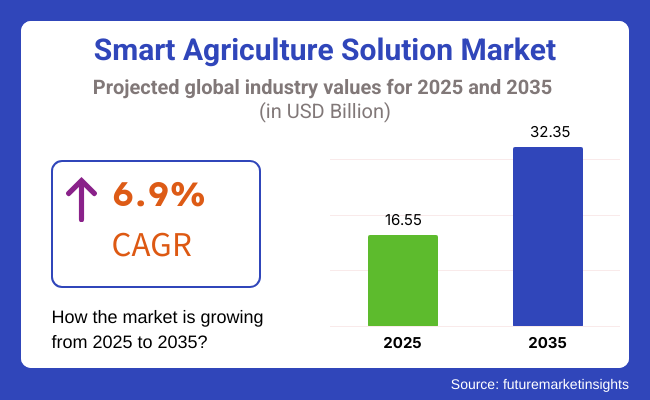

The smart agriculture solution market will continue to grow steadily between 2025 and 2035 as IoT-powered agriculture, precision agriculture, and AI-driven analytics gain more traction. The market is projected to reach USD 16.55 billion in 2025 and expand to USD 32.35 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.9% during the forecast period.

With the rising demand for sustainable farming practices, real-time monitoring, and data-driven decision-making, smart agriculture solutions are gaining traction. The combination of AI-enabled predictive analytics, drone surveillance, and automation for irrigation and fertilization is maximizing agricultural productivity and optimizing resources. Moreover, the improvement in sensor technology, climate-resilient farming practices, and satellite tracking is increasingly driving market growth.

Furthermore, cloud-based farm management software, blockchain-supported farm supply chains, and autonomous farm vehicles are transforming the industry. Robotic automation, machine learning-backed yield forecasting, and remote sensing are being increasingly embraced by farmers and farming enterprises alike to improve the efficiency and sustainability of operations.

Explore FMI!

Book a free demo

The smart agriculture solution market is growing due to new technologies like AI, IoT, big data, and automation. Precision farming makes data accuracy, automation, and IoT integration the main tools in the quest to increase crop yields and resource use.

Livestock monitoring solutions have real-time health tracking, automated feeding, and behavior analysis is the main reason for requiring AI-powered analytics and adaptability. Smart greenhouses bring out climate control, sensor integration, and automation as IoT compatibility and energy efficiency are crucial issues.

A water management system for irrigation is a low-cost, efficient water and real-time monitoring that ensures sustainability. Agricultural drones are indeed very important for analyzing crops, spraying pesticides, and mapping the area, which also involves scalability, precision, and adaptability. The factors of sustainability in farming, together with the support from the government for digital agriculture, are driving the growth of the business of smart farming technologies in different sectors.

| Company | Contract Value (USD Million) |

|---|---|

| John Deere | Approximately USD 90 - 100 |

| Trimble Inc. | Approximately USD 70 - 80 |

| AGCO Corporation | Approximately USD 60 - 70 |

| Raven Industries | Approximately USD 50 - 60 |

| CNH Industrial | Approximately USD 80 - 90 |

In 2024 and early 2025, the industry experienced significant growth driven by the rapid adoption of digital technologies and IoT-enabled systems in farming. Leading companies such as John Deere, Trimble Inc., AGCO Corporation, Raven Industries, and CNH Industrial have secured pivotal contracts and strategic partnerships aimed at enhancing precision farming, optimizing resource utilization, and boosting operational efficiency. These developments underscore the industry's commitment to innovation and sustainability in modern agriculture.

Between 2020 and 2024, there was rapid growth in the industry as farmers embraced IoT, AI-driven automation, and precision farming technologies to enhance productivity and sustainability. GPS-guided tractors, AI-powered crop monitoring drones, and soil moisture sensors optimized irrigation and fertilizer use, improving yields while reducing costs.

IoT-enabled real-time data from sensors and satellite imagery facilitated predictive analytics for disease detection and livestock management. Cloud-based farm management software streamlined operations, while sustainable practices like automated irrigation, vertical farming, and regenerative agriculture gained momentum, supported by government incentives.

Despite these advancements, high costs, limited rural connectivity, and data security challenges remained barriers to adoption. From 2025 to 2035, AI-powered autonomous farming, blockchain-secured supply chains, and biotechnology innovations will drive the next phase of smart agriculture.

AI-driven robotic harvesters and self-operating tractors will enhance efficiency, while predictive analytics will optimize planting schedules and livestock care. Blockchain technology will ensure transparency in food supply chains, enabling secure digital transactions and smart contracts for crop insurance.

Climate-smart agriculture will advance with AI-based climate modeling, drought-resistant crops, and bioengineered fertilizers. Meanwhile, 5G and edge computing will enable real-time drone surveillance, AI-powered pest detection, and ultra-precise farm management, transforming agriculture into a more responsive and resource-efficient industry.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter agricultural regulations (EU Green Deal, USDA organic certification, precision farming mandates) pushed farmers to adopt smart solutions for compliance and resource optimization. | AI-driven, blockchain-backed smart farming solutions enable real-time compliance monitoring, automated sustainability reporting, and predictive yield optimization for eco-friendly agriculture. |

| AI-powered analytics optimized crop health monitoring, pest detection, and automated irrigation to improve yield and efficiency. | AI-native, self-learning agricultural ecosystems provide real-time crop diagnostics, autonomous farm management, and hyper-personalized agronomic recommendations based on AI-driven climate modeling. |

| Farmers deployed IoT-connected sensors for real-time soil moisture, weather tracking, and livestock health monitoring. | AI-powered, edge-native IoT networks autonomously collect and analyze farm data, optimizing irrigation, fertilization, and livestock health in real-time for maximum productivity. |

| Autonomous tractors, robotic weeders, and AI-driven harvesters reduced labor costs and enhanced efficiency. | AI-integrated, fully autonomous farming systems use swarm robotics, precision drone spraying, and self-driving farm vehicles to automate every aspect of food production. |

| Smart greenhouses integrated climate control, automated irrigation, and AI-based nutrient optimization for year-round food production. | AI-powered, fully autonomous greenhouses leverage real-time climate adaptation, vertical farming optimization, and regenerative agriculture principles for sustainable, high-yield farming. |

| Faster connectivity enabled real-time remote farm monitoring, drone-based aerial imaging, and AI-driven decision-making. | AI-enhanced, 6G-powered smart agriculture networks enable ultra-low latency data transmission, real-time farm automation, and global AI-driven precision farming intelligence. |

| Increased reliance on digital agriculture required advanced cybersecurity, encrypted farm data storage, and AI-driven anomaly detection. | AI-secured, quantum-resistant smart farm networks prevent cyber threats, ensuring tamper-proof farm data integrity, decentralized traceability, and secure cloud-based farm management. |

| AI-assisted plant breeding and gene editing improved crop resilience, reducing the need for chemical fertilizers and pesticides. | AI-powered bioengineered crops use real-time environmental adaptation, regenerative genetic programming, and smart microbial interaction for next-gen climate-resilient agriculture. |

| Farmers adopted sustainable irrigation, renewable energy-powered equipment, and carbon-tracking analytics for eco-friendly farming. | AI-driven, carbon-negative farming solutions integrate regenerative agriculture, smart soil management, and predictive carbon sequestration models to optimize sustainability goals. |

| Blockchain-based smart contracts improved farm-to-table traceability, reducing fraud and ensuring fair trade. | AI-integrated, decentralized agricultural finance ecosystems enable automated smart subsidies, AI-driven farm credit scoring, and real-time transparent supply chain tracking for ethical food sourcing. |

The Smart Agricultural Solutions Market faces a plethora of threats, including technology acceptance worries, data security risks, high initial costs, regulatory constraints, and climate uncertainties. The foremost risk is the resistance to technology adoption prevailing among conventional farmers.

Many crop growers, particularly in developing areas lack either the functional knowledge or the financial resources to incorporate smart solutions such as IoT sensors, AI-driven analytics, and automated irrigation systems. Companies have to lay steep emphasis on user-friendly solutions, training programs, and financial incentives to push the adoption rate up.

Data security and privacy risks further jeopardize the situation. Smart agriculture frequently centers around cloud platforms, wireless connection, and IoT, leading to vulnerability crops being susceptible to wrecks, breaches of data, and trespassers. Putting robust cybersecurity practices in place, along with not only following but also being seen to comply with data protection laws, serves as the assurance of the farmer's trust.

Surprisingly enough, climate change and erratic weather conditions also halve the efficacy of smart agriculture solutions. AI-powered forecasting machines and changes in technology, which would be included in the same process, would be necessary to decrease environmental concerns and, at the same time, enhance the endurance of farms.

In overcoming these risks, it is first and foremost necessary for companies to prioritize cybersecurity, then focus on cost, commit to rule-following, and finally, primarily educate the farmers on the boons of a normalized smart agriculture tech.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 11.5% |

| UK | 11.2% |

| European Union | 11.4% |

| Japan | 11.1% |

| South Korea | 11.7% |

The USA is dominating the Smart Agriculture Solution Market due to the growth of precision farming, AI-based crop monitoring, and IoT-based farm automation. By deploying smart sensors, GPS-collected machinery, and real-time data analytics, they work to optimize yield and limit resource wastage.

Investments in AI-powered pest detection, cloud farm management software, and real-time soil health monitoring solutions are being produced to boost productivity with USA Department of Agriculture (USDA) funds and Agri-Tech inventors.

Automated irrigation systems and AI-powered livestock trackers are some of the innovations that farmers have been bringing in the market, making farming more efficient and effective than ever before.

Innovation-place-changing companies such as John Deere, Trimble, and AgEagle Aerial Systems are reinventing precision agriculture with AI-enabled cropping management, satellite-grounded information of areas, and the application of cloud results to arrive at data-driven farm outcomes. FMI anticipates that the USA smart agriculture solutions market is poised to expand at 11.5% CAGR through the course of the study.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Precision Farming Adoption | Due to agriculture being one of the world's oldest industries, the implementation of such technology is far from common. |

| AI in Pest & Crop Management | Using AI models, these solutions are able to identify early signs of pests, allowing intervention before the infestation occurs. |

The UK Smart Agriculture Solution Market is growing due in part to the government's sponsored agricultural innovation initiatives, driving AI-based yield optimization and climate-smart farming. Soil tracking, AI-driven illness forecast, and automatic herd handling are workflows that farmers implement for an effective agricultural process.

The UK's Department for Environment, Food & Rural Affairs (DEFRA) promotes AI-based farm automation, real-time evaluation of crop health, and smart greenhouse technologies. The agricultural landscape is being transformed from precision irrigation systems and sensor-based livestock health monitoring to AI-driven farm logistics.

This range of solutions, from real-time soil analytics, smart fertilizer applications, and AI robotic devices to transform farms businesses such as CNH Industrial, Agri-EPI Centre, and Yara International are harnessing Agtech to drive agricultural productivity through the roof. According to FMI, the UK smart agriculture solution market is projected to grow at 11.2% CAGR during the forecast period.

Growth Factors in UK

| Key Drivers | Details |

|---|---|

| AI in Crop & Livestock management | Farmers use AI for disease prediction and automated livestock tracking. |

| Government Initiatives | Policies are encouraging AI-based smart farming. |

Precision farming policies within the European Union drive the adoption of smart plantation technology as the smart agriculture solution market expands in the EU. The European Union's (EU) Common Agricultural Policy (CAP) and Green Deal initiatives also support digital farming.

At the same time, European countries like Germany, France, and the Netherlands have recently led the way in robotic-assisted agriculture, AI-enhanced soil analysis, and cloud-connected crop management platforms. Real-time environment monitoring, AI-based irrigation scheduling, and intelligent supply chain management are driving real-time industry developments.

BASF, Bayer CropScience, and CLAAS are examples of agrotech companies that are investing in big data-powered farm consulting, AI pest control, and automated greenhouses. According to FMI, the European smart agriculture solution market is expected to grow at 11.4% CAGR during the forecast period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| EU Policies & Regulations | Digital and sustainable agriculture is at the center of the Agri-CAP and Green Deal initiatives. |

| Climate-Smart Agriculture | Farmers embrace precision irrigation and AI-powered environmental monitoring. |

Japan Smart Agriculture Solutions Market is developing with cutting-edge agribusiness mechanization, AI-empowered crop investigation, and IoT-based greenhouse the board. AI-based yield prediction, unmanned cultivating robots, and weather-based irrigation systems serve to enhance more efficient agriculture supported by MAFF.

Vertical farming is propelled by sensors, crop inspection via drones with AI, and pest detection have become automated. Japanese companies are in charge of developing AI-powered farm machinery, smart irrigation drones, and automatic livestock tracking systems used by manufacturers like Kubota, Fujitsu, and Yamaha Motor, which are paving the way for digital farming. According to FMI, Japan is expected to grow at 11.1% CAGR during the forecast period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Smart Farm Automation | AI-powered farm equipment and robotics improve efficiency. |

| AI-Based Yield Forecasting | Crop planning and productivity are optimized by predictive analytics. |

South Korea is expected to dominate the Smart Agriculture Solution Market in the next two years coupled with the developed smart farming infrastructures in the country as well as AI based farms monitoring. Such smart farming cases include AI in the farm (greenhouse) automation, livestock health monitoring, and farm analytics in real-time (some examples can be found in MAFRA).

Demand for robotic irrigation, drone-based soil mapping, and AI-enabled automated harvesting are only increasing. AI-powered farming intelligence, cloud-connected smart irrigation, and IoT-fueled crop tracking solutions dot smart agriculture terrains cultivated by Samsung Electronics, LG CNS, and Nongshim Data System. According to FMI, the South Korean industry is expected to grow at 11.7% CAGR during the forecast period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Powered Livestock Tracking | Syncing records enhances managerial productivity & animal health monitoring. |

| Automation Harvesting Solutions | Farm labor and efficiency are optimized through robotics and AI. |

Among the different types, the sensor monitoring system segment is anticipated to dominate in 2025, with a share of 52.3%, owing to the growing requirements for real-time data acquisition, remote monitoring, and predictive analytics in smart agriculture.

Farms that use smart agriculture solutions leverage IoT-enabled sensors, AI-driven analytics, and cloud-based data processing to monitor critical variables, including soil moisture, temperature, humidity, nutrient levels, and crop health. Sensor-based systems keep track of field parameters and automatically notify the farmers to optimally utilize irrigation, spotting early diseases and improving the yield.

Companies like Bosch, Trimble, and Ag Leader Technology race to innovate AI-powered sensor integration, wireless data transmission, and real-time machine learning models to catalyze the next generation of precision agriculture; they can also apply similar technologies to improve their own supply chains.

This enables the minimization of resource wastage, improves the production capacity of farms, and guarantees sustainable farming practices. The Smart Detection System segment is expected to grow significantly due to a surge in AI-powered detection technologies for farm monitoring, pest recognition, and automatic farm security.

Real-time detection of diseases and pests in plants, abnormalities in livestock health, and equipment failures are made possible when smart detection systems utilize computer vision, LiDAR, hyperspectral imaging, and AI-based pattern recognition techniques. Such systems are essential for precision farming, automated quality monitoring, and early abnormality detection to minimize potential crop loss or disruptions to business operations.

Industry heavyweights, from John Deere to DJI to Sentera, are putting their money into AI-based image processing, drone-propelled smart detection, and edge-computing solutions to help continue to make agriculture more intelligent.

In 2025, the Automated Machinery Guidance Control segment is estimated to hold a 28.1% share. The growing need for precise agriculture, automatic tools, and live route navigation systems has led to the adoption of sophisticated steering control alternatives in smart farming.

Such systems rely on GPS, LiDAR, AI-powered vision sensors, and RTK (Real-time kinematic) technology to navigate tractors, combines, and other farm equipment at high precision. These used to gather data regarding soil moisture, temperature and topography, in addition to others, are facilitated by automated steering, VRA (Variable rate application) and path optimization that ensure lesser human actions, less waste and improved total farm productivity with less intervention.

Pioneering agricultural gear makers like John Deere, Trimble, and AGCO Corporation increasingly feature AI-fueled path planning, cloud-based fleet management, and real-time terrain analysis to optimize precision across field activities.

The Tractor Collision and Obstacle Detection (Automated & semi-automated) segment is anticipated to grow significantly over the forecast period due to the increasing adoption of AI-enabled safety systems in automated and semi-autonomous tractors.

Starting from laser-based sensors like LiDAR to avoid rocks in the field, to introductory radar for collision avoidance, or ultrasonic sensors for fine movement avoidance, and all sorts of advanced AI computer vision systems for perception, all the way up to full dynamic resensing of a 3D model of the area around the tractor to detect anything from pedestrian farm workers to hidden animals.

Offering real-time alerts, automatic braking, and even autonomous rerouting abilities, these technologies significantly help to lower accidents, equipment damage, on-site injuries, and waste. Artificial intelligence can help tractor manufacturers implement predictive collision avoidance, automated emergency braking, and sensor fusion technologies that will make tractor operations safer on farms, according to Kubota, CNH Industrial, Bosch, and other industry players investing capital in applying smart farming applications.

The Smart Agriculture Solution Market is transforming contemporary farming through the adoption of artificial intelligence, the Internet of Things, and data-driven technologies for enhanced efficiency, sustainability, and productivity. It has been growing primarily due to increased demand for precision farming, environmentally resilient agriculture, and resource optimization due to increases in global demand for food.

The major players in the industry share include John Deere, Trimble, AGCO Corporation, Raven Industries, and Topcon Positioning Systems, which leverage AI-based analytics of farm information along with autonomous vehicles and monitoring smart systems connected to the internet. On the other hand, emerging companies and niche providers such as sensor-based soil analysis, smart irrigation, and AI-based crop health monitoring tend to be gaining higher competition.

Adoption is continuing to grow into robotics, automated irrigation, and precision agriculture with drones. Cost-effective precision farming tools, seamless integration with existing agricultural equipment, and fulfillment of sustainability regulations are the strategic factors dictating competition. Companies will develop strong positions by providing scalable, intelligent agriculture solutions powered by AI and data.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| John Deere | 20-25% |

| Trimble Inc. | 15-20% |

| AGCO Corporation | 12-16% |

| Raven Industries | 10-14% |

| Topcon Positioning Systems | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| John Deere | Develops AI-driven autonomous tractors, precision planting systems, and smart irrigation. |

| Trimble Inc. | It specializes in GPS-based precision farming, drone analytics, and farm operations automation. |

| AGCO Corporation | Focuses on smart harvesting, advanced crop monitoring, and AI-integrated farming solutions. |

| Raven Industries | Innovates in precision spraying, real-time data analytics, and autonomous farming technology. |

| Topcon Positioning Systems | Provides IoT-enabled farm management systems and automated irrigation solutions. |

Key Company Insights

John Deere (20-25%)

John Deere is leading the smart agriculture market with AI-based farming equipment, precision planting, and autonomous field operations to improve the efficiency of farm operations.

Trimble Inc. (15-20%)

Trimble is changing how smart farming is being conducted, focusing on automation with GPS, field mapping with drones, and farm analytics with AI to optimize crop production.

AGCO Corporation (12-16%)

AGCO is fast emerging as a leader in smart harvesting and automated machinery with AI decision support for large-scale farming operations.

Raven Industries (10-14%)

Raven is pioneering autonomous farming solutions, building smart sprayers, machine learning analytics, and real-time monitoring on-field solutions.

Topcon Positioning Systems (6-10%)

Topcon is increasing agricultural productivity with IoT-enabled farm management systems, automated irrigation processes, and precision agricultural technology.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 16.55 billion in 2025.

The industry is predicted to reach a size of USD 32.35 billion by 2035.

Key companies include John Deere, Trimble Inc., AGCO Corporation, Raven Industries, Topcon Positioning Systems, and Other Companies (combined).

South Korea, driven by the rapid adoption of precision farming technologies and automation in agriculture, is expected to record the highest CAGR of 11.7% during the forecast period.

Automated machinery guidance control is among the most widely used applications, enabling precision farming through GPS-enabled tractors and automated machinery operations.

The market includes Hardware (Sensor Monitoring Systems, Smart Detection Systems, GPS-enabled ranging systems, Drones), Software, and Services (Climate Information Service, Supply Chain Management Service, and Others such as System Integration, Maintenance, and Consulting Services).

The market covers automated machinery guidance control, tractor collision and obstacle detection, machinery safety and parameter monitoring, variable rate technology, and building and premises surveillance.

The market spans North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Middle East & Africa, and Japan.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.