Smoked Salt Market 2025 to 2035 will see the steady growth attributed to an upsurge in consumer preference for gourmet and artisanal food products, as well as theext ensive applicability of natural flavour-enhancers in the food service and home cooking sectors. Smoked salt, with its deep flavour profile and rich, smoky smell, is gaining traction with chefs, food manufacturers and consumers looking for alternatives to artificial seasonings.

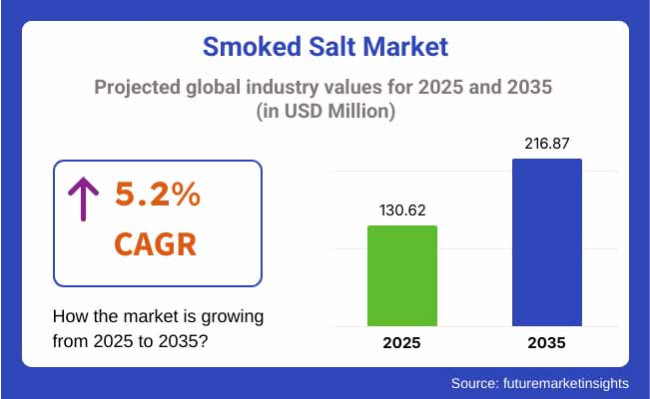

The market is expected to grow from USD 130.62 Million by 2025 to USD 216.87 Million by 2035 at a CAGR of 5.2% over the forecast period. Expanded market growth is driven by the growing need for organic, wood-smoked, and specialized salts combined with the rising demand for global cuisines in home cooking and fine dining.

United States and Canada are the main adopters in the North America smoked salt market. The rising popularity of BBQ culture, gourmet cooking trends and clean-label food products are driving demand. Top food manufacturers and restaurants are using smoked salt in everything from meat rubs, seafood and plant-based substitutes to intensify flavours. In addition, the increasing number of organic and small-batch artisanal salts is also supporting the growth of the market.

Europe demonstrates a large share in market, owing to extensive interest of consumers towards top-notch culinary ingredients, natural seasonings. The product is particularly enjoying a resurgence in countries such as Germany, France and the UK, with smoked salt now being used with greater frequency in gourmet restaurants, packaged food products, and home cooking trends inspired by Mediterranean and Nordic cuisines. The increasing popularity of vegan-friendly, non-GMO and naturally processed salts is also contributing to its market growth.

Asia-Pacific will record the highest growth, driven by increases in incomes of the region's middle-class, a growing appetite for Western and fusion cuisines and the emergence of premium food retail chains. Countries such as China, Japan and Australia are adopting smoked salt for traditional and contemporary dishes, while a booming gourmet food industry in India is driving up demand, too. The growth of e-commercial and branded food stores are additionally facilitating the development of the trading in the area.

Challenge

High Production Costs and Limited Awareness in Developing Markets

Smoked salt is created through special smoking techniques that employ hardwoods like hickory, alder, and mesquite, which is why this variety is pricier than standard table salt. Mass adoption is hindered by the higher cost of production and the fact that consumer awareness in the emerging markets is not highest, hence the limited volume of consumers. Other factors that can restrict the growth of the market are supply chain issues of natural salt and the smoking process.

Opportunity

Expansion of Organic and Specialty Smoked Salt Varieties

Growing preference for organic, sustainably sourced, artisanal food products is creating new lucrative avenues for premium smoked salt manufacturers. Businesses will cater to health-conscious customers and gourmet food shoppers by specializing in unique wood-smoked varieties, infused flavours and eco-friendly packing. The rise of online shopping and direct-to-consumer sales channels is also allowing small-batch producers to tap into a global audience, contributing to the ongoing growth of the industry.

The market is driven by the growing adoption of gourmet seasonings, artisanal foods, and natural flavour enhancers between 2020 and 2024. Consumers increasingly turned to smoked salts infused with hickory, mesquite, Applewood and alderwoodflavours to enhance home-cooked and restaurant-quality dishes.

