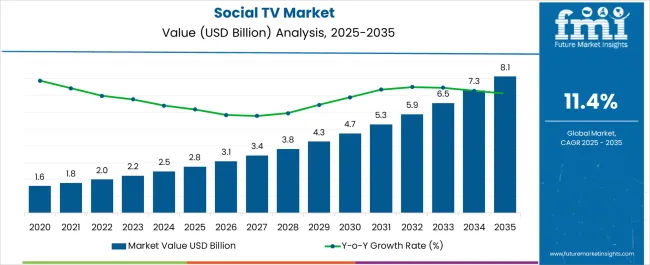

The Social TV Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period.

| Metric | Value |

|---|---|

| Social TV Market Estimated Value in (2025 E) | USD 2.8 billion |

| Social TV Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The social TV market is expanding rapidly, reflecting the convergence of broadcasting, digital streaming, and interactive social engagement. Industry reports and media company disclosures have emphasized the growing integration of real-time audience participation features within television and streaming platforms, reshaping how viewers consume content. Broadcasters and streaming providers are increasingly leveraging social TV solutions to boost viewer engagement, retention, and advertising value.

Technological advancements such as second-screen applications, live polls, and synchronized social media feeds have improved interactive experiences, strengthening audience involvement during live events. Strategic collaborations between media firms and technology providers have accelerated the deployment of scalable solutions across global markets.

The demand for social TV has been further amplified by the surge in live programming, sports broadcasts, and reality shows, which rely heavily on real-time audience interaction. Looking ahead, the market is expected to sustain momentum through AI-driven personalization, predictive analytics, and deeper integration of social networks with traditional broadcasting, positioning social TV as a core enabler of immersive entertainment experiences.

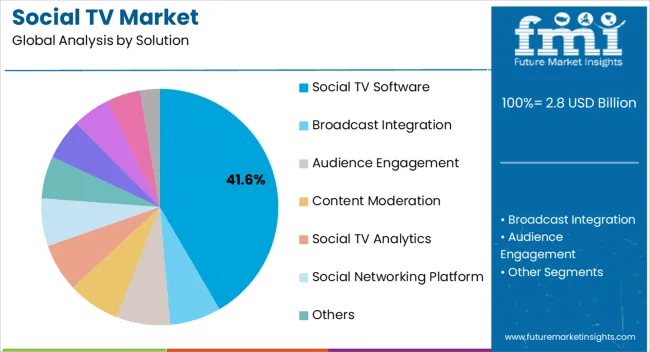

The Social TV Software segment is projected to account for 41.60% of the social TV market revenue in 2025, establishing itself as the leading solution category. Growth of this segment has been driven by the ability of software platforms to deliver scalable, customizable, and interactive features that enhance viewer participation.

Broadcasters and streaming providers have increasingly implemented software-driven solutions to integrate social media conversations, real-time analytics, and personalized content feeds. Software innovations have also supported the seamless integration of advertising and sponsorships into interactive formats, creating additional revenue streams for media companies.

The flexibility of cloud-based platforms has enabled rapid deployment and real-time updates, making software solutions highly adaptable to evolving viewer preferences. As demand for interactive programming intensifies, the Social TV Software segment is expected to maintain its leadership, supported by continuous advancements in AI, machine learning, and data-driven engagement technologies.

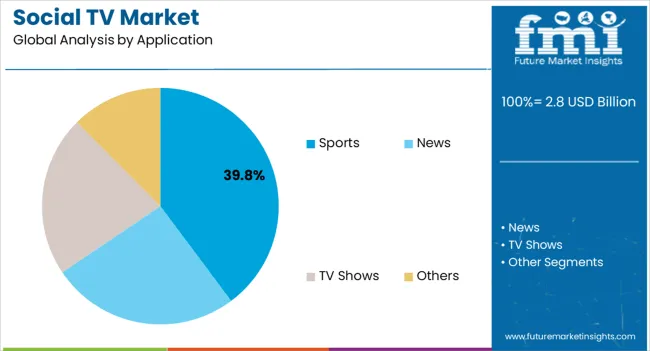

The Sports segment is projected to contribute 39.80% of the social TV market revenue in 2025, positioning itself as the dominant application category. This growth has been driven by the inherently interactive nature of sports broadcasts, where real-time commentary, live statistics, and fan discussions play a central role in enhancing viewer experiences.

Sports leagues, broadcasters, and streaming services have increasingly utilized social TV to integrate live polls, fantasy sports updates, and social media interactions, creating immersive experiences for fans. Reports from sports media organizations have highlighted that social TV significantly boosts audience engagement during major events, driving higher advertising revenues and sponsorship opportunities.

The global appeal of live sports, coupled with fans’ growing reliance on mobile devices for second-screen interactions, has reinforced the segment’s strength. With the continued expansion of digital sports broadcasting and real-time fan engagement strategies, the Sports segment is expected to remain at the forefront of social TV adoption.

An 11.5% CAGR was experienced between 2020 and 2025 in the social TV market. Global demand for Social TV is predicted to increase at a CAGR of 12% from 2025 to 2035.

The popularity of sporting events is evident among a wide range of individuals. According to statistics, Americans spent more than 1.6 billion dollars on sports events from 2020 to 2020.

A significant spike in sales was caused by a rise in TV viewership following the COVID-19 outbreak last year. Due to social conventions that discourage people from leaving their homes, e-commerce firms have been shipping non-essential items for some time now.

| Historical CAGR from 2020 to 2025 | 11.5% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 12% |

Researchers found that 40% of TV viewers engage in social media while watching television. Viewers are now sharing and talking about specific shows on social media as they watch them, which has led to a new phenomenal growth.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by the United States and the India. Through 2035, these two countries will dominate the market, with a size of USD 8.1 billion and USD 2 billion.

Expected Market Values in 2035

| South Korea | USD 1.3 billion |

|---|---|

| India | USD 2 billion |

| United States | USD 8.1 billion |

| China | USD 1 billion |

| United Kingdom | USD 900 million |

Forecast CAGRs from 2025 to 2035

| South Korea | 7.4% |

|---|---|

| India | 11.8% |

| United States | 9% |

| China | 6.2% |

| United Kingdom | 6.8% |

According to estimates, the United States will lead the market with USD 8.1 billion by the end of 2035 and a CAGR of 9%. The social TV industry is booming because entertainment firms have to cater to customers' preferences. Cable operators to improve the customer experience are using technology.

According to recent research, 46% of 13 to 17-year-olds in the United States watch local TV news channels. Social networks have transformed news access by providing live capabilities to enable news content to spread and expand online. Since then, TikTok has gained a lot of popularity and has become a substitute for many TVs for many users.

Among young people, YouTube is the most popular social network for news, followed by Instagram (33%), TikTok (35%), and Facebook (29%). Increasingly, TV and broadcast companies are incorporating online platforms into their operations to better engage with their audiences. Businesses are making aggressive forays into space in order to meet the growing demand in the industry.

According to estimates, the social TV market in India will reach USD 2 billion by 2035. Over the next ten years, the market is projected to increase at a CAGR of 11.8%. About 600 TV channels are broadcast through DTH. Sites such as YouTube and Yahoo are constantly adding new videos in large numbers.

Smartphone use and a growing population are expected to drive social TV demand in the market. A growing number of viewers in these countries has fueled the growth of social TV demand. Growing OTT platforms and shows in India has propelled demand for social TV on the market. Both domestic and international markets present opportunities for animation and VFX studios due to the increasing popularity of over-the-top (OTT) channels, the increasing importance of animated IP, and the growing number of studios investing in VFX.

For example, iDubba is a website that can also be accessed on smartphones and tablets (app). By using SMS alerts, sharing and recommending programmes over social networks such as Twitter and Facebook, and interacting with producers, subscribers can influence how programs are viewed.

Social TV in China is expected to reach USD 1 billion by 2035. A 6.2% CAGR is expected between 2025 and 2035 in the region. A tremendous amount of data is collected in China.

Smartphone use is one of the most common forms of communication in China. Smartphones are often used by TV viewers to comment on shows, share opinions, and participate in polls. Platforms such as Douyin, Kuaishou, and Bilibili are extremely popular in China. In real time, viewers can interact with their favorite hosts and celebrities on these platforms, watch live TV shows, and send virtual gifts.

Social media elements are incorporated directly into many TV shows in China. To participate in online discussions about the show, viewers are recommended to use hashtags and subscribe to official accounts. Online participation is an interactive element in some Chinese TV shows, especially talent and reality shows.

Social media is a popular place for Chinese TV shows to connect with their fans. In addition to organizing fan clubs, online events, and supporting their favorite celebrities, fans engage in a variety of online activities. As part of social television, viewers may also be able to shop for products featured on TV shows through social media platforms. Some shows and influencers have benefited from this revenue stream.

The United Kingdom's market continues to grow steadily. A 6.8% CAGR is predicted for the country between 2025 and 2035. By the end of the forecast period, Social TV in the United Kingdom will total around USD 900 million.

Many United Kingdom viewers use their phones, tablets, or laptops to watch television. Watching TV programs entices them to tweet live, comment on Facebook, or participate online in discussions.

Social media platforms provide viewers with a great opportunity to interact with popular TV sports shows, especially live entertainment events. Viewers often participate in these shows socially and share their experiences through hashtags on platforms like Twitter.

Social media has become an increasingly important means of engaging the audience for TV networks and producers in the United Kingdom. In addition to traditional TV, they often feature social media content, comments, and reactions on air.

Through online or SMS voting, some UK TV shows provide viewers with the opportunity to vote for their favored contestants. Reality and talent shows are particularly prone to this type of engagement. The popularity of streaming services such as Amazon Prime Video, Netflix, and Disney+ in the United Kingdom has also contributed to social TV's popularity. On these platforms, viewers can sometimes share their viewing experiences on social media. They can also interact with other viewers over social media.

It is common for United Kingdom’s viewers to read, recommend, and comment on TV shows and movies via social media. Viewership of a particular show can be greatly impacted by this social sharing. In addition to providing real-time social media integration and additional content related to the show, some TV networks and third-party developers have created dedicated social TV apps.

Social TV market in south Korea is projected to expand by 7.4% from 2025 to 2035. A valuation of USD 1.3 billion is expected by the end of the forecast period.

South Korea has become a popular destination for live streaming platforms like AfreecaTV, V LIVE, and Twitch. These platforms permit celebrities and content creators to communicate directly with their fans. South Korea has a thriving fan culture, and K-pop, actors, and celebrities have dedicated fan bases. Fans of these superstars and television shows are active participants in online communities.

Viewers are often encouraged to use hashtags related to TV shows by television networks and producers. Viewers can then share their experiences with each other and create a sense of community.

Social media interactions are incorporated into some South Korean TV programs. As a result, they allow viewers to participate within the show by displaying their comments and reactions on screen.

Streaming platforms like Netflix have made Korean dramas (K-dramas) popular worldwide, stimulating discussion worldwide. Mobile apps developed by some television shows in South Korea offer additional content, interactive features, and polls. Social interaction is encouraged through these apps, which makes watching more enjoyable. TV dramas and shows in South Korea are often discussed on social media, with viewers sharing their reviews and speculation.

According to market forecasts, social TV software will dominate the market through 2035, growing at a CAGR of 12%. The TV shows segment is predicted to thrive at a CAGR of 11.5% during the forecast period.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Social TV Software | 12% |

| TV Shows | 11.5% |

Based on the solution, the social TV software segment is predicted to remain dominant in the social TV market through 2035. The market is predicted to expand at a CAGR of 12% between 2025 and 2035.

Social media platforms are popular places for people to share their TV watching experiences. The social features of social TV software are integrated directly into the TV viewing experience to enhance it process. With TV viewing becoming more social, the demand for such software is likely to grow. Social media activity often spikes during major live events, such as sports games and award shows. Such occasions can increase demand for social TV software that allows viewers to interact with each other through live discussions, polls, or games.

Users' social network activity and preferences can be used by social TV platforms to recommend content. Social TV software that provides rich content discovery features could become more popular as viewers demand more personalized recommendations. Social TV features have become increasingly popular with the rise of streaming services. The demand for watching experiences that are synchronized can be met with social TV technology.

Social TV software is increasingly sought after by advertisers as a way to engage advertising campaigns with viewers. A real-time feedback mechanism, interactive ads, and social sharing options can all be part of the solution.

Media companies and content creators to collect valuable information on viewer preferences and behavior may use a social TV monitoring software. In addition to improving content and advertising strategies, this data can also help viewers engage with content more effectively. In order to provide a seamless experience for users with smart TVs, social TV software must seamlessly integrate with these devices.

By application, social TV shows are anticipated to be the most popular in all applications. A growth rate of 11.5% is projected from 2025 to 2035. Viewers were encouraged to interact with TV shows in real-time through a second screen, like a smartphone or tablet. Social media discussion, voting, and polls are all engaging methods of participation.

Social TV engagement was largely driven by Twitter. Watchers are often encouraged to participate in the conversation by using official hashtags created by shows. Viewers could influence the outcome of some reality shows and sporting events in real-time. Voting or suggesting challenges for contestants could be included in the voting process.

With social TV shows, viewers could engage with television beyond the TV screen and enjoy the viewing experience in more ways. Social media exclusive interviews, interactive quizzes, and behind-the-scenes content could be included.

Social TV shows often display comments and reactions from viewers live during live events, incorporating social media feeds directly into broadcasts. Many TV shows and networks have companion apps that provide more content, interactive features, and synchronize with live content. Networks and advertisers were also able to gain valuable insight about viewer behavior and preferences from social TV. A targeted advertising campaign and content optimization could be conducted using this data.

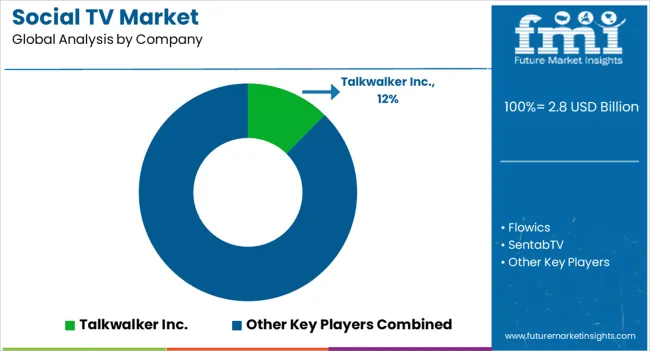

A variety of start-ups have been offering creative solutions catering to different industrial requirements in the social TV market due to fierce competition.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 2.8 billion |

| Projected Market Valuation in 2035 | USD 8.1 billion |

| Value-based CAGR 2025 to 2035 | 11.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Solution, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Talkwalker Inc.; Flowics; SentabTV; Telescope; Haier Group; Hitachi, Ltd.; iPowow Ltd; Sharp Corporation; Snipperwall; Socialbakers Ltd. |

The global social tv market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the social tv market is projected to reach USD 8.1 billion by 2035.

The social tv market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in social tv market are social tv software, broadcast integration, audience engagement, content moderation, social tv analytics, social networking platform, others, social tv service, integration and consulting, operation and intallation and maintenance and repairing.

In terms of application, sports segment to command 39.8% share in the social tv market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA