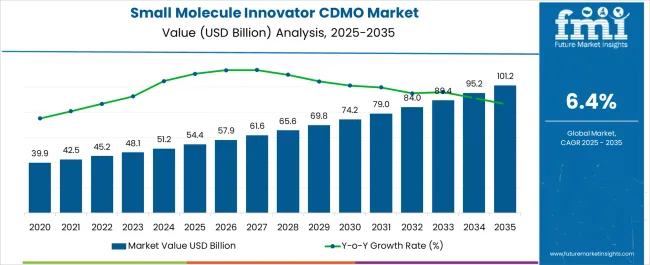

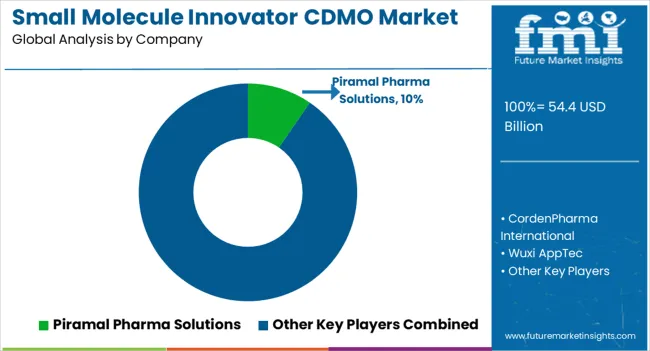

The Small Molecule Innovator CDMO Market is estimated to be valued at USD 54.4 billion in 2025 and is projected to reach USD 101.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Small Molecule Innovator CDMO Market Estimated Value in (2025 E) | USD 54.4 billion |

| Small Molecule Innovator CDMO Market Forecast Value in (2035 F) | USD 101.2 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The small molecule innovator CDMO market is expanding steadily as pharmaceutical and biotechnology companies increasingly rely on outsourcing to accelerate drug development and reduce operational costs. Rising complexity of active pharmaceutical ingredient synthesis, coupled with the growing demand for specialized expertise in formulation and regulatory compliance, has heightened the role of CDMOs in the value chain.

Strategic partnerships and long term contracts between drug developers and CDMOs are becoming more common, driven by the need for scalability and global supply reliability. Technological advancements in continuous manufacturing, green chemistry, and analytical development are further supporting growth in this market.

The outlook remains positive as innovators continue to focus on accelerating time to market, optimizing cost structures, and leveraging CDMO capabilities for both niche therapies and high volume production requirements.

The small molecule API product segment is projected to contribute 57.30% of total revenue by 2025 within the product category, making it the leading segment. Growth in this segment is being supported by rising demand for outsourced API development, the complexity of chemical synthesis, and the need for scalable production facilities.

CDMOs have been increasingly relied upon for cost efficiency, quality assurance, and regulatory compliance across multiple geographies.

Their ability to handle large scale production while meeting stringent safety standards has reinforced the dominance of this segment in the overall market.

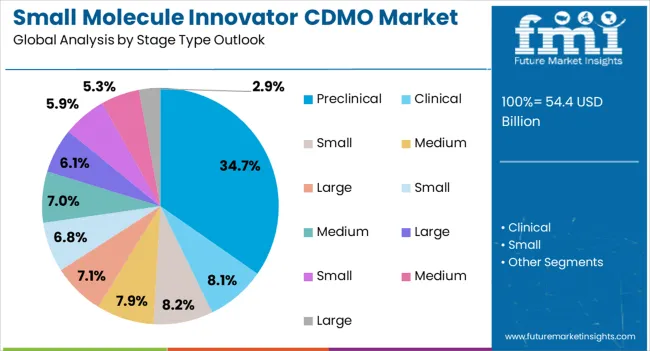

The preclinical stage type segment is expected to hold 34.70% of total revenue by 2025, establishing it as the most significant stage category. This dominance is being driven by growing investments in early drug discovery, rising demand for preclinical safety and efficacy data, and increased outsourcing of non core R&D functions by pharmaceutical companies.

CDMOs offering integrated services including preformulation, analytical method development, and toxicology support have gained preference.

The emphasis on faster progression from laboratory to clinical testing has further reinforced reliance on CDMOs at this stage.

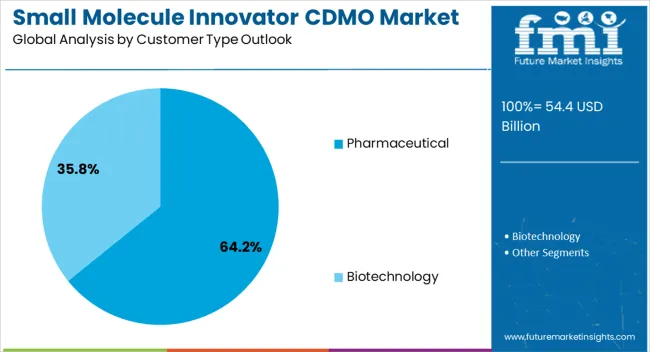

The pharmaceutical customer type segment is projected to account for 64.20% of the overall market revenue by 2025, positioning it as the leading customer category. This leadership is attributed to the increasing outsourcing strategies adopted by pharmaceutical companies seeking to optimize resources, expand global reach, and enhance operational efficiency.

CDMOs have been trusted partners for handling complex synthesis, ensuring regulatory compliance, and providing flexible capacity for both large volume and specialty drugs.

The strong presence of established pharmaceutical players in outsourcing partnerships has consolidated this segment’s dominance within the customer type category.

The Small Molecule Innovator CDMO market was valued at USD 54.4 billion in 2025, with a substantial growth trajectory of 6.1%% between the analysis period of 2020 to 2025.

The small molecule innovator CDMO market is a growing segment of the pharmaceutical industry that provides contract services for developing and manufacturing small molecule drugs. The market is driven by increasing demand for small-molecule drugs, rising R&D costs, and the need for specialized expertise in drug development and manufacturing.

Future Market Insights expects the small molecule innovator CDMO market to grow at a CAGR of 6.4% from 2025 to 2035. The growth can be attributed to the following reasons

The market is driven by increasing demand for small-molecule drugs, which effectively treat various diseases and disorders. The trend of outsourcing drug development and manufacturing is also driving the market as companies look to reduce costs and gain access to specialized expertise. Additionally, the need for innovative and efficient drug development and manufacturing processes is driving the market.

Overall, the small molecule innovator CDMO market is poised for continued growth, driven by increasing demand for small molecule drugs and the outsourcing of drug development and manufacturing. Companies in this space have to need to stay abreast of new technologies and regulatory requirements to remain competitive in the market.

Considering the factors mentioned above, FMI opines the small molecule innovator CDMO market is more likely to witness a market value of USD 101.2 billion by the end of 2035.

The market is divided into three stages: preclinical, clinical, and commercial. A large number of small-molecule drugs are in the clinical stage. Aside from that, drug research and development spending is constantly increasing. For example, according to World Preview, total research and development spending on drugs accounted for USD 54.4.0 billion in 2025, and total R&D spending on drugs is expected to reach USD 69.8.0 billion by 2029. The increase in R&D spending is expected to boost clinical segment growth.

The rapid advancement of biopharmaceutical research and technology creates new opportunities for developing innovative and creative small-molecule drugs. Advances in prediction, structure-based design, and imaging, as well as automation, artificial intelligence, and machine learning, have all become major enablers for small molecule-led optimization to speed up and improve success rates in recent years.

The market is divided into therapeutic areas such as cardiovascular diseases, oncology, respiratory disorders, neurology, metabolic disorders, infectious diseases, and others. Other factors driving segment growth include an increase in cancer cases worldwide, significant government reimbursement policies, and an increase in funding for the development of small-molecule oncology therapies.

North America is a significant contributor to the growth of the Contract Development & Manufacturing Organization (CDMO) industry for small molecule API innovators.

North America is one of the significant markets for small molecule innovator CDMOs, accounting for a significant share of the global market. The region is home to many large pharmaceutical companies and has a well-established healthcare infrastructure, which drives demand for small-molecule drugs. Additionally, the trend of outsourcing drug development and manufacturing is also driving the market in the region.

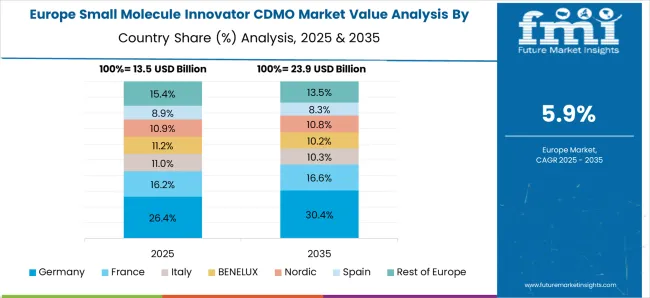

Europe is another potential market for small molecule innovator CDMOs, with a well-established pharmaceutical industry and a strong focus on research and development. The region is also home to many contract manufacturing organizations (CMOs) that provide small molecule innovator CDMO services.

Technological advancements, low service costs, and the availability of skilled labor are expected to drive regional market growth.

Asia Pacific region is expected to be the highly progressive market for small molecule innovator CDMOs, driven by increasing demand for small molecule drugs and a growing pharmaceutical industry. The region is home to many contract manufacturing organizations, particularly in countries such as India and China, which offer cost-effective services.

Latin America is a growing market for small molecule innovator CDMOs, driven by increasing demand for affordable healthcare and rising investment in the pharmaceutical industry. Brazil and Mexico are the potential markets in the region.

The Middle East and Africa region is a relatively small market for small molecule innovator CDMOs. However, the region is experiencing significant growth in the pharmaceutical industry, driven by rising demand for affordable healthcare and increasing investment in healthcare infrastructure.

The small molecule innovator CDMO market is highly competitive, with several key players dominating the market. The market is characterized by a few large players and many smaller players, with some companies offering a full suite of services while others focus on a specific aspect of drug development or manufacturing. Here is an overview of the competitive landscape in the market:

Other key players in the market include WuXi AppTec Co., Ltd., Piramal Pharma Solutions, Jubilant Life Sciences Ltd., Recipharm AB, and Sterling Pharma Solutions.

Overall, the small molecule innovator CDMO market is highly competitive, with several large players dominating the market. These companies offer a wide range of services and operate globally, serving both pharmaceutical and biotech companies. The market is also characterized by many smaller players, particularly in the Asia-Pacific region, which offer cost-effective services. Companies in the space will need to navigate intense competition, changing customer demands, and evolving regulatory requirements to remain competitive.

Recent Developments

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.4% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends and Pricing Analysis |

| Key Segments Covered | By Therapeutic Area, By Product, By Stage Type, By Customer Type, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Piramal Pharma Solutions; CordenPharma International; Wuxi AppTec; Cambrex Corporation; Recipharm AB; Pantheon (Thermo Fisher Scientific); Lonza; Catalent Inc.; Siegfried Holding AG; Boehringer Ingelheim; Labcorp Drug Development |

| Customization & Pricing | Available upon Request |

The global small molecule innovator CDMO market is estimated to be valued at USD 54.4 billion in 2025.

The market size for the small molecule innovator CDMO market is projected to reach USD 101.2 billion by 2035.

The small molecule innovator CDMO market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in small molecule innovator CDMO market are small molecule api, _small molecule drug product, _oral solid dose, _semi-solid dose, _liquid dose and _others.

In terms of stage type outlook, preclinical segment to command 34.7% share in the small molecule innovator CDMO market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule CMO/CDMO Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Small Molecule API Market Analysis - Size, Share & Forecast 2025 to 2035

Small-Molecule Injectable Market Analysis - Trends, Growth & Forecast 2025 to 2035

RNA-Targeted Small Molecules Market – Trends & Forecast 2024-2034

Small Form Factor (SFF) Connectors Market Size and Share Forecast Outlook 2025 to 2035

Small Satellite Market Size and Share Forecast Outlook 2025 to 2035

Small Marine Engine Market Forecast Outlook 2025 to 2035

Small Gas Engine Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Metabolic Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Running Wheel System Market Size and Share Forecast Outlook 2025 to 2035

Small Caliber Ammunition Market Size and Share Forecast Outlook 2025 to 2035

Small Boats Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Small Animal Imaging (In Vivo) Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Network Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA