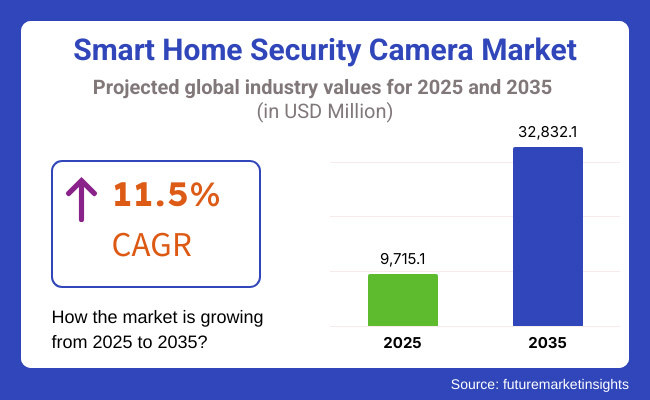

The global Smart Home Security Camera market is projected to grow significantly, from 9,715.1 million in 2025 to 32,832.1 million by 2035 an it is reflecting a strong CAGR of 11.5%.

Growing demand for improved security solutions which help to boost home security is driving the growth of the Smart Home Security Camera Market. Growing adoption of smart cameras for making sure of real time monitoring, intrusion detection, and remote access by consumers is expected to drive the market for better security and control over property. The integration of AI and IoT technologies is another major driver of innovation, enhancing the efficiency and user-friendliness of these devices even more.

Compliance to regulation drives the market growth, as there are data privacy laws like GDPR and CCPA for manufacturer to concern for strong encryption layer and for adequately avoiding and handling security threat. With consumers becoming more aware of privacy issues, firms were moved to build solutions that provide greater cybersecurity protections and adhere to changing regulations.

The growth in demand can be ascribed to the growing adoption of smart home ecosystems, which demand a well-integrated suite of connected security devices. The rise of wireless smart camera solutions that can easily be installed and accessed from anywhere. Homeowners prefer solutions that they can integrate into their other smart devices, including voice assistants and home automation systems, allowing them to create an interlinked smart living ecosystem.

North America is the leading market due to high smart home penetration in the region, rigorous cybersecurity policies, and the presence of major tech players. Research Highlights The region has a strong focus on innovation and security awareness which leads to fast implementation of smart security solutions. In contrast, the only other region with a rapid rise is Europe and Asia-Pacific from the rising urbanization, increasing income/capita, and awareness of home security.

Smart home security cameras are being adopted in countries such as India and Australia as consumers adapt to digital transformation and increased security. Market growth in developing nations is being driven by the increasing number of smart city initiatives and the implementation of wireless connection and AI-powered security features.

Explore FMI!

Book a free demo

| Company | Arlo Technologies, Inc. |

|---|---|

| Contract/Development Details | Entered into an agreement with a major home improvement retailer to supply smart home security cameras, expanding their market presence and accessibility to consumers. |

| Date | February 2024 |

| Contract Value (USD million) | Approximately USD 25 |

| Renewal Period | 5 years |

| Company | Ring (Amazon Inc.) |

|---|---|

| Contract/Development Details | Partnered with a property management firm to install smart security camera systems across multiple residential communities, aiming to enhance tenant safety and property security. |

| Date | August 2024 |

| Contract Value (USD million) | Approximately USD 30 |

| Renewal Period | 4 years |

Increasing crime rates and home invasions are driving demand for smart security cameras

Rise in crime rates and home/office invasions have greatly pushed the need for smart security cameras. Home invasions in Australia’s New South Wales reached a four-year high, with more than 20,000 reported in the 12 months up to March 2024. As a result of this troubling trend, homeowners are spending more than ever on sophisticated security systems to protect their homes.] Radio host Kent 'Smallzy' Small also had an attempted break-in at his home in Sydney when four masked intruders armed with large knives attempted to force their way into his house. Fortunately, Ring security cameras caused the burglars to give up on an attempt of burglary. Residents of Sydney's Glenbrook area have also tightened their security measures, with some even going to the length of installing up to 30CCTV cameras around their homes. By taking this proactive step, you are not only protecting your own home, but you are also contributing to a broader trend towards utilizing smart home security technology as a means to deter criminal activity in our communities.

Increasing use of smart cameras for office and commercial security

The office and commercial spaces are increasingly adopting smart cameras to ensure higher security and better operation efficiency. Companies are commonly using high-resolution security cameras for monitoring premises and organization to prevent theft as well as keep employees and assets safe. For instance, in the retail industry, the implementation of HD cameras has been vital in minimizing cases of shoplifting and vandalism. These other systems provide clearer images, making it easier to distinguish between people and their activities. In addition, the use of AI-driven analytics enables real-time monitoring and detection of anomalies, setting off alerts, and ensuring immediate action against outliers. This is not restricted to retail, corporate offices are also adopting smart security solutions to monitor access points and sensitive areas to insulate against possible internal threats as well as external security threats. Modern smart camera systems are scalable and flexible enough to be deployed for various commercial applications from small businesses to large organizations. And as technology continues to advance, it's likely that these cameras will gain even more powerful functions like facial recognition and behavior analysis, providing security measures in commercial polls.

High-resolution imaging and advanced low-light performance are becoming standard

High-resolution imaging and advanced low-light performance are now standard qualities of smart home security cameras. Consumers having been spoiled and expecting clear, detailed footage under any light source, leading manufacturers to step up their camera technology. Cameras have now advanced to the level of sensor technology that enables it to record HD video and make sure no details go unnoticed. Such clarity is key in identifying intruders, as well as providing actionable evidence should a security breach occur. Furthermore, enhancements in low-light performance make it possible to monitor in the evening hours or in darkened areas, eliminating a major weakness of traditional security systems. Such features have garnered the attention of government agencies; the Department of Homeland Security, for example, has already stressed the need for surveillance cameras capable of generating decisive video evidence in a variety of light conditions, including low-light scenarios. The emphasis on improving image quality means that whatever the conditions, such as at night, in the rain or fog, security cameras persist as powerful deterrents and investigative aids.

Growing fears of data breaches and unauthorized surveillance hinder adoption

The widespread use of smart home security cameras raises major issues with regard to data breaches and the unauthorized use of such surveillance. Many are concerned that cybercriminals may take advantage of these web-connected devices to hijack access to personal video streams, which could be threatening to personal security. Smart cameras always record videos locally and send them to the servers through the networks, making them as a target for hacking. Such devices are prepped for hackers who can exploit vulnerabilities within them, which can include spying on users, taking control of sensitive information or even controlling the cameras.

Moreover, concern goes far beyond those malicious actors to manufacturers and service providers who might misappropriate the tool. Consumers are concerned about data being stored on cloud servers without encryption or being accessed by third parties without the respective data owners’ consent. Inadvertent capturing and storing of sensitive moments by smart cameras has only aggravated this distrust.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Data privacy concerns led to regional regulations for cloud-stored surveillance footage. |

| AI & Video Analytics | AI-powered object detection improved threat detection capabilities. |

| Cloud vs. Edge Processing | Hybrid cloud-edge AI processing enhanced real-time security monitoring. |

| Interoperability & Smart Ecosystems | Integration with broader smart home systems increased interoperability. |

| Market Growth Drivers | Rise in smart home adoption and increasing security concerns fueled demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments introduce AI-driven facial recognition restrictions to enhance user privacy. |

| AI & Video Analytics | Autonomous threat response systems enable real-time intervention without human oversight. |

| Cloud vs. Edge Processing | Edge-based AI processing becomes the industry standard for improved latency and security. |

| Interoperability & Smart Ecosystems | AI-driven voice and gesture controls enable seamless, hands-free home security management. |

| Market Growth Drivers | Expansion of 6G networks enhances real-time security streaming and AI processing. |

Tier 1 Vendors - These are market leaders with huge market shares and a worldwide presence. The top brand was Amazon’s Ring, which more than doubled its market share in 2020, easily beating out brands like Arlo and Wyze. Ring has also done very well under Amazon, due in part to its brand recognition and expanded lineup of security camera products. Arlo Technologies, a reputable brand in wireless security solutions, also held a significant share in the market, catering to the needs of consumers looking for advanced features and trustworthiness.

Wzeye, which sells its devices for a fraction of the price of its competitors, has developed a large fan base among people who care about their budget more than anything else but still want basic features. Alarm's integration with the Google ecosystem brings seamless smart home experiences with its Nest brand, while User. com works with a full interactive security platform that brings together several smart devices to help you to secure your home smart.

Tier 2 vendors may not be market leaders, but they possess substantial stakes and frequently serve specific segments or deliver distinct products. D-Link, Eufy, EZVIZ, Kasa, and Resideo are a few examples of brands that fall into this category. Cost, style, and other specialized functions are some of the features these companies focus on, ranging from budget-friendly to unique home security cameras as well as specialized smart home CCTV options. Their market share due to consumer needs and preferences to be stable in a market with competitive pressure.

Tier 3 vendors usually have a more localized reach or focus on niche markets. While there are many players in this tier, ADT, SimpliSafe and Vivint are three of the most predominant in the USA These brands typically provide integrated security solutions, featuring a combination of hardware and monitoring services. Their business models could be subscription models providing consumers professional monitoring as well as the hardware. Their global market shares are smaller and Tier 1 and Tier 2 vendors, their goliath competitors, but they can meet customers who wish to a complete security solution with professional support.

The section highlights the CAGRs of countries experiencing growth in the Smart Home Security Camera market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.1% |

| China | 12.9% |

| Germany | 9.3% |

| Japan | 10.8% |

| United States | 11.2% |

There is tremendous growth in the China smart home security camera market due to a rapidly expanding e-commerce space and a middle-class population on the rise. On platforms such as Alibaba, JD. com, and Pinduoduo leading the online sale, Consumers can now get different smart security cameras at a very low price.

Besides, the convenience of online shopping with discounts and prompt delivery services gave a push in adoption rates across urban and suburban territories. As well, China continues to see the expansion of the middle class, which results in greater disposable income and more spending on smart home solutions, such as security cameras. With more consumers concerned with safety and convenience in their own homes, the need for AI-powered and cloud-connected cameras is continuing to grow.

Smart city initiatives is one of the most widely focused areas by the chinese government and home security technology is a major segment of them. 2023 - New legislation was approved regarding the cybersecurity settings for smart home devices. China is anticipated to see substantial growth at a CAGR 12.9% from 2025 to 35 in the Smart Home Security Camera market.

The smart home security camera market in India is booming, driven by rising safety concerns and the increasing adoption of smart technologies at home. Smart cameras with access to real-time monitoring and alerts on mobile devices are being purchased as solutions by homeowners and businesses as urban crime rate increases.

With urban areas growing, gated neighborhoods and condominium complexes are adopting smart security systems that further fuel demand. Moreover, the availability of Internet services and smartphone usage has also made smart home devices more accessible in the hands of the individual consumer. The popularity of smart assistants and IoT-enabled home automation solutions is also driving security cameras into the mainstream.

In addition, the Indian government has embarked on new initiatives aimed at expanding surveillance infrastructure in the country by developing smart cities, in hopes that citizens will be incentivized to develop applications for their cell phones and other digital devices. The new AI surveillance system built remotely, announced by the Ministry of Home Affairs in 2023 to be implemented in a nationwide city-centred programme involving 100 smart cities. India's Smart Home Security Camera market is growing at a CAGR of 14.1% during the forecast period.

It encompasses the latest technology and services from the home automation industry such as cloud-based video storage and integrated with voice-assisted technologies. Consumers are opting more towards cloud storage solutions that enable them to access and review footage from any location without the threat of lost data because of damage or stolen devices.

Leading brands such as Ring, Google Nest and Arlo have pounced on this trend, providing subscription-based cloud services which offer continuous recording and AI event detection. Smart cameras are also increasingly adopting voice assistants such as Amazon Alexa, Google Assistant, and Apple’s Siri, to allow users to control their security devices through voice commands hands-free.

Data Security in New Cloud-Based Surveillance Systems In 2023, the Federal Trade Commission (FTC) implemented new sub-licenser rules, compelling smart camera manufacturers to adopt stronger encryption noticeably and restrict third-party access to the data they collected. USA is anticipated to see substantial growth in the Smart Home Security Camera market significantly holds dominant share of 78.3% in 2025.

The section provides detailed insights into key segments of the Smart Home Security Camera market. Among these, Smart Indoor Camera is growing quickly and making prominent advancements. The Physical Stores/Offline hold dominant share.

The best home protector to bridge the gap between security and automation The need for smart indoor cameras is soaring. It offers real-time viewing, enhanced security through motion detection, and AI-based facial recognition, making them a must-have for every modern-day household.

As urbanization is increasing and nuclear families are becoming the norm, people are focusing more on indoor security especially for monitoring children, elderly family members, and pets. Smart Indoor Camera Popularity and Growth in Adoption, the availability of these cameras is a factor that is further fueling adoption with voice assistants such as Alexa and Google Assistant integrated smart cameras allowing users to control their system using their voice.

Governments have also contributed to this growth element by introducing stricter security standards to households. This regulation, which was drafted in 2023, will make all electronic security cameras to comply with new cybersecurity protocols to protect user information.

The legislation impacted a large number of smart camera users across Europe - an estimated 15 million - and led manufacturers to implement end-to-end encryption and enhanced authentication procedures. Smart Indoor Cameras grows at a substantial CAGR of 14.0% from 2025 to 35.

| Segment | CAGR (2025 to 35) |

|---|---|

| Smart Indoor Cameras (Camera Type) | 14.0% |

Even with rapid growth of e-commerce, physical retail stores currently control the largest value share for the market for smart home security cameras. As a result, the majority of consumers prefer buying security devices when they can visit their local offline stores, where they can have a look at the devices, compare features with similar devices and signs of such devices.

Offline sales largely come through electronic retail chains, home improvement stores and specialized security shops. Since physical stores also provide bundled installation services, homeowners looking for a seamless installation process may also be inclined towards physical stores.

In addition, government policies are playing a significant role in boosting offline revenue by regulating product safety and adherence to standards. On Tuesday, the USA Consumer Product Safety Commission (CPSC) announced a new requirement that all smart home security cameras sold commercially must include a certification label that proves it adheres to national cybersecurity standards. Physical Stores/Offline are projected to dominate the Smart Home Security Camera market, capturing a substantial share of 72.9% in 2025.

| Segment | Value Share (2025) |

|---|---|

| Physical Stores/Offline (Sales Channel) | 72.9% |

The market of smart home security camera is a very competitive market and innovation in AI powered surveillance as well as smart home integration, drives the growth of this market. Additionally, companies are working on improving image quality, cloud-based storage for seamless access, and operability with other smart devices, so that they can stay ahead in the race.

Pricing pressure is still high, with the brands competing to offer low cost while including high level security features. This consumer demand where some users prefer privacy-centric solutions and localized data options in devices contribute to the growth of product differentiation in the market.

Industry Update

The Global Smart Home Security Camera industry is projected to witness CAGR of 11.5% between 2025 and 2035.

The Global Smart Home Security Camera industry stood at USD 9,715.1 million in 2025.

The Global Smart Home Security Camera industry is anticipated to reach USD 32,832.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.9% in the assessment period.

The key players operating in the Global Smart Home Security Camera Industry Arlo Technologies, Ring (Amazon), Google Nest, Eufy Security (Anker), Wyze Labs, TP-Link Tapo, Blink (Amazon), Reolink, Lorex Technology, SimpliSafe.

In terms of camera type, the segment is divided into Smart Video Doorbell Camera, Smart Indoor Camera and Smart Outdoor Camera.

In terms of Connectivity, the segment is segregated into Wired Smart Camera and Wireless Smart Camera.

In terms of Sales Channel, the segment is segregated into e-commerce/Online and Physical Stores/Offline.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.