The global market for smoked dextrose is likely to advance at an even rate with higher demand for natural flavor enhancers, rising use in processed meat foods, and changing consumer acceptance of clean-label food ingredients. Smoked dextrose is a critical ingredient to add depth to the flavor profile of any line of food products by imparting strong, smoky flavor without any open process of smoking.

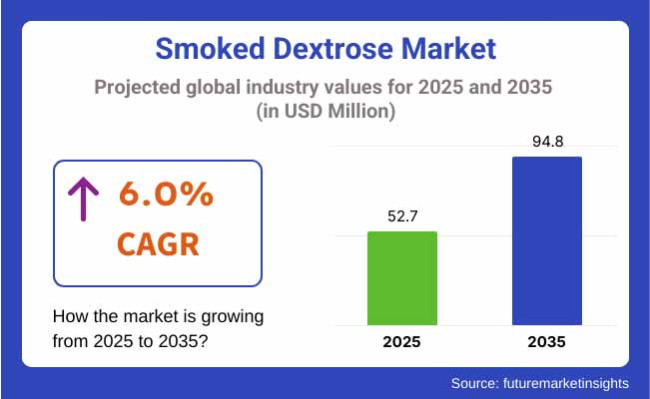

Since the food industry keeps changing at every moment to meet shifting consumer needs, smoked dextrose will soon witness a surge in demand. The world market for smoked dextrose will be approximately USD 52.7 million as of 2025. It will be approximately USD 94.8 million as of 2035 with a 6.0% compound annual growth rate (CAGR).

The market is complemented by technological advancements in smoking, such as addition of liquid smoke and controlled smoking processes that enhance product consistency. Increasing demand for smoke flavor in snack foods, meat-free meat products, and upscale condiments also complements market development. With increasing applications in industrial food processing as well as in artisanal food preparation, the market for smoked dextrose will experience strong growth until 2035.

North America boasts a huge market for smoked dextrose due to an extremely developed processed food market and a surging consumer trend towards natural and authentic flavor. The United States is the biggest market due to extensive per capita consumption of smoked and barbecued food and a clean-label product innovation trend.

Europe is a key market, where ready-to-eat food smoked flavor ingredients, gourmet sauces, and meat substitutes are increasing sales. The front runners are Germany, France, and Italy, where natural and premium food ingredients are subject to strict food safety and sustainability regulations.

The Asia-Pacific region is the fastest-growing, and Asia-Pacific growth is being propelled by increased production of processed foods, urbanization, and increasing middle-class population with a transformed food palate. Smoked dextrose is also gaining increasing demand in Japan, China, and South Korea in convenience foods, instant flavoring, and value-added meat products. Increasing investment in food innovation in the region is ensuring stable market growth.

Challenges

Regulatory Barriers, Cost of Production, and Consumer Awareness

Smoked dextrose is also afflicted with the issue of strict food safety regulation, i.e., use of smoked ingredients in food products. Secondly, production cost is always involved because high quality smoked dextrose is used in high quality smoking processes and raw material purchasing. The second issue is that there is barely any consumer awareness because most of the end-users are not aware of the application and benefit of smoked dextrose.

Opportunities

Clean-Label Trends, Plant-Based Alternatives, and Advanced Smoking Techniques

Contrary to such challenges, the market presents enormous prospects for development based on rising demand for natural food fortifiers and clean-label ingredients. The global trend towards plant-based meat alternatives presents room for smoked dextrose as a flavor enhancer. Improved consistency and product scalability also arise from technology growths in controlled smoking and liquid smoke applications, making smoked dextrose a highly adaptable product in the new food economy.

For the years 2020 to 2024, dextrose smoking market grew because natural flavor replacers were necessitated by the food processors so that they would be able to deal with changing customers' demands. The market experienced growing acceptability with the processed meats but was restrained from deeper penetration by the other parts of the foods due to reduced customer awareness. Ecological sustainability was also present, and hence this encouraged the producers to search for greener ways of smoking.

During the years 2025 to 2035, manufacturing of smoked dextrose will further become more sophisticated with the use of sophisticated smoking technologies that reduce the environment footprint without compromising intense intensive flavor profiles.

Clean-labeling will also be more actively driving demand, being used more and more on plant-based food items, gourmet spice blends, and high-end culinary uses. As consumers are becoming increasingly concerned with natural and pure taste, demand for smoked dextrose will see strong and sustained growth in the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food-grade smoking agents and FDA/EU-approved processing methods. |

| Consumer Trends | Rising demand for smoked dextrose in processed meats and gourmet seasonings. |

| Industry Adoption | Usage limited to meat curing, bakery applications, and artisanal food products. |

| Supply Chain and Sourcing | Dependent on traditional hardwood smoking methods and regional ingredient suppliers. |

| Market Competition | Dominated by regional specialty ingredient manufacturers and food processing firms. |

| Market Growth Drivers | Fueled by demand for natural flavor enhancers, clean-label food ingredients, and premium food products. |

| Sustainability and Environmental Impact | Early adoption of controlled wood combustion to minimize environmental footprint. |

| Integration of Smart Technologies | Implementation of automated smoking processes and flavor intensity control. |

| Advancements in Equipment Design | Use of conventional smoking kilns and batch-based processing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter emission regulations, carbon-neutral production mandates, and bio-based smoke flavoring adoption. |

| Consumer Trends | Expansion into plant-based protein products, functional beverages, and clean-label snacks. |

| Industry Adoption | Increased incorporation in non-dairy cheese, fermented foods, and nutraceutical formulations. |

| Supply Chain and Sourcing | Shift toward sustainable wood sources, controlled smoking chambers, and alternative smoking techniques. |

| Market Competition | Entry of biotech firms producing enzymatically smoked dextrose and large-scale ingredient suppliers. |

| Market Growth Drivers | Driven by increasing consumer preference for smoked umami flavors , organic ingredient certifications, and extended shelf-life benefits. |

| Sustainability and Environmental Impact | Transition to smoke condensates, sustainable biomass sources, and reduced-carbon processing techniques. |

| Integration of Smart Technologies | Growth in AI-driven smoking precision, real-time quality assessment, and blockchain -based traceability. |

| Advancements in Equipment Design | Development of precision smoking chambers, low-temperature vapor infusion systems, and electrostatic smoke technology. |

The USA market for smoked dextrose is changing very rapidly because of the increasing demand from the cured meat industry. Smoked dextrose has varied uses in cured meats, sausages, and deli items for flavoring and shelf life preservation to meet the demands of consumers for natural products.

Additionally, the shift towards clean-label food trends has led to food companies replacing natural smoke ingredients with artificial smoke flavoring and chemical preservatives. Uses of functional foods, including snack foods, sauces, and seasonings, are also driving market growth. Natural smoke flavor-friendly regulatory policy and limitations on synthetic additives are also driving adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

Demand for natural and artisan food ingredients in the UK is shaping the market for smoked dextrose. Consumer demand for gourmet foods with natural taste is rising, and this is driving its consumption in high-end foodservice markets such as premium meats, sauces, and smoked cheeses.

The government and food safety regulators also keep stressing clean-label ingredients, thus encouraging manufacturers to move from synthetic smoke additives to natural sources. Naturally smoked ingredients demand extends beyond meat food to affect the bakery, snack, and plant food sectors since specialty smoky flavors in such products provide depth in taste profiles and address shifting consumers' habits.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

The market for European smoked dextrose is expanding further, driven by stringent EU food safety laws and the increased popularity of smoked flavor in plant food. Germany and France are among the world's top innovative countries, employing eco-friendly processing techniques to produce naturally smoked foods.

These countries are at the forefront in applying eco-friendly processes such as wood-smoking alternatives and water smoke condensates in order to attain sustainability goals. Second, as plant and alternative protein food demand rises, smoked dextrose application is spreading its scope in attempting to replicate deep, smoky tastes that were hitherto the norm of meat-contained foods, driving its use throughout dairy substitutes, snacks, and seasonings.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6 .1% |

Japan's market is brimming with demand for smoked dextrose based on the assumption of Japan's vast gastronomical history that focuses on umami-rich foods. The item is being received positively in the conventional and alternative applications, particularly in fermented products, seafood, ramen soups, and fish dishes.

Smoked dextrose gives complexity of flavor to miso, soy sauce, and pickling without compromising on their inherent beauty. Use in ready-to-eat and convenience foods is expanding with Japan's hectic lifestyle. Such shifts to natural, functional ingredients are concomitant to consumer trends with ongoing demand at restaurants and home kitchens for smoked dextrose.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

The market for smoked dextrose in South Korea is on the rise as it is increasingly being applied to substitute proteins like plant meat and fermented foods. The national trend towards food tech innovation has encouraged greater experimentation by consumers with the application of smoky flavors beyond traditional applications.

Smoked dextrose is now showing up in plant-based meat substitutes to create a more authentic barbecue taste, one that consumers are enamored with as consumers shift towards flexitarianism. Fermented foods like kimchi, doenjang (fermented soybean paste), and gochujang (red chili paste) also employ smoked dextrose to impart depth of flavor, appealing to consumers who want intense, smoky flavor profiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6 .3% |

| By Source | Market Share (2025) |

|---|---|

| Corn | 52% |

Corn dextrose in smoked form will be most likely to be the market leader and will have a 52% market share in 2025. Corn-based dextrose is used worldwide due to its neutral flavor and satisfactory solubility and it being a great ingredient in processed meat, bakery foods, and milk products.

Food behemoths prefer to source using corn because of its omnipresent availability and low cost compared to wheat-derived sources. Demand for corn-derived smoked dextrose is driven by the movement towards clean-label and non-GMO ingredients in Europe and North America.

Wheat-derived smoked dextrose follows, catering primarily to artisanal and specialty food manufacturers serving premium, organic, and gluten-free applications. While its market penetration is still less than corn's, wheat-based dextrose is appealing to health-oriented consumers and specialized applications in niche markets.

| By Distribution Channel | Market Share (2025) |

|---|---|

| Supermarket/Hypermarket | 45% |

Supermarkets and hypermarkets will dominate the distribution of smoked dextrose, with a 45% market share in 2025. The domination is due to in-person product selection by consumers, which is highly preferred for food ingredients. Facilitating choice, brand comparison, label reading for clean label claims, and availability of a large range of food-grade dextrose forms promotes bulk buying from retailing giants such as Walmart, Carrefour, and Tesco.

Online stores, while growing considerably, are lagging behind conventional retail owing to reduced consumer confidence in purchasing specialty food ingredients online. Yet, the ease of online buying and direct-to-consumer brand tactics are in position to drive sales expansion within online shopping within the next couple of years.

Growing consumer demand for natural flavor intensifiers, clean label, and smoke-flavor sweeteners is influencing the smoked dextrose market. Food and beverage companies are utilizing smoked dextrose in savory sauces, meat rubs, and vegetable alternatives. Companies are developing proprietary smoke processes, sustainable raw material supply, and granulation processes for improved flavor stability and solubility.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kerry Group | 22-26% |

| Givaudan | 18-22% |

| Archer Daniels Midland (ADM) | 14-18% |

| Red Arrow International | 10-14% |

| B&G Foods (Wright’s) | 6-10% |

| Other Companies (combined) | 14-18% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kerry Group | In 2024, introduced a liquid smoked dextrose extract for clean-label meat marinades. In 2025, expanded production facilities in North America to meet growing demand in plant-based proteins. |

| Givaudan | In 2024, launched a new range of wood-smoked dextrose powders for snack seasonings. In 2025, integrated AI-driven flavor profiling to optimize smoked sweetness for beverage applications. |

| Archer Daniels Midland (ADM) | In 2024, developed a sustainable sourcing initiative for dextrose derived from non-GMO corn. In 2025, introduced a cold-smoke infusion process to retain volatile smoky notes in confectionery. |

| Red Arrow International | In 2024, expanded its portfolio with cherrywood -smoked dextrose for artisanal barbecue sauces. In 2025, collaborated with quick-service restaurants to develop smoked sugar blends for specialty menu items. |

| B&G Foods (Wright’s) | In 2024, launched a smoked dextrose syrup targeted at the craft brewing industry. In 2025, scaled up distribution channels to cater to growing demand from gourmet spice manufacturers. |

Key Company Insights

Kerry Group (22-26%)

Kerry dominates the market with its large portfolio of smoked flavor ingredients, serving both traditional and plant-based meat markets. Its emphasis on natural smoke condensates and eco-friendly processing adds further leverage to its competitive advantage.

Givaudan (18-22%)

Givaudan leads in the smoked dextrose innovation with the use of artificial intelligence-driven flavor mapping for developing highly accurate smoky-sweet profiles. It uses its solutions extensively across the snack food and seasoning markets.

Archer Daniels Midland (ADM) (14-18%)

ADM aims at sustainable and non-GM sources of dextrose and maximizes its production process in order to attain the maximum retention of smoke. Its cold-smoke technology makes it competitive when used in the bakery and confectionery applications.

Red Arrow International (10-14%)

Red Arrow is a leader in smoke flavor technology, with significant presence in barbecue sauce and meat seasoning. Its wood-smoked dextrose blends presence makes it a top choice for food makers looking for authentic smoky flavors.

B&G Foods (Wright's) (6-10%)

Wright's smoked dextrose products have broad uses in artisan food applications, especially in craft brewing and gourmet spice channels. The company continues to develop its distribution channels to further expand its market coverage.

Other Key Players (14-18% Combined)

The overall market size for the smoked dextrose market was USD 52.7 million in 2025.

The smoked dextrose market is expected to reach USD 94.8 million in 2035.

The increasing application in the food & beverage industry, along with rising demand for natural and clean-label ingredients, fuels the smoked dextrose market during the forecast period.

The top 5 countries that drive the development of the smoked dextrose market are the USA, Germany, France, China, and Japan.

On the basis of application, the food & beverage segment is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smoked Meat Market Size and Share Forecast Outlook 2025 to 2035

Smoked Fish Market - Size, Share, and Forecast 2025 to 2035

Smoked Yeast Market Trends - Growth & Industry Forecast 2025 to 2035

Smoked Salt Market Trends - Growth, Demand & Forecast 2025 to 2035

Smoked Black Pepper Market Trends - Flavor Innovation & Demand 2025 to 2035

Smoked Condensates Market Growth - Industry Applications & Trends 2025 to 2035

Smoked Cheese Market

Frozen Smoked Salmon Market Insights – Trends & Forecast 2025 to 2035

Dextrose Monohydrate Market Size, Growth, and Forecast for 2025 to 2035

Dextrose Syrup Market

Polydextrose Market Analysis - Size, Share & Forecast 2025 to 2035

Polydextrose Industry Analysis in Korea – Growth & Consumer Demand 2025 to 2035

Polydextrose Industry Analysis in Japan – Demand & Market Trends 2025 to 2035

Polydextrose Industry Analysis in Western Europe Growth, Trends and Forecast from 2025 to 2035

Polydextrose Ingredients Market Trends - Functional Benefits 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Demand for Polydextrose in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA