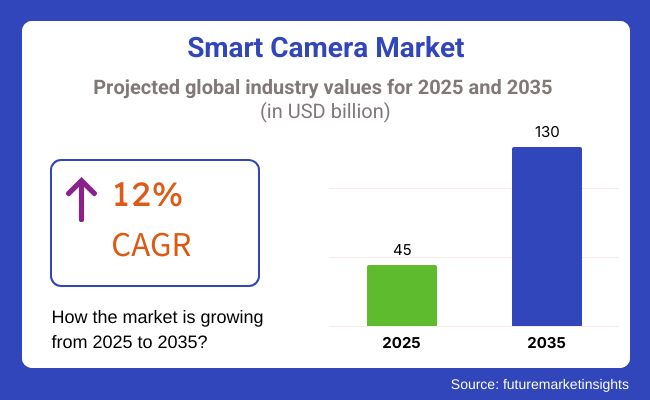

The smart camera market accounted for USD 45 billion in 2025 and is projected to grow at a CAGR of 12% over the forecast period and reach USD 130 billion by 2035. Increasing demand for AI-powered facial recognition, autonomous threat detection, and smart home security solutions is one of the major drivers of industry growth. In addition, increasing investments in industrial automation and smart city infrastructure are fueling industry growth, which are key elements of the monitoring system, smart surveillance system, and advanced & industrial security system.

They utilize technologies like deep learning algorithms, cloud storage, and 5G connectivity to optimize image processing, security, and automation. They combine AI-driven analytics with real-time monitoring and IoT connectivity to assist in enhancing operational efficiency in a variety of industries, ranging from retail, automotive, healthcare, and manufacturing. The capability of receiving, understanding, and processing continuous video feed is revolutionizing security, traffic flow, and customer engagement solutions.

There are various drivers for the growth of the industry. The expanding use of AI-based surveillance solutions enhances threat detection, crowd management, and& law enforcement activities. The rising trend of smart home security solutions is owing to high-level monitoring, motion detection, and the necessity of remote& access.

They are utilized by retail and healthcare& sectors to study customer behavior, automate checkout, and track patients. The growth in smart city schemes that are centered on smart traffic management systems and surveillance of cities is another& driving factor for the industry.

Though the industry has extremely high growth potential, some challenges also exist. Concerns about facial recognition and surveillance technology-based privacy, as well as some regulatory and ethics issues, have been raised and could restrict adoption in certain industries.

It will also discourage residential and small users who simply cannot pay for exorbitant installation fees, particularly AI-based smart camera systems. However, due to cloud storage and IoT integration, cybersecurity attacks are also looking for data security, which demands strong encryption and secure access solutions.

The video camera& industry discovery remains to be facilitated through timely evolutions and further collaborations among technology dealers and defense concrete states. The & functionality will expand to unprecedented levels with the advent of new technologies mobilizing AI-powered video analytics, edge computing, and blockchain data protection. The ubiquity& of 5G connectivity is also enhancing real-time information processing and remote monitoring capabilities.

The surging urbanization, rising automation, and escalating concerns over security& will transform them into an integral component of the smart security system and propel industry take-up across residential, commercial, and industrial domains in the coming decade.

Explore FMI!

Book a free demo

The industry worldwide is growing at a fast pace, fueled by increasing demand for AI vision systems, automation, and security. In the automotive industry, they are crucial for ADAS, driver monitoring, and autonomous driving applications, emphasizing high-resolution imaging and AI features.

Healthcare applications are centered around AI-driven diagnostics, distant monitoring, and medical imaging, with high power efficiency and accuracy being critical. Industrial smart cameras have widespread use in quality control, machine vision, and automation, where integration and cost form the prime purchase drivers.

Consumer electronics experience mass adoption in smartphones, home automation, and gaming, with customers prioritizing connectivity and image processing capability. The security & surveillance industry requires AI-driven facial recognition, motion detection, and night vision for greater monitoring and threat detection.

Smart cameras in retail and smart cities are crucial in traffic management, crowd analytics, and targeted advertising, underlining the need for real-time processing and cloud connectivity.

Contracts and Deals Analysis

| Company | Contract Value (USD million) |

|---|---|

| Meta Platforms and EssilorLuxottica | Approximately USD 500 - USD 700 |

| Apple Inc. | Approximately USD 300 - USD 400 |

| Hikvision | Approximately USD 100 - USD 150 |

The smart camera industry witnessed incredible expansion in 2024 and early 2025 with advancements in technology and government interventions. With the consolidation of Meta Platforms and EssilorLuxottica, they succeeded in introducing the Ray-Ban smart glasses, with traditional design and smart specs, and boosting enormous sales.

So-called smart door lock camera with Face ID is a beacon for Apple moving into the smart doorbell camera segment of the home security industry as an effort to augment its ecosystem. Similarly, Hikvision stepping back from Xinjiang contracts is a sign of how international regulations and ethical considerations are impacting the industry. These events are indicative of a dynamic industry that is compelled by the need for consumers to acquire new goods as well as a need to comply with global standards.

Between 2020 and 2024, the industry expanded significantly as industries integrated artificial intelligence (AI), edge computing, and advanced image processing into surveillance, automation, and real-time analytics. AI-enabled smart cameras enhanced the performance in security, automotive, healthcare, and industrial applications through facial recognition, object detection, and deep learning-driven decision-making. The industry overcame the challenge of expensive production, data privacy, and interoperability despite the upgrade. The industry responded by simplifying AI models, lowering the cost of hardware, and enhancing cloud storage ability to facilitate seamless running and management of data.

2025 to 2035 will witness the industry mature with advancements in technology, along with quantum-enabled imaging, neuromorphic vision processing, and self-learning artificial intelligence-based systems. Artificial intelligence-driven smart cameras will foretell security attacks, facilitate industrial automation, and enhance medical diagnosis with computer vision.

Smart cities will propel safety and efficiency through AI-powered traffic management, people analytics, and smart retail. Edge processing will decrease latency in AI-based computing to enhance the real-time decision-making of autonomous vehicles and industrial automation. Intelligent cameras will lead the applications for mixed reality and augmented reality use in delivering interactive gaming, training, and virtual collaboration.

Manufacturing will focus on sustainability through power-saving processors, recyclable packaging, and sun-powered smart cameras. Ubiquitous 6G-capable smart cameras will give rise to ultra-high-speed data transfer, remote monitoring, and AI-based predictive maintenance and thus find applications in robotics, telemedicine, and autonomous security systems.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments imposed privacy regulations and cybersecurity requirements on AI-enabled smart cameras. | AI-driven compliance monitoring, blockchain-secured video storage, and decentralized surveillance frameworks will define governance. |

| AI-powered facial recognition, deep learning-based object detection, and 5 G-enabled smart cameras improved efficiency. | Quantum-enhanced imaging, neuromorphic vision processing, and AI-powered real-time analytics will redefine their capabilities. |

| They optimized security, traffic management, automated quality control, and consumer electronics. | AI-based real-time security monitoring, augmented reality integration, and autonomous vehicle vision systems will widen the applications. |

| Companies used AI-driven surveillance, automated threat detection, and edge computing-based smart cameras. | 6G-powered real-time vision processing, blockchain-protected video analytics, and AI-driven autonomous monitoring systems will fuel adoption. |

| Companies maximized energy-efficient smart cameras, cloud storage, and AI-driven video compression. | AI-driven energy optimization, solar-powered smart cameras, and biodegradable camera parts will maximize sustainability and cost savings. |

| AI-based real-time analytics of data, predictive maintenance, and anomaly detection boosted operations. | Predictive vision processing with quantum assistance, behavior analytics through AI, and decentralized real-time monitoring will transform predictive modeling. |

| Adoption of smart cameras was affected by supply chain disruptions, high component prices, and cyberattacks. | Quantum-protected data transmission, AI-optimized supply chain logistics, and next-generation semiconducting materials will make markets more robust. |

| AI adoption, 5G, and growing demand for high-resolution surveillance propelled the industry growth. | The future industry growth will be propelled by AI-driven decentralized surveillance, neuromorphic vision processing, and future-edge computing. |

The industry surge is due to the rising need for these devices in urban surveillance, automotive, retail stores, and other industrial settings. However, the implementation of high production costs and the fast pace of technological advancements turn out to be the financial wear and tear. The companies must stress erecting cost-effective production, forming a partnership, and unending research and development to uphold profitability and competitiveness.

The disturbances in the supply chain, as well as the semiconductor shortages, and dependence on specialized parts, have effects on production and pricing. Tensions in global politics, restrictive trade measures, and increased raw material prices all contribute to industry instability. The companies need to diversify their suppliers, put money into local manufacturing, and explore alternative materials to reduce possible risks and maintain their supply chain.

Hyper-accelerated developments in artificial intelligence, edge computing, and high-definition imaging create the danger of products becoming obsolete. Companies should give first priority to modular architecture, software-based improvements, and the use of Artificial Intelligence in their products in order to comply with the emerging requirements of the industry and the consumers but in the long run make sure of the product's relevance.

The security issues that have arisen threaten the implementation of smart cameras with Internet of Things and cloud Tethering. The risk includes the unauthorized access of outsiders to, data breaches, and hacking attempts ruin the security and the user privacy. The main pillar to achieving data protection and customer trust is the rigorous implementation of encryption, AI-driven detection of threats, and updating regular firmware.

During the forecast period, the Image sensor segment is expected to dominate the industry, with 57% of the total industry share in 2025. Image sensors are an essential part of cameras in smartphones, automotive, industrial inspection, medical imaging, and security surveillance. CMOS-based image sensors are experiencing increasing demand for higher-resolution, AI-enabled, and low-light imaging applications.

Companies like Sony, Samsung, and OmniVision are developing cutting-edge image sensor technologies such as stacked sensors, AI-based image processing, and quantum dot sensors. The penetration of autonomous vehicles, AR/VR applications, and high-end smartphone cameras is anticipated to drive growth momentum for this segment.

In 2025, the Memory segment is expected to account for 43% of the industry share, on account of the increasing demand for high-bandwidth data storage as well as processing in the IoT devices, AI-based applications, and automotive sensors. The rapid growth in sensor data complexity and the need for high-performance DRAM, NAND, and NOR flash memory has become a requirement in edge computing, as well as in ADAS (Advanced Driver Assistance Systems) and industrial automation.

Micron, SK Hynix, and Samsung are the big players in this segment, launching low-power and high-capacity memory types that have been optimized for AI and machine learning, 5G, and the IoT. Emerging non-volatile memory (NVM) technologies (e.g., MRAM, ReRAM) are also gaining popularity for real-time sensor data processing.

Given AI’s dominance, automation, and real-time data analytics, image sensors and memory will remain crucial as we push forward toward smarter devices, autonomous systems, and connected industries.

In 2025, the transportation and automotive systems segment will also remain the largest performer, representing a 58% industry share. LiDAR, radar, accelerometers, and image sensors are flying off the hypothetical shelves with the rise of autonomous vehicles, advanced driver-assistance systems (ADAS), and smart transport solutions.

Sensor technologies equipped with AI capabilities are slowly getting integrated into vehicles companies like Tesla, BMW, and Toyota are already using them to ensure safety, navigation, and real-time assessment of traffic. The increasing adoption of electric vehicles (EVs) is also driving demand for battery monitoring sensors and thermal management systems.

The healthcare & Pharmaceutical segment is projected to hold a 42% industry share in 2025, as the development of wearable health devices, remote patient monitoring, and smart medical imaging systems will fuel robust growth in this area. It is the increase in chronic diseases, boom in ageing population, and the increasing trends in personalized medicine that are driving the demand for biosensors, pressure sensors, and infrared imaging sensors.

Companies such as Medtronic, Philips, and Abbott are using MEMS-based and CMOS sensors to create non-invasive diagnostic tools, smart insulin pumps, and AI-assisted imaging solutions. The growth explosion of telehealth and AI-enabled clinical diagnostics is only driving the demand for sensor-driven healthcare applications even higher.

With the explosion of smart mobility solutions and innovative digital healthcare solutions, these two industries, the automotive and healthcare sectors, will drive sensor industry growth on both ends, as making transportation safer and patient care more efficient are driving indicative goals.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 8.2% |

| France | 8.1% |

| Germany | 8.3% |

| Italy | 8% |

| South Korea | 8.6% |

| Japan | 8.3% |

| China | 8.8% |

| Australia | 7.9% |

| New Zealand | 7.8% |

The USA CAGR is calculated as 8.5% in 2025 to 2035. The USA industry grows robustly with the growing adoption of computer vision, AI, and IoT across sectors. Google, Apple, and Amazon heavily invest in smart camera solutions in security, retail analytics, and consumer electronics. Growing demand for face recognition, edge computing, and AI-powered surveillance technology is driving innovation, and therefore, industries benefit from added security and automation. The defense industry is also driving adoption through the help of smart cameras, which utilize and apply smart cameras to provide enhanced reconnaissance and threat identification.

The retail industry facilitates business through the utilization of artificial intelligence-based smart cameras to track customers, prevent loss, and offer personalized shopping experiences. The automotive sector applies sophisticated ADAS and autonomous navigation with high-resolution smart cameras. Governments also promote businesses to adopt energy-efficient and high-resolution camera solutions, therefore driving the industry.

8.2% CAGR is projected between 2025 to 2035. The UK industry grows as companies adopt digital transformation and AI-based surveillance solutions. Companies such as Dyson and BAE Systems create advanced imaging technology for industrial automation, defense, and consumer use. The demand for smart home security, AI-based analytics, and industrial monitoring systems drives the industry. Companies leverage cloud-connected smart cameras to streamline surveillance and boost monitoring capabilities across sectors.

The UK government also invests in smart city solutions, which necessitate smart camera technology for astute surveillance in public safety and transportation. The ones that are artificially intelligent simplify traffic control and planning, and are utilized by retailers to interact with clients. Furthermore, businesses also spend on compliance with regulations and data protection, thus necessitating GDPR-compliant smart camera technology.

CAGR for 2025 to 2035 is estimated to be 8.1% through 2035. The French industry evolves as industries embrace AI-driven surveillance solutions in the automotive, aerospace, and retail sectors. Thales and Schneider Electric dominate industrial vision, defense-imaging-grade offerings, and security offerings. Public safety and autonomous surveillance for the same perpetually enhance the need for AI-driven smart cameras and real-time processing.

Automotive is witnessing growing usage of smart cameras in autonomous driving and retail use cases. Artificial intelligence-based imaging technology is driving facial recognition for security applications, with retail utilizing it to monitor customers and monitor inventory. Government-initiated digital transformation initiatives drive further industry growth.

CAGR is estimated to be 8.3% during the forecast period. The German industry grows as enterprises invest in AI-based vision systems for automotive, industrial automation, and security. Bosch, Siemens, and Zeiss develop high-precision imaging solutions that boost the demand for machine vision and surveillance technology. Industry 4.0 drives the deployment of them for manufacturing and robotics automation.

Automotive manufacturers embed sophisticated cameras in cars to identify lanes, watch over drivers, and allow for autonomous driving. Governments provide stringent data privacy laws that compel firms to manufacture AI-enabled cameras with high-quality encryption and privacy safeguards. Furthermore, investment in urban intelligent infrastructure propels smart traffic monitoring and security service uptake.

The CAGR for the smart camera market is likely to be around 8% during the forecast period. Italy's industry grows consistently as industries embrace AI, automation, and IoT-based security systems. Leonardo and STMicroelectronics are driving smart imaging growth in aerospace, defense, and industrial automation. The adoption of an AI-based security system enhances surveillance in public spaces, transportation, and shopping complexes.

The automotive industry has driver assistance and safety. Retailers deploy AI-based surveillance systems to watch for customers' activities and inventory management. Smart city projects and government digitalization policies also drive more investments into AI-based camera solutions.

The CAGR for South Korea market is likely to be around 8.6% through 2035. South Korea's industry flourishes as the world leader in AI imaging, real-time monitoring, and intelligent home security solutions. Samsung, LG, and Hanwha finance industry automation, security, and consumer electronics camera technologies. Government-sponsored smart city infrastructure stimulates demand for high-definition surveillance systems.

Companies incorporate 5G-connected AI-intelligent smart cameras to drive security, transportation, and healthcare applications. Smart vision technologies find applications in the automotive sector in self-driving cars, and smart home applications are gaining traction with increased demand for networked security systems. Semiconductor technology fuels innovation in small-sized, high-performance ones as well.

The industry in Japan is set to record 8.3% CAGR during the forecast period. Japan's industry is growing as top players innovate quality imaging technology in robotics, healthcare, and security products. AI-based technologies drive the industry with Sony, Panasonic, and Canon, leading to the provision of thorough real-time analysis and process automation. Japan's robot and factory automation drive stimulates machine vision technology adoption.

They are employed in the automotive sector for automated parking, collision avoidance, and traffic monitoring. Artificial intelligence-enabled healthcare imaging streamlines diagnosis and patient care. Furthermore, the requirement for smart infrastructure and urban security fuels the wide use of AI-based surveillance solutions in cities.

China’s industry is projected to grow at a CAGR of 8.8% during the forecast period. The Chinese industry is expanding at a rapid rate, with organizations investing in vision systems that incorporate AI to secure, retail, and manufacture applications. Industry giants Hikvision, Dahua, and Huawei dominate the competition with face recognition, real-time inspection, and IoT-driven cameras. Mass surveillance and city planning are also encouraged by the government, which contributes to mass-scale penetration.

The AI-based ones are designed for application in the e-commerce industry to provide automatic warehouses and fraud detection. The transport industry improves safety through the use of intelligent traffic monitoring software. Furthermore, the reality that China is a leading producer of semiconductors guarantees that there will be continuous research the technology.

It is estimated to be 7.9% CAGR from 2025 to 2035. The industry in Australia expands with industries embracing AI-based surveillance, industrial automation, and weather monitoring. Cochlear and Atlassian lead image-based solutions for security, healthcare, and infrastructure sectors. Maximum usage of smart home security drives the demand for household use of AI-based cameras.

Government investment in smart city infrastructure begins with the creation of real-time traffic management and public security programs. The agriculture sector is facilitated by AI imagery technology for efficient utilization of resources and farm inspection. Companies also enhance sustainability through the creation of power-efficient technology.

The CAGR between 2025 and 2035 is 7.8%. The industry in New Zealand grows more and more as businesses invest in AI-based security, environmental monitoring, and automation. Businesses such as Fisher & Paykel Healthcare incorporate smart imaging for patient diagnosis and remote monitoring of patients. The government has plans around smart cities, hence creating demand for AI-based surveillance systems.

They help agriculture through livestock monitoring and intelligent irrigation. Smart home solutions also increase, and thus the need for AI-driven security solutions increases. AI and edge computing investment also fuels smart camera solutions in industry segments.

The industry is characterized by intense competition, fueled by the rising deployment of AI-based surveillance, facial recognition, and IoT-integrated surveillance systems. An increase in security concerns, urbanization, the development of smart city infrastructure, and industrial automation drives demand. Innovative advances in real-time video analytics, edge computing, and cloud-based storage have been significant drivers of growth in the industry, along with prominent trends, including thermal imaging & low-light performance, as well as AI content recognition.

Through the establishment of tech companies, security firms, niche camera makers, solid R&D capabilities, extensive distribution expeditors, and innovative approaches, Mistral Co. dominates the industry. All Rights Reserved. Some of the key players in the Video Surveillance Industry include Sony Corporation, Bosch Security Systems, Hikvision Digital Technology, Axis Communications, and FLIR Systems. Niche players and the new kids in town, likewise, are creating tools and solutions pertaining to AI-driven analytics, green smart camera tech, and integrated smart home ecosystems as a way to set themselves apart from the competition.

The evolution of this industry, although, is shaped by multiple other major forces, including algorithms-enabled image processing, profuse edge computing, regulatory requirements for data privacy and cyber security, etc. To sustain growth, companies are emphasizing product line expansion, diversification into industrial and smart city applications, and penetration into home security and enterprise surveillance.

Some of the strategic dimensions being contemplated in terms of defining competitive dynamics include price competition, supply chain efficiencies, and changing consumer preferences and demand in terms of AI-powered, cloud-connected and energy efficient smart cameras. With ongoing emphasis on security, automation, and AI-based analytics, brands should differentiate based on superior image quality, regulatory compliance, and integration into existing IoT ecosystems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Corporation | 20-25% |

| Bosch Security Systems | 15-20% |

| Hikvision Digital Technology | 12-17% |

| Axis Communications | 8-12% |

| FLIR Systems | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Corporation | Drives AI image sensors, high-res surveillance, and smart home camera solutions. |

| Bosch Security Systems | AI-powered security cameras, IoT(Internet of Things) connected surveillance and intelligent analytic video. |

| Hikvision Digital Technology | Specializes in facial recognition, thermal imaging, and smart city surveillance solutions |

| Axis Communications | Specializes in network cameras, real-time analytics , and AI-powered security systems. |

| FLIR Systems | Authorized dealer of thermal imaging cameras, intelligent monitoring systems, and detection of moving objects based on AI. |

Key Company Insights

Sony Corporation (20-25%)

They pioneered the industry segment by integrating AI-based image sensors, high-resolution video processing, and cybersecurity solutions.

Bosch devices (15-20%)

Bosch security and surveillance with AI-enabled smart cameras, IoT monitoring, and real-time video analytics.

Hikvision Digital Technology (12-17%)

Hikvision's focus includes AI-driven facial recognition, smart city surveillance, and integrated security monitoring systems.

Axis Communications (8-12%)

Axis Communications leads the development of network cameras, end-to-end real-time security analytics, and AI/human-centric systems for smart monitoring.

FLIR Systems (5-9%)

FLIR Systems is known for thermal imaging solutions, military-grade security cameras, and AI-enhanced monitoring.

Other Key Players (30 - 40% Combined)

Dahua Technology, Samsung Techwin (Hanwha), Avigilon (Motorola Solutions), Honeywell Security, Panasonic i-PRO Sensing Solutions

The industry is expected to generate USD 45 billion in revenue by 2025.

The industry is projected to reach USD 130 billion by 2035, growing at a CAGR of 12%.

Key players include Sony Corporation, Bosch Security Systems, Hikvision Digital Technology, Axis Communications, FLIR Systems, Dahua Technology, Samsung Techwin (Hanwha), Avigilon (Motorola Solutions), Honeywell Security, and Panasonic i-PRO Sensing Solutions.

North America and Asia-Pacific, driven by increasing concerns over security, rising adoption of smart home solutions, and government initiatives for public surveillance.

AI-powered security cameras dominate due to their ability to offer real-time analytics, motion detection, and automated threat recognition.

By components, the industry covers image sensor, memory, processor, communication interface, lens, display, and others.

By applications, the industry includes transportation and automotive systems, healthcare & pharmaceuticals, food & beverages, military & defense, commercial areas, consumer segments, and others.

By region, the industry covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Industrial Media Converter Market Growth – Trends & Forecast 2025 to 2035

IR Spectroscopy Market Analysis – Growth & Forecast 2025 to 2035

Mobile Handset Protection Market Analysis by Protection Provider, Pricing Model, Sales Channel, and by Region - Forecast through 2025 to 2035

Land Mobile Radio (LMR) Market Analysis by Type, Technology, Frequency, Application, and Region Through 2025 to 2035

Extreme Ultraviolet Lithography (EUV) Market Analysis by Light Source Type, Application, and Region through 2025 to 2035

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.