Surge in demand for barbecue culture and premium seasoning blends in North America and Europe led to market expansion. Moreover, as consumers became more health-conscious, they also chose natural smoked salts without additives, rather than synthetic flavouring agents, which led to an increase in the demand for organic and handcrafted smoked salts.

The foodservice segment, especially of fine dining and premium fast-casual restaurants, picked up smoked salt for meat rubs, seafood dishes, and plant-based cuisine, adding to demand. But high production costs, a lack of supply of a true wood-smoked variety, and supply chain disruptions proved to be roadblocks over this period.

The smoked salt market will be transformed by AI-driven flavour profiling, eco-friendly smoking techniques, and diversified product applications in the years 2025 to 2035.Manufacturers will harness AI and machine learning to create customizable smoked salt blends that align with regional and individual tastes.

Advancements in eco-friendly smoking technology vending, like low-emission wood smoking or controlled vapour infusion, will help reduce environmental footprints and make authentic flavours more accessible.

Outside of gourmet cooking, smoked salt will extend into snack foods, plant-based meat alternatives and functional health products. This will provide high-growth opportunities for low sodium alternatives and mineral enriched smoked salts, which will appeal to consumers seeking a healthy lifestyle.

Market penetration will be driven by the e-commerce boom and direct-to-consumer (DTC) sales of personalized subscription services for limited-edition smoked salt blends. In addition, eco-friendly packaging and ingredient tracking based on block chain technology will cater to environmentally conscious customers.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Culinary Applications | Used in gourmet dishes, barbecue rubs , and fine dining. |

| Flavour Innovation | Traditional wood-smoked flavours like hickory and mesquite. |

| Sustainability Focus | Small-scale organic production, high carbon footprint. |

| Health Trends | Preference for natural, additive-free smoked salts. |

| Retail & Distribution | Specialty stores and premium foodservice outlets. |

| Market Growth Drivers | Demand driven by gourmet food trends and restaurant adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Culinary Applications | Expanded into snacks, plant-based meats, and functional health foods. |

| Flavour Innovation | AI-powered, customizable blends for regional and personal preferences. |

| Sustainability Focus | Low-emission smoking, vapour -based infusion, and eco-friendly sourcing. |

| Health Trends | Growth of low-sodium and mineral-fortified smoked salt products. |

| Retail & Distribution | E-commerce dominance, personalized DTC subscriptions, and traceability. |

| Market Growth Drivers | Growth fuelled by AI-driven flavour innovations, sustainability, and functional benefits. |

With no seasoning or flavour on the smoky ingredient incorporates another dimension in to user friendly and aromatic progression both of which have driven revenue growth attentive to the growing demand for gourmet as well as artisanal food products across the USA smoked salt market.

As the popularity of natural and minimally processed food ingredients increases, a larger consumer base is turning towards premium seasoning solutions like smoked salt. Interests in homemade dishes, encouraged by food bloggers and cooking television shows as well as social media, have also contributed to a surge in demand.

The latest trend is towards naturally smoked salts, which provide rich and robust flavours without synthetic additives, thanks to the growing penetration of organic and clean-label food products. The food service sector is also contributing to market growth, with fine-dining restaurants, specialty restaurants, and smokehouse restaurants expanding their menu with smoked salt. USA manufacturers are launching specialty smoked salt products and new varieties like hickory, mesquite and Applewood-smoked salt to accommodate a wider variety of consumer preferences.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

With a growing interest in gourmet home cooking and substantial shift towards premium culinary ingredients, the UK smoked salt market is thriving. British consumers are trying out distinctive flavours, and smoked salt is an attractive alternative to table salt because of its rich, deep taste profile.

The growing trend towards plant-based and vegan diets in the UK is another factor, as it adds umami to meat substitutes and vegetable-based dishes. Also, as the food industry embraces natural, sustainable seasonings, smoked salt is being embraced across retail and foodservice segments.

Supermarkets and specialty stores have been adding different types of smoked salt over the years, from coarse flakes to fine-grain varieties, for those with different cooking styles. The UK’s strong barbecue and grilling culture, particularly in the summer months, has spurred market presence for smoked salt even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The demand for smoked salt in EU countries are expected to grow at a significant rate due to the rich culinary heritage of the region and a growing demand for specialty food ingredients. Germany, France, Italy and Spain are just some of the country’s leading this charge, with their strong gastronomic traditions centring on top-tier seasonings.

Increasing acceptance of organic and clean-label products and thus increasing demand for naturally smoked salt that does not contain any artificial preservatives and additives. Moreover, manufacturers have been influenced to adopt eco-friendly manufacturing methods to comply with sustainability and ethical sourcing by the European food industry's emphasis on the same.

The hospitality and restaurant sector in Europe is also playing a significant part in the market growth, with chef gourmets integrating smoked salt into ready-made meals, seafood and meats and plant-based cuisines. As more and more consumers are choosing premium, handcrafted seasonings, demand for smoked salt is projected to remain high in the EU market in the future.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

With Japan’s longstanding passion for high-quality seasonings that provide an umami kick, the country’s smoked salt market is slowly growing. Japanese consumers have a discerning taste for premium, natural ingredients. Since Japanese cuisine traditionally uses delicate yet complex seasoning, smoked salt is a very welcome addition to the culinary landscape.

Both the growing influence of Western cooking and the popularity of barbecue culture have led to rising use of smoked salt in Japan. A range of smoked salt, including cherry wood and bamboo-smoked varieties, is being sported in many high-end restaurants and specialty food retailers to cater for discerning consumers. In addition, the increasing health-conscious consumer base in Japan is looking for healthier substitutes for processed seasonings, which also supports the usage of naturally smoked salt in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The South Korean market for smoked salt is on the rise amidst growing interest in gourmet seasonings, international culinary trends, and a preference for natural and unprocessed food products. As South Korea falls deeper into a fusion food culture, consumers are playing with all sorts of seasonings in traditional and Western-style dishes.

Smoked salt is making its way into Korean barbecue, marinades and even fancy restaurant menus, where it rounds out the meaty and briny flavour of grilled meats and seafood. Smoked salt gained popularity through social media and the work of digital food influencers who raised awareness of its distinct taste and versatility, inspiring home cooks and chefs alike to use it in their dishes.

In addition, the health-conscious consumer segment considers regular table salt harmful to their health and is therefore searching for alternatives, preferring smoked salt over ordinary table salt because it is produced naturally and contains a higher amount of minerals. The growth of the smoked salt is propelled with the launching of new type of product variations by companies to accommodate their taste vary in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

| By Type | Market Share (2025) |

|---|---|

| Sel Gris | 38.4% |

Owing to its high moisture retention, mineral concentration, and flavour absorption capacity, Sel Gris is the highest in demand among the companies in the smoked salt market. This traditional sea salt, harvested using solar evaporation process, is rich in essential trace minerals like magnesium, calcium, and potassium.

The natural constituents therein are responsible for its signature grey colour, prominent texture, and greater flavour complexity, appealing to a range of advanced and artisanal culinary applications.

One of the main reasons smoked Sel Gris is so popular is because it complements a broad range of ingredients while leaving behind its complex, smoky notes. Sel Gris takes on a more intense flavour when exposed to wood smoke and goes particularly well with grilled meats, roasted vegetables, seafood and desserts such as salted caramel. Sel Gris, unlike highly processed salts, maintains natural moisture and, therefore, is better able to adhere to food surfaces, providing a more even flavour distribution.

The urbanization and rising disposable income levels of consumers, along with the proliferating consumer preferences towards high end, organic, and minimally processed seasonings accelerating the smoked Sssssel Gris market growth. Health-oriented consumers growing increasingly favour unrefined salts with nutritional value alongside sodium chloride.

Its natural umami enhancing properties make it a staple in the world of gourmet cooking without the artificial additives. But as food lover’s amateur and professional alike continue to use adventurous flavours, smoked Sel Gris is gradually becoming more popular in upscale grocery stores, specialty spice blends, and artisanal condiments.

| By Application | Market Share (2025) |

|---|---|

| Meat & Poultry | 46.2% |

Demand for smoked salt for the meat & poultry segment aspects the largest revenue share of the global smoked salt market, owing to the critical function of smoked salt in meat flavour enhancement, quality preservation and provision of a gourmet touch, in protein-based recipes.

Smoked salt has a broad range of applications, as it is often used in meat curing, dry rubs, marinades and post-cooking seasoning, adding an authentic smokiness that marries well with most proteins, including beef, pork, chicken and lamb.

In meat applications, one of the main benefits of smoked salt is its ease of penetration and ability to get into the meat and deliver a rich, earthy flavour like that of barbecue cooked over a fire for hours or grilled over an open flame.

In contrast to liquid smoke, which can sometimes give off a faux aftertaste, naturally smoked salts deliver an authentic wood-smoked fragrance and preserving the integrity of the substance being seasoned. Such an ideal seasoning for grilling, roasting, slow cooking, and smoking processes.

In addition, smoked salt not only preserves food but also prolongs the shelf life of cured and processed meats and improves their texture. Smoked salt is used in products for butchers, specialty meat producers and gourmet food brands, creating distinctive and high-quality meat products that capture the expanding consumer demand for artisanal and craft-style foods.

Consumers are looking for artisanal spices, which is the driving force behind the growth of the smoked salt market. Companies emphasize diverse wood-smoked varieties, organic sourcing and clean-label production. Key stakeholders are creating sustainable production, and innovation in flavours, and premium packaging to meet this increasing demand in retail, foodservice, and specialty markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tassal Group Ltd. | 18-22% |

| The Union Group PCL | 14-18% |

| Gourmet Nut | 12-16% |

| The Original Smoke & Spice Company Pty Ltd. | 10-14% |

| Other Companies (combined) | 30-46% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tassal Group Ltd. | In 2024 , expanded its smoked salt line with eco-friendly packaging and premium blends. |

| The Union Group PCL | In 2025 , launched an exclusive range of naturally smoked salts for gourmet retail chains. |

| Gourmet Nut | In 2024 , introduced new mesquite-smoked salt for premium seasoning applications. |

| The Original Smoke & Spice Company Pty Ltd. | In 2025 , increased production capacity to meet rising demand for all-natural smoked salts. |

Key Company Insights

Tassal Group Ltd. (18-22%)

Tassal leads the market by leveraging sustainable sourcing and premium smoked salt varieties for retail and foodservice sectors.

The Union Group PCL (14-18%)

The Union Group focuses on expanding its gourmet smoked salt portfolio, targeting high-end culinary markets.

Gourmet Nut (12-16%)

Gourmet Nut innovates with unique smoked flavours and high-quality sea salt offerings for seasoning and cooking applications.

The Original Smoke & Spice Company Pty Ltd. (10-14%)

The company enhances its production and distribution network, emphasizing clean-label, wood-smoked salt products.

Other Key Players (30-46% Combined)

Several niche and specialty brands contribute to market growth with innovative offerings:

The overall market size for the Smoked Salt Market was USD 130.62 Million in 2025.

The Smoked Salt Market is expected to reach USD 216.87 Million in 2035.

The demand is driven by increasing consumer preference for gourmet and artisanal food products, rising use of smoked salt in seasoning and meat processing, growing demand in home cooking and foodservice industries, and expanding availability through online retail channels.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Sel Gris segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smoked Meat Market Size and Share Forecast Outlook 2025 to 2035

Smoked Fish Market - Size, Share, and Forecast 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Smoked Yeast Market Trends - Growth & Industry Forecast 2025 to 2035

Smoked Dextrose Market Trends - Flavor Enhancements & Demand 2025 to 2035

Smoked Condensates Market Growth - Industry Applications & Trends 2025 to 2035

Smoked Cheese Market

Frozen Smoked Salmon Market Insights – Trends & Forecast 2025 to 2035

Salt Content Reduction Ingredients Market Size & Trends 2035

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Cesium Salts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA