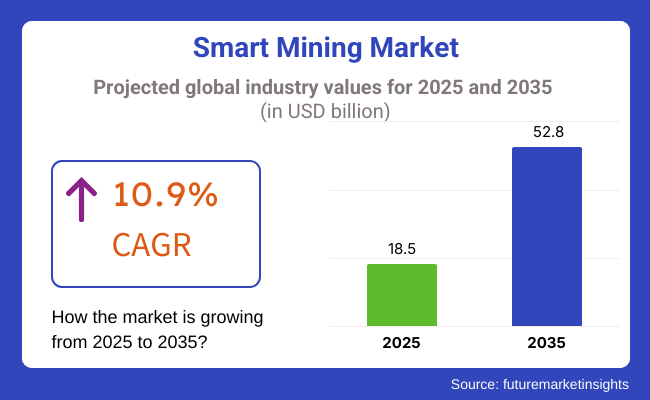

The smart mining is projected to increase tremendously 2025 to 2035 with regards to adoption of automation, artificial intelligence (AI), and IoT-based technologies, which is responsible for the Industry. At USD 18.5 billion in 2025, the industry is projected to increase to USD 52.8 billion by 2035, with a CAGR of 10.9% for the forecast period.

This growth is driven by the need for improved efficiency, safety of workers and economic mine solutions. With rapidly changing digital technologies, mining businesses are embracing smart ASSET solutions increasingly to improve efficiency and achieve resource savings.

It is a combination of the latest available technologies, like the autonomous haulage systems, predictive maintenance, and remote monitoring, which are all employed to increase the mine's efficiency and productivity. It's a real revolution within the sector as mining firms struggle to implement current operations via real-time data analysis, cloud technology and cyber security solutions. Additionally, increasing environmental issues and tougher government regulations are compelling the sector to embrace energy-efficient and green mining techniques, including electrification of mining machinery and real-time emission monitoring. These technologies are not only enhancing productivity but also lowering greenhouse gas emissions and assuring compliance with global sustainability norms.

Rise in autonomy and AI-driven decision making is also a significant factor for smart mining industry. Mining operators can predict equipment breakdowns, streamline supply chain management, and reduce operating downtime by deploying AI-driven analytics and IoT-based monitoring systems. Its second main driver is investment in workforce safety, through which businesses engage autonomous haul trucks, robotic drill rigs and wearable technologies to drive down risk on its sites. Further, the coal, metal and mineral mines are using connected mine to gain efficiency, consume less energy and make better asset use.

However, its own potential growth apart, the smart mining industry itself encounters a range of challenges. One of the challenges that have arisen in the way of adoption of automation, AI analytics, data mining, and IoT infrastructure is the large capital requirements for deployment of these technologies, mainly for small and medium-sized mining companies. One of the challenges is the complexity of integration with legacy mine equipment and the necessity to have appropriately qualified personnel for maintenance of digital mine technology. Cyber security is also of concern as rising connectivity provides possibilities for possible cyber-attacks. With regard to that, mitigating these insecurities through security practices and training programs will be fundamental to the bulk adoption of smart mining technologies.

Industry value depends on the technological advancement and trends covered in the industry. Visibility in the supply chain through blockchain, automation through artificial intelligence and digital twin technology will increase efficiency and ignite innovation in mining. Additionally, investments in 5G networks, edge computing, and real-time monitoring technology are fueling efficiency. Europe and North America head the solution deployment with rapid growth being observed across the Asia-Pacific and Latin America regions owing to growing mining activity, as well as government-sponsored initiatives backing digitization. Going forward, with the ongoing innovation in the sector, the technologies will revolutionize the operational aspects of the mining sector by making mining activities safer, greener, and far more efficient.

Explore FMI!

Book a free demo

The industry is at the forefront of the transformations chromatic through the automation, IoT, AI-driven analytics, and environmentally sustainable mining practices. Surface and underground mining companies are acquiring autonomous drilling rigs, real-time monitoring systems, AI predictive maintenance for safety and productive efficiency improvements.

The mineral processing industry is preoccupied with the automation of production lines that costs less, consumes less energy, and is more efficient in processing the materials to improve the quality of the final product. Exploration and drilling businesses utilize AI geospatial analysis, and drone imaging to cut costs and exploration time.

Equipment companies are working on the traditional model of interoperability and connection by introducing smart, connected machinery that consists of real-time diagnostics and remote operation functionalities. Furthermore, cybersecurity measures are now taking the front seat mainly because of the exploding use of IoT-powered devices and cloud-based data security management.

The need for sustainable mining is thus also pushing the demand for green solutions, emission cuts, and water-efficient technologies for processing.

| Company | Contract Value (USD Million) |

|---|---|

| Hexagon AB | Approximately USD 70 - USD 80 |

| Komatsu Ltd. | Approximately USD 90 - USD 100 |

| Sandvik AB | Approximately USD 60 - USD 70 |

| Caterpillar Inc. | Approximately USD 80 - USD 90 |

2020 to 2024, the industry for smart mining saw a meteoric rise with demand for operational efficiency, safe working conditions, and environmental responsibility in mines growing higher by the day. Autonomous drilling, autonomous haulage systems, and real-time data analytics were the solutions embraced by mining industries to increase levels of productivity and lower operational expenses. IoT sensors, predictive maintenance based on artificial intelligence, and machine learning-based algorithms allowed equipment performance and geological conditions to monitor in real-time.

Governments and regulatory authorities instituted more stringent environmental regulations, propelling the use of electric and hybrid mining vehicles for curbing emissions and optimizing fuel efficiency. Remote-controlled mining equipment, AI-driven geological modeling, and automated ventilation systems enhanced the safety of workers and minimized the exposure of people to dangerous environments.

Despite advancement, the industry was challenged by high initial capital expenditure, security threats from cyber-attacks, and technology uptake in conventional mining operations. But rising investments in digital transformation and adoption of cloud-based mining solutions enhanced scalability and technology convergence across the sector.

2025 to 2035, the industry will experience revolutionary transformation through AI, automation, and green mining.

Artificial intelligence-enabled autonomous drill and haul systems will characterize big-mining operations with less human contact and higher efficiency. Artificial intelligence-driven geological modeling and quantum computing will accelerate the identification of ore bodies and maximize mineral returns. Supply chain management using blockchain technology will enhance material traceability and transparency of materials mined to enhance compliance with ethical sourcing provisions. Solar-powered mining camps and hydrogen fueled heavy equipment will minimize the green footprint of mines.

Environmental monitoring systems based on artificial intelligence will enable real-time tracking of air quality, water usage, and soil health to aid sustainable mining practices. Drone and robotics technologies will be used in deep-sea mining and hostile environment exploration. Enhanced cybersecurity via AI-driven threat detection and quantum encryption will protect mining facilities against cyberattacks. The implementation of circular mining practices like metal recycling and waste reduction will align the industry with global sustainability targets.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments enacted stricter environmental and safety regulations, which forced mining companies to adopt automation and real-time monitoring technologies. | Stricter global sustainability regulations require carbon-free mining operations. Governments mandate AI-based compliance monitoring and emissions cuts. |

| Firms utilized autonomous haul trucks, drilling rigs, and predictive maintenance with AI to optimize efficiency and minimize downtime. | Autonomous mines are the norm, utilizing AI-powered robots, real-time decision-support systems, and digital twin technology to optimize mining operations. |

| IoT sensors have been adopted by mining operators for tracking equipment condition, reducing fuel usage, and optimizing employee safety. | Highly sophisticated sensor packages and artificial intelligence-driven predictive analytics drive autonomous mines to respond to changing real-time operating and environmental conditions. |

| Companies started replacing diesel-powered mine vehicles with electric vehicles in order to cut down on emissions and fuel costs. | Hydrogen fuel cell-based mining fleets and all-electric underground mining are the standard, solar and wind providing power to the energy for mining activities. |

| COVID-19 accelerated the use of remote-operated mining systems, requiring fewer on-site employees. | AI-based remote command centers control a number of mines from centralized locations through high-speed 6G networks for seamless operation. |

| Top mining firms tested digital twins to replicate mining operations and maximize the extraction of resources. | Digital twins become critical to mine planning, sustainability tracking, and real-time adjustments in operations, minimizing waste and maximizing efficiency. |

| Mining companies incorporated AI-powered supply chain analytics to manage raw material deficiencies and maximize logistics. | AI-driven smart contracts and blockchain enable efficient, effective, and ethical supply chain management for minerals and rare earth. |

| Higher digitization of mining processes generated higher issues with cyber security threats, encouraging firms to integrate robust security technologies. | Artificial intelligence-based cybersecurity systems and quantum encryption safeguard linked mining systems from changing cyber risks, making operations integrity intact. |

| Firms invested in minimizing tailings waste and installing water recycling systems to meet environmental standards. | Artificial intelligence-based waste separation and circular mining practices optimize resource recovery, significantly minimizing environmental footprint and maximizing sustainable mining operations. |

The industry is growing due to the operating efficiencies and safety improvements as a result of automation, IoT, and AI technologies. Nonetheless, the initial cost incurred is very high, and the difficulty involved in the integration of new technologies remains a barrier to financial growth. However, companies must employ Agile technologies, ensure financial flexibility through the right strategic partnerships, and utilize affordable implementation means to entirely exploit the available returns and sustain their competitiveness in the industry.

Production and mining operations are heavily affected by supply chain interruptions like chip shortages and dependence on special purpose tools. Also, due to geopolitical tensions, trade embargoes, and raw material price fluctuation, the market is instability is further compounded. The situation can be rectified by the diversification of the supplier base, investments in local industries, and contingencies for various risks.

Companies should focus on digital upscaling, especially on security systems, and regular software upgrades to avoid the aforementioned attacks and other damage to systems. Moreover, companies need to consider the impact of AI environmental protection on the industry.

The ethical framework is harder to follow as strict safety, environmental, and data protection rules and regulations make the industry challenging. Companies need to deal with the changes in the law, get the necessary accreditations, and adopt sustainable mining methods to avoid any legal penalties or operational disruptions. The success of the industry in the long run will depend on creativity, resilience in cyberspace, and a solid supply chain policy.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

| UK | 6.5% |

| France | 6.8% |

| Germany | 7.2% |

| Italy | 6.3% |

| South Korea | 7.0% |

| Japan | 7.6% |

| China | 8.5% |

| Australia | 7.4% |

| New Zealand | 6.1% |

The USA industry is expanding with the use of autonomous haulage systems, real-time monitoring solutions, and AI-based predictive maintenance. Green mining operations and stringent policy regulations necessitate the digitalization of mines by investing in them. Industry behemoths like Caterpillar and Komatsu are leading the way with best-of-breed autonomous mining solutions. This boom for electric vehicles also propels the demand for lithium and other primary minerals, spurring investment in automation and AI.

Big mining players, such as Newmont Corporation and Freeport-McMoRan, are using IoT technology for increased efficiency and safer operations. The industry is getting significant venture capital investments, driving technological advances in remote monitoring and digital twins. Carbon footprint minimization has also led to increased use of electrified haul trucks and AI-driven efficiency solutions.

The UK industry is transforming with the adoption of digital twins, AI-based exploration, and green mining technologies. Efficiency in mining is prioritized in the nation with the application of automation and analytics to ensure maximum extraction of resources. Rio Tinto, an entity with a presence in the UK, invests in premium mining solutions, driving the industry growth.

The UK government's pledge to net zero has encouraged investment in green mining technology. Mining companies are utilizing blockchain technology for improved supply chain traceability, and AI-based predictive maintenance is used to reduce downtime. Better battery technology and demand for critical minerals such as cobalt and lithium add a further drive for the industry operations.

The mining industry in France is changing, with an overwhelming focus on sustainability and automation. With increased demand for rare earth minerals, the mining industry is implementing AI-based geospatial analytics and drone reconnaissance. Advanced predictive mining simulation software by French technology companies such as Dassault Systèmes allows overall productivity to be improved.

Government initiatives supporting digitalization and greenery spur the adoption of electric mining machines and remote equipment. Eramet, a leader in French mining, is leading carbon reduction through electrification and AI-based mining operations. The adoption of battery-grade nickel and lithium also spurs industry demand.

Smart mining in Germany thrives thanks to strict rules on sustainability and adopting Industry 4.0 technology. Industry giants Siemens and Bosch are at the forefront of developing AI-enabled mining automation technology that fuels operation efficiency and safety. Digital twins and predictive analysis are used in Germany's mining sector to provide better-informed decisions.

Germany's efforts to reduce its carbon footprint have led the way in the use of electrified heavy mining equipment and hydrogen fuel cell-battery mining trucks. Innovation is also being driven by the focus on recycling necessary minerals and environmentally friendly mining. The demand for rare earth metals used to manufacture electric cars further rooted the industry.

Italy's industry is emerging due to increased automation and digitalization of mineral mining. EU sustainability targets through adopting energy-efficient mining strengthen the country. AI-driven exploration and real-time monitoring provide opportunities for investment. Companies like Prysmian Group provide infrastructure services for digitizing mining.

Italy's mining industry, though small in size relative to others, also has the benefit of high-technology robotics and sensor-based exploration technology. The push towards sustainable mining operations has opened up industry opportunities for employing AI-facilitated risk analysis tools and electric mine vehicles. Expansion in the application of battery components offers impetus to the application of the industry machines.

South Korea's technological expertise in AI, IoT, and high-end automation makes it possible for the country's industry. Hyundai and Samsung Heavy Industries are just a few of the big industrial giants that make autonomous vehicle innovation in mining possible. Demand for rare earth elements and battery materials drives the investment in the industry technology.

Government support for digitalization has led to the development of AI-based exploration techniques and blockchain traceability of supply chains. The mining industry is relying more and more on 5G connectivity to provide real-time data and enhance efficiency and safety measures.

The 7.6% CAGR growth for the 2025 to 2035 period is projected. Robotics, artificial intelligence-based automated processes, and deep sea mining make Japan's high-tech mining flourish. Hitachi and Komatsu lead the way in constructing autonomous systems by automating drill and haulage operations independently to provide maximum efficiency and safety. The industry growth is driven by demand for the application of rare earth metals in electronics and EVs.

Japan emphasizes digitalization, such as AI-based predictive maintenance and IoT-based monitoring systems. Green mining is encouraged through government subsidies to invest in electric mining gear and energy-saving mining. Digital twins also increase productivity

China leads the sector with massive investment in AI, automation, and digitalization. The government actively supports smart mining infrastructure, and industry leaders like Huawei and Baidu are developing AI-driven mining solutions. The country's vast mining industry heavily invests in automated drilling and autonomous haulage systems.

China's push for local self-reliance in strategic minerals has encouraged the application of blockchain-based traceability systems. The combination of digital twins and real-time monitoring enhances productivity and security. Increasing demand for lithium and rare earth metals also encourages the application of the industry.

Australia's huge mining sector embraced automation and AI-driven efficiency solutions. Companies like BHP and Rio Tinto are spearheading investment in autonomous trucks, AI-driven predictive maintenance, and electric mining. The country's effort to lower emissions coincides with the application of renewable energy in mining.

Australia's remote mining operations are facilitated through IoT-based tracking and machine learning to enhance decision-making. Operational efficiency is brought by bringing AI and digital twins together. This strategic mineral demand expands driven by EV production worldwide and supports the vibrancy of the industry growth opportunity.

New Zealand's smart mining industry is in an early stage with increased investment in automated and eco-friendly green mining technology. The government supports green mining and the use of AI monitoring-based and electric-powered machinery.

New Zealand companies are emphasizing mineral exploration using AI-driven geospatial analytics and remote sensing technology. Predictive analytics and digital twins improve efficiency, while blockchain-based traceability enhances supply chain transparency. New Zealand's mining industry is increasingly using autonomous operations to mine the maximum resources.

Drillers & Breakers, and Load Haul Dump (LHD) Machines are part of the Automated Equipment segment of the industry, which is expected to grow at a healthy compound annual growth rate (CAGR) from 2018 to 2025. 41% of the industry share will be covered by Drillers & Breakers, while the remaining 59% will be covered by Load Haul Dump (LHD) Machines.

Drillers & Breakers are a key part to modernizing mining operations, improving accuracy and reducing human labor on site. Mineral exploration companies, such as Rio Tinto, have led the way in implementing autonomous blast hole drill rigs to advance productivity and worker safety. Drilling automation has lowered operational costs and reduced human exposure to hazardous environments.

Machine Loading Haul Dump (LHD) underground mining It has all but doubled productivity and improved safety. It is now in one prominent system, the DISPATCH Underground from Modular Mining Systems, the original utility of which was laid at least as far back as 1991 in a diamond mine in South Africa. The system displayed real-time equipment location and engaged automated fleet management, which resulted in improved coordination and less downtime.

Driving the movement toward Automation is the demand for efficiency, worker and environmental safety. Fortescue Metals Group Policy is at the forefront of this transition with a USD 2.8 billion partnership with Liebherr to convert two-thirds of its mining fleet to zero-emission battery technology. This consists of 360 electric trucks, 55 excavators, and 60 dozers, coming into service in 2025, but all of them will be autonomous, too. As the industry approaches sustainability, the Automation of mining will proceed to change global operations.

By component, hardware is expected to account for 48% of the industry share in 2025, and the smart systems segment accounts for 52%.

Hardware is the backbone of the industry, from autonomous drilling equipment and haul trucks to monitoring sensors. The adoption of IoT-based sensors from organizations such as Caterpillar and Sandvik has captured real-time data to optimize equipment performance while reducing unplanned downtime. Autonomous haul trucks are in heavy demand, with industry share dominated by Komatsu and Liebherr, which manufacture autonomous mining machinery that boosts efficiency and safety.

Smart systems are leading the digital transformation of the mining industry, harnessing the power of AI, machine learning, and cloud-based analytics for predictive maintenance, fleet management, and operational optimization. For example, Rio Tinto’s Mine of the Future program is using AI-powered predictive analytics to improve productivity and reduce costs. On a macro level, Anglo American’s FutureSmart Mining™ initiative makes data-driven decision-making integral to its approach to advancing resource usage and sustainable practices.

Investment is being driven by the increasing demand for Automation, energy efficiency, and safety standards, in addition to the need for smart systems. The move towards AI-based platforms, as well as the adoption of digital and autonomous mining solutions, is likely to accelerate the digitization and decarbonization of operations, as big mining companies are looking to shift to digital at scale. It is leading the way to the future of mining by providing greater operational efficiency, lower costs, and less environmental impact.

The demand for smart mining organic practices has opened the growth of the industry. Several steps are being taken to optimize mining operations, from employing automated systems for hauling materials to real-time monitoring of data and predictive maintenance solutions to enhance safety and operational efficiency.

Industry leaders like Caterpillar Inc., Komatsu Ltd., and Sandvik AB are capitalizing on advanced digital technologies and AI-driven solutions. Hitachi Construction Machinery, ABB Ltd., etc which offer smart mining software, conversion to electric fleets, and asset optimization are also among keeping gaps filled in smart technologies for the industry.

Fleet automation, sustainability mining solutions, and increased funding in AI-powered digital and automated transformation processes are key factors shaping the competition. Organizations offer evolving technologies like process optimization, industrial automation cybersecurity, and AI-enabled predictive maintenance to maintain a competitive advantage. With global demand for effective and eco-friendly mining solutions on the rise, the industry will be led by businesses investing in smart technologies and automation in the future.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Caterpillar Inc. | 20-25% |

| Komatsu Ltd. | 15-20% |

| Sandvik AB | 10-15% |

| Hexagon AB | 8-12% |

| Hitachi Construction Machinery | 5-10% |

| ABB Ltd. | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Caterpillar Inc. | Autonomous haulage systems, real-time fleet management, AI-powered predictive analytics. |

| Komatsu Ltd. | Autonomous vehicles, smart mining solutions, remote monitoring, and optimization of operations. |

| Sandvik AB | Advanced drilling automation, digital mine solutions, and connected equipment for safety enhancement. |

| Hexagon AB | The integrated mining software, IoT-enabled monitoring solutions, and AI-driven asset tracking. |

| Hitachi Construction Machinery | Smart mining devices, cloud computing analytics, and self-ruling armada control frameworks. |

| ABB Ltd.AI- | AI-driven mine automation, electrification solutions, and digital twin technology for process optimization. |

Strategic Outlook

Caterpillar Inc. (20-25%)

Caterpillar's future smart mining solutions feature industry-first autonomous haulage systems powered by artificial intelligence-enabled predictive maintenance. By integrating IoT and machine learning into equipment, the company is committed to enhancing the efficiency and safety of mining operations. Executive summary Digital twin: Overview and recent developments

Komatsu Ltd. (15-20%)

Komatsu is a smart mining powerhouse leaning on autonomous vehicle and remote operation tech. The company offers real-time monitoring and analytics solutions that provide operational visibility and allow for better control of cost factors. These innovations trend in the same direction as the recently established AI-powered fleet management platforms, which put Komatsu on the map as a leading constructor in the sector.

Sandvik AB (10-15%)

Sandvik is a leader in mining automation and digital transformation, with connected solutions that improve drilling, loading, and hauling operations. With its AI-driven predictive maintenance and IoT-enabled equipment monitoring, it provides mining sites around the world with maximum production efficiency and minimum downtime.

Hexagon AB (8-12%)

Hexagon provides integrated software and real-time data analytics solutions across several industries, including mining. The AI-powered mine safety solutions and Internet of Things (IoT)-connected monitoring devices they provide help the mining operators become more efficient while minimizing their impact on the environment. It goes on to establish itself more through acquisitions and tech advancements.

Hitachi Construction Machinery (5-10%)

Hitachi where uses smart mining equipment and cloud-based data analytics to optimize mining operations. Its fleet control systems are fully autonomous, and its teams lead digital transformation initiatives that focus on enhanced efficiency and risk mitigation. Hitachi is bolstering its smart mining portfolio with a growing focus on AI and robotics.

ABB Ltd. (4-8%)

ABB focuses on electrification and automation solutions designed for the mining industry. Its AI-powered process optimization and digital twin technologies support mining companies in converting to more sustainable and efficient operations. ABB provides power management solutions that help mine efficiently by using energy in a smart way.

Other Key Players (30-38% Combined)

The industry is expected to generate USD 18.5 billion in revenue by 2025.

The industry is projected to reach USD 52.8 billion by 2035, growing at a CAGR of 10.9%.

Key players include Caterpillar Inc., Komatsu Ltd., Sandvik AB, Hexagon AB, Hitachi Construction Machinery, ABB Ltd., Rio Tinto, Siemens AG, Schneider Electric, Trimble Inc., and Epiroc AB.

North America and Asia-Pacific, driven by the demand for sustainable mining practices, digital transformation, and the deployment of autonomous mining equipment.

Automated drilling and autonomous haulage systems dominate due to their ability to improve safety, reduce operational costs, and enhance productivity in mining operations.

By automated equipment, the industry includes driller & breaker, load haul dump, mining excavator, robotic truck, and other automated equipment, with robotic trucks leading due to their efficiency in reducing operational costs and improving safety in mining operations.

By component, the industry is segmented into hardware, intelligent systems, RFID tags and sensors, and other hardware, with intelligent systems holding the largest share due to their role in optimizing automation and data-driven decision-making.

By solution, the industry includes data & operation management software, analytics solutions, and connectivity platforms, with analytics solutions gaining traction due to their ability to enhance predictive maintenance and operational efficiency.

By services, the industry covers engineering & maintenance services, consulting services, product training services, and implementation & integration services, with implementation & integration services leading due to the increasing adoption of automation technologies in mining operations.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA), with North America leading due to heavy investments in mining automation and smart technology adoption.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.