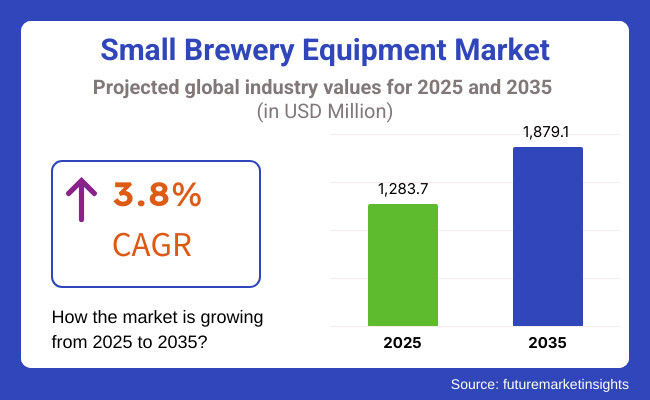

The small brewery equipment market is anticipated to be valued at USD 1,283.7 million in 2025. It is expected to grow at a CAGR of 3.8% during the forecast period and reach a value of USD 1,879.1 million in 2035.

Small brewery equipment is small-scaled machinery and systems for brewing, fermenting, and packaging within craft and microbreweries. Microbreweries, brewpubs, and independent craft breweries have turned them into quite essential equipment for turning out unique high-quality beers in demand as a consequence of the increasing popularity of artisanal and locally brewed beverages.

The small brewery equipment market includes brewing systems designed for craft and microbreweries to produce beer on a smaller scale. Market growth is driven by rising consumer demand for craft beer, increasing microbrewery establishments, technological advancements in brewing automation, and a growing preference for unique, locally brewed beverages worldwide.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual growth as a result of expanding craft beer culture and growing number of microbreweries. | Faster-than-ever technological growth and automation will further spur the market. |

| Semi-automated brewing practices with traditional equipment. | Artificial intelligence-driven brewing operations, IoT-integrated monitoring, and automated quality monitoring. |

| Transition towards energy-efficient equipment and water recycling systems. | Universal uptake of carbon-free brewing systems, renewable energy-fueled configurations, and zero-waste brewing techniques. |

| Manual control systems with stainless steel tanks and simple temperature control. | Self-regulating temperature control-enabled intelligent brewing tanks, sophisticated filtration equipment, and ingredient dosing enabled by automation. |

| Increased demand for individualized brewing installations to support one-of-a-kind craft beer products. | Greater emphasis on sustainable brewing, with demand for organic inputs and AI-powered recipe development. |

| Increased sales through online platforms and direct-to-manufacturer purchases. | Artificial intelligence-based supply chain optimization, predictive maintenance, and blockchain-based ingredient traceability. |

| Strict license requirements and food safety and alcohol compliance. | More efficient regulatory systems favoring small brewers with incentives for sustainability efforts. |

| High upfront capital costs, complicated licensing processes, and low scalability. | Overcoming the cost of automation, data security in AI-based brewing, and keeping up with changing consumer trends. |

Automated and Smart Brewing Systems

Consumers are embracing small brewery equipment that integrates automation and smart technology for precision brewing. Craft brewers now prefer systems with AI-driven fermentation monitoring, remote-controlled temperature adjustments, and automated ingredient dosing to ensure consistency in flavor and quality.

These innovations reduce manual effort, allowing small-scale brewers to experiment with new recipes while maintaining efficiency. As demand for craft beer grows, people expect brewing equipment that combines convenience with high-tech customization.

Sustainable and Waste-Reducing Brewing Solutions

Consumers are prioritizing eco-friendly brewery equipment that minimizes waste and optimizes resource use. Manufacturers are developing systems that recycle water, repurpose spent grains for animal feed or baking, and use energy-efficient heating methods.

Small breweries now seek solutions that align with sustainability goals while maintaining cost-effectiveness. With increasing awareness of environmental impact, people demand brewing equipment that supports green brewing practices without compromising production quality.

The fermentation tanks segment plays a crucial role in small brewery operations, ensuring consistent beer quality and controlled fermentation. These tanks are designed to maintain ideal temperatures and pressure, allowing brewers to achieve precise flavor profiles. Stainless steel tanks are widely preferred for their durability, hygiene, and resistance to contamination.

Modern fermentation tanks come equipped with advanced monitoring systems, enabling brewers to track pH levels, temperature, and yeast activity. The demand for customized tank sizes is rising, allowing small breweries to scale production efficiently. As craft brewing gains popularity, investments in high-quality fermentation tanks continue to grow.

As per FMI research, the residential segment in the small brewery equipment market is expanding due to the growing trend of home brewing. Enthusiasts seek compact, user-friendly brewing systems to create custom craft beers at home. Small-scale equipment, including mini fermentation tanks and brewing kits, allows users to experiment with unique flavors and ingredients.

Homebrewing has gained popularity due to online tutorials, brewing communities, and DIY culture. Manufacturers are developing affordable and efficient brewing systems tailored for residential users. With increasing interest in personalized brewing experiences, the demand for small-scale residential brewing equipment continues to rise.

The microbreweries segment drives demand for small brewery equipment, as independent brewers focus on crafting high-quality, small-batch beers. Equipment such as fermentation tanks, kettles, and filtration systems helps microbreweries maintain flavor consistency and production efficiency. These breweries cater to local markets and niche audiences, emphasizing unique brewing techniques.

The rise of brewpubs and taprooms has fueled investments in versatile and scalable brewing systems. Microbreweries require efficient and space-saving equipment to optimize limited production areas. With consumers increasingly seeking artisanal and locally brewed beers, microbreweries are continuously upgrading their brewing infrastructure to meet market demand.

UK A Flourishing Industry with Expanding Opportunities in Brewing

The UK is experiencing significant growth, driven by the increasing number of microbreweries and the rising popularity of craft beer. The UK's rich brewing heritage and consumer demand for unique, high-quality brews have led to a surge in small-scale breweries. This trend is further supported by favorable government policies and initiatives that encourage local brewing enterprises.

Manufacturers in the UK are focusing on producing advanced brewing equipment tailored to the needs of small breweries. Innovations in brewing technology, such as energy-efficient systems and automation, are enabling brewers to enhance production efficiency and maintain consistent quality. The market is also benefiting from the growing trend of home brewing, with enthusiasts seeking professional-grade equipment to replicate commercial brewing processes.

The USA Dominant Region with Credibility in Brewing Industry

The USA continues to lead the market, bolstered by a robust craft beer culture and a substantial number of small brewers. As of 2025, the USA is home to approximately 6,000 small breweries, a testament to the nation's thriving craft beer industry. This proliferation is driven by consumer demand for diverse and premium beer flavors, prompting an increase in microbreweries and brewpubs across the country.

American manufacturers are renowned for producing high-quality brewing equipment, contributing to the market's dominance. The emphasis on innovation has led to the development of advanced brewing systems that cater to the specific needs of small-scale brewers.

Features such as automation, compact designs, and energy efficiency are becoming standard, enabling brewers to optimize production and reduce operational costs. The reputation of USA equipment manufacturers continues to attract new entrants to the market, further solidifying the country's leading position.

China’s Rapid Expansion Amidst Growing Craft Beer Culture

China is undergoing rapid growth, fueled by the burgeoning craft beer scene and a rising number of microbreweries. Chinese consumers are increasingly exploring diverse beer flavors, moving away from traditional mass-produced options. This shift in consumer preference has led to a surge in demand for small brewing equipment, as entrepreneurs establish new breweries to cater to this evolving taste.

Local equipment manufacturers are capitalizing on this trend by offering cost-effective and technologically advanced brewing solutions. The focus is on developing equipment that meets international standards while being accessible to small and medium-sized enterprises. Government support in the form of favorable policies and subsidies is also playing a crucial role in nurturing the craft beer industry, thereby boosting the small brewing equipment market.

India is Emerging Opportunities in a Nascent Industry

India is in its early stages but shows promising potential due to the growing interest in craft beer among urban consumers. The increasing number of brewpubs and microbreweries in metropolitan areas reflects a shift towards premium and diverse beer offerings. This trend is creating a demand for specialized brewing equipment tailored to small-scale operations.

Indian manufacturers and international players are recognizing this opportunity, leading to collaborations and the introduction of advanced brewing technologies in the market. Challenges such as high import duties and regulatory hurdles are being addressed through policy reforms and local production initiatives. As the craft beer culture gains momentum, the small brewing equipment market in India is poised for substantial growth between 2025 and 2035.

Germany Balancing Heritage and Modernization in Brewing Equipment

Germany, with its deep-rooted beer culture and adherence to quality, presents a mature yet evolving market for small brewing equipment. The country's Reinheitsgebot (Beer Purity Law) has long dictated brewing practices, emphasizing traditional methods. However, there is a growing trend of craft breweries experimenting within these guidelines to offer unique flavors, leading to a demand for specialized brewing equipment.

German equipment manufacturers are renowned for their precision engineering and quality. The market is characterized by a blend of tradition and innovation, with brewers seeking equipment that allows for experimentation while maintaining compliance with established brewing standards.

The export of German-made brewing equipment is also significant, as international brewers look to incorporate German engineering into their operations. Between 2025 and 2035, the German small brewing equipment market is expected to maintain steady growth, driven by both domestic demand and international partnerships.

The small brewery equipment industry is fragmented, with numerous manufacturers competing on customization, automation, and cost-efficiency.

Leading suppliers design advanced brewing systems with precision controls and modular configurations. Their ability to provide high-quality fermenters, kettles, and filtration units ensures strong demand from craft breweries and microbreweries, reinforcing their presence in both local and international brewing markets.

These manufacturers invest in research to enhance energy efficiency, brewing consistency, and space optimization. By integrating automation and digital monitoring systems, they differentiate their products. While established brands cater to large-scale craft brewers, smaller firms focus on affordable, customizable solutions that appeal to independent brewers and startup businesses.

Pricing and distribution strategies vary widely, with global players leveraging economies of scale, while niche manufacturers emphasize personalized service and flexible equipment designs. Established companies secure contracts with major breweries, while smaller firms rely on direct sales and local distributors to reach emerging brewers.

The competitive landscape remains diverse, with continuous innovation in compact and energy-efficient brewing systems. Top-tier firms expand through technological advancements and turnkey solutions, while new entrants introduce budget-friendly alternatives. This balance between established industry leaders and independent suppliers keeps the market dynamic, offering opportunities for both premium and cost-conscious brewery equipment buyers.

The small brewery equipment market is experiencing significant growth, driven by the rising popularity of craft beer and the increasing number of microbreweries worldwide. Manufacturers are focusing on developing compact, efficient, and cost-effective brewing systems tailored to small-scale operations. This trend is particularly prominent in regions with a burgeoning craft beer culture.

Technological advancements, such as automation and IoT integration, are transforming small brewery operations. Automated brewing equipment enhances consistency, reduces manual labor, and improves overall efficiency, making it an attractive investment for small breweries aiming to scale their production while maintaining quality.

Sustainability is becoming a key focus, with breweries adopting eco-friendly equipment to minimize environmental impact. Energy-efficient brewing systems and waste-reduction technologies are gaining traction, aligning with the global shift towards sustainable manufacturing practices. This approach not only appeals to environmentally conscious consumers but also helps in reducing operational costs.

The competitive landscape is marked by collaborations between equipment manufacturers and breweries to develop customized solutions. Tailored equipment designs that meet specific brewing requirements provide a competitive edge, fostering innovation and enhancing product offerings in the market. This collaborative approach ensures that the unique needs of small breweries are met effectively.

Recent Development

In October 2024, Sussex-based Hepworth Brewery is the first in the UK to trial Futraheat’s innovative heat pump, which recycles waste vapor into 130°C steam. This groundbreaking technology can cut carbon emissions by up to 90%, reinforcing the brewery’s commitment to sustainability and energy-efficient brewing practices.

The small brewery equipment market is expected to be valued at USD 1,283.7 million in 2025 and reach USD 1,879.1 million by 2035, growing at a CAGR of 3.8%.

The future prospects of small brewery equipment sales are promising, driven by rising craft beer demand, automation, and sustainability trends.

Key manufacturers in the small brewery equipment market include Krones, Criveller, Ss Brewtech, GEA, Newlands System, and DME Brewing Solutions.

North America, Europe, and China are expected to generate lucrative opportunities due to the growing craft beer culture and technological advancements.

The market is segmented by equipment type into fermentation tanks, bright beer tanks, brewhouses, and kettles.

Based on the application, the market is segmented into residential, commercial, and industrial.

The market are categories based on end-user, including microbreweries and nanobreweries.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.