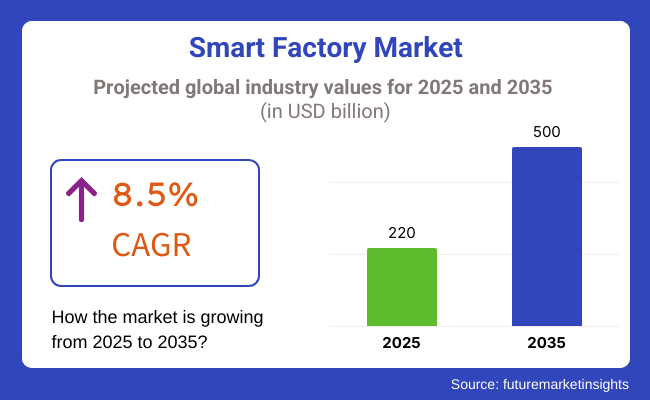

The smart factory market will be USD 220 billion in 2025 and expected to grow to USD 500 billion through 2035, growing at a CAGR of 8.5% from 2025 to 2035. It is being driven by accelerating incorporation of cyber-physical systems, sophisticated analysis of data to provide predictive maintenance, and live monitoring of the manufacturing process.

Along with this, the industry is seeing a growth boost owing to the government initiatives to expand smart manufacturing along with investments made in digitalization, which is helping industries maximize efficiency, reduce operating expenses, and enhance production capacity at a high rate.

The aim of smart factories is to do little more than maximize production and rationalize supply lines with the assistance of cutting-edge technologies that could range from AI-driven automation, digital twin simulations, cloud computing, and edge computing.

Such manufacturing lines leverage networked systems and smart machines to enhance efficiency, reduce downtime and maximize the flexibility of production. Real-time communications are gaining massive boost, digital twin techniques and augmented reality (AR) and virtual reality (VR) are increasingly being used in remote diagnosis, training of workers, and operating simulation, and intelligent factories are becoming an emerging pillar of global industrial revolution.

The industry is expanding due to a range of factors. The increasing demand for automated and data-driven production is compelling industries to deploy AI and IoT connected machinery-based robots. Machine learning technology is being employed to enable companies to minimize unplanned downtimes and maximize the life of their equipment with predictive maintenance. Digital twins are also allowing manufacturers to simulate production processes and optimize workflows dynamically. Global governments are facilitating smart manufacturing with the provision of funding programs and enabling policies, which are further driving adoption across various industrial verticals.

The industry is not challenge-free, even in its fast-paced environment. The necessity of huge investment in the deployment of AI, IoT, and digital twin technology may hamper usage, especially by small and medium-sized enterprises (SMEs). Second, during a time when factories are more connected than ever before, fear of cybersecurity threats and data privacy may also turn out to be dangerous. Integration challenges with existing systems also serve as a barrier for organizations to move toward smart manufacturing. Resolution of these problems using increased security, interoperability solutions, and government backing will be paramount to the smooth transition of the technology.

Invention through technology and inter-industry collaboration will have a serious bearing on the destiny of the industry. Artificial Intelligence, blockchain and 5G networks will be making ever larger contributions to automation, supply chain transparency and real-time decision-making integration.

Green manufacturing and smart factories: Investments in green manufacturing and technology are on the rise. Human-machine collaboration capability in factory operations is evolving with the development of cobots (collaborative robots). The leading industry for the best smart factories in the world is witnessing a gradual evolution in the hundreds of years with the strategy reducing the effect on the ecosystem, particularly greenhouse gases, nitrous oxide, paints and solvents, and water usage.

Explore FMI!

Book a free demo

The industry is growing rapidly because of the factors like Industry 4.0 technologies, AI implementation, and adoption of IoT. Automakers are investing in their production lines that are highly automated as well as AI-powered for precision, efficiency, and predictive maintenance.

In the electronics industry, real-time data analysis and robotics are in rising demand to enhance process efficiency and quality control. The food & beverage sector requires cost-efficient automation and intelligent packaging to optimize production efficiency and safety. Healthcare industries target AI-based diagnostics, automated laboratory processes, and robot-assisted manufacturing, which need high regulatory compliance and cybersecurity.

Aerospace and defense sectors require advanced robotics, digital twins, and IoT tracking systems in order to deliver high accuracy and operational effectiveness. Equally so, manufacturing in industry is shifting towards interoperability, cost reduction, and energy-saving measures to increase production while reducing downtime.

Contracts and Deals Analysis

| Company | Contract Value (USD million) |

|---|---|

| Mingyang Smart Energy and Scottish Government | Approximately USD 37.5 |

From 2020 to 2024, the industry grew at a fast pace as companies adopted automation, artificial intelligence (AI), and Internet of Things (IoT) technologies to enhance production efficiency and productivity. Companies integrated robotics, cloud computing, and digital twin technologies to facilitate real-time decision-making, predictive maintenance, and supply chain responsiveness.

Cyber-physical systems, edge computing, and 5G-enabled industrial networks provided continuous machine-to-machine (M2M) communication, minimized downtime, and optimized efficiency. Artificial intelligence (AI)-powered analytics optimized processes, and robotic process automation (RPA) rationalized processes and reduced errors. The COVID-19 pandemic has accelerated the usage of industry solutions, and this witnessed high demand for remote monitoring, AI-based demand forecasting, and touchless activities. Industry 4.0 technologies such as additive manufacturing, AI-powered quality control, and cognitive systems revolutionized conventional factories to smart, connected ecosystems.

However, challenges such as exorbitant implementation costs, interoperability challenges, and hacking pushed it to be hardened in data governance as well as ICS security. The years 2025 to 2035 will be the time when the smart factory business will be operating in a era of hyper-automation, self-manufacturing, and cognition through AI-infused systems.

Firms will apply quantum computing to real-time optimization, digital twins enabled by artificial intelligence for dynamic process simulation, and adaptive robotics for flexible manufacturing. AI-decision intelligence will ensure autonomous production planning, pre-failure prediction, and automated self-healing manufacturing systems. Blockchain-secured and decentralized industrial markets and procurement networks will improve transparency and efficiency of supply chains.

Smart factories will embrace green production technologies such as AI-optimized energy management, carbon-free manufacturing lines, and waste reduction by circular economy approaches. Quantum-enhanced simulations will enable real-time material analysis and production optimization adaptively, while AI-driven augmented reality (AR) and virtual reality (VR) technologies will enable remote factory management as well as employee training. The propagation of 6G-enabled smart factories will enable ultra-low-latency communications, which will enable real-time industrial edge computing. AI-driven threat detection, quantum-encrypted data protection, and blockchain-based data security frameworks will protect industrial systems and manufacturing data against new cyber threats.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced Industry 4.0 compliance requirements, cybersecurity regulations, and industrial IoT data protection policies. | AI-powered regulatory compliance, blockchain-secured manufacturing data governance, and quantum-encrypted cybersecurity frameworks will shape governance. |

| AI-powered predictive maintenance, autonomous robots, and digital twin adoption improved efficiency. | Quantum computing, AI-driven cognitive manufacturing, and decentralized AI-powered industrial ecosystems will redefine smart factories. |

| Smart factories enabled real-time process optimization, robotic automation, and predictive maintenance. | AI-driven decision intelligence, autonomous production planning, and self-healing manufacturing networks will expand market applications. |

| Manufacturers deployed AI-integrated industrial robots, digital twin simulations, and edge computing-enabled production systems. | AI-powered quantum-enhanced production, decentralized robotic manufacturing, and autonomous industrial IoT networks will drive next-gen smart factories. |

| Companies focused on green energy adoption, AI-driven efficiency optimization, and carbon-neutral manufacturing initiatives. | AI-powered carbon footprint reduction, self-powered IoT sensors, and blockchain-secured sustainable manufacturing will enhance cost efficiency and sustainability. |

| AI-driven predictive analytics optimized production planning, quality control, and supply chain forecasting. | Quantum-enhanced AI-driven decision intelligence, AI-powered real-time material analysis, and decentralized predictive manufacturing models will redefine process optimization. |

| Supply chain disruptions, rising production costs, and workforce challenges impacted industry adoption. | AI-optimized decentralized supply chains, quantum-assisted demand forecasting, and autonomous industrial blockchain networks will improve resilience and scalability. |

| Industry 4.0 adoption, automation demand, and AI-driven manufacturing efficiency accelerated market expansion. | AI-powered autonomous factories, decentralized industrial intelligence, and self-healing manufacturing networks will drive future industry growth. |

The industry is expanding mainly due to the drivers such as rising automation, IoT, and AI-based manufacturing. However, high upfront investment and integration issues result in financial risks. In order to achieve maximum ROI and long-term competitiveness, organizations must move their attention towards scalable, cost-effective solutions and strategic collaborations.

The implementation of smart factories is affected by supply chain disruptions like semiconductor shortages and dependence on specialized components. The uncertainties are compounded by geopolitical tensions, trade restrictions, and price fluctuations. Companies should diversify their suppliers, invest in localized production, and apply risk management techniques to sustain stability in operations.

The progress in the fields of AI, robotics, and cloud computing is leading to the rapid system evolution, which in turn is increasing the risk of obsolescence. Organizations should allocate resources to the development of modular, upgradable systems and also need to encourage ongoing R&D to be competitive in the industry and satisfy demands for new manufacturing processes.

Interconnected networks are the foundation for smart factories; thus, cybersecurity has become a big concern. Data breaches, ransomware, and unauthorized access can disrupt production and compromise sensitive information. The deployment of AI-based security measures, robust encryption, and regular system upgrades is vital for the protection of essential operations and the integrity of the data.

The industry has been segmented into hardware, software, and services segments, out of which the hardware segment accounted for the highest industry share of 68% in 2025, owing to rising automation, artificial intelligence, and Industry 4.0 adoption. ABB, Fanuc, and KUKA are at the forefront of the evolution of AI automation. To illustrate this, the International Federation of Robotics (IFR) predicts that the automotive and electronics industries alone will account for surpassing half a million global installations of industrial robots per year as of 2025.

Alternatively, perceptive machine vision systems, which could be used in the use of inspection systems in these kinds of applications, like Cognex and Keyence AI, help system gr to be gradually used in quality assurance and detect any imperfections in the fast-speed production process.

Besides, leading industrial giants such as Bosch & Honeywell are also transforming factory safety, energy efficiency, and operational intelligence through IoT-enabled sensor technology, which has become integral for real-time monitoring to predict maintenance needs.

In 2025, manufacturing companies have been estimated to capture a services industry share of 32% by virtue of integrations to predictive analytics and cybersecurity solutions, among others. Siemens and Rockwell Automation provide consulting and integration services that help businesses embrace AI-driven automation strategies, while system integrators Schneider Electric and GE Digital help make deployment easier.

Consequently, support and maintenance services are taking centre stage, while IBM and PTC are using AI-based analytics to avoid machine breakdowns and maximize production uptime. Additionally, with the rise in cybersecurity threats, manufacturers are placing emphasis not only on protecting data but also on training their workforce with Industry 4.0 competencies. However, the industry continues to grow rapidly as the global manufacturing process undergoes a revolution facilitated by these technologies.

The industry is rapidly gaining traction within both discrete and process industries owing to the increasing penetration of automation, AI, and IoT solutions across sectors. The discrete industry segment is predicted to achieve a 59% industry share by 2025, with the adoption of intelligent manufacturing solutions by the automotive and electronic industries and in the aerospace sector. Tesla, Siemens, and General Electric, for instance, are utilizing industrial robots, machine vision systems, and digital twins to boost accuracy, downtime, and product quality. Continuous customization to the mass industry and the need for flexible manufacturing systems act as further catalysts for smart factories in discrete industries.

In 2025, the process industry segment is expected to hold a 41% industry share due to the rapid transformation process in the oil & gas, pharmaceuticals, chemicals, and food & beverage sectors during the forecasted period. Full-fledged industries need constant and seamless functioning of machines and processes. Deploying IoT-enabled sensors, AI-backed predictive maintenance, and cloud-based analytics are helping firms ensure production efficiency while eliminating operational risks.

BASF, Nestlé, and ExxonMobil are just a few examples of major enterprises making moves toward smart factory solutions for improved energy management, process automation, and real-time production line monitoring. Stringent regulatory requirements in industries such as pharmaceuticals are also pushing the adoption of automated compliance and quality control systems.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| UK | 7.9% |

| France | 7.8% |

| Germany | 8% |

| Italy | 7.7% |

| South Korea | 8.3% |

| Japan | 8.1% |

| China | 8.5% |

| Australia | 7.5% |

| New Zealand | 7.3% |

CAGR of 2025 to 2035 stands at 8.2% as firms are speeding up automation, AI, and IoT-based manufacturing. America is a world leader in the technology, and General Electric, Rockwell Automation, and Tesla are driving innovation. Increased demand for predictive maintenance, digital twins, and networked ecosystems boosts industry growth. Furthermore, organizations invest in analytics fueled by AI to improve manufacturing efficiency and minimize downtime.

Automotive and aviation industries are at the forefront of the adoption of robotics and cloud-based manufacturing execution systems. Energy conservation goals and legal requirements drive enterprises towards efficient energy use and smart industrial solutions. Moreover, pro-Industry 4.0 government policies enhancing deployment contribute towards speeding up digitalization in the manufacturing sector and making the industry highly rewarding.

7.9% CAGR during 2025 to 2035 is anticipated, with the UK taking the lead in the development. Rolls-Royce and BAE Systems utilize AI-powered automation, robotics, and cloud to propel production automation. Manufacturing firms use IoT networks backed up by cybersecurity for real-time continuous monitoring and data protection.

State-funded smart industrialization initiatives promote automation for pharmaceuticals and logistics at a faster pace. The evolution of digital and green manufacturing forces industries to invest in environmentally friendly manufacturing equipment. Besides this, high demand for edge computing boosts efficiency, driving the sustained growth of the industry.

CAGR between 2025 and 2035 is projected to be 7.8% as France places industrial digitalization and automation as a top priority. Schneider Electric and Dassault Systèmes are some of the industry leaders that dominate the creation of smart factory solutions through AI, IoT, and cybersecurity technologies. The nation's high demand to lower operational expenditures and maximize supply chain visibility is the driving force behind industry expansion.

The government of France actively encourages industry through tax breaks and financial assistance to manufacturers adopting digitalization. Aerospace, automotive, and luxury industries apply digital twins and predictive analytics to enhance efficiency. In addition, partnerships with technology companies increase innovation in smart, sustainable factories with AI functionality.

CAGR is projected at 8% as Germany becomes a global leader in intelligent manufacturing. Siemens, Bosch, and BMW make significant investments in AI-based automation, robotics, and cyber-physical systems to transform production. The German economy prospers with technological excellence and precision engineering, leading to a high penetration of digital factory solutions.

Germany's strong regulatory framework requires environmentally friendly and energy-efficient production processes, further driving smart factory investment. Industry 4.0 projects, supported by 5G and edge computing technologies, drive the digitalization of factories. Moreover, demand for high-precision AI-based production increases industry demand.

7.7% is CAGR 2025 to 2035, with Italy transforming its manufacturing sector. Fiat Chrysler and Leonardo are among the companies that include AI, IoT, and robots in production. Flexible automation is the trend in the automobile and fashion sectors as the country confronts rising demands.

Government assistance facilitates manufacturers' shift to green smart factories. Blockchain and digital twin-based supply chains make industry-wide operations more efficient. Additionally, Italy has a robust SME base that invests actively in cloud-based smart factory technology to enhance productivity and competitiveness.

8.3% CAGR during 2025 to 2035 when South Korea has established its digital manufacturing infrastructure. Industry titans like Samsung and Hyundai invest in AI-driven robots, 5G-networked automation, and cloud-based manufacturing systems. The country's push for high-tech industrialization positions it as the lead driver of smart factory implementation.

Government-backed programs drive the uptake of real-time data analytics and cybersecurity technologies in manufacturing. South Korea's emphasis on semiconductor and electronics manufacturing also drives innovation in AI-driven smart factory networks. Integration of digital twins and autonomous systems further enhances operational accuracy.

8.1% CAGR for the period of 2025 to 2035 is predicted for Japan as it maintains its track record of innovations in technology. Toyota, Hitachi, and Fanuc are some of the organizations that top the list in the implementation of robotics, machine learning, and IoT-based manufacturing automation. Japanese lean manufacturing strategies allow for cost-effectiveness and minimized production costs.

Industries prefer AI-based automation and cyber-physical systems to remain globally competitive. The fast advancement of autonomous manufacturing solutions further drives digital transformation faster. Moreover, the government of Japan also enables AI-based industry research to allow the next generation of industrial automation.

The CAGR is likely to grow at the rate of 8.5%, owing to China's aggressive pursuit of industrial automation. Huawei and Haier, among others, have been investing in AI, robotics, and IoT to develop future-proof smart factory environments. China's robust manufacturing ecosystem and government-backed industry initiatives make China the world leader in digital industrialization.

The quick rollout of 5G networks provides smooth real-time connectivity in manufacturing. Moreover, China's emphasis on semiconductor and high-tech manufacturing autonomy enhances its industry ecosystem. Green industrial automation investment further enhances industry appeal.

7.5% is the estimated CAGR of 2025 to 2035 as Australia develops manufacturing technologies into cutting-edge tech. Organizations like CSL and BHP implement automation and cloud technology based on artificial intelligence to minimize production bottlenecks: evolving cybersecurity requirements and IoT-driven monitoring boost operation resilience.

Government policies facilitate the digital transformation of energy-efficient smart factories for the pharmaceutical, mining, and logistics industries. Moreover, Australian strategic investment in energy-efficient smart factories is in accordance with global sustainability directions. The use of 3D printing and analytics by artificial intelligence facilitates manufacturing efficiency and scale in markets.

CAGR over 2025 to 2035 is estimated to be 7.3% as New Zealand adopts digital manufacturing. Fisher & Paykel Healthcare, among others, invest in automation and AI-based manufacturing systems to reap the highest levels of efficiency. The country's emphasis on sustainability and green manufacturing drives the adoption of smart factories.

Government programs encourage businesses to invest in Industry 4.0 solutions. Moreover, cloud computing technology and IoT-based logistics enhance supply chain visibility. The biotech and high-tech orientation of New Zealand also drives the demand for industry solutions.

Industries are increasingly embracing automation, AI-based production techniques, and IoT-driven operations, paving the way for significant growth in the Industry. Industrial robotics, digital twin technology, real-time data analytics, and cloud-based automation platforms drive demand. However, smart energy management, predictive maintenance systems, and AI-powered quality control systems are some additional factors driving growth.

Key players include leading, established industrial automation companies like Siemens AG, Rockwell Automation, General Electric, Schneider Electric, and ABB Ltd, which have strong domain knowledge, a global footprint, and sustained product innovation, as well as new entrants and specialized automation vendors that are innovating in the space, especially in the form of AI-powered process optimization, cybersecurity solutions, and connected manufacturing ecosystems that respond to the evolving needs of the sector.

In addition, growing movements towards sustainability and green manufacturing, as well as advancements in manufacturing technologies, are likely to increase growth opportunities in the global Industry. Organizations are now placing a higher emphasis on product diversification to offer end-to-end digital transformation solutions, besides increasing their focus toward high-growth sectors such as automotive, healthcare, and electronics.

Cost optimization, supply chain digitization, compliance with industry dynamic regulatory policies, and implementation of an advanced cybersecurity framework to repel frequent attacks are some of the most pertinent strategic factors defining competition in the industry. As the industry continues to embrace Industry 4.0, organizations must start to vary in their energy efficiency, compatibility, scalability, and AI-based production insight.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 20-25% |

| Rockwell Automation | 15-20% |

| General Electric | 12-17% |

| Schneider Electric | 8-12% |

| ABB Ltd. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Leading Digital Twin Technology with Industrial Automation, AI-Powered Manufacturing Analytics. |

| Rockwell Automation | Responsible for industry solutions, industrial IoT platforms, and AI robotics to maximize production. |

| General Electric | Focuses on AI-powered predictive maintenance, digital transformation, and industrial automation. |

| Schneider Electric | Expertise In smart energy management, connected manufacturing, and real-time operational insights. |

| ABB Ltd. | Supply robotics, AI-integrated automation, and intelligent control systems for smart factories. |

Key Company Insights

Siemens AG (20-25%)

Siemens is an industry leader in smart factories, with features like AI-based industrial automation, digital twin simulations, and predictive analytics. It's data center edge computing solutions, and AI-driven operational intelligence is the industry gold standard for efficient and scalable operations.

Rockwell Automation (15-20%)

Rockwell Automation is leading the way in industrial IoT implementation, real-time manufacturing intelligence, and AI-powered robotics for plug-and-play smart factories.

General Electric (12-17%)

GE focuses on predictive maintenance, real-time industrial insights, and end-to-end digital transformation to enhance manufacturing resilience and operational efficiency.

Schneider Electric (8-12%)

With expertise in smart energy management, automation solutions, and real-time monitoring systems, Schneider Electric leads industrial sustainability and cost efficiency.

ABB Ltd. (5-9%)

ABB is at the forefront of intelligent robotics, AI-infused automation offerings, and intelligent control architectures that enable productivity in smart factories.

Other Key Players (30-40% Combined)

The industry is expected to generate USD 220 billion in revenue by 2025.

The industry is projected to reach USD 500 billion by 2035, growing at a CAGR of 8.5%.

Key players include Siemens AG, Rockwell Automation, General Electric, Schneider Electric, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Fanuc Corporation, Bosch Rexroth AG, and Hitachi Ltd.

Asia-Pacific and North America, driven by increasing investments in Industry 4.0, industrial automation, and smart manufacturing technologies.

Industrial IoT (IIoT) and robotics dominate due to their role in enhancing operational efficiency, predictive maintenance, and real-time data analytics for manufacturing processes.

The industry covers hardware, software, and services.

The industry includes discrete industry and process industry, with discrete industry holding the largest share due to increasing automation in manufacturing and assembly lines.

The industry spans smart factories for automotive, aerospace & defense, electrical & electronics, food & beverages, energy & utilities, healthcare & pharmaceuticals, and others, with automotive smart factories leading due to rapid advancements in industry technologies.

The industry covers North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA), with Europe leading due to strong industrial automation initiatives and government support for smart manufacturing.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.