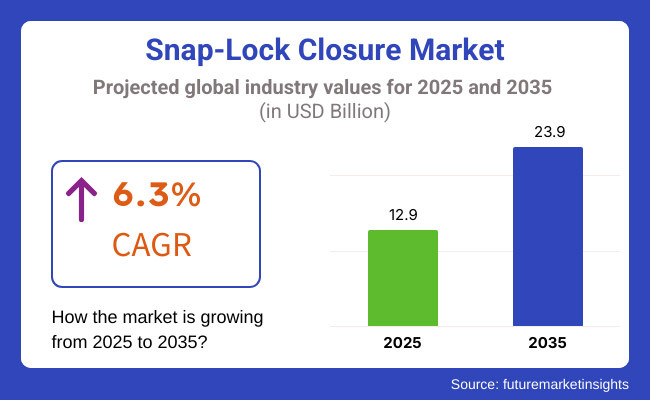

The global snap-lock closure market is estimated to account for USD 12.9 billion in 2025. It is anticipated to grow at a CAGR of 6.3% during the assessment period and reach a value of USD 23.9 billion by 2035.

Industry Outlook

As per FMI analysis, the market for snap-lock closures will grow steadily from 2025 to 2035 as demand for convenience and sustainability in packaging grows among consumers. Expansion of reclosable packaging solutions across different industries such as food and beverage, pharma, personal care, and household products will be the key driver that will shape the market.

Packaging companies will be emphasizing innovation, including eco-friendly materials and cutting-edge sealing technology to increase the protection of the product and lower environmental impact. Regulatory pressures for sustainable packaging and waste reduction efforts will also compel the shift toward recyclable and biodegradable snap-lock closures.

In addition, growth in e-commerce and increasing demand for secure, tamper-evident packaging will continue to drive adoption. As companies prioritize convenient-to-use and aesthetically pleasing packing designs, the market will shift with developments in materials, automated production, and customization to meet different consumer needs.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market experienced steady growth due to the rising demand for convenient and reclosable packaging. The food and beverage industry led the adoption, driven by consumer preference for fresh and resealable products. | Growth is expected to accelerate as packaging innovations and sustainability initiatives take center stage. The expansion of e-commerce and regulatory support for eco-friendly solutions will further drive demand. |

| Consumers prioritized convenience and freshness, with an increasing preference for resealable packaging to reduce food waste and enhance usability. | Consumers will increasingly demand eco-friendly, biodegradable, and recyclable closures, with sustainability becoming a key purchasing factor. |

| Traditional plastic products dominated, with limited focus on sustainable materials. Some brands started experimenting with bio-based plastics and recyclable options. | A shift toward biodegradable, plant-based, and recyclable materials will reshape the market. Companies will invest in alternatives like compostable polymers and recycled plastic to meet environmental goals. |

| Regulations on plastic waste and packaging sustainability were emerging but not stringent in many regions. Companies faced growing pressure to adopt recyclable and reusable solutions. | Governments worldwide are expected to implement stricter regulations on plastic use, mandating eco-friendly packaging solutions, which will push manufacturers to adopt greener products. |

| Basic snap-lock closure designs were used, with improvements focused on durability and ease of use. | Advanced designs will integrate smart packaging features, such as tamper-evident indicators, antimicrobial coatings, and automated production techniques for enhanced efficiency. |

| The rise of online shopping, accelerated by the COVID-19 pandemic, increased demand for secure and tamper-proof closures. However, packaging design for e-commerce was still evolving. | E-commerce packaging will drive innovation in products, with a strong focus on durability, leak-proof designs, and branding customization to enhance consumer experience. |

| The food and beverage sector was the primary adopter, with growing applications in pharmaceuticals and personal care. | Adoption will expand across multiple industries, including healthcare, homecare, and industrial applications, as companies recognize the advantages of reclosable and secure packaging. |

| Sustainability was an emerging trend, with brands gradually shifting toward recyclable options, but large-scale adoption was slow. | Sustainability will be a core market driver, with major brands committing to carbon-neutral packaging and recyclable closure systems to align with global environmental goals. |

Increasing Customers Demand for Convenience and Functionality

Consumers are looking for convenience and functionality, and this is driving the demand for easy-to-use and reclosable packaging. Consumers desire packaging that maintains product freshness, prevents leaks, and facilitates easy access to contents. This has prompted industries like food and beverages, pharmaceuticals, and personal care to embrace the product immediately to cater to changing customer demands.

Sustainability emerged as a primary motivator, making the consumers purchase green products. Consumers make their purchasing decisions selecting packaging materials comprising biodegradable, recyclable, or compostable materials, as they have become more aware of the importance of environmental health. Companies responded by utilizing bioplastics sourced from plants, recycled resins, and refusable closure mechanisms to satisfy consumer requirements for less contaminating goods.

As internet shopping and go-about living became increasingly trendy, demand for tamper-proof, tamper-evident, and shipment-tolerant packaging skyrocketed. The customers demand durable closures that withstand shipment without sacrificing packaged product integrity. Companies are integrating tamper-evident and leak-tight snap-lock technology to provide added guarantee of security and reliability in applications like online food ordering and personal care.

| Attributes | Value |

|---|---|

| By Material Type | Metal |

| Market Share in 2025 | 57.20% |

According to the type of material, the market is segmented into metal and plastic. Metal products are used everywhere due to their higher strength, wear-resistance, and dependability, hence being one of the best options in many industries. In comparison to plastic closures, metal closures are very resistant to impact, corrosion, and temperature and thus guarantee long-term product performance and safety.

The fact that they can create an airtight and tamper-evident seal makes them best suited for use in the food and beverage, pharmaceutical, and industrial packaging industries where product integrity and safety are of paramount concern. Consumers prefer metal closures because of their premium texture and reuse, further establishing their use in premium packaging applications.

Metal closures are also used by manufacturers due to their compatibility with advanced sealing systems, making them convenient and efficient in car-production lines. The growing interest in recyclability and sustainability has also cemented the position of metal since metal caps such as aluminum and steel can be recycled and reused efficiently, causing less damage to the environment.

| Attributes | Value |

|---|---|

| By Application | Bags |

| Market Share in 2025 | 50.20% |

On the basis of application, the market can be categorized as bags, roofing, and others. Snap-lock closure bags find wide use due to convenience, flexibility, and safeguarding the freshness of a product. These closures are popular with the producers as they embody a secure, resealable, and convenient packaging technology that enhances consumer experience.

In the food industry, snap-lock bags help keep perishable goods fresh, safe from contamination, and reduce food wastage by making them reusable several times. They are also portable and compact, which makes them the ideal solution for use on the go, which suits modern consumers' lifestyles.

Other than food items, snap-lock closures are widely used in household products, personal care, and drugs, where packaging needs to be safe and yet openable. The new market for e-commerce has further driven the application of snap-lock bags due to their tamper resistance and spill-proof nature during transport.

Sustainability is a driving force, too, as manufacturers increasingly include biodegradable and recyclable components in bag closures to meet environmentally conscious consumer requirements. With industries focusing more on functionality, durability, and sustainability, bags are likely to continue their solid market presence.

| Countries | CAGR% |

|---|---|

| USA | 4.90% |

| Germany | 3.80% |

| Japan | 5.70% |

| Australia | 3.50% |

| China | 7.40% |

| India | 6.90% |

| UK | 3.00% |

Sustained Growth with Sustainability and Personalization

The USA snap-lock closure market will focus on green materials, advanced security features, and customized solutions to address the needs of industries like healthcare, retail, and food & beverage. With a strong regulatory framework in place for sustainable packaging, brands will use biodegradable closures and smart packaging solutions to respond to consumer needs.

Technically Advanced Closures for Industry and Automotive Applications

Germany's market will be characterized by engineering with high performance and sustainability initiatives, where industrial and automotive demand will dominate. Long-term, precision-engineered closures, with green manufacturing and high-end retail packaging directions remaining the focus, will be demanded.

Innovative and High-Tech Packaging Solutions

Japan's technology-focused snap-lock closure industry will incorporate design aesthetics, smart home usage, and electronics packaging. High-quality, precision-engineered closures driven by consumer demand will fuel the use of automated and digital packaging solutions in retail and e-commerce.

Tough Closures for Severe Conditions and F&B Industry Growth

Australia will see mid-term growth with mining, outdoor, and foods leading demand for tough and abrasion-resistant snap-lock closures. Sustainability will also continue to urge companies to develop towards biodegradable and recyclable materials that support environmental regulation.

Fast Growth with High-Volume Production and E-Commerce Supremacy

China shall lead large-scale production of snap-lock closures for global and local market supplies. Expanded e-commerce, urban living, and high-level packaging automation shall prompt demand, smart, tamper-proof, yet economical solutions leading the market.

Booming Market with SME Adoption and Digital Commerce Growth

India's market will expand with low-cost, innovative, and colorful snap-lock closures applied in small and medium businesses, pharmaceuticals, and food packaging. The nation's growing digital commerce industry will fuel demand for safe, easy-to-use, and personalized closures.

Premium, Sustainable, and E-Commerce Packaging Focus

The UK will prioritize premium packaging, sustainability, and regulatory compliance, with circular economy policies driving recyclable and reusable snap-lock closures. The emerging e-commerce business will require creative, tamper-evident, and good-looking solutions.

By 2035, technological innovation, better sustainability practices, and increasing need for secure and functional packaging will drive the world snap-lock closure market, changing regional growth trends and industry reform.

The snap-lock closure market is moderately to highly concentrated, with major players dominating the market through product innovation and technological developments. Major manufacturers concentrate on durability, security, and sustainability, utilizing automated manufacturing and high-volume production to sustain a competitive advantage in food, pharmaceutical, and personal care markets.

Top regional and international players drive market consolidation through mergers, acquisitions, and strategic alliances. Companies invest in R&D, introducing biodegradable and smart closure systems to meet evolving consumer demands. The presence of established players and new entrants triggers competitive pricing, product differentiation, and innovation based on evolving market trends.

The Asia-Pacific, especially China and India, lead manufacturing with cost-efficient production and growing e-commerce markets. North America and Europe focus on premium, sustainable, and regulatory-compliant closures, highlighting recyclability and circular economy concepts. Regional differences in material use and industrial applications influence market growth and expansion strategies worldwide.

Major Developments

The market for snap-lock closures is extremely competitive, with global and local players competing for market share on the basis of innovation, sustainability, and technology. Top manufacturers emphasize durability, tamper evidence, and easy-to-use designs, serving food, pharmaceutical, and personal care industries where packaging needs to be secure and resealable.

Major multinational companies rule the market utilizing sophisticated manufacturing methods, automation, and material technologies. Businesses spend on eco-friendly packaging innovations, creating biodegradable, recyclable, and light-weight closures that can satisfy tough environmental laws and changing consumer attitudes. These provide a competitive landscape where businesses have to change constantly to follow evolving trends and market needs.

The growth in eCommerce and package solutions in the digital age stokes competition in the manufacturing world, with consumers preferring security, good looks, and ease in snap-lock close packaging designs. Brands aim for efficient packaging, greater product security, and inclusions of innovative packaging features such as smart packs in order to distinguish themselves and capture the digital-minded consumer population.

Local players compete on the basis of affordable and adaptable solutions, especially in the emerging markets where affordability and adaptability are driving demand. Asia-Pacific continues to be a leading center for high-volume production, while Europe and North America focus on premium, regulatory-compliant, and sustainable closure systems, defining the competitive landscape through innovation and sustainability.

The market is anticipated to reach USD 12.9 billion in 2025.

The market is predicted to reach a size of USD 23.9 billion by 2035.

Prominent players include Silgan Holdings, RPC Group, Owens-Illinois, Graham Packaging, and others.

With respect to material type, the market is classified into metal and plastic.

In terms of application, the market is segmented into bags, roofing, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.