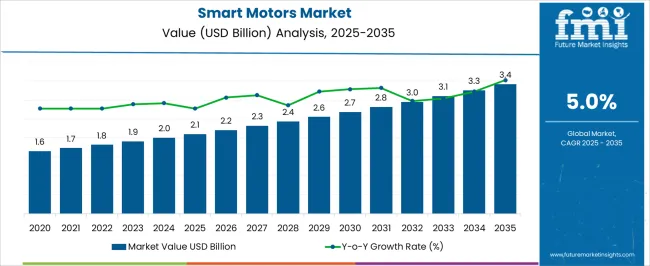

The Smart Motors Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Motors Market Estimated Value in (2025 E) | USD 2.1 billion |

| Smart Motors Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The smart motors market is gaining strong traction as industries increasingly adopt energy efficient and intelligent motion control solutions. Rising emphasis on automation, predictive maintenance, and operational efficiency has accelerated the integration of smart motors across manufacturing and industrial environments.

These motors are equipped with embedded sensors and communication capabilities that allow real time monitoring, reduced downtime, and optimized performance. Regulatory frameworks focused on energy conservation and the global push toward Industry 4.0 are further driving adoption.

Additionally, advancements in IoT connectivity, cloud integration, and AI enabled diagnostics are enhancing the functionality and scalability of smart motor systems. The outlook for the market remains positive as industries continue to prioritize sustainable and digitally enabled production systems, reinforcing the role of smart motors as critical enablers of efficiency and productivity.

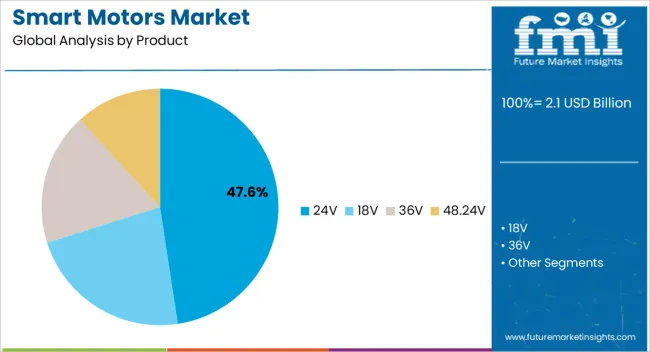

The 24V product segment is expected to contribute 47.60% of overall revenue by 2025 within the product category, making it the leading segment. This dominance is driven by its widespread compatibility with industrial automation systems, compact design, and cost efficiency.

The voltage level provides a balance of safety and performance, making it suitable for a broad range of industrial and commercial applications. Ease of integration with control units and sensors has further supported its preference across industries.

As automation initiatives expand globally, the adoption of 24V smart motors is expected to rise consistently, consolidating its leadership in the product segment.

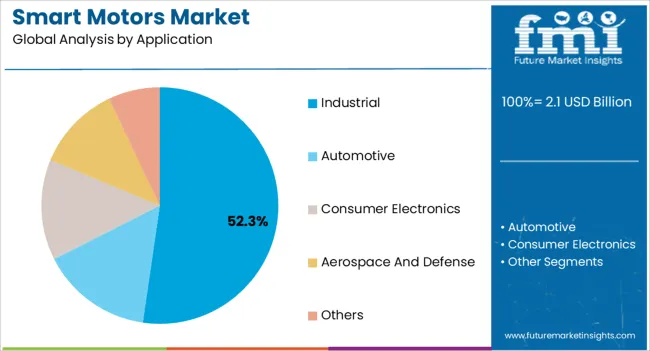

The industrial application segment is projected to account for 52.30% of total revenue by 2025, positioning it as the most dominant application category. This growth is being propelled by rising investment in factory automation, robotics, and process optimization initiatives.

Smart motors in industrial environments enable energy savings, predictive maintenance, and precise operational control, reducing both costs and downtime. Their ability to connect seamlessly with digital platforms has reinforced their importance in modern manufacturing ecosystems.

The integration of smart motors in assembly lines, material handling, and production machinery continues to strengthen their demand, ensuring the industrial sector remains the largest and most influential application segment.

Based on FMI research findings, the global smart motors market exhibited a valuation of around USD 2.1 billion in 2025 as compared to the projected value of USD 2.1 billion in 2025 and eventually reaching around USD 3.4 billion by 2035.

The market has witnessed significant growth from 2020 to 2025, with increasing demand and technological advancements driving the market expansion.

With the continuous integration of smart technologies and the rising need for energy efficiency across various industries, the smart motors industry is predicted to experience significant growth and surpass the achievements of the previous years.

The market is projected to exhibit substantial expansion, presenting key opportunities and demonstrating a notable advancement in terms of market size, revenue, and adoption.

As per FMI, the market for smart motors is predicted to advance at a CAGR of 5.2% from 2025 to 2035.

What are the Growth Prospects for the Smart Motors Industry?

How is the Market Projected to Expand due to the Rising Demand for Industrial Automation, Robotics, and Efficient Material Handling Solutions?

What are the Limitations and Challenges Faced by the Smart Motors Industry?

| Country | The United States of America |

|---|---|

| CAGR (2025 to 2035) | 4.3.4% |

| Market Size (2035) | USD 3.4 billion |

| Country | The United Kingdom |

|---|---|

| CAGR (2025 to 2035) | 4.4% |

| Market Size (2035) | USD 3.453.7 million |

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 6.2% |

| Market Size (2035) | USD 257.3 million |

| Country | Japan |

|---|---|

| CAGR (2025 to 2035) | 4.7% |

| Market Size (2035) | USD 23.47.4 million |

| Country | South Korea |

|---|---|

| CAGR (2025 to 2035) | 5.6% |

| Market Size (2035) | USD 3.423.4.3 million |

The supremacy of the smart motors market in the United States of America can be attributed to multiple factors that are contributing to the country’s anticipated growth rate of 4.3.4% during the forecast period, touching USD 3.4 billion in 2035.

The country's strong industrial sector, encompassing manufacturing, automotive, and aerospace industries, drives the demand for smart motors.

The United States has a culture of technological innovation and adoption, with significant investments in research and development. Supportive government initiatives, favorable regulatory frameworks, and incentives for energy efficiency contribute to market dominance.

The presence of established market players, technological expertise, and a large customer base further solidify the United States' position as a leader in the smart motors market.

The market demand for smart motors in the region is expected to be driven further by the increased need to adopt energy-efficient solutions, fueled by stringent environmental regulations set by the US Environmental Protection Agency.

These regulations, aimed at reducing carbon emissions, have created a growing necessity for businesses to embrace energy-efficient technologies such as smart motors. As a result, the market for smart motors is anticipated to expand as organizations strive to comply with environmental regulations while optimizing their energy consumption.

The market potential and opportunities for the smart motors industry in the United Kingdom are driven by supportive government initiatives as they play a significant role in creating a conducive environment for the adoption of smart motors.

The United Kingdom government has implemented policies, regulations, and incentives that prioritize energy efficiency and sustainability, thereby promoting the use of smart motors across various sectors. The increasing focus on energy efficiency and carbon emissions reduction drives the demand for smart motors.

There is a growing preference for energy-efficient solutions as organizations and individuals become aware of the importance of energy conservation. Smart motors offer enhanced efficiency, control, and optimization of energy consumption, making them a compelling choice.

As per the FMI study, the market for smart motors in the United Kingdom is anticipated to garner revenue of USD 3.453.7 million by 2035, securing a 4.4% CAGR from 2025 to 2035.

The notable industrial manufacturing sector in China is mostly attributed to the country’s projected market share of USD 257.3 million in 2035. As per FMI, the market for smart motors in China is likely to move forward at 6.2% CAGR in the forthcoming years.

Due to supportive government initiatives like "Make in China 2025," which is likely to encourage the use of smart motors in a variety of industries and thereby increase market demand, the industrial sector in the country is also predicted to experience massive growth.

China's growing emphasis on renewable energy and sustainability has provided a significant boost to the smart motors market. Smart motors are increasingly being utilized in renewable energy generation and distribution systems to optimize efficiency, control, and integration with smart grids.

The 24V sub-segment is anticipated progress at a CAGR of 5.1% from 2025 to 2035 on the global level.

Excellent power and reliability are factors that boost the segment's growth. Even while operating under a heavy load, it does so quietly and smoothly, making it suited for heavy loads in a small space. However, it can also be utilized as an industrial-grade continuous usage motor because it offers strong and dependable performance. Additionally, it provides industrial power tools with high torque and economy as well as robotic applications.

The sub-segment supremacy can be attributed mostly to low cost, extended life, high reliability, precise operation, and efficient operation without losses. Moreover, it provides incredibly silent operation and is appropriate for applications that require minimum audible noise.

By the end of the forecast period, it is anticipated that the industrial application segment is likely to capture a huge market share with a CAGR of 5.0% from 2025 to 2035.

Smart motors are extensively utilized in industries due to their remarkable energy efficiency and effectiveness. They find wide-ranging applications in various industrial processes, including compressors, conveyor systems, automation, and material handling.

The growing global focus on regulations concerning carbon emissions has generated a heightened emphasis on the adoption of energy-efficient solutions in industries. As a result, the demand for smart motors in the industrial sector has witnessed an upsurge, driven by the need to reduce energy consumption, propelling the market growth.

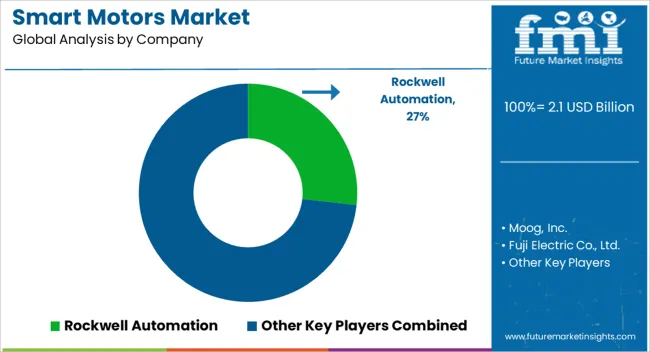

The smart motors industry is characterized by intense competition, due to the presence of numerous prominent companies offering smart motor products. The companies present in the market actively engage in strategic partnerships and product advancements as part of their ongoing efforts to expand their market share.

Key Players invest significant resources in fostering strategic collaborations with other industry players, aiming to leverage complementary strengths and enhance their market position. Additionally, these companies prioritize continuous product development, introducing innovative features and technologies to meet evolving customer demands and stay ahead in the competitive landscape.

Key Players in the Market

Developments in the Market:

The global smart motors market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the smart motors market is projected to reach USD 3.4 billion by 2035.

The smart motors market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in smart motors market are 24v, 18v, 36v and 48.24v.

In terms of application, industrial segment to command 52.3% share in the smart motors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA