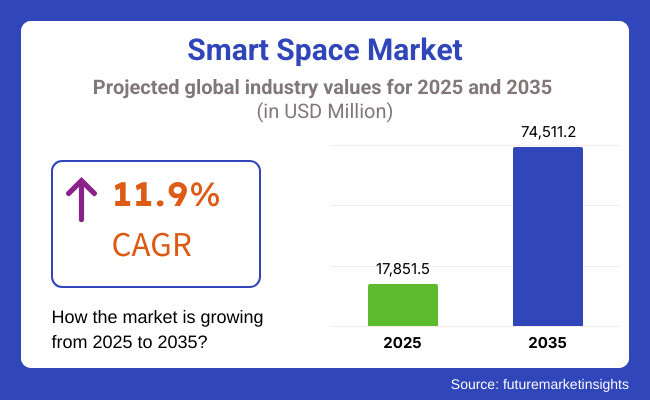

The global Smart Space market is projected to grow significantly, from 17,851.5 million in 2025 to 74,511.2 million by 2035 an it is reflecting a strong CAGR of 11.9%.

With organizations utilizing more external vendors and partners for smart space solutions, managing third-party risk will be critical. Recent developments in smart spaces are seeing atoms and bits converge with the integration of IoT devices, AI-driven automation and cloud-based services that create a new surface area for attack that requires thorough vendor assessments in order to not incur security breaches or compliance failures.

The market is governed by the growing regulatory frameworks, such as GDPR in Europe and the energy efficiency mandate, that want organizations to perform risk assessments prior to the implementation of smart space technologies. Businesses can also use automated compliance tools to ensure they meet regulatory requirements while adopting third party solutions.

As companies pursue digital transformation, they rely more and more on third-party providers for the smart technologies they need, from real-time occupancy monitoring to AI-fueled building management systems. This increasing dependency has led to a demand for risk management solutions to prevent vulnerabilities and ensure compliance.

As organizations are becoming more susceptible to risks created by third-party smart space vendors, the rising cyber threat has made organizations more vulnerable. It extends protection against breaches, secures connections with external partners, and ensures continuous monitoring and real-time risk assessment.

North America is the largest smart space market, owing to rigorous regulatory requirements, significant attention to cybersecurity, and a well-established base of key smart space solution providers. Conversely, emerging economies such as India and Australia increasingly adopt risk management tools to back their growing digital frameworks.

Explore FMI!

Book a free demo

| Company | Cisco Systems, Inc. |

|---|---|

| Contract/Development Details | Collaborated with a global real estate developer to implement smart building solutions, integrating IoT devices and sensors to optimize energy usage and enhance occupant comfort. |

| Date | May 2024 |

| Contract Value (USD million) | Approximately USD 40 |

| Renewal Period | 6 years |

| Company | Siemens AG |

|---|---|

| Contract/DevelopmentDetails | Awarded a contract to develop smart campus infrastructure for a leading university, focusing on sustainability and efficient space utilization through advanced analytics and automation. |

| Date | October 2024 |

| Contract Value (USD million) | Approximately USD 35 |

| Renewal Period | 5 years |

Increased integration of IoT devices enhances smart space efficiency

The revolutionary changes brought by Internet of Things(IoT) devices are introducing robust transformations to smart spaces that are making systems more efficient and functional in many sectors. In 2024, the total global number of connected IoT devices is estimated to amount to 18.8 billion, corresponding to a year-on-year growth of some 13 percent. The growth is fueled by the need for inter-connected systems that optimize operations in smart offices, smart homes, smart industrial facilities and the like.

The Internet of Things (IoT) plays a pivotal role here, allowing for the collection and analysis of data in real-time to adjust lighting, heating, and even security systems accordingly, consequently optimizing resource utilization and minimizing operational expenses. The sensors can know whether a room is occupied or not and manage energy use effectively (IoT enabled devices for smart grid). Around the globe, the vision of smart cities - where technology and data work in tandem to enhance urban living - is being realized by governments. You are based on data until October 2023. This initiative highlights the importance of IoT devices in creating smart spaces that can adapt in real-time to the requirements of the individuals within.

Growing investments in urban infrastructure fuel smart space adoption

Globally, urbanization is happening rapidly, leading to heavy investments on urban infrastructure to provide for larger urban population and improve the urban living standards. Smart Infrastructure is fueling a global ecosystem, which, according to a recent report, is expected to grow rapidly, going from USD 370.22 billion in 2023 to USD 2,038.48 billion in 2033, with infrastructure being one of the biggest energy consumers at 66% of the global consumption. This includes development of smart networks for transportation, buildings, and communication systems, which are key components of smart spaces.

For instance, the European Union's "{Green City Initiative} in 2024 allocated USD 1 billion to promote urban smart projects in member states, prioritizing the incorporation of renewable energy sources and others as smart grids into urban infrastructures. These kinds of investments not only improve the smarts and sustainability of urban environments but also open up opportunities for smart solution providers and service companies. With ongoing urban growth, resource management issues and the need for environmental sustainability means that smart space optimization techniques are required to create the cities of the future.

Rising smart infrastructure projects in developing countries drive demand

Smart infrastructure projects are being embraced in developing nations as they are able to positively address urbanization issues while foreseeing low-cost economic development. The projected value of the smart cities market is USD 3,052.7 billion by 2032 with incremental demand mainly being generated through initiatives (ICT, IR, IoTs, etc) taken by emerging nations (or economies). Description These projects usually include the deployment of IoT devices, smart grids, intelligent transportation systems, and these tools can be used to support urban services and improve the quality of life for their residents.

For example, the partnership between China and countries in Africa has already boosted the rollout of smart city technologies such as traffic management systems and energy-efficient building solutions to improve efficiency and sustainability in cities. In 2024, the Indian government announced a USD 1.2 billion investment under its "Smart Cities Mission" to develop 100 smart cities, with a focus on digital infrastructure and sustainable urban planning.

Such initiatives serve to not only remedy infrastructural shortfalls but also spur demand for smart space solutions, providing potential entry points and expansion opportunities for technology providers in these emergent markets. Ongoing initiatives in developing countries for smart solutions around infrastructure are expected to play a significant role in the expansion of the global smart space market as innovative solutions beg competitive practices that address the specific challenges presented by urbanization faced by nations worldwide.

Integration of diverse technologies from multiple vendors is complex

The smart space market still faces many challenges such as integrating different technologies from different vendors. Smart spaces operate on multiple interdependent systems that combine IoT devices, AI-based analytics, cloud platforms, and automation tools. Often, however, each of these components is built by separate vendors, which leads to compatibility issues and other technical quirks. For example, an intelligent building may include security systems from one vendor, HVAC automation from another, and occupancy sensors from yet another. Complex middleware solutions and interoperability frameworks are needed to ensure seamless communication between these technologies.

Lack of universal standards adds to the challenge of integration - with different vendors using proprietary protocols, it becomes a struggle to share data across systems. Inherited lack of standardization can lead to performance inefficiencies, security vulnerabilities, and delays in deploying smart space solutions.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Smart city initiatives drove investments in connected infrastructure. |

| IoT & Connectivity | Adoption of 5G-enabled smart devices enhanced real-time monitoring. |

| AI-driven Automation | AI-powered building management systems optimized energy consumption. |

| User Experience & Personalization | Sensor-driven personalization improved workplace and residential automation. |

| Market Growth Drivers | Expansion of smart offices and co-working spaces accelerated adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered urban planning mandates enhance smart space integration. |

| IoT & Connectivity | Integration of quantum networks enables instant and secure smart space communication. |

| AI-driven Automation | Fully autonomous smart spaces adapt dynamically to environmental and occupancy changes. |

| User Experience & Personalization | AI-enabled ambient intelligence predicts and adjusts user preferences in real time. |

| Market Growth Drivers | Widespread adoption of autonomous smart environments revolutionizes urban living. |

Tier 1 Vendors - Established industry players with a large market share, a significant geo footprint, and broad product portfolio pertaining to smart space. They frequently lead the way in setting industry standards and innovation. Some of the major tier 1 vendors in the smart space market include Cisco Systems, Inc., Hitachi, Ltd., and Huawei Technologies Co., Ltd. With their vast resources and ongoing commitment to research and development, they have been able to provide integrated solutions across multiple sectors, such as commercial real estate, healthcare, and urban infrastructure.

Tier 2 Vendors: These are larger organizations with a well-established presence in the market, providing targeted smart space solutions, very often either industry-specific (i.e. transportation, healthcare) or very technology-specific (i.e. IoT, robotics, energy efficiency). Though not as widely adopted globally as the Tier 1 vendors, they are respected for innovation and can address regional markets relatively well. Tier 2 vendors include companies such as ABB Ltd. and Iconics, Inc. offering customized solutions that target specific segments of a smart space including energy management and building automation.

Tier 3 Vendors: This tier consists of new entrants & start-ups that are becoming prominent in the smart space domain. You are a domain-specific expert focused on targeted smart space challenges or disruptive technology. They have a smaller market share, but their nimbleness enables them to swiftly respond to both the demands of the market and technology changes. It includes Tier 3 vendors like Adappt Intelligence Private Limited & Capmo GmbH who are bringing diversity and dynamism to the smart space ecosystem.

The section highlights the CAGRs of countries experiencing growth in the Smart Space market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.0% |

| China | 15.4% |

| Germany | 9.8% |

| Japan | 12.0% |

| United States | 11.3% |

With the accelerated growth of urban typologies within China, megacities have been cropping up with a great demand for smart space solutions. Urbanization is among the highest priorities of the government, which has enacted policies for modernization of cities to accommodate resident migration. Li Keqiang, the Chinese premier, estimates that another 300 million Chinese will shift to urban areas in the years to come, making intelligent infrastructure required to accommodate this settler invasion. On the other hand, technology, including embedded sensors, metering devices, and cameras combined with big data processing, is integrated by China as a global leader in smart city to facilitate urban management and public services.

The goal is to maximize usefulness and efficiency for daily life, and streamline government activities leading to a huge market for smart space products to counter increasing urban complexity. China is anticipated to see substantial growth at a CAGR 15.4% from 2025-2035 in the Smart Space market.

In India, the adoption of industrial IoT-based energy management systems is rapidly growing. The reduced demand stems from the imperative of improving energy efficiency and cutting operational expenses in a fast-expanding economy. It is becoming common to integrate Internet of Things (IoT) in Power distribution applications to fortify real-time asset condition monitoring which would enhance the reliability of energy systems.

This movement is further supported by the Indian government's emphasis and devotion towards smart energy management policies that will help build sustainable smart cities with energy-efficient dynamics, which can turn out to be impactful for future carbon footprints. Consequently, sectors are adopting advanced technologies like IIIoT to monitor and manage energy consumption more efficient that this energy management market volume, is expected to reach USD 338.5 million by 2029. The expansion demonstrates the nation's focus on harnessing IoT technologies to solve energy problems and advance eco-friendliness. India's Smart Space market is growing at a CAGR of 14.0% during the forecast period.

Enterprises in the United States are increasingly embracing cloud-based smart space platforms to provision intelligent spatial environments. In the 'Cloud Smart' strategy, released in October 2018, the federal government encouraged the use of commercial cloud technologies to improve operational efficiency and minimize implementation barriers. In fact, due to this initiative, federal agencies spent a total of USD 4.3 billion on cloud services in FY2018 alone. According to the USA Department of Labor's Bureau of Labor Statistics, cloud computing is a key driver of growth among all technology occupations, which are expected to grow by 13% between 2016 and 2026. USA is anticipated to see substantial growth in the Smart Space market significantly holds dominant share of 78.4% in 2025.

The section provides detailed insights into key segments of the Smart Space market. Among these, Software is growing quickly and making prominent advancements. The Commercial Smart space hold dominant share.

Increased use of software solutions is a key factor driving the growth of the global smart space market. Software allows to integrate and optimize different smart systems and provides better control, analysis of data in real-time and automation for intelligent spaces. With more businesses and cities embracing smart infrastructure, software platforms enabling IoTs, data analytics, and machine learning algorithms are set to play an increasingly important role. These software solutions enable centralized management, predictive maintenance, energy optimization, and security monitoring.

USA Government Cloud Smart for Smart Spaces USA, Cloud Smart, a new initiative from the government, encourages agencies to expand and innovate upon cloud-based cloud-based platforms across sectors in areas like smart spaces. Driven by the need to increase efficiency, flexibility, and collaboration, as well as to support employees during digital transformation. Even the USA federal government spent over USD 4B on cloud services in FY 2018, solidifying the criticality of cloud-based software. The growing emphasis on adopting the cloud plays a vital role in integrating advanced software through smart spaces and expands their reach while providing a seamless user experience. Software grows at a substantial CAGR of 13.7% from 2025-2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Software (Component) | 13.7% |

The commercial smart spaces application segment accounted for the largest market in terms of value and dominate the smart space market. Insights that can help organizations become more effective, get more value from their resources, and form leaner, greener workplaces are key to unleashing the power of these spaces. Commercial smart space segments consist of office buildings, retail establishments, and other business environments in which IoT device integration, building automation systems, and energy management solutions can drive substantial cost and performance improvements.

Support for commercial smart spaces has been further bolstered by USA government programs promoting green building and energy efficiency. According to the USA Green Building Council (USGBC), there are more than over 100,000 LEED-certified commercial buildings, which speaks to the trend toward sustainable and smart building solutions. These structures usually make use of smart technologies such as automated lighting, HVAC systems and occupancy sensors that are all powered by a software integration that makes sure the operation is optimized. Commercial Smart Spaces are projected to dominate the Smart Space market, capturing a substantial share of 42.3% in 2025.

| Segment | Value Share (2025) |

|---|---|

| Commercial Smart Spaces (Premises Type) | 42.3% |

The market on the basis of solution is segmented as hardware, software, and service. Organizations are centered on accommodating IoT advancements, AI, and cloud computing for an economy of smart space solutions that are more confident, scalable, and successful. The increasing need for energy-efficient, automated, and connected surroundings has also spurred innovations and significant product launch and partnerships. With the proliferation of businesses, companies are more reliant on data analytics and AI-based platforms to streamline and optimize operations, as well as to improve user experience.

Industry Update

The Global Smart Space industry is projected to witness CAGR of 11.9% between 2025 and 2035.

The Global Smart Space industry stood at USD 17,851.5 million in 2025.

The Global Smart Space industry is anticipated to reach USD 74,511.2 million by 2035 end.

East Asia is set to record the highest CAGR of 13.8% in the assessment period.

The key players operating in the Global Smart Space Industry Siemens AG, Schneider Electric SE, ABB Ltd., Honeywell International Inc., Huawei Technologies Co., Ltd., Johnson Controls International plc, Cisco Systems, Inc., Legrand S.A., Philips Lighting (Signify), Hitachi Vantara LLC.

In terms of component, the segment is divided into hardware, software and services.

In terms of application, the segment is segregated into Energy Management & Optimization, Air Quality Monitoring, On-demand Cleaning, Building Security Management, Building Automation and Others.

In terms of Premise Type, the segment is segregated into Residential Smart Spaces/Smart Homes, Commercial Smart Spaces and Industrial Smart Spaces.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.