The single-use gastroscopes market is valued at USD 252.4 million in 2025. As per FMI's analysis, the Single-use Gastroscopes Industry will grow at a CAGR of 15.6% and reach USD 966.7 million by 2035. In 2024, the industry witnessed significant momentum due to increased adoption of single-use medical devices driven by infection control protocols in hospitals and ambulatory surgical centres.

Hospitals in North America and Europe particularly accelerated the shift from reusable to single-use gastroscopes, following a series of clinical reports highlighting contamination risks associated with traditional endoscopes. Furthermore, regulatory bodies such as the FDA and EMA issued stronger guidelines for reusable endoscope hygiene, indirectly boosting the credibility and demand for single-use alternatives.

Key industry players expanded production capacities in 2024, with new product launches offering improved flexibility, imaging, and affordability. Partnerships between OEMs and healthcare providers further supported adoption through bundled service models. Additionally, rising endoscopy volumes due to an aging population and increased gastrointestinal disorder diagnoses created stronger pull for efficient, low-risk solutions.

Looking ahead to 2025 and beyond, the industry is expected to benefit from continuous innovation, cost optimization, and expanding usage in emerging economies. Technological advancements and favourable reimbursement policies are likely to further accelerate global penetration of single-use gastroscopes.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 252.4 million |

| Industry Value (2035F) | USD 966.7 million |

| CAGR (2025 to 2035) | 15.6% |

The Single-use GastroscopesIndustry is on a strong growth trajectory, driven by rising demand for infection-free, disposable medical devices. Stