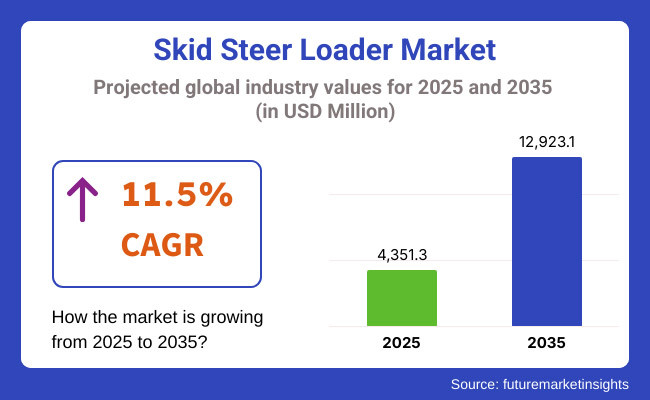

The Skid Steer Loader Market is projected to witness substantial expansion between 2025 and 2035, driven by the increasing demand for compact and versatile construction equipment across various industries, including infrastructure development, agriculture, and landscaping. The market is estimated to be USD 4,351.3 million in 2025 and is anticipated to reach USD 12,923.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 11.5% during the forecast period.

One of the major drivers influencing market growth is the rapid expansion of urbanization and smart city projects, particularly in emerging economies. Governments and private players are investing heavily in infrastructure modernization, road construction, and commercial projects, increasing the demand for multi-functional, maneuverable, and fuel-efficient skid steer loaders. Additionally, the rising preference for rental equipment due to cost-effectiveness and reduced maintenance liabilities is further accelerating market growth.

Medium Frame Skid Steer Loaders belong to the Size categories and this type has the highest market share because they are versatile and can balance power and maneuverability while still being able to adapt to several applications.

Available in 25 different models, the loaders are primarily used in construction, agriculture and industrial work, with higher lifting capacities than small-frame loaders but lower fuel usage than large-frame models. Their capability to accommodate attachments like trenchers, augers, and grapples makes them most favored for urban and suburban construction operations.

The highest market share in the Ownership Type category is controlled by Rental Companies owing to the trend of increasing leasing of equipment used in construction and industrial processes. Small- and medium-sized contractors opt for leasing instead of buying because of expensive initial outlays, maintenance requirements, and varied project requirements.

Rental companies are increasing their fleet with next-generation and fuel-saving skid steer loaders and becoming the end-use industry favorites. The growing requirement for economical and adaptable solutions is also fueling expansion in this segment.

Due to the strong construction, farming, and lawn maintenance industries in the United States and Canada, skid steer loaders are a high-value market for North America. Skid steer loaders are also widely used for excavation, materials handling, and surface preparation in the country's mature infrastructure sector. Urbanization and smart city project also further augment demand for mini construction equipment.

Moreover, stringent environmental regulations in North America are prompting manufacturers to develop low-emission, high fuel efficient electric, and hybrid skid steer load handlers. Rise in rental equipment services such as skid steer loaders is also expected to support the growth of the market by offering skid steer loaders at low cost to small and medium-sized contractors especially in the United States.

Europe has the largest market share of skid steer loader market, due to high demand of these machines in countries like Germany, France and UK The development of sustainable and emission-limiting practices around the globe has prompted the regional adoption of energy-efficient and low-emitting skid steer loaders. In Germany, construction and agriculture Markets are industries that utterly rely on compact equipment for process efficiency.

In parallel, France and Italy are more and more demanding skid steer loaders for urban renewal and road construction works. In Europe, tightening diesel engine emissions regulations are prompting the use of electric and hybrid skid steer loaders, and manufacturers are working on new battery technology and alternative fuel options.

The skid steer loader market is expected to witness the highest growth within the Asia-Pacific region, relatively, owing to high urbanization and infrastructural growth along with growing mechanization in the agriculture segment. Skid steer loaders are primarily consumed in China, India, Japan, and Australia, with China accounting for the highest production and sales of skid steer loaders. Growth of compact construction equipment in India is driven by various government initiatives towards smart cities and rural infrastructure development.

Furthermore, growing use of skid steer loaders in mining and waste management industries in Australians states as well as Southeast Asia further assists market expansion. However, the major issues in some developing societies remain the higher capital up-front cost of advanced intelligent skid steer loaders and the lack of widespread infrastructure for electrification.

Challenge: High Cost of Advanced Equipment

The high cost on advanced and electric skid steer loaders is one of the key challenge in the skid steer loader market. The adoption of skid steer loaders is lower among small-sized contractors and companies, as the initial cost of skid steer loaders is going up with the incorporation of emerging technologies such as telematics, automation, and battery-electric technology. In addition, the costs of replacement parts and maintenance of highly advanced skid steer loaders can too high to be borne by end users and, thus, can lower the levels of market adoption.

Opportunity: Expansion of Electrification and Smart Technologies

The shift toward electrification and smart construction equipment presents a significant opportunity for the skid steer loader market. Companies are actively investing in electric skid steer loaders to comply with stringent emission norms and meet sustainability goals.

Advancements in battery technology, fast-charging infrastructure, and telematics integration are making skid steer loaders more efficient and cost-effective in the long run. The increasing adoption of automation, GPS tracking, and remote monitoring solutions further enhances operational efficiency and reduces downtime, creating growth opportunities for market players.

Between 2020 and 2024, the skid steer loader market witnessed steady growth driven by increasing construction activities, infrastructure development, and the expanding adoption of compact construction equipment. The demand for versatile and high-maneuverability loaders surged, particularly in urban construction, agriculture, and landscaping applications. The growing focus on mechanized farming and small-scale excavation projects further fueled market expansion.

Between 2025 and 2035, the skid steer loader market is poised for a transformative shift, driven by automation, electrification, and AI-integrated operations. The adoption of autonomous skid steer loaders equipped with AI-powered navigation, obstacle detection, and self-learning control algorithms will redefine efficiency in construction and agriculture. The shift toward zero-emission machinery will accelerate, with manufacturers investing in hydrogen fuel cell-powered loaders and next-generation solid-state battery technologies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter emission regulations, safety standards for construction equipment, and environmental impact policies. |

| Technological Advancements | Telematics, GPS tracking, electric skid steer loaders, and enhanced hydraulic systems. |

| Industry Applications | Construction, agriculture, landscaping, and material handling. |

| Adoption of Smart Equipment | Remote monitoring, GPS-based navigation, and telematics integration. |

| Sustainability & Cost Efficiency | Hybrid and electric skid steer loaders, fuel-efficient engine designs, and noise reduction technologies. |

| Data Analytics & Predictive Modeling | IoT-enabled diagnostics, predictive maintenance alerts, and real-time performance tracking. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased demand for lightweight components, and production delays. |

| Market Growth Drivers | Growth driven by urbanization, construction industry expansion, and mechanized farming adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring, hydrogen-powered loader regulations, and block chain-based sustainability tracking. |

| Technological Advancements | AI-powered autonomous loaders, real-time terrain adaptation, and solid-state battery technology. |

| Industry Applications | Expansion into AI-integrated smart city infrastructure, precision farming, and autonomous site preparation. |

| Adoption of Smart Equipment | Fully autonomous loaders, AI-assisted load balancing, and cloud-based fleet management. |

| Sustainability & Cost Efficiency | Hydrogen fuel cell-powered loaders, biodegradable hydraulic fluids, and AI-optimized energy efficiency. |

| Data Analytics & Predictive Modeling | Quantum-enhanced fleet analytics, decentralized AI-driven loader management, and blockchain-secured equipment usage records. |

| Production & Supply Chain Dynamics | AI-optimized component manufacturing, 3D-printed loader parts, and blockchain-based quality assurance. |

| Market Growth Drivers | AI-powered autonomous operations, zero-emission loader innovations, and expansion into next-gen smart infrastructure projects. |

The importance of debris-removal equipment is depending upon the type of task applied, with a new role of boosting interest of construction and storage of the USA skid steer loader market. The growing demand for versatile and high-performance loaders in landscaping, agriculture, and material handling applications is also fueling market growth. Furthermore, the rapid adoption of electric and hybrid skid steer loaders is still a growing trend to meet the demand for sustainable and low-emission construction equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

The United Kingdom skid steer loader market is progressing due to increasing urbanization, rising initiatives roadworks, and the rising acceptance of compact machines for work in cramped places. The agricultural & landscaping industries, where skid steer loaders are used for hauling and excavating, are also contributing to growth in the market. Also, government campaigns for building machines with low emissions are prompting producers to develop electric and hybrid machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.1% |

Growing demand for skid steer loaders in residential and commercial building, agriculture, and road building projects is driving the EU market. Germany, France and Italy are the frontrunners in this trend thanks to the strength of their infrastructure spending and their advanced construction equipment. Strict EU emission standards are also encouraging the use of electric and low emission skid steer loaders. Improvements in automation and telematics are also augmenting machine efficiency and uptake.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.7% |

Also, the Japanese market skid steer loaders is growing is due to the high emphasis on smart construction technology, increasing investment in public infrastructure projects, and the need for smaller equipment with the growth of urban development.

In addition, it is reaping the benefits from the increasing usage of automated and remotely controlled skid steer loaders, which has been enhancing operation nominal efficiency in space-constricted work environments. Energy-efficient and electric skid steer loaders are also being developed in response to Japan's renewed focus on sustainable building practices, driving demand for skid steer loaders.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.4% |

High-speed industrialization, increasing smart city projects, and the adoption of advanced construction machines are driving the growth of the South Korean skid steer loader market. Growing investments in the modernization of infrastructure such as roads, bridges and commercial structures are also contributing to the market. Moreover, the demand for electric and hybrid skid steer loaders is driven by government-sponsored initiatives for low-emission equipment and advancements in automation and operator-aid features.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.6% |

Rental companies have become one of the fastest-growing segments in the skid steer loader market, giving customers the ability to get access to flexible equipment at a reasonable price without the cost of ownership. In terms of direct equipment purchases, rental solutions allow companies to scale their operations up or down based on project requirements, an attractive proposition for small and mid-sized companies that need short-term equipment solutions.

Skid Steer Loaders: Increasing demand for short-term road work, road maintenance, and farm projects drives growth in rental market, as companies choose financial flexibility rather than heavy capital expenditures.

A broad selection of skid steer loaders that include state-of-the-art attachments, advanced telematics systems and fuel-saving technology have offered enhanced productivity for a variety of applications, enabling the expansion of rental fleets has brought down market demand.

The emergence of digital rental platforms with AI-based optimized equipment matching, block chain-backed smart contract systems, and remote diagnostics for tracking equipment health has also been a contributor to increased adoption, providing seamless rental experiences and reduced downtime for customers. Skid steer rental company collaboration with constructions companies, farming enterprises, local authorities is fettering to market extension, maneuverability with a view to a variety of applications has led to enhance your access towards the necessary skid steer loader.

Emergence of environmentally-measurement rental operations; hybrid and electric skid steer loaders; carbon footprint monitoring; and reconditioned equipment with a circular economy approach have established market growth aligned with green construction and sustainability policies. Despite its advantages, such as fiscal flexibility, project/statistical availability, and low maintenance costs, the rental marketplace comes with concerns in terms of high equipment turnover, wear and tear management, and rental pricing which can vary with market conditions.

However, advancements in predictive maintenance, AI-based rental price optimization, and block chain-secured usage tracking are improving efficiency, reliability, and cost-effectiveness, advancing continued growth for skid steer loader rental services across the world.

Construction firms have achieved robust market acceptance, especially among infrastructure developers, commercial construction firms, and residential builders, as they increasingly invest in skid steer loaders for earthmoving, demolition, and material handling operations. In contrast to conventional heavy equipment, skid steer loaders offer superior maneuverability in confined areas, making them a must-have in urban construction and renovation activities.

The growing need for high-performance skid steer loaders, with more powerful load capacities, more sophisticated control systems, and multifunctional attachments, has driven market growth, as construction companies look for compact but powerful solutions for various site operations.

Growth in fleet ownership by construction organizations, with highly technologically enhanced skid steer loaders equipped with telematics, GPS positioning, and self-control systems, has enhanced market demand, delivering higher efficiency and safety in operations. The merging of AI-assisted equipment optimization, with real-time performance tracking, predictive component failure detection, and automated load balancing, further accelerated adoption, ensuring maximum productivity and minimum downtime.

The evolution of construction industry alliances, with the inclusion of skid steer loader manufacturers, engineering companies, and government infrastructure projects, has maximized market growth, guaranteeing greater use of advanced construction equipment. The use of green construction practices, with the inclusion of electric skid steer loaders, biofuel compatibility, and noise-reduction technology, has strengthened market growth, guaranteeing compliance with regulatory requirements and green building programs.

In spite of its operational efficiency, site flexibility, and increased productivity, the construction companies segment is challenged by high initial investment expenses, skilled operator scarcity, and varying project requirements. Nevertheless, new technologies in autonomous skid steer loader design, AI-driven job site surveillance, and hybrid powertrain research are enhancing cost-effectiveness, labor efficiency, and environmental friendliness, ensuring ongoing growth for skid steer loader use in construction sectors globally.

Since large frame skid steer loaders provide users with larger lifting capacity, better stability, and higher efficiency at tough work conditions, they are widely adopted by construction companies, material handling operators, and infrastructure construction projects. Large frame skid steers are equipped with increased horsepower and more attachment compatibility than small and medium class loaders, making them ideal for high intensity digging, stick blowing jobs and site grading.

The growing demand for high capacity skid steer loaders, along with turbocharged engines, high-flow hydraulic capabilities, and precise joystick operation, has led to the uptake of the market, as industries keeping their eye on productivity and operational efficiency. Expansion in technologically advanced skid steer loaders, supported with AI-based performance optimization, real-time load sensing, and automated job site tracking, has fortified market demand with assured worksite productivity and equipment durability.

The adoption of telematics-based fleet management, including GPS location tracking, remote fault detection, and AI-induced maintenance notification, has also added to the adoption, ensuring smooth monitoring of equipment and reduced downtime.

The strategic alliances have further evolved leading to collaboration between construction firms, rental suppliers and equipment manufacturers thus have optimally served the market by providing improved access to advanced large frame skid steer loaders for industrial use. Additionally, cooperative efforts to implement eco-friendly machinery solutions such as hybrid engine models, alternative fuel support, and emission-reducing technology have bolstered market growth, owing to the need to meet strict environmental regulations and corporate sustainability objectives.

While these features make the large frame skid steer loader market powerful, load bearing, and operationally flexible, their high acquisition prices, higher fuel efficiency, and maintenance challenges keep them from being widely adopted. Innovations which are changing electric powered loaders, AI Technology-based efficiency enhancement, and modular adapters are creating economic savings, performance increase, and therefore favorably large-frame skid loader in the commercial sectors globally.

The Skid Steer Loader Market is experiencing significant growth due to rising demand in construction, agriculture, and material handling applications. Skid steer loaders are compact, highly versatile machines used for tasks ranging from excavation to road maintenance.

The increasing emphasis on infrastructure development, coupled with advancements in skid steer loader technologies, such as enhanced hydraulic capabilities and automation, is driving market expansion. Leading manufacturers are focusing on product innovation, efficiency enhancement, and strategic partnerships to strengthen their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| CNH Industrial | 18-22% |

| Doosan Corporation | 14-18% |

| Takeuchi Construction Machinery | 10-14% |

| Kato Works Co. Ltd. | 8-12% |

| Hyundai Heavy Industries Co. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| CNH Industrial | Develops advanced skid steer loaders with high efficiency and durability, focusing on automation and fuel efficiency. |

| Doosan Corporation | Manufactures robust skid steer loaders with enhanced lifting capabilities and operator comfort features. |

| Takeuchi Construction Machinery | Specializes in compact skid steer loaders, integrating advanced hydraulic systems for superior maneuverability. |

| Kato Works Co. Ltd. | Produces versatile and cost-efficient skid steer loaders tailored for urban and heavy-duty applications. |

| Hyundai Heavy Industries Co. | Focuses on innovative skid steer loader designs with improved fuel economy and safety features. |

Key Company Insights

CNH Industrial (18-22%)

As a leader in the market, CNH Industrial is leading the pack in innovation when it comes to skid steer loaders. CNH incorporates smart technology and automation to drive efficiency in operations. Ongoing investments in R&D have allowed the company to roll out tougher and more fuel-efficient models that align with changing needs of construction and farming industries.

Doosan Corporation (14-18%)

Doosan Corporation is a key player, known for manufacturing high-performance skid steer loaders with superior lifting capacities. The company has been actively expanding its global footprint through acquisitions and partnerships, improving its market presence and technological capabilities.

Takeuchi Construction Machinery (10-14%)

Takeuchi specializes in compact and maneuverable skid steer loaders, making them ideal for confined construction sites. Its focus on developing eco-friendly and energy-efficient models has positioned the company as a strong competitor in the market.

Kato Works Co. Ltd. (8-12%)

Kato Works is renowned for producing versatile and cost-effective skid steer loaders. The company emphasizes customization and application-specific solutions, making its machines popular across diverse industries, from road construction to mining operations.

Hyundai Heavy Industries Co. (6-10%)

Hyundai Heavy Industries has made significant strides in developing fuel-efficient and technologically advanced skid steer loaders. Its emphasis on operator safety and ease of use has helped the company carve a niche in the market.

Other Key Players (30-40% Combined)

Several regional and emerging companies contribute to the competitive landscape, including:

The overall market size for skid steer loader market was USD 4,351.3 Million in 2025.

The skid steer loader market is expected to reach USD 12,923.1 Million in 2035.

The increasing demand for compact and versatile construction equipment across various industries, including infrastructure development, agriculture, and landscaping fuels Skid steer loader Market during the forecast period.

The top 5 countries which drives the development of Skid steer loader Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of ownership, rental companies to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Ownership, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Lift Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Lift Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Size, 2023 to 2033

Figure 22: Global Market Attractiveness by Ownership, 2023 to 2033

Figure 23: Global Market Attractiveness by Lift Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Size, 2023 to 2033

Figure 46: North America Market Attractiveness by Ownership, 2023 to 2033

Figure 47: North America Market Attractiveness by Lift Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Ownership, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Lift Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Ownership, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Lift Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Ownership, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Lift Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Ownership, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Lift Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Ownership, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Lift Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Lift Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Ownership, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Lift Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Lift Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Lift Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Lift Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Ownership, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Lift Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-skid Films Market

Industrial Skid System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Skid Plate Market

Industrial RO Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coolant Filtration Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steerable Needle Market Size and Share Forecast Outlook 2025 to 2035

Steering Wheel Switches Market Size and Share Forecast Outlook 2025 to 2035

Steering Column Control Module Market Growth – Trends & Forecast 2025 to 2035

Steering Stabilizers Market Growth – Trends & Forecast 2025 to 2035

Steering Column Locks Market Growth - Trends & Forecast 2025 to 2035

Steering Tie Rod Market Growth – Trends & Forecast 2024-2034

Steering Gear Market

Steering Wheel Armature Market

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Power Steering Filter Market Growth - Trends & Forecast 2025 to 2035

Power Steering Fluids Market

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Rotary Steerable System Market

Heated Steering Wheel Market

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA