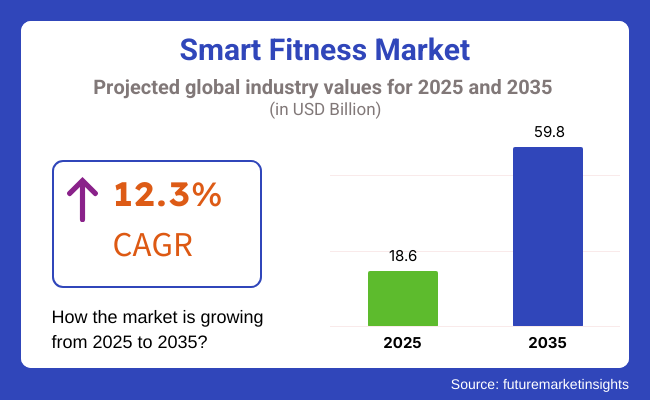

From 2025 to 2035, the smart fitness sector will be under remarkable development, as consumers continuously become used to AI technology and AI-connected fitness devices. The growth from USD 18.6 billion in 2025 to USD 59.8 billion by 2035 is anticipated to register a compound annual growth rate (CAGR) of 12.3% in the forecast period of 2025 to 2035.

This upsurge is driven by various factors like the proliferation of smart wearables, increasing digitization of fitness regimens, and rising inclination towards at-home and AI-powered workouts. North America will lead the pack in technological advancement, while Europe will see fitness solutions forged by sustainability, and Asia-Pacific will see consumer demand reach new highs in volume. The smart fitness industry is on track to be a high-growth rate through 2035.

Explore FMI!

Book a free demo

Plant-based, non-plant-based, and others. Global Smart Fitness by Application: Household, gym and fitness centers, health clubs, corporate wellness, and others. Global Smart Fitness Overlook by Region: North America (USA, Canada), Europe (Germany, UK, France, Spain), Asia Pacific (China, Japan), and RoW Region (LAMEA).

As consumers become increasingly conscious of their health and fitness routines, the smart fitness growth is seeing significant growth and an increasing focus on personalized, tech-based solutions. Connected fitness devices, subscription-based platforms, and AI-powered training top the wish lists for 350 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East surveyed by Gympass.

North America continues to be a major country for smart fitness solutions due to large expenditures on digital fitness solutions, the exponential rise of AI-driven fitness and wellness technologies, and high consumer demand for connected wearables. North America is leading the way with businesses launching their wearables and apps for AI-powered fitness coaching.

Moreover, leading fitness brands integrate virtual reality (VR) into exercise sessions to boost user interaction. Also on the rise are subscription-based digital fitness services, from on-demand workout classes to interactive training programs.

Europe is the second-largest and fastest-growing country, backed by regulatory frameworks that enable and encourage a variety of digital health and wellness programs. Leading the way in smart fitness solutions with an emphasis on sustainability and user-centric innovations are Germany, France, and the UK.

Asia-Pacific is expected to grow at the fastest rate due to factors like smartphone penetration, urbanization, and rising disposable income. China, India, Japan, and South Korea are leading the way with a sharp increase in demand for smart fitness devices and virtual exercise programs.

China is witnessing a boom in connected fitness equipment, with companies launching AI-driven personal training solutions. India’s expanding fitness industry has embraced digital wellness platforms, providing home workout solutions and AI-powered coaching. The region’s younger, tech-savvy demographic is increasingly adopting smart fitness solutions, contributing to expansion.

Challenge: Data Privacy and Security Risks

Concern over data security and privacy is growing in the era of smart fitness devices. Large volumes of user health data are gathered by wearables and fitness applications, making them vulnerable to cyberattacks and illegal access. Strict data protection laws are implemented by regulatory bodies to address these issues, but businesses still need to secure user data.

To gain consumer confidence and ensure compliance with evolving security regulations, they will be relying on strong encryption, secure cloud storage, and transparent privacy policies.

Opportunity: Expansion of AI-Driven Virtual Coaching

The economy for smart fitness offers an exciting opportunity with AI-suggestive virtual coaching. There are wearable technology and fitness applications that use artificial intelligence-based analytics to track your progress and offer real-time feedback and customized training regimens.

AI & machine learning-based virtual coaching solutions can map movements and analyze performance patterns to enable performance outcome prediction and tailored workout suggestions. With increasing number of consumers adopting digital fitness, AI-based coaching is expected to be a game-changer in the fitness industry by fostering innovations as well as engagements.

| Shift Parameter | 2025 to 2035 |

|---|---|

| Technology Integration | AI-driven smart wearables will provide real-time muscle fatigue analysis, hydration tracking, and predictive health monitoring. |

| Fitness Ecosystem | The industry will evolve into fully integrated smart fitness environments, combining VR/AR workouts with AI-powered nutrition guidance and biometric monitoring. |

| Wearable Innovation | Next-gen wearables will focus on metabolic tracking, real-time glucose monitoring, and neuro-feedback for mental performance optimization. |

| Consumer Behavior | Biometric data ownership will become a priority, with consumers demanding personalized AI-driven insights and decentralized health data storage. |

| AI & Virtual Training | AI will power fully automated personal trainers, delivering real-time muscle activation feedback and adapting workouts based on physiological data. |

| Gym & Studio Transformation | Fitness centers will become hybrid wellness hubs, offering real-time biometric assessments, AI-driven coaching, and immersive digital experiences. |

| Health & Longevity Focus | This part will expand into longevity-focused fitness, using real-time physiological data to prevent aging-related decline. |

| Sustainability in Fitness Tech | The industry will prioritize energy-efficient fitness tech, biodegradable sensors, and self-powered wearables that harness body movement for energy. |

| Regulatory & Data Privacy | Governments will enforce stricter biometric data privacy laws, mandating ethical AI in fitness tracking and decentralized health data storage. |

The smart fitness is primarily driven by the advancements in technology and demand for health monitoring solutions in the industry, which makes it one of the largest in the world and the largest in the field of smart fitness products. Wearable fitness trackers, such as Apple Watches and Fitbits, have become indispensable for monitoring heart rates, calories burned, and quality of sleep.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.8% |

China’s smart fitness is expanding due to rapid urbanization, rising disposable income, and strong government health initiatives. Local brands like Xiaomi, Huawei, and Amazfit dominate the sectors by offering high-tech yet affordable fitness wearables. Chinese consumers integrate fitness tracking with super apps like WeChat and Alipay, making fitness an integral part of daily life.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 13.5% |

The mix of engineering excellence, fitness consciousness, and technological precision makes the smart fitness in Germany thrive. High-performance fitness wearables by Garmin and Polar are welcomed by consumers in Germany, who boast a vibrant cycling, running, and endurance sports community. Regulatory standards for AI-based health monitoring and data security ensure that fitness wearables can provide accurate insights while respecting user privacy.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 10.9% |

Japan’s smart fitness industry benefits from technological innovation, health-focused policies, and an aging population. Japanese consumers prioritize high-precision biometric tracking, posture correction, and AI-driven fitness coaching. Companies like Sony and Omron develop wearables tailored for elderly users, ensuring advanced heart rate monitoring and fall detection features.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

The smart fitness sector in India has grown exponentially due to the rising awareness about health, affordable fitness technology, and smartphone-driven fitness solutions. Domestic brands such as Noise, boAt, and Xiaomi are ahead in the economy with budget-friendly smartwatches and fitness bands.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 15.2% |

Strong fitness culture in Australia, outdoor sports scenarios, and wearables acceptance were the key factors in the growth of the smart fitness in Australia. Those who prefer the great outdoors (like hiking, cycling, and surfing) can find options from Garmin and Fitbit, leading the way in a burgeoning of GPS-equipped fitness wearables. Rising AI-led virtual training enabled fitness and smart-home gym adoption as it creates room for at-home workouts.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 12.8% |

The entry of strength training devices into the smart fitness trend, which is one of the fastest-growing players in the smart fitness field, is increasing as customers pay more attention to muscle building, stamina building, and holistic body strength. Connected strength machines and more advanced AI-powered strength machines will bring real-time performance tracking, adaptive weight adjustments, and guided workout recommendations to home and commercial fitness spaces.

The advantages of connected strength training solutions for health clubs and gyms are clear since they support member engagement and offer a data-driven approach to fitness and health. With an increasing number of corporate wellness programs adding strength training to employee fitness plans, the demand for smart weight lifting will be high.

Nutrition-tracking apps are part of the new smart fitness ecosystem, helping users track caloric intake, macronutrient breakdown, hydration levels and diet plans. There are apps commonly used in conjunction with smart fitness wearables and exercise equipment that enable users to track more than just food by connecting their physical activity data with their diet to offer a more complete overview of health.

Features like AI-powered personalized meal planning, barcode scanning for food tracking and real-time nutritional insights are increasing user engagement and retention in fitness journeys. These apps are being integrated into gym and health club services as well, providing personalized diet plans and virtual sessions with nutritionists.

Smart fitness solutions are being widely embraced by corporate wellness programs for employee well-being and productivity. Businesses are integrating fitness tracking apps, smart wearables and connected fitness equipment into workplace wellness programs to encourage healthy lifestyles and prevent health-related absenteeism.

Some of gym memberships are being subsidized while on-site fitness centers with smart cardiovascular training machines are being built which helps in cultivating a culture of fitness consciousness in the workplace.

The smart fitness is evolving quickly because of advancements in technology, more focus on health, and a need for customized fitness options. Companies in this field offer products like wearable devices, smart exercise equipment, and fitness apps that use artificial intelligence (AI) and the Internet of Things (IoT). Top companies succeed by being innovative, creating partnerships, and expanding their networks to capture more of this competitive sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fitbit (Google) | 15-20% |

| Apple Inc. | 12-17% |

| Samsung Electronics | 10-15% |

| Garmin International | 8-12% |

| Xiaomi | 7-11% |

| Other Companies (combined) | 40-48% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fitbit (Google) | Offers advanced fitness wearables with AI-driven health insights and sleep tracking. Expands into healthcare partnerships. |

| Apple Inc. | Leads in smartwatch integration with Apple Health, providing advanced fitness and wellness tracking. Focuses on seamless user experience. |

| Samsung Electronics | Develops smart wearables with robust fitness features and biometric monitoring. Integrates fitness solutions with Samsung ecosystem. |

| Garmin International | Specializes in high-end GPS-enabled fitness and outdoor sports devices. Provides analytics for performance training. |

| Xiaomi | Delivers affordable smart fitness wearables with comprehensive health-tracking features. Targets mass consumers. |

Strategic Outlook

Fitbit (Google) (15-20%)

Now a part of Google, Fitbit leads the smart fitness with its health-centric wearables. It specializes in AI-powered analytics, sleep, and heart rate tracking. In addition to that, the firm has been increasing its health efforts-integrating fitness into Google’s health services and creating strategic partnerships within the health industry.

Apple Inc. (12-17%)

Apple is establishing a leadership position in premium smart fitness wearables. Apple’s integration of hardware and software keeps it on top of consumer loyalty. As watchOS continues to get more updates, Apple is all about wellness with features like mindfulness, personalized workouts, and health insight.

Samsung Electronics (10-15%)

For biometric tracking and personalized workout recommendations, there are the Galaxy Watch series vibrant smart fitness wearables by Samsung as well. Samsung's ecosystem-centric approach integrates its smart home appliances like Galaxy smartphones and fitness solutions.

Garmin International (8-12%)

Garmin focuses on performance-driven fitness solutions for athletes and outdoor adventurers. Garmin’s GPS-enabled smartwatches and fitness trackers offer granular metrics for running, cycling, and other endurance sports.

Xiaomi (7-11%)

Xiaomi dominates the budget segment of the smart fitness with its affordable yet feature-rich wearables. Its Mi Band series has gained global popularity for its long battery life, comprehensive fitness tracking, and competitive pricing. Xiaomi’s strategy involves mass penetration, ensuring accessibility to a broad consumer base.

The remaining players in the smart fitness contribute a significant share, each bringing unique innovations and strategies. This category includes:

The Global Smart Fitness industry is projected to witness a CAGR of 12.3% between 2025 and 2035.

The Global Smart Fitness industry is estimated to reach USD 18.6 billion in 2025.

The Global Smart Fitness industry is anticipated to reach USD 59.8 billion by 2035 end.

North America is expected to record the highest CAGR rising adoption of smart wearables and digital fitness solutions.

Some of the major players are Fitbit (Google), Apple Inc., Samsung Electronics, Garmin International, Xiaomi, etc.

The segments into Smart Fitness Equipment, Cardiovascular Training, Strength Training, Others, and Smart Fitness Wearables.

It categorizes into Fitness Tracking Apps, Workout Apps, Nutrition-Tracking Apps, and Others.

It includes Individuals, Corporates, Gyms & Health Clubs, and Others.

It covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.