The smart locks market comprises major corporations like regional leaders and emerging startups creating highly competitive landscape somehow. Major brands control market share yet smaller outfits slowly gain ground via really innovative stuff.

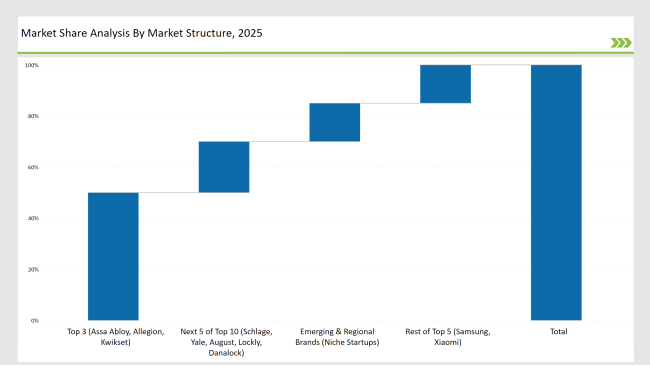

Major companies such as Assa Abloy, Allegion, and Kwikset hold roughly 60% market share largely because of their strong brand reputation and vast distribution networks. These companies specialize in high-end products featuring sophisticated smart lock systems with biometric access and seamless integration.

Regional brands such as Samsung hold nearly 20% of market share due to affordability and ease of use features. These brands deliver smart lock solutions featuring localized functionalities like compatibility with regional platforms at affordable prices. Their adaptability in regional markets has enabled solid footholds overseas somehow and they compete fiercely on a global scale.

Emerging players control the remaining 20% of the market gaining traction with super sleek highly adaptable innovative solutions. These companies frequently prioritize sustainability alongside robust security features and innovative technologies such as cloud-based management.

Smaller brands being newer still manage to capture the attention of consumers via affordable alternatives featuring current smart home trends. Emerging players swiftly gain traction within specialized sectors keeping pace with the rapidly shifting demands of contemporary shopper cohorts pretty rapidly nowadays

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Assa Abloy, Allegion, Kwikset) | 50% |

| Rest of Top 5 (Samsung, Xiaomi) | 15% |

| Next 5 of Top 10 (Schlage, Yale, August, Lockly, Danalock) | 20% |

| Emerging & Regional Brands (Niche Startups) | 15% |

The smart locks market is moderately consolidated. Major global brands such as Assa Abloy, Allegion, and Kwikset dominate premium segments mid-range markets with emerging players serving budget-conscious consumers somehow. Emerging brands redefine market trends with pretty affordable alternatives beneath sleek smart home devices but established brands still dominate.

Market trends feature a rapid shift towards IoT-enabled smart locks with increasing demand for keyless entry systems rising swiftly nowadays. E-commerce platforms play a pivotal role in driving sales via digital marketing online channels making smart lock solutions accessible worldwide rapidly.

Smart locks sales get heavily influenced by online platforms and brand sites that make up roughly 55% of total sales volume. These channels offer convenience and a broad selection of products that appeal directly to tech-savvy consumers somehow.

Supermarkets and hypermarkets account for 30% of sales as retail locations offer customers an opportunity to experience products firsthand beneath expert guidance from staff. Most sales originate from elsewhere but 15% come from specialty stores and mono-brand outlets that offer bespoke solutions

In the smart locks market, deadbolt smart locks account for 40% of the market due to robust security features and relatively easy operation. Locks are usually sold via a direct sales approach providing personalized services and installation on site. Keypad smart locks along with combination locks constitute 35% of the market share striking the balance between convenience security found frequently in mono-brand stores appealing directly to residential customers or commercial ones.

Biometric smart locks dominate roughly 25% of the market share due to advanced security features like fingerprint recognition and facial scanning technology. These smart locks sell via various outlets like supermarkets hypermarkets and online retailers for high-end users seeking enhanced security

2024 saw significant developments in the smart locks market, as the sector continued to evolve with new technological breakthroughs, rising security concerns, and increased adoption across residential and commercial spaces. Key market players contributed in the following ways:

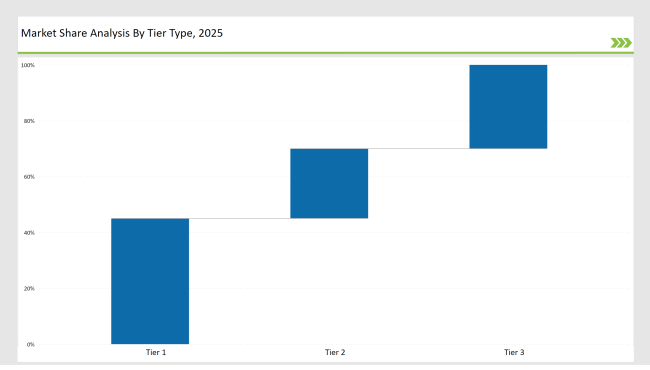

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | August Home, Schlage, Yale, Kwikset |

| Market Share % | 45% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | ASSA ABLOY, Samsung, Nest |

| Market Share % | 25% |

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Regional brands, startups |

| Market Share % | 30% |

d

| Brand | Key Focus Areas |

|---|---|

| August Home | Integration with smart home ecosystems, user-friendly interfaces, advanced security features |

| Schlage | Biometric recognition, mobile app features, and high-security systems |

| Yale | Voice-activated locks, increased compatibility with smart home devices |

| Kwikset | Enhanced encryption, IoT partnerships for broader compatibility |

| ASSA ABLOY | Commercial and enterprise-level solutions, cloud-based access control |

| Emerging Brands | Affordable smart lock solutions, integrating advanced features for both residential and commercial markets |

The smart lock industry is set to undergo rapid transformation with a strong focus on cybersecurity, user experience, and smart home integration. Leading players are making heavy investments in R&D to enhance product efficiency and adapt to evolving consumer demands.

The industry is shifting towards digital-first strategies, with brands focusing on e-commerce and DTC channels to expand their reach. The integration of smart locks with other IoT devices will drive innovation, and the trend toward biometric solutions will continue to grow, with an emphasis on improving user convenience and security.

Subscription-based services for smart lock systems are gaining traction, allowing companies to offer maintenance, upgrades, and customer support through a membership model. Influencer marketing, especially on social media platforms, will continue to play a significant role in building brand awareness and consumer trust. Sustainability will also be a driving force, with eco-conscious consumers pushing for the use of recyclable materials and energy-efficient technologies in smart locks.

August Home, Schlage, and Yale collectively dominate the market with 45% share.

Regional brands and startups hold approximately 30% of the market by offering affordable, feature-rich alternatives.

Startups and smaller brands focusing on innovative, affordable solutions account for 30% of the market.

The market is categorized as high for top players holding over 50%, medium for top 10 brands capturing 40-50%, and low for fragmented market shares below 30%.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.