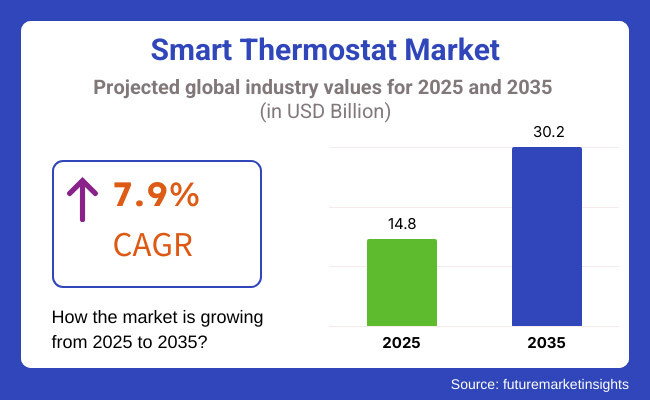

The smart thermostat market is predicted to expand to USD 14.8 billion in 2025 and USD 30.2 billion by 2035 with a CAGR of 7.9% over the forecast period. Smart thermostats with adaptive scheduling, geofencing, and remote access are gaining popularity among consumers with greater control over energy usage. Industry and commerce are also starting to see the cost benefits of these systems and combining them with sophisticated HVAC technologies for the efficient control of air temperature and humidity.

Government initiatives-such as financial incentives and stricter energy efficiency standards-are boosting industry acceptance and encouraging both individual homeowners and corporate buyers to adopt more advanced climate management solutions.

The industry focuses on technologically advanced temperature control devices that utilize artificial intelligence (AI), Internet of Things (IoT) connectivity, and automation to optimize heating and cooling consumption in residential, commercial, and industrial environments. They are more than traditional models, as they can learn the preference of one’s settings, adjust the temperature based on occupancy patterns, and connect to a smart home environment.

They offer features like remote access, voice control, real-time energy monitoring, enabling users to optimize comfort, reduce energy consumption, and lower utility costs. As energy efficiency and sustainability become global priorities, they are playing an ever-larger role in modern climate control solutions.

This is helping make heating and cooling systems increasingly intuitive, these rapid technology advancements in machine learning algorithms, vector flow and voice-based controls and predictive analytics will lead to a larger than ever Industry. Self-learning thermostats use these advances to learn occupancy patterns, product user behaviour, and climate to minimize heating and cooling energy used based on user preference.

For example, wireless connectivity and advanced cybersecurity solutions are strengthening device security and functionality, allowing them to seamlessly integrate with larger IoT ecosystems.

Product org is working to build these thermostats that can be integrated into multiple HVAC systems and the high usage of products across residential, commercial & industrials. With businesses and consumers craving sustainable energy utilization, the focus will largely be on the inustry - responsible for reducing carbon footprints while improving indoor comfort.

Charge is an independent unit of energy meter sold separately from units with a collection of energy consumption history stored onboard or in an external energy data recorder, allowing their embedding in a smart home, smart building, or green building.

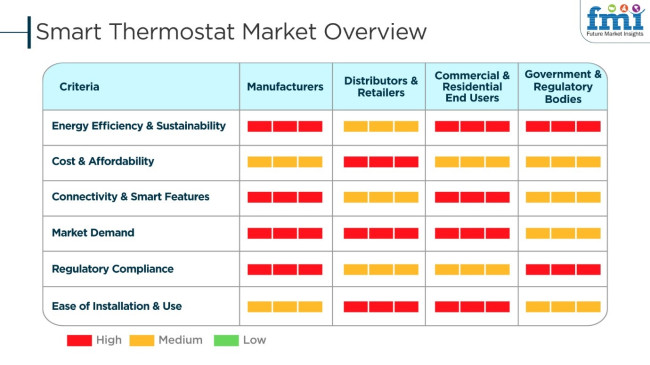

The industry is driven by the growing demand for energy savings, the development of home automation, and the application of IoT devices. Focus is put on AI-powered learning algorithms, mobile app remote control, and compatibility to smart home ecosystems to manufacturers for enhancing personal comfort. Overall, distributors and retailers concentrate on affordability, brand credibility, and customer care to ensure customer expectations.

The main consumers, such as homeowners and businesses, value cost-effectiveness, simplicity of installation, and compatibility with HVAC systems, making products an essential in contemporary living. The energy efficiency standards are imposed and supported by governmental and regulatory bodies through the implementation of incentives to promote the widespread adoption, thus, backing sustainability objectives.

Buying decisions are dictated by parameters such as the price, the energy-saving potential, support for voice assistants (Amazon Alexa, Google Assistant), and the simplicity of use of interfaces. As homes turn into smarter places the industry is switching towards the deployment of AI-powered predictive analytics, geofencing modes, and secured features thereby ensuring energy management and accommodation comfort.

Between 2020 and 2024, the industry grew as there was more need for energy efficiency. Consumers looked for appliances that used less energy and brought convenience in life, with ubiquitous integration with home automation platforms becoming a consequence. Artificial intelligence-based learning algorithms enhanced temperature management, with voice assistant integration becoming mainstream.

Governments around the world provided incentives for energy-efficient residential upgrades, driving adoption as well. However, concerns such as cybersecurity attacks, data privacy, and high costs limited penetration in some regions. North America and Europe were top regions, and also Asia-Pacific region was growing due to urbanization and smart city initiatives.

During 2025 to 2035 the industry will grow with AI-driven predictive climate control, adaptive learning capacity, and increased integration with renewable energy. Thermostats will be using machine learning to manage energy in real-time and adjust climate to the specific requirements of an individual.

Decentralized energy management systems and grid-interactive thermostats will propel sustainability initiatives. Other factors propelling mass uptake among developing countries include improved affordability and enhanced data security.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Manufacturers maximized their energy-saving schedules and incorporated adaptive learning algorithms. Integration with weather forecasting allowed optimization of heating and cooling settings based on climate variations. | Products are in coordination with renewable energy generation, such as solar and wind. Dynamic energy management systems further optimize the energy use of households in terms of balancing the grid load and benefitting from net-zero homes. |

| Products connected with voice assistants like Alexa, Google Home, and Siri for hands-free control. Compatibility with smart lighting and security systems enhanced home automation. | Seamless integration with multi-devices ensures unified control over lighting and appliances. Interoperability with smart grids facilitates demand-response energy management. |

| Remote control and mobile apps permitted temperature control. | Multi-user recognition provides customized temperature settings according to individual preference. Smart zoning provides room-by-room climate control for energy savings and individual comfort. |

| Products included air quality sensors to monitor humidity, CO2, and VOC. Air purification devices integrated with HVAC systems to improve indoor air quality. | Sophisticated analysis of air quality provides real-time health recommendations. Smart ventilation systems regulate airflow automatically to maintain the air quality at its optimal level and reduce allergens. |

| Homeowners adopted them for energy efficiency and remote control. Commercial buildings used centralized products for cost-saving climate control. | There is higher demand for intelligent climate control in urban areas. Products centralized are employed to enhance energy management and comfort of occupants. |

| Cloud storage secure by design and end-to-end encryption were employed by manufacturers to safeguard the data of users. Privacy policies guaranteed protection of the information. | Zero-trust security architecture protects product ecosystems. Decentralized storage prevents user data from becoming impersonal and disallows unauthorized access. |

| Companies justified manufacturing with modular designs and optimized factory production lines. Local production reduced logistics expenses and lead times. | Predictive supply chain management increases inventory accuracy and minimizes lead times. Circular manufacturing practices allow for recycling and reuse of product parts. |

| Governments implemented energy efficiency standards, which encouraged innovation in green-friendly designs. Safety laws required compliance with electrical and fire safety codes. | Compliance requirements encourage net-zero energy devices. Regulatory systems promote compatibility with renewable energy systems and smart grids. |

The global smart thermostat market faces several high-impact risks that could affect both manufacturers and consumers. Among the most critical threats is cybersecurity. Since smart thermostats are connected via Wi-Fi and integrated into broader IoT ecosystems, they are particularly vulnerable to hacking, ransomware attacks, data breaches, and unauthorized access. To mitigate these risks, manufacturers must implement robust encryption protocols, multi-factor authentication, and frequent firmware updates.

Regulatory compliance poses another major challenge. Companies must adhere to a growing list of standards and regulations related to energy efficiency, data privacy, and device safety-set forth by authorities such as Energy Star (EPA), the Federal Communications Commission (FCC), and the General Data Protection Regulation (GDPR). Failure to comply can lead to legal consequences, product recalls, and restricted market access.

Technology obsolescence is also a growing concern. Rapid advancements-such as AI-powered climate control, voice assistant integration, and energy optimization algorithms-risk rendering older models outdated quickly. To stay competitive, companies must invest continuously in R&D, cloud-based functionalities, and regular software updates.

The market is becoming increasingly competitive, with both established brands and new entrants fighting for visibility. To differentiate themselves, companies must focus on strong unique selling propositions (USPs), including self-learning capabilities, ecosystem compatibility, remote access, and user-friendly design. These features are key to capturing market share and building long-term customer loyalty.

The services component-installing, maintaining, remote monitoring, energy management solutions-is becoming the main source of growth as customers begin to demand a smoother integration in smart home ecosystems. Companies such as Google Nest, Ecobee and Honeywell Home offer subscription services with AI-powered energy optimization, predictive maintenance, and real-time consumption monitoring for greater efficiency and cost savings.

Government policies and subsidies are also driving the uptake of products and related services. The USA Department of Energy's ENERGY STAR program encourages product adoption with rebates, while utility companies worldwide run demand-response programs paying customers to reduce energy use during peak times.

The growth of the smart grid network has made service-based offerings more critical in handling energy loads and optimizing the use of HVAC (heating, ventilation, and air conditioning) systems for both residential and commercial purposes.

The smart home industry is led by Europe and North America. The frequent adoption of smart homes and favourable policies have been expected, because of this the geographic sector has the maximum number of industry participants. Managed services industry Demand- Increasing adoption of IoT in home automation to hamper hassle connectivity between assorted smart devices in managed services demand industry.

With growing concern for the environment, service models including remote diagnostics, automated temperature control, and cloud-based analytics, will be essential to industry growth, meaning that the service segment is a key driver of long-term industry growth.

Enhancements of security & access, lighting & window control, and other solutions benefit physical and digital educational environments.

Solutions like security and access help educational institutions remain secure, in-person and online. Cybersecurity remains a pressing issue as schools and colleges amass a mountain of information about students and faculty.

For instance, organizations such as McAfee, Palo Alto Networks, and Fortinet offer AI-powered cybersecurity solutions to safeguard educational institutions against cyber threats, phishing attacks, and data breaches. As a part of the Microsoft 365 suite, Educators get advanced threat protection and compliance management to secure their digital learning platform with Microsoft Defender for Education.

HID Global and Honeywell offer biometric access control and smart ID cards, while facial recognition systems provide campus security and restriction of access to sensitive areas in physical security.

Lighting and window solutions have improved energy efficiency, comfort, and student productivity in smart learning environments. For example, Schneider Electric, Lutron Electronics, and Philips Hue offer AI-based lighting systems that automatically modulate brightness and color temperature to boost focus and reduce eye fatigue in classrooms.

Smart shading and daylight optimization to regulate natural light create what’s known as solutions from View Inc. and Somfy Systems to manage the “thermally comfortable” learning experience. This boosts student well-being in schools and universities that employ these solutions and helps them meet energy efficiency and sustainability targets.

With the increase in demand for smart education solutions, institutions are investing in integrated security, access control, and smart infrastructure to build safe, efficient, and technology-driven learning environments.

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 9.0% |

| UK | 8.7% |

| European Union | 8.8% |

| Japan | 8.9% |

| South Korea | 9.2% |

The USA industry grows fast as homes and enterprises embrace energy-saving climate control systems. Organizations develop AI-powered thermostats that control temperature, save energy, and maximize user convenience. Smart home adoption in the USA crosses 40%, which indicates growing interest in home automation solutions. Voice-based, learning-capable as well as IoT-enabled thermostats remain on the rise as consumer’s demand convenience and cost reduction.

Government initiatives, including incentives and rebates, encourage homeowners and businesses to fit products.

The industrial and commercial sectors also implement these solutions in order to address sustainability regulations and long-term energy efficiency goals.

FMI is of the view that the USA industry is anticipated to increase at 9.0% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| High Smart Home Adoption | 40% of USA households adopt smart home technologies, driving product demand. |

| Government Incentives | Energy efficiency initiatives and rebates incentivize homeowners and businesses to embrace smart climate control technology. |

| AI and IoT Integration | Products leverage AI and IoT to simplify thermostat use and optimize energy efficiency. |

| Commercial & Industrial Use | Businesses utilize products to meet sustainability objectives and lower operating expenses. |

The UK industry expands as consumers increasingly look for energy-saving home automation products. Firms combine the use of AI and remote control with thermostats, allowing consumers to control and keep track of energy use in real-time. The focus of the government on carbon neutrality further drives the development of smart climate control solutions.

A big proportion of new houses and business buildings feature smart thermostats as a standard appliance.

Wireless connectivity technology allows for convenience, fuelling greater use in urban and suburban locations. Greater demand for learning-based, app-controlled thermostats fuels long-term industry growth.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Awareness of Energy Efficiency | Homeowners are keen to save energy, and this has spurred the adoption of smart thermostats. |

| Government Targets for Sustainability | Smart climate control solutions are being supported by initiatives for carbon neutrality. |

| Smart Home Automation Development | More and more new buildings and commercial facilities have intelligent thermostats. |

| Wireless Connectivity Developments | Enhanced connectivity enhances the use and acceptance of intelligent thermostats. |

European Union industry grows as domestic and industrial markets embrace new climate control technology. Germany, France, and Italy are at the forefront of embracing AI-based energy management systems and smart home solutions. The EU's high energy efficiency standards compel manufacturers to develop green and programmable thermostats.

Machine learning and predictive analytics advancements accelerate the commercial and residential space growth of smart thermostats. Additionally, the rise in the incidence of smart cities and green building efforts promotes the development of the industry.

FMI is of the opinion that the European Union industry will expand at an 8.8% CAGR during the forecast period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Stringent Energy Efficiency Policies | The EU demands strict regulations, promoting energy-efficient installation of thermostats. |

| Smart City and Green Building Initiatives | Growing urban sustainability initiatives increase industry demand. |

| AI and Predictive Analytics | Smart thermostats employ AI for optimized and automated energy usage. |

| High Residential and Industrial Penetration | Residential and industrial customers install smart thermostats to minimize costs and meet environmental regulations. |

Japan's industry grows as companies and homes adopt AI-regulated climate control systems. Firms create highly accurate devices that improve temperature control, reduce energy costs, and improve comfort. Smart homes represent a growing share of the housing industry, which allows for the growing demand for smart climate control systems.

Increased emphasis on energy conservation and home automation drives adoption of smart thermostat solutions in the nation. Real estate, hospitality, and business sectors utilize artificial intelligence-based climate management solutions for optimizing operations and meeting sustainability objectives.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Energy Conservation Programs | Government policy places emphasis on judicious use of energy, which leads to adoption of smart thermostats. |

| Accelerating Smart Home Adoption | The smart home trend keeps on growing, paving the way for industry expansion. |

| AI-Powered Precision Control | Firms create precise thermostats with high accuracy for efficient energy management. |

| Commercial Sector Investment | Firms invest in smart thermostats to increase business efficiency. |

The South Korean industry grows as customers and businesses adopt smart home technology, IoT connectivity, and AI climate control. The government actively promotes energy efficiency initiatives and smart city initiatives, driving more prevalent adoption of intelligent climate control systems.

Firms introduce voice-activated, learning-based, and network-connected thermostats in order to enhance customer convenience and energy efficiency. Improvements in sensor technology and real-time energy readings make smart thermostats an energy-efficient choice for home as well as commercial purposes. Industry in South Korea, as per FMI, is expected to expand at 9.2% CAGR during the forecast period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government Support for Smart Cities | National initiatives encourage the utilization of smart climate control systems. |

| AI and IoT Integration | AI and IoT are employed in smart thermostats for superior energy management. |

| Advancements in Sensor Technology | Smart sensors enable real-time monitoring and auto-correcting. |

| Increasing Consumer Demand for Smart Homes | Homeowners look for smart, networked solutions to maximize energy efficiency. |

The global industry is on the verge of explosive growth, with increasing consumer preferences for energy-efficient connected homes being one of the key factors that are driving the industry. The major industry drivers include the ongoing advancements in IoT, AI-powered climate control, and increasing acceptance of smart home ecosystems.

The increasing regulatory emphasis on energy conservation and sustainability would lead to even further adoption, as theys build one of the most important cornerstones of the modern HVAC system.

Tech giant companies like Google Nest, Ecobee, Honeywell, Emerson, and Johnson Controls control the industry with their product and service innovations in machine learning-derived temperature optimization, compatibility with voice assistants, feature-rich applications for mobile access and others.

The companies are mainly concerned with smooth and flawless integration with smart home systems, data-driven automation, and geofencing technology for consumer convenience and energy savings.

New startups and niche vendors are emerging by providing affordable yet feature-rich standards and customized solutions for commercial and multi-unit residential applications.

Smart home technology demand is expected to continue growing, and service providers that focus on AI-powered automation, high compatibility with existing smart ecosystems, and energy efficiency certifications will have a competitive edge in the future marketplace.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google Nest | 20-25% |

| Ecobee | 15-20% |

| Honeywell Home | 12-17% |

| Emerson Electric | 8-12% |

| Johnson Controls | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google Nest | Leads in AI-powered smart thermostats, voice control integration, and adaptive climate automation. |

| Ecobee | Develops smart thermostats with occupancy sensing, energy analytics, and seamless smart home integration. |

| Honeywell Home | Specializes in IoT-enabled thermostats, remote temperature control, and predictive heating/cooling. |

| Emerson Electric | Focuses on programmable thermostats, HVAC automation, and commercial energy management solutions. |

| Johnson Controls | Provides smart climate control systems, building automation, and AI-driven energy optimization. |

Key Company Insights

Google Nest (20-25%)

Certainly, Google Nest stands as the leader in the industry, with its product based on AI-enabled climatic automation, voice assistant integration, and real-time energy-saving measures.

Ecobee (15-20%)

Elevate household comfort with occupancy-sensitive smart thermostats and energy-efficient heating and cooling mechanisms supported by the seamless connectivity offered by Ecobee.

Honeywell Home (12-17%)

The service offered by Honeywell Home comprises IoT-based climate control, predictive temperature automation, and advanced home energy management.

Emerson Electric (8-12%)

Emerson Electric delivers programable thermostats, smart management of HVAC systems, and answers to commercial energy efficiency.

Johnson Controls (5-9%)

Johnson Control's customer- AI-enabled climate control, smartly integrated buildings, and optimized heating and cooling systems.

Other Key Players (30-40% Combined)

By services, the industry is divided into managed and integration.

By solution, the industry is divided into security and access, lighting and window, audio-visual and entertainment, and energy management and climate.

By region, the industry is divided into North America, Latin America, Europe, Asia pacific, and the Middle East & Africa.

The industry is expected to reach USD 14.8 billion in 2025.

The industry is projected to witness USD 30.2 billion by 2035.

The key companies in the industry include Google Nest, Ecobee, Honeywell Home, Emerson Electric, Johnson Controls, Schneider Electric, Amazon (Ring Thermostat), Resideo Technologies, Lennox International, and Tado.

South Korea is slated to grow at 9.2% CAGR during the forecast period.

Their main application is security and access.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Solution, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Solution, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 13: Global Market Attractiveness by Services, 2023 to 2033

Figure 14: Global Market Attractiveness by Solution, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 28: North America Market Attractiveness by Services, 2023 to 2033

Figure 29: North America Market Attractiveness by Solution, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Solution, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Solution, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Solution, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 58: Europe Market Attractiveness by Services, 2023 to 2033

Figure 59: Europe Market Attractiveness by Solution, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Services, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Solution, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Solution, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Solution, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Services, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Solution, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Services, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Solution, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Services, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Solution, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Solution, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Solution, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Solution, 2023 to 2033

Figure 118: MEA Market Attractiveness by Services, 2023 to 2033

Figure 119: MEA Market Attractiveness by Solution, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wi-Fi Smart Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Thermostatic Radiator Valves Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA