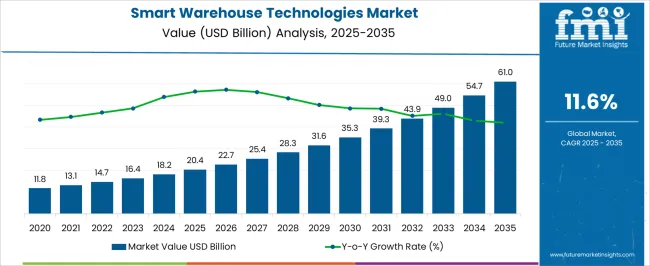

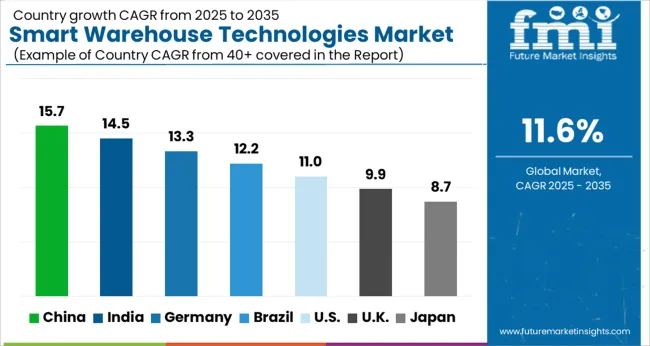

The Smart Warehouse Technologies Market is estimated to be valued at USD 20.4 billion in 2025 and is projected to reach USD 61.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Smart Warehouse Technologies Market Estimated Value in (2025 E) | USD 20.4 billion |

| Smart Warehouse Technologies Market Forecast Value in (2035 F) | USD 61.0 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The smart warehouse technologies market is expanding rapidly due to increasing adoption of automation, real time data tracking, and advanced robotics in supply chain management. Rising global e commerce activity and the demand for faster order fulfillment are driving investments in smart storage, automated retrieval, and digital inventory systems.

Companies are prioritizing technologies that enhance operational efficiency, reduce manual errors, and improve overall throughput. Integration of IoT enabled sensors, AI powered analytics, and cloud platforms is transforming warehouses into highly connected ecosystems capable of predictive decision making.

Additionally, the emphasis on cost efficiency, sustainability, and scalability is encouraging enterprises across industries to adopt modernized warehouse solutions. With growing reliance on digital commerce and supply chain resilience, the outlook for smart warehouse technologies remains robust, supported by continuous innovation in automation and real time logistics management.

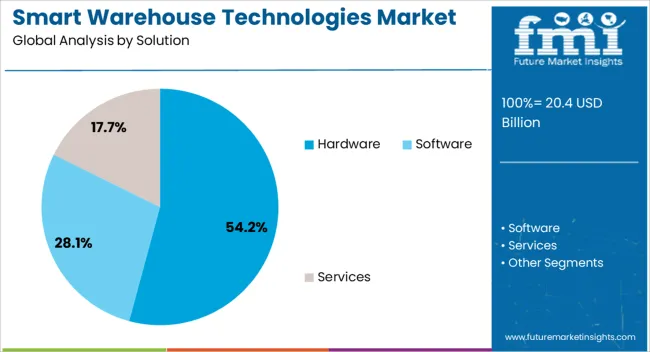

The hardware segment is expected to contribute 54.20% of total revenue by 2025 within the solution category, positioning it as the most prominent segment. This growth is being fueled by the adoption of automated guided vehicles, robotic picking systems, and conveyor technologies that streamline material handling and warehouse operations.

Investments in RFID readers, barcode scanners, and IoT enabled devices have further enhanced visibility and accuracy across inventory management. The demand for scalable and efficient warehouse automation has reinforced the dominance of hardware solutions, as businesses continue to prioritize reliability, speed, and operational efficiency.

As enterprises expand their digital transformation initiatives, hardware systems remain the foundation of smart warehouse infrastructure.

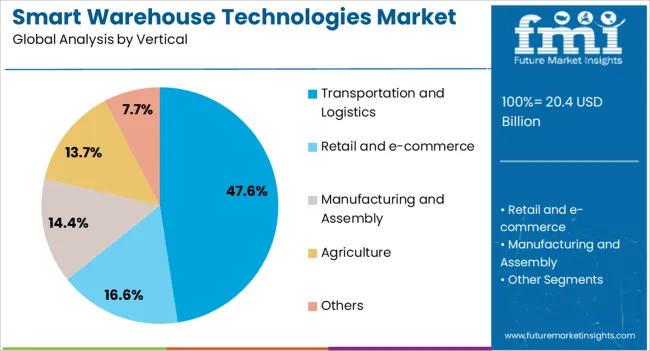

The transportation and logistics vertical is projected to account for 47.60% of total revenue by 2025 within the vertical category, making it the leading industry adopter. This dominance is driven by the increasing need for real time shipment tracking, improved order accuracy, and efficient last mile delivery solutions.

The integration of smart warehouse technologies has enabled logistics providers to optimize route planning, reduce turnaround times, and enhance customer satisfaction. With global supply chains becoming more complex, the sector has prioritized automation, AI powered analytics, and IoT based monitoring to maintain competitiveness.

These factors have positioned transportation and logistics as the primary vertical driving the adoption of smart warehouse technologies.

Technologies are progressing rapidly across all economic sectors. Warehouses must continue to make technological advancements to remain competitive and meet the demands of consumers, manufacturers, and producers. The implementation of smart warehouse solutions and automation will improve productivity, efficiency, and accuracy, allowing employees and processes to be more flexible and responsive.

With an increasing focus on reducing human error, preventing workplace injuries, and optimizing throughput, smart warehouse technologies are becoming more popular. The market will also be significantly impacted by the growth of flexible hours for operations and accurate assessment.

Europe and North America are leading the way in promoting these technologies, which are thereby expanding the global market rapidly. Advanced automation technologies and products are being launched by companies in these regions to offer users a more intuitive warehouse experience. Many warehouse management systems offer quick reporting, real-time statistics, and detailed planning capabilities.

The use of IoT technologies will allow businesses to reduce risks and accidents that have the potential to cause losses in the supply chain by detecting them at an early stage. As sensors are deployed in warehouses, businesses will be able to monitor temperatures, moisture, and other conditions.

Furthermore, the internet simplifies the process of managing data associated with delivery vehicles, spoilage prevention, theft, counterfeiting, and diversion.

Business processes and infrastructure will be streamlined by implementing Cobots with existing associates, while improved workflow will be achieved with these technologies in the future market. Smart warehouse technologies will expand with the advent of automatic guided vehicles and voice command automated picking.

By leveraging RFID and data mining technologies, warehouse processes can be optimized, inventory counts can be improved, and errors can be reduced to further grow the market. Moreover, RFID tags will be a great help to stock management and will allow for more accurate scanning of the products with less effort.

Using smart warehouses accelerates picking times and optimizes inventory tracking and reporting so that the fulfillment process can be expedited, which in turn facilitates faster shipping in the market. In addition, a tech-enhanced system reduces order errors and damages, resulting in fewer returns.

Rising e-commercial sales is enhancing revenue reports for companies across the globe. However, with growth in business, retailers invest in scaling and expansion, which in turn incurs challenges pertaining to warehousing and inventory management as monitoring and managing huge volumes of inventory becomes a tough and tedious task.

Therefore, warehousing and inventory management professionals turn to smart warehouse technologies in order to cater to the requirements of on-demand customers. Well-established multi-national e-commerce and logistics companies, like Amazon.com, Alibaba and DHL, employ smart warehouse technologies to take warehouse and inventory monitoring and management to the next level.

Mobility in warehouses is a guaranteed challenge for inventory management professionals. Most cases suggest requirement of automobiles for quick trips in warehouses and ladders to reach high shelves. These inconveniences minimize productivity of warehousing and inventory management and maximize risk of injuries.

Smart warehouse technologies, like drones, guided vehicles and robots, help combat such operational inefficiencies. Internet of Things (IoT) enabled warehouse equipment enable professionals to scan items instantly, record their locations, and monitor these items in real-time. Such smart warehouse technologies also protect manpower from injuries.

A high demand for smart warehouse technologies is being recorded on a global level. This increase in demand may be attributed to well-established e-commerce companies and retailers with huge warehousing operations and sales networks adopting smart warehouse technologies to combat operational inefficiencies of conventional inventory management and logistics.

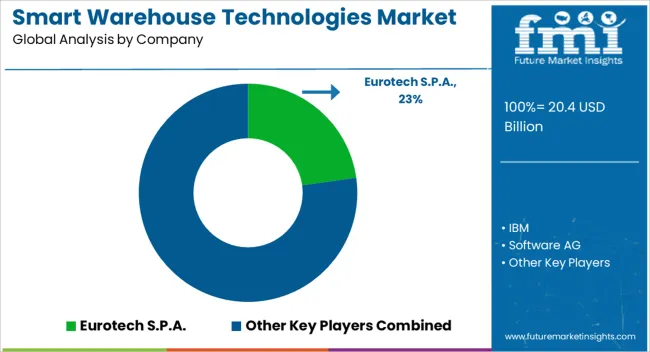

Some of the key players in the global smart warehouse technologies market are

Following are the key initiatives incorporated by vendors competing in the global smart warehouse technologies market:

Currently, the smart warehouse technologies market in North America is leading the global market. This dominance may be owed to accelerated adoption of IoT integrated solutions in e-commerce warehouses and logistics industry.

Smart warehouse technologies market in Southeast Asia Pacific region is expected to record the fastest growth over the forecast period, followed by the market in Middle East and Africa. Increasing demand for efficient warehousing technologies, especially in India and China, is propelling the adoption of smart warehouse technologies in the Asia Pacific region.

The Smart Warehouse Technologies market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. The market report also maps the qualitative impact of various market factors on market segments and geographies.

The global smart warehouse technologies market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the smart warehouse technologies market is projected to reach USD 61.0 billion by 2035.

The smart warehouse technologies market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in smart warehouse technologies market are hardware, software and services.

In terms of vertical, transportation and logistics segment to command 47.6% share in the smart warehouse technologies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA