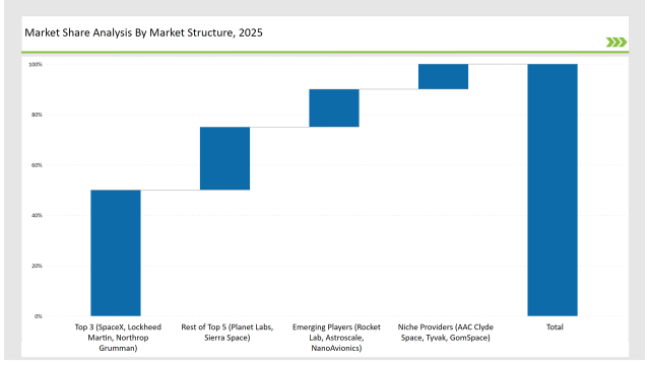

The small satellite market is rapidly expanding due to the increasing demand from commercial, government, and defense sectors for low-cost, high-performance space solutions. Dominating the industry are SpaceX (via Starlink), Lockheed Martin, and Northrop Grumman, holding 50% of the market. These leaders drive innovation with reusable launch systems, satellite constellations, and advanced communication technologies.

Mid-tier vendors include Planet Labs, Sierra Space, and Blue Canyon Technologies, with 25% of the market share, concentrating on earth observation, remote sensing, and data analytics. The emerging providers such as Rocket Lab, Astroscale, and NanoAvionics capture 15% of the market share in innovative propulsion systems, satellite servicing, and in-orbit debris removal. Niche vendors, which include AAC Clyde Space, Tyvak, and GomSpace, also make up 10%, with niche applications in scientific research, IoT connectivity, and deep space exploration.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 (SpaceX, Lockheed Martin, Northrop Grumman) | 50% |

| Rest of Top 5 (Planet Labs, Sierra Space) | 25% |

| Emerging Players (Rocket Lab, Astroscale, NanoAvionics) | 15% |

| Niche Providers (AAC Clyde Space, Tyvak, GomSpace) | 10% |

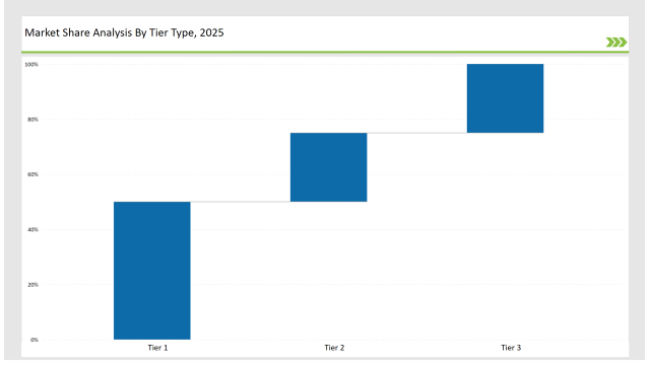

The small satellite market remains moderately consolidated, with top firms controlling 60% to 70% of the market. Leading players like SpaceX, Lockheed Martin, and Northrop Grumman set pricing and technology standards, creating high entry barriers for new competitors.

The small satellite industry includes minisatellites, microsatellites, cubesats, picosatellites, and femtosatellites.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Key Trends Shaping the Future of the Small Satellite Market

AI Drives Satellite Operations, Enhancing Data Processing and Autonomy

Companies employ artificial intelligence, such as machine learning, to enable automatic data analysis, optimize satellite performance, and improve predictive maintenance. AI-powered algorithms mean that satellites can process valuable data in real-time, instead of relying so much on Earth-bound operations.

All these technologies improve mission efficiency across defense, climate monitoring, and disaster response sectors. AI-powered autonomous satellite constellations bring decreased operational costs with reduced human input, enhancing system reliability.

Mega-Constellations Accelerate Market Growth in Low Earth Orbit (LEO)

SpaceX, Amazon’s Project Kuiper, and other satellite providers deploy mega-constellations to expand global broadband coverage, driving the demand for small satellites. These companies invest heavily in LEO networks, increasing the need for high-throughput, cost-efficient satellites.

They provide seamless global internet access, especially in remote and underserved regions, by launching thousands of interconnected satellites. Manufacturers rapidly produce small satellites with advanced communication technologies, lower latency, and higher bandwidth to support these networks. The increasing commercial viability of LEO mega-constellations attracts significant investments from private and government sectors, further accelerating market expansion.

Public-Private Partnerships Boost Space Commercialization

Governments and space agencies are partnering with private companies to develop cost-effective small satellite solutions. NASA, the ESA, and the ISRO engage in commercial cooperation to expand its space-based communications, weather forecast, remote sensing, and scientific research.

Such collaboration enables an agency to pool the expertise in the private sector on satellite building, launch service, and data analytics, making the whole program cheaper and moving at a greater pace. Collaboration also stimulates more technological advancements as well as gives birth to business opportunities in such a dynamic industry. With increased commercialization, small satellite companies become important in delivering critical services, making possible new business models, and integrating space technologies into everyday applications.

| Tier | Tier 1 |

|---|---|

| Vendors | SpaceX, Lockheed Martin, Northrop Grumman |

| Consolidated Market Share (%) | 50% |

| Tier | Tier 2 |

|---|---|

| Vendors | Planet Labs, Sierra Space, Rocket Lab |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | NanoAvionics, AAC Clyde Space, GomSpace, Tyvak |

| Consolidated Market Share (%) | 25% |

| Vendor | Key Focus |

|---|---|

| SpaceX | Expanding Starlink’s satellite constellation for global internet connectivity. |

| Lockheed Martin | Developing AI-powered imaging and secure communication satellites. |

| Northrop Grumman | Advancing satellite servicing and in-orbit sustainability solutions. |

The vendors are improving the AI algorithms for predictive satellite analytics, which enhance data processing and the making of decisions autonomously in satellites. The optimization of the satellite by integrating advanced models of machine learning contributes to the early detection of anomalies and executing corrective actions without human intervention.

Satellites can predict system failures, assess environmental conditions, and manage the energy consumption to further extend the operational lifespan. Besides, real-time decision-making capabilities can empower satellites to autonomously alter their orbits, perform on-demand imaging, and respond to emerging threats such as space debris or cybersecurity risks. As AI technology advances, operators rely less on ground stations to operate, thereby improving the efficiency of the entire mission, thus making autonomous satellite operations more reliable.

SpaceX, Lockheed Martin, and Northrop Grumman collectively hold 50% of the market.

Emerging players like Rocket Lab and Astroscale hold 15% of the market.

Niche providers such as AAC Clyde Space and GomSpace hold 10%.

The top 5 vendors control 75% of the market.

Low Earth Orbit (LEO) dominates with 75% market share due to the increasing deployment of mega-constellations.

Explore Telecommunication Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.