low-emission manufacturing processes and capacity increases to meet the regional and export industries. Policy conformity with EU sustainability guidelines and industrial management of emissions continues to be the cornerstone of industry stability [Source: German Federal Environment Agency].

Italy will expand at a CAGR of 3.7%. Food-grade application in bakery food and processed food, as well as in personal care and water treatment, sustains industry demand. The multifunctionality as a deodorizer and pH buffer makes it a staple in household products.

Italian producers and home formulators are simplifying supply chains to satisfy the growing demand for natural and allergy-free cleaning and wellness products. Green regulation of the food processing and chemical industries is predicted to underpin continued growth [European Commission - Chemicals Strategy, Source:].

South Korea is projected to grow at a CAGR of 4%, driven by increasing use in industrial gas cleaning, personal care, and pharmaceutical applications. Its capacity to remove acidic gases from emission streams complements environmental regulatory initiatives and clean energy shifts.

LG Chem and OCI Company Ltd. are upgrading technical-grade for high-efficiency emission scrubbing and specialty use. Increased uptake in packaged healthcare and animal care also supports industry growth [Source: OECD].

Japan is anticipated to register a growth rate of 3.9% CAGR. The industry has a steady demand for high-precision pharmaceutical formulation, cosmetic materials, and ecological applications. The non-reactive, biocompatible character of the compound fits well with dermal and gastrointestinal product lines.

Firms like Tosoh Corporation and Asahi Kasei Corporation are focusing on ultra-refined grades for sensitive medical and personal care applications. Government subsidies on eco-friendly chemicals and aging population trends are expected to underpin consumption in healthcare segments [Source: IMF].

China is anticipated to lead growth with a CAGR of 4.1% based on robust demand in food processing, metallurgy, flue gas treatment, and agriculture. Sodium bicarbonate finds widespread application in livestock feed, aluminum processing, and pharmaceutical production, supporting its cross-sectoral importance.

Producers such as HailianSanyuan and HaohuaHonghe Chemical are increasing production to meet domestic and export demand. National policies favoring clean industry operations and environmental treatment facility expenditure are the drivers of industry growth [Source: UN].

Australia is expected to expand at a CAGR of 3.8%. The compound experiences consistent demand for packaged food, animal health, water treatment, and home cleaning products. It also serves as a chemical-free cleaning option and is being increasingly accepted in environmentally regulated industries.

Formulators and importers are increasingly using sodium bicarbonate in low-impact agrochemicals and household chemical lines. Industrial emission goals at the national level and eco-labeling regulations are maintaining demand in regulated segments [Source: Australian Department of Agriculture, Fisheries and Forestry].

New Zealand will grow at a CAGR of 3.7%. Applications vary from food-grade usage in bakery and meat preservation to the control of pH in dairy applications and treatment product applications in rural and sanitary veterinary industries. Emphasis on low-processing and organic foods sustains the trend.

Local wholesalers have strong import relationships with Asian and Australian producers to meet growing purity and bio-compatibility standards. Government-initiated clean farming and waste management programs ensure material relevance persists longer in the long term [Source: New Zealand Ministry for Primary Industries].

The competition for the industry is tough as Solvay SA, Merck KGaA, Tata Chemicals Ltd., GHCL Ltd., and Ciech SA emerge as top contenders. Their emphasis would include production capacity expansion, sustainability, and pure manufactured for varying applications in pharmaceuticals, foods and beverages, and industry.

As a leader in this leader, Solvay SA has built itself by investing in sustainable production technologies, including carbon capture and utilization (CCU) techniques that reduce emissions in sodium bicarbonate making. Meanwhile, Merck KGaA seems to be redirecting efforts towards high-purity bicarbonate solutions, mainly in pharmaceutical and laboratory applications, with the recent establishment of new production facilities in Europe. Tata Chemicals Ltd.'s long-standing approach to penetrating industries worldwide includes strategic acquisitions and product innovation. Recently, it enhanced its bicarbonate product line to support food processing and healthcare applications.

However, GHCL Ltd. has strengthened its competitive advantage by constructing its manufacturing facility in India to meet the growing domestic and international demand. Its portfolio is so profuse that it offers one of its products, sodium bicarbonate, to various treatment applications in flue gas and purifications of water. Also, in the South Asian industry, Nirma Ltd. and DCW Ltd. have kept competition high on their side because they utilize cost-efficient production methods to stay price-competitive.

The global industry is marked by strong investment in pharmaceutical-grade sodium bicarbonate production, with the cosmetic giants emphasizing various methods of stringent regulatory compliance along with new-age purification processes. Long-term supply agreements are also in favor of the end-user industries, thus further boosting their competitive strength in the industry.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Solvay SA | 18-24% |

| Merck KGaA | 14-20% |

| Tata Chemicals Ltd. | 12-18% |

| GHCL Ltd. | 10-15% |

| Ciech SA | 8-12% |

| Other Players | 25-30% |

| Company Name | Offerings & Activities |

|---|---|

| Solvay SA | Leading sustainable production with carbon capture technologies. |

| Merck KGaA | Focuses on high-purity bicarbonate solutions for pharmaceutical and laboratory applications. |

| Tata Chemicals Ltd. | Expanding its bicarbonate product line for food processing and healthcare. |

| GHCL Ltd. | Strengthening production capabilities in India to meet increasing demand. |

| Ciech SA | Diversifying into environmental applications, including flue gas treatment. |

Key Company Insights

Solvay SA (18-24%)

Continues to lead the industry with innovations in low-emission production and investments in sustainable bicarbonate technologies, catering to industries requiring high-purity solutions.

Merck KGaA (14-20%)

Remains a dominant player in pharmaceutical and laboratory-grade, with recent expansions in European manufacturing capabilities.

Tata Chemicals Ltd. (12-18%)

Expanding its bicarbonate offerings for food and healthcare industries, leveraging its strong supply chain in emerging industries.

GHCL Ltd. (10-15%)

Increased production capacity in India, ensuring domestic and international supply security amid rising demand.

Ciech SA (8-12%)

Integrating sodium bicarbonate into environmental solutions, such as emissions control and water treatment, strengthens its European presence.

Other Key Players

The industry is estimated to reach USD 5.1 billion by 2025.

The industry is projected to grow to USD 8.5 billion by 2035.

China is expected to grow at a rate of 4.1%.

Food-grade sodium bicarbonate is the leading segment, owing to its widespread use in baking, food preparation, and as an antacid in healthcare.

Key players in this industry include Solvay SA, Merck KGaA, Tata Chemicals Ltd., GHCL Ltd., Ciech SA, Nirma Ltd., DCW Ltd., Seqens Group, Tosoh Corporation, Hawkins, Inc., Vitro, and Church & Dwight Co., Inc.

By grade type, the industry is segmented into pharmaceutical grade, technical grade, food grade, and feed grade.

By form, the industry is categorized into powder, pellets, slurry, and liquid.

By end use, the industry is segmented into processed food, pharmaceuticals, personal care products, chemicals, agrochemicals & nutrients, detergent, fire extinguisher, leather & dyeing, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.