The smart education and learning market refers to the segment focused on the integration of digital technology, artificial intelligence (AI), and interactive learning tools in learning and educational spaces. This system serves various needs like e-learning platforms, virtual classrooms, adaptive learning systems, and cloud-based education solutions, which help to improve accessibility, engagement, and efficiency in educating.

Intelligent education is reforming traditional systems of learning and building ones that are more tailored and tech-based, considering that education institutions, business schools, and corporate training institutes are rapidly adopting AI-based platforms, gamification, and live analytics.

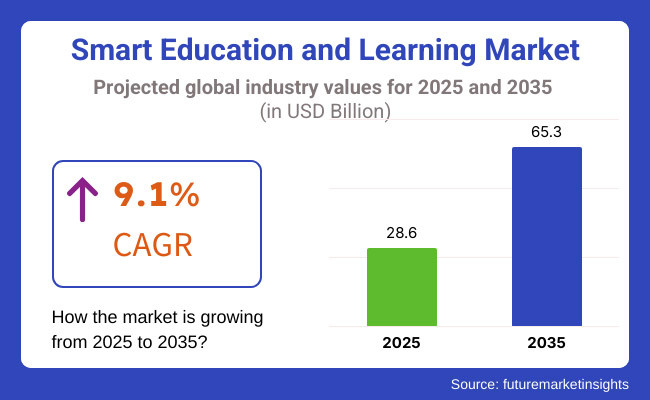

The industry size needs to grow from USD 28.6 billion in 2025 to USD 65.3 billion by 2035 at a robust CAGR of 9.1% throughout the anticipated period.

Key contributors to this growth are Increased demand for digital learning tools, Government investment in smart classrooms, and a boom in artificial intelligence-driven ed-tech tools. With education increasingly being made fuller and accessible across population groups, schools, colleges, and companies are turning to next-gen learning management platforms (LMP) and cloud-based solutions to facilitate remote learning with ease.

The industry is being influenced by technological innovation in artificial intelligence, augmented reality (AR), and machine learning, which has revolutionized the industry by offering adaptive and personalized learning experiences. AI-based platforms assess student performance and tailor lessons to meet learning needs, making the process more efficient and engaging.

The enhanced use of gamification, microlearning, and real-time assessment tools also improves knowledge retention and learner motivation. Digital learning spaces are growing in importance, making cybersecurity and data privacy critical issues. Schools and edtech are implementing stringent security protocols to protect sensitive data without acceding to a seamless and secure online learning experience.

So, the rise of AI-driven analytics allows teachers to keep track of progress, identify gaps in knowledge, and adjust teaching approaches accordingly, making education more effective and result-oriented.

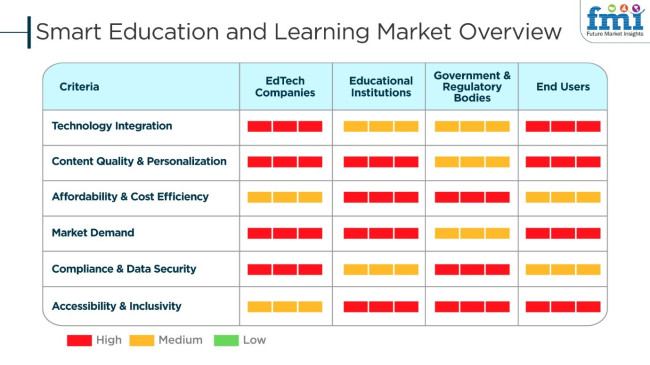

With this booming adoption of smart education technology, edtech companies are now focused on developing scalable and affordable solutions that work with existing educational infrastructures.

The positive industry growth will continue to meet with the contemporary trend toward Hybrid & a comprehensive digital learning model focused on smart education becoming an inevitable part of future learning systems.

The industry is poised to revolutionize how education and training processes are conducted on a global scale, with the constant advancement of edtech and investments towards intelligent learning spaces.

Explore FMI!

Book a free demo

The Industry is showing considerable growth in the direction of the higher utilization of AI technologies for personalized learning, the use of a cloud-based platform, and interactive content. The government and regulatory authorities’ direct attention to compliance, data security, and digital inclusion is the main step in bridging the education divide.

End users, particularly students and professionals, prefer learning solutions that are flexible, low-cost, and interactive and also assist them in getting certifications, progressing in their careers, and acquiring skills. Factors like content personalization, mobile accessibility, competitiveness, and live analytics affect the purchase decision.

As distance learning practices are developing, the industry is transitioning to AI-powered tutoring, blockchain-based credentialing, and immersive digital classrooms, thus making education more engaging, available, and effective.

| Company | Institute of Education Sciences (IES) |

|---|---|

| Contract/Development Details | The Institute of Education Sciences (IES), a federal research agency tracking American students' academic progress, faced nearly USD 900 million in budget cuts under the Department of Government Efficiency (DOGE). This reduction led to the termination of 169 contracts essential for long-term studies and research aimed at improving student outcomes. |

| Date | February 2025 |

| Contract Value (USD million) | Approximately USD 900 million |

| Estimated Renewal Period | 5 - 7 years |

| Company | Yondr |

|---|---|

| Contract/Development Details | Yondr expanded its services into the education sector, contracting with schools across various states and countries to implement phone-locking pouches designed to limit student phone usage during school hours. The effectiveness of these pouches has varied, with some schools reporting improved classroom focus and others noting challenges in enforcement. |

| Date | January 2025 |

| Contract Value (USD million) | Approximately USD 30 per pouch |

| Estimated Renewal Period | 1 - 3 years |

| Company | Pearson |

|---|---|

| Contract/Development Details | Pearson, a leading educational publisher, continued its transition towards digital learning solutions, focusing on integrating artificial intelligence (AI) to enhance educational support. This strategic shift aims to tap into the growing digital education industry, particularly in the United States. |

| Date | December 2024 |

| Contract Value (USD million) | Approximately USD 500 - USD 700 |

| Estimated Renewal Period | 4 - 6 years |

In 2024 and early 2025, the industry experienced significant developments influenced by budgetary decisions, technological integrations, and strategic shifts by key players. The substantial budget cuts to the Institute of Education Sciences highlight the impact of governmental policies on educational research and data collection.

Yondr's expansion into schools reflects a growing trend of implementing technological solutions to manage student behavior, though the mixed effectiveness underscores the importance of proper implementation and enforcement. Pearson's ongoing digital transformation, with an emphasis on AI-driven educational tools, indicates the industry's move towards personalized and accessible learning experiences.

These developments collectively illustrate the dynamic and evolving nature of the Industry, shaped by financial, technological, and strategic factors.

Between 2020 and 2024, the industry grew rapidly due to digital transformation, increased e-learning adoption, and the demand for remote and hybrid learning solutions. The COVID-19 pandemic made people adapt to virtual classrooms, AI-enabled adaptive learning, and cloud-based education platforms.

Learning Management System (LMS) and virtual reality (VR) simulations were made in schools, universities, and corporate training programs to enhance engagement and accessibility. Areas of growth were worked upon by taking care of challenges such as digital divide challenges, cybersecurity issues, and technology adoption resistance.

The industry will experience a radical change from 2025 through 2035 regarding hyper-personalization by AI, decentralized education systems, and immersive learning experiences. Real-time and personalized content input will be delivered through AI-adaptive learning platforms. Blockchain would allow for credentialing with storage infrastructure for secure lifelong learning record-keeping.

Transforming skill-based training is given to VR and AR. Neural networks will also integrate brain-computer interfaces (BCIs) to facilitate cognitive learning advancement. Sustainability and inclusion remain at the top of everyone's agendas, with AI-driven translation tools and offline-first education solutions opening new vistas of global accessibility.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments encouraged digital learning policies, data privacy laws, and EdTech integration in academic curricula. | AI governance frameworks, blockchain-based credentialing policies, and ethical AI regulations for smart learning platforms will define future standards. |

| AI-powered adaptive learning, cloud-based LMS, virtual tutors, and gamified education platforms improved engagement. | AI-driven hyper-personalized education, VR/AR-based experiential learning, decentralized academic records, and brain-computer interface-assisted learning will revolutionize education. |

| Schools, universities, and corporate training programs use smart education platforms for digital classrooms and remote learning. | AI-powered corporate upskilling, immersive medical and engineering simulations, and decentralized peer-to-peer learning networks will expand industry applications. |

| Institutions embraced digital whiteboards, AR/VR headsets, and IoT-based smart classrooms. | Neurotechnology-based learning devices, holographic learning platforms, and AI-based education assistants will rule next-gen learning spaces. |

| Smart learning analytics measured student performance, detected learning gaps, and automated grading. | AI-based real-time cognitive assessment, predictive career path modeling, and quantum computing-based educational research will define future education analytics. |

The industry is exposed to various risks, including data privacy issues, the digital divide, cybersecurity threats, regulatory compliance, and technology adoption problems. The most prominent threat is the data privacy and security risk, as educational institutions are obligated to collect and store substantial amounts of student-related information, such as learning progress and the disclosure of personal data.

The other hurdle is the digital divide, as students residing in economically backward regions or developing countries may not have the ability to access the internet, smartphones, and digital literacy training. This gap can hinder the adoption of smart education solutions in the region, which in turn will have a direct impact on industry growth.

Also, the cloud-based learning platforms, like LMS (Learning Management Systems) and EdTech applications that deal with online learning, are the most affected by this security issue. They are the vulnerable links to which hackers, ransomware attacks, and unauthorized data access are affecting. The institutions will have to take proper steps, such as installing strong encryption, implementing multi-factor authentication, and performing regular security audits in order to prevent the loss of sensitive data.

The territoriality of compliance with regulations differs since the government imposes educational technology standards, content guidelines, and accreditation requirements. Non-compliance can incur industry restrictions and the modification of the product, thus affecting profitability.

Interactive displays are essential to modern smart education solutions that help facilitate real-time interaction between educators and learners. They are commonly used in classrooms, corporate training rooms, and virtual learning environments for an interactive and immersive experience.

For instance, interactive display industry leaders include SMART Technologies, BenQ, Promethean, and ViewSonic, all providing advanced touch-screen displays with AI-enhanced writing recognition and multi-user collaboration features.

For example, SMART Technologies’ SMART Board series is a common tool in K-12 and higher education for digital whiteboarding, interactive lessons, and real-time annotation. Likewise, BenQ’s RP Series also features antimicrobial screens and cloud-based collaboration tools for easy and hygienic learning in the classroom.

The increasing digitization of education fuels demand for the 4K UHD interactive flat panel in North America and Europe. According to industry research, the adoption of interactive displays will record more than a 10% compound annual growth rate (CAGR) from 2024 to 2030 due to growing investments in smart classrooms.

Learning Management System (LMS) platforms are the driving force behind smart education, allowing schools and enterprises to manage online courses, evaluations, and credentials in one place. Artificial intelligence, AI-driven learning analytics, automated grading, and adaptive learning technologies are woven into these online platforms to help enhance personalization and improve learning outcomes. Among the most popular learning management systems (LMS) are

Blackboard, Moodle, Canvas (in structure), Google Classroom, and SAP Litmos. Other Text-Based Systems Moodle is an open-source LMS popular in corporate and academic spaces because it is flexible and scalable. Likewise, Canvas LMS became widely known for its intuitive interface, seamless third-party application integration, and real-time student performance tracking.

Supported by the Google Cloud ecosystem, Google Classroom allows for seamless document sharing, AI-aided feedback, & Real-time collaboration, making it the most suitable tool for such a digitized learning environment. Even industries have adopted the LMS by sector to enhance the overall potential of the employees, and some of the best LMSs are SAP Litmos and Cornerstone OnDemand to ensure that everything they do will enhance their future work. This opens the door for advanced AI-powered and cloud-based LMS solutions in digital education.

Social learning is about working together, sharing, and collaborative knowledge creation, often using digital resources. For example, companies such as LinkedIn Learning and Udemy and platforms like Edmodo and Coursera have added social learning elements to boost engagement. For working professionals, this is an industry-focused platform that helps them engage in courses related to their field, and with this comes AI-based recommendations for courses based on their career goals.

Coursera and Udemy have introduced instructor-led conversations, community learning, and AI-based discussion boards for enhanced engagement and interactivity. Edmodo-is widely used in K-12 education and enables students and teachers to work together by creating group discussions and shared assignments for a connected learning environment.

It emphasizes working with peers, team assignments, and online knowledge sharing. With the support of collaboration tools in EdTech, such as Microsoft Teams for Education, Zoom for Education, and Google Meet for Learning, they perform a vital role in improving collaboration in real-time. AI-powered transcriptions, interactive whiteboards, and cloud-based group projects help ensure seamless setup for collaboration and knowledge-sharing through Microsoft Teams for Education.

By providing features like real-time breakout rooms and AI-powered engagement metrics that track all forms of student participation, Zoom for Education can make distance learning more participative than ever. Similarly, Google Meet for Learning is powered by the same cloud collaboration solution for a live classroom experience that users love in Google Workspace tools and provides a possible digital engagement experience everywhere.

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| UK | 9.8% |

| European Union | 10.0% |

| Japan | 10.1% |

| South Korea | 10.4% |

The USA is developing swiftly with more uses of innovative digital learning systems within schools, universities, and organizations. Schools, universities, and business institutions must pay for AI-driven systems to personalize instruction, engage learners, and ensure distance education.

Mass installation of e-learning applications, cloud-based learning management solutions, and online classrooms disintegrate traditional education systems. Government support policies of e-learning and technology transformations propel this industry. As per FMI, the USA industry is anticipated to grow at 10.2% CAGR during forecast periods.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| AI and Data Analytics in Education | AI is used by schools for personalized learning processes, tracking students' performance, and improved engagement. |

| Online Education Demand Booms | Corporate training and business schools enjoy AI-capable platforms and cloud-based learning services. Thus, online learning and online training fuel the demand for cloud-based offerings. |

The UK industry is growing due to corporate training and business schools falling for AI-capable platforms and cloud-based learning services. Schools and institutes access adaptive learning facilities and more intelligent content to facilitate better learning opportunities. Online class training is required the most, and ed-tech policy-making towards innovations ensures engagement with technology.

Even the corporate fraternity buys the facilities of more intelligent learning platforms en-mass to equip the level of employee learning training programs.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| AI-Based Training Solutions | Institutions and organizations adopt AI-based training solutions for increased interaction and outcomes. |

| Digital Classroom Adoption | Schools and educational institutions adopt intelligent as well as interactive learning environments. |

| Ed-Tech Government Support | Ed-tech government initiatives facilitate industries in adopting smart education solutions. |

The industry grows with educational institutions like institutes, colleges, and schools adopting AI-driven digital learning solutions. Germany, Italy, and France are most keen on virtual learning environments, AR/VR-based learning, and gamification of the education industry. European Commission-funded education modernization programs make it mandatory for institutions to implement smart education technologies.

Cloud infrastructure and AI-based learning analytics are also leaving their impressions. FMI predicts the European Union industry will achieve a 10.0% CAGR through the forecast period.

Growth Drivers in the European Union

| Key Drivers | Details |

|---|---|

| AR/VR-Based Education Integration | Virtual technology for improved education in schools and colleges. |

| Government-Driven Digital Education Policies | The EU government promotes the utilization of smart learning platforms. |

| AI-Based Learning Analytics | Universities and colleges utilize AI to monitor learner activity and customize learning plans. |

The smart learning and education industry increases with schools and institutions incorporating learning software through AI-based learning. Smart tutoring aids in saving data, and software for learning extends availability.

Building education technology is a high priority in Japan, culminating in the cumulative use of responsive and interactive solutions for learning. Professional development and schooling in K-12 are part of the field that incorporates online sites as a mode of increasing accessibility rather than learning.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| AI-Based Tutoring Systems | AI-based tutoring is more efficient in learning and retention. |

| Educational Digital Transformation | Schools and companies are driving adaptive learning systems. |

| Smart Learning Platform Investment | Technology investments are being invested in industries to make it more common. |

The Korean industry keeps evolving rapidly, with schools and institutions adopting AI-driven learning, virtual reality training, and smart classrooms. The government is investing heavily in digital learning infrastructure to make learning more convenient and engaging.

Firms develop interactive learning solutions, AI-based assessments, and instant feedback solutions to improve student performance and employee training. The adoption of 5G technology also accelerates mobile learning solutions. According to FMI, the industry is anticipated to grow at 10.4% CAGR during the forecast period in South Korea.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| AI-Powered Learning and VR Training | Firms use AI and VR technology for improved learning and interaction. |

| Government Support of Digital Learning | The government promotes digital learning at the national level. |

| 5G-Based Mobile Learning | Improved connectivity provides online learning accessibility. |

The global industry is rapidly expanding with the increasing adoption of digital learning solutions, AI personalization, and cloud-based educational platforms. Accelerating the growth of the industry further are hybrid learning, flexibility in education models, and advancements in immersive technologies like AR/VR.

Major players like Google, Microsoft, Blackboard, Pearson, and Coursera are investing heavily in AI-driven adaptive learning and interactive content that can scale across clouds for educational institutions, corporations, and individual learners. They are also growing via strategic partnerships, acquiring other entities, and developing local content that would enhance accessibility and engagement.

Start-ups and niche providers are at the forefront of offering specialized solutions such as gamified learning, AI-tutoring, and blockchain credentialing. While institutions and enterprises increasingly gear toward digital transformation in Education, those that focus on innovation-supported data-driven personalization and flawless integration with existing LMS will lead the competition in the changing paradigm of intelligent learning solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google for Education | 20-25% |

| Microsoft Education | 15-20% |

| Coursera | 12-17% |

| Blackboard Inc. | 8-12% |

| Pearson | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google for Education | Leads in cloud-based learning tools, AI-driven tutoring, and virtual classroom integration. |

| Microsoft Education | Develop interactive e-learning platforms, AI-based student analytics, and collaboration tools. |

| Coursera | Specializes in online courses, AI-powered personalized learning, and professional certification programs. |

| Blackboard Inc. | Focuses on adaptive learning technology, virtual classrooms, and digital assessment solutions. |

| Pearson | Provides digital textbooks, AI-enhanced education tools, and cloud-based learning solutions. |

Key Company Insights

Google for Education (20-25%)

Google for Education is big in smart education, cloud learning platforms, AI tutoring, and the rest; of course, there is no better complement to it than the integration with Google Workspace for Education.

Microsoft Education (15-20%)

Microsoft Education can make learning much better with AI-powered analytics and interactive course materials supplemented with collaborative virtual classroom experiences.

Coursera (12-17%)

Coursera concentrates on online learning, with AI-driven personalized learning, certifications recognizable in the industry, and partnerships with universities.

Blackboard Inc. (8-12%)

Blackboard Inc. provides adaptive learning solutions, digital assessments, and AI-powered virtual classroom tools for institutions and businesses.

Pearson (5-9%)

Pearson offers digital education tools for learners, such as learning in the cloud, financial learning platforms, and study resources enhanced with AI.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 28.6 billion in 2025.

The industry is predicted to reach a size of USD 65.3 billion by 2035.

South Korea, slated to grow at 10.4% CAGR during the forecast period, is poised for the fastest growth.

The key players in the industry include Google for Education, Microsoft Education, Coursera, Blackboard Inc., Pearson, Udemy, Khan Academy, Byju’s, Duolingo, and EdX (2U Inc.).

Social learning is in high demand.

By component, the industry is segmented into hardware (interactive display, interactive projector, interactive board), software (learning management system (LMS), learning content management system, adaptive learning platform, assessment system and others), service (managed service, professional services), and education content.

By learning, the industry is segmented by learning into social learning, collaborative learning, simulation-based learning, and others.

By end user, the industry is segmented into corporate, academic, and others.

By region, the industry is segmented by region into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.