World demand for smoked yeast will grow moderately with growing demand in the food and beverage sector, growing interest in natural umami flavor, and growing application in plant protein substitutes. Smoked yeast is widely applied as a flavoring ingredient in sauces, snack food, meat substitutes, and specialty spice blends due to its intense, smoky flavor profile.

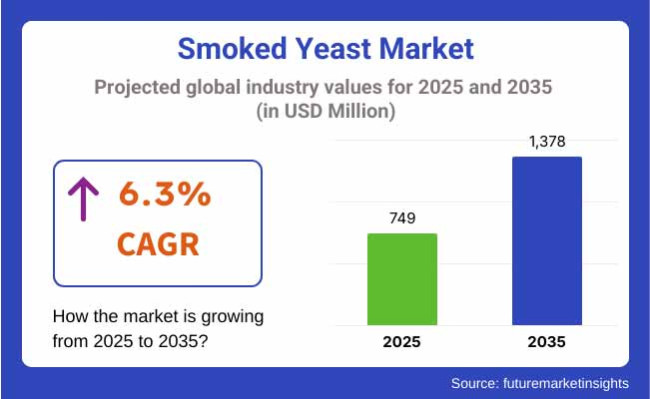

With the customers insisting on clean-label ingredients and natural flavor enhancers, there is a growing demand for smoked yeast. Smoked yeast market is around USD 749 million in 2025 globally. It will be around USD 1,378 million in 2035 with a growth rate of 6.3% CAGR.

Demand is fueled by growing popularity of vegetarian food consumption, fermentation technological advances, and greater utilization of smoked yeast as a natural food flavor enhancer in specialty foods. Wellness trend, along with growing demand for vegan-friendly and non-GMO food, will be quantified to drive the market value to 2035.

The largest market for smoked yeast is North America due to leadership from a changing plant-based food marketplace, growing customer demand for nature-based flavor drivers, and food processing application driven demand. The largest market-leader market is the United States due to clean-label innovation and growing demand in artisanal snack food and ready-to-eat foods.

Europe leads, with its more robust underlying foundation of healthy consumers, stricter food safety measures, and methods in organic food and fermented foods processing. Lead countries are the United Kingdom, Germany, and France, fueled by gourmet applications of smoked yeast and premium-quality vegan cheese substitutes.

The highest demand for smoke yeast fermented food products exists in the Asia-Pacific region, followed by demand drivers in China, Japan, India, and South Korea. Demand drivers are driving consumption trend and volume changes in food start-ups that incorporate smoke yeast products.

Challenges

Supply Chain Disruptions, Consistency of flavors, and Higher Cost of Manufacturing

Supply of smoked yeast is covered, e.g., supply chain breakage, i.e., good quality yeast availability and consistent smokiness across batches. Uncertainty of raw material availability and manufacturing scalability is a threat to manufacturers ready to accommodate increasing demand. Moreover, expensive high-pressure smoking technologies and fermentation technology expense may deter small manufacturers from coming in.

Opportunities

Plant-Based Foods growth, Clean-Label Ingredients, and GourmetApplications growth

Despite all the issues, the market is rich in vast growth potential. Demand growth for plant-based food is fueling innovation in the usage of smoked yeast, especially in vegan cheese, meat substitutes, and protein-enriched flavor-full alternatives. Clean-label ingredients are gaining more popularity among consumers shifting towards natural substitutes for artificial flavor enhancers. In addition, applications of smoked yeast in high-end foods, gourmet seasonings and spices, and snack foods are generating new revenue streams for producers.

During the period 2020 to 2024, there was increased application of smoked yeast in vegetable food and specialty food. The companies were keen on producing differentiated umami-flavored foods, and the consumer's choice of flavor was naturally smoked flavor with minimal processing. The decade also witnessed increased sustainability of practice in yeast production to reduce environmental footprints.

During the years 2025 to 2035, increased use of AI-governed fermentation, eco-smoking processes, and higher productivity efficiencies for yeast smoked will be witnessed. Food ingredient demand patterns for non-GMO, organic, and allergen-free foods will drive fast growth of the smoked yeast to other segments. With evolving trends in food on a global level, the contribution of smoked yeast in driving clean-label and umami-flavored foods into the future will be most essential.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety standards, allergen labeling , and organic certifications. |

| Consumer Trends | Rising demand for umami-rich plant-based ingredients in meat alternatives. |

| Industry Adoption | Adoption in plant-based meats, seasonings, and functional food sectors. |

| Supply Chain and Sourcing | Dependence on traditional yeast fermentation and wood smoke infusion techniques. |

| Market Competition | Dominated by companies like Lesaffre , Lallemand , and Angel Yeast. |

| Market Growth Drivers | Fueled by the plant-based movement, demand for clean-label flavors , and yeast-derived B vitamins. |

| Sustainability and Environmental Impact | Early adoption of biodegradable packaging and reduced processing emissions. |

| Integration of Smart Technologies | Implementation of automated yeast smoking processes for consistency. |

| Advancements in Equipment Design | Use of traditional wood smoke chambers and batch fermentation tanks. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of stringent clean-label requirements, non-GMO verification, and carbon-neutral production mandates. |

| Consumer Trends | Shift toward fermented and smoked yeast blends in gourmet and artisanal foods. |

| Industry Adoption | Expansion into premium snack foods, pet nutrition, and microbiome-friendly dietary supplements. |

| Supply Chain and Sourcing | Shift to controlled smoking methods with traceable sourcing of hardwood chips and eco-friendly production. |

| Market Competition | Entry of niche fermented food startups and craft-based smoking process innovators. |

| Market Growth Drivers | Driven by expansion into functional health foods, probiotic-rich formulations, and eco-conscious manufacturing. |

| Sustainability and Environmental Impact | Transition to zero-waste yeast production, carbon-neutral smoking techniques, and regenerative ingredient sourcing. |

| Integration of Smart Technologies | Growth in AI-driven fermentation control, blockchain -based ingredient traceability, and precision smoking techniques. |

| Advancements in Equipment Design | Development of controlled-atmosphere smoking chambers, hybrid cold-smoking tech, and AI-optimized yeast cultivation. |

The USA smoked yeast market has grown considerably due to the expanded use of plant foods and the consumer demand for clean-label flavorings. The ability of smoked yeast to deliver depth and richness to flavor profiles has put it in place for different uses such as vegan cheese, plant-based meat alternatives, and specialty packaged food.

As food producers hunt for alternative measures to amplify umami flavor in the absence of added artificial adjuncts, trend-setting food market leaders are finding their way toward incorporating smoked yeast into products. The trend will be supported by consumer interest in natural, environmentally friendly, less-processed foods, again driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

In the UK, demand for smoked yeast is on the rise due to higher consumer interest in plant-based and green food. With rising environmental consciousness, consumers are increasingly turning towards clean-label and eco-friendly-approved foods, which increases demand for naturally smoked yeast.

Food players are falling prey to the trend with the launch of allergen-free and functional foods with smoked yeast as the prime ingredient. The shifting food culture of the nation, with an acute focus on natural foods and novel plant foods, is making smoked yeast a key player in promoting healthier and sustainable food.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.7% |

Strict European Union organic and clean-labeling regulations have profoundly influenced the market for the smoked yeast. Increased customer demand in countries such as the Netherlands, Germany, and France for high-quality foods that address organic and natural food demands has been seen. Naturally smoked yeast is therefore widely used in breadth within organic-high-grade snack foods, dairy-replacement food, and high-class vegetable-based delicacies.

European food companies are also focused on sustainability when it comes to their ingredients, so smoked yeast is an omnipresent feature because it is capable of providing intense, smoky flavorings without resorting to artificial preservatives. Regulation-driven demand is influencing market development and trend.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.1% |

Smoked yeast Japanese market continues to evolve step by step on the surfs of the affluent gastronomic heritage of food ferments and adding up on umami taste-basis orientation of the nation. Japanese cooking bestows supreme importance on natural flavors and equilibrium as a fact, and therefore it makes smoked yeast a common commodity among both food engineers and culinary professionals.

It unveils more diverse uses in soy sauces, miso pastes, and other high-end food uses which demand robust, meaty, and smoky flavors. Japanese food consumers' health-consciousness has also been utilized on another front to utilize smoked yeast as functional health food, which brought it even further as a food industry contribution.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

South Korea is experiencing a new boom for the consumption of smoked yeast, especially in South Korea's energetic and open food culture. The Korean cuisine that is known to be rich and nutritious in terms of taste has welcomed naturally flavored yeast through the medium of products like ramen, snack foods, and fermented sauces.

With a growing demand for health foods, yeast flavorings are on the rise for their potential to intensify flavors with nutritional value. Growing demand for functional ingredients in the Korean food sector, and strong demand for umami-flavored ingredients, is driving smoked yeast mainstream into foodservice and packaged food applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6 .3% |

| By Source | Market Share (20 2 5) |

|---|---|

| Baker’s Yeast | 58% |

Baker's yeast is projected to dominate the market for smoked yeast, with 58% of overall demand by 2025. Its superior fermentation characteristics, strong umami flavor, and baked goods flavor enhancement make it an industry standard. Leading artisanal bread manufacturers and plant-based food firms employ smoked baker's yeast in sourdough, crackers, and plant-based meat alternatives to enhance flavor depth and create unique smoky flavor profiles.

Companies like AB Mauri and Lallemand also keep on expanding the product lines they supply, catering to the rise in demand for natural, clean-label flavor enhancers in the food industry. The growth in demand for smoky-flavored plant-based cheese and meat alternatives continues to fuel the supremacy of baker's yeast in the segment as well.

| By Distribution Channel | Market Share (202 5) |

|---|---|

| Online Retail | 32% |

Online sales are making their way as a major channel of distribution for smoked yeast with a market share of 32% in 2025 as Amazon, Walmart, and other online store operators keep filling up their gourmet food sections. Ease of consumer-to-consumer selling, volume buying by the food industry to create inventory for products, and expanding need for specialty gourmet products push growth to higher levels.

Subscription ingredient boxes by subscription and health-centric online retailers drive increased purchasing of smoked yeast among home bakers, vegan food enthusiasts, and specialty brewers. Furthermore, expansion of D2C brands centered on gourmet and plant-based food drives online shopping as a leading channel for the purchase of high-end versions of smoked yeast.

Growing demand for umami-rich, natural flavor enhancers in plant-based food, specialty seasonings, and clean-label applications is driving the smoked yeast market. Smokers are complementing smoking processes with hardwoods like hickory and applewood while optimizing fermentation processes to enhance intensity of flavors and solubility. Businesses are also investing in AI-quality control and green yeast cultivation to maintain pace with increased demand for specialty food ingredients.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lesaffre Group | 22-26% |

| Lallemand Inc. | 18-22% |

| Ohly (ABF Ingredients) | 14-18% |

| Angel Yeast Co., Ltd. | 10-14% |

| Kerry Group | 6-10% |

| Other Companies (combined) | 14-18% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lesaffre Group | In 2024, introduced an oak-smoked yeast extract for vegan cheese applications. In 2025, expanded production facilities in Europe to enhance supply chain resilience. |

| Lallemand Inc. | In 2024, launched a mesquite-smoked yeast product for gourmet spice blends. In 2025, integrated AI-based flavor profiling to create customized umami solutions for plant-based meat producers. |

| Ohly (ABF Ingredients) | In 2024, developed a high-solubility smoked yeast powder for instant soups and sauces. In 2025, partnered with snack brands to introduce smoked yeast-infused savory coatings. |

| Angel Yeast Co., Ltd. | In 2024, expanded its wood-smoked yeast product line targeting the Asian market. In 2025, invested in sustainable yeast fermentation to align with eco-conscious consumer trends. |

| Kerry Group | In 2024, launched a liquid smoked yeast extract for clean-label meat rubs. In 2025, expanded collaborations with foodservice chains to develop smoked umami seasonings. |

Key Company Insights

Lesaffre Group (22-26%)

Lesaffre leads with its creative smoked yeast solutions for dairy alternatives, sauces, and meat substitutes. Its natural smoking and fermentation knowledge make it a pioneer in specialty ingredients.

Lallemand Inc. (18-22%)

Lallemand is among the cutting-edge innovators of applications of smoked yeast through AI-assisted flavor mapping to achieve maximum umami strength. Its mesquite-smoked yeast is gaining acceptance in upscale seasoning mixtures and plant-based meat alternatives.

Ohly (ABF Ingredients) (14-18%)

Ohly specializes in yeast extracts for food applications, with an emphasis on high solubility and clean-label formulation. Its ultra-high-solubility smoked yeast powder is a first choice with instant food manufacturers.

Angel Yeast Co., Ltd. (10-14%)

Angel Yeast is expanding rapidly in the Asian market, offering diversified smoked yeast products suitable for local tastes. Its emphasis on environmentally friendly fermentation processes aligns with the growing demand for green food ingredients.

Kerry Group (6-10%)

Kerry leverages its smoke flavoring experience to produce liquid smoked yeast extracts for the foodservice and retail channels. Its restaurant chain relationships position it as a market leader in the smoked umami seasoning space.

Other Key Players (14-18% Combined)

The overall market size for the smoked yeast market was USD 749 million in 2025.

The smoked yeast market is expected to reach USD 1,378 million in 2035.

The increasing demand from various industries such as food & beverage, animal feed, and dietary supplements fuels the smoked yeast market during the forecast period.

The top 5 countries which drive the development of the smoked yeast market are USA, Germany, France, China, and Japan.

On the basis of application, the food & beverage sector to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smoked Meat Market Size and Share Forecast Outlook 2025 to 2035

Smoked Fish Market - Size, Share, and Forecast 2025 to 2035

Smoked Dextrose Market Trends - Flavor Enhancements & Demand 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Smoked Salt Market Trends - Growth, Demand & Forecast 2025 to 2035

Smoked Condensates Market Growth - Industry Applications & Trends 2025 to 2035

Smoked Cheese Market

Frozen Smoked Salmon Market Insights – Trends & Forecast 2025 to 2035

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Nucleotides Market Analysis by Product Type, Nature, Form and Application Through 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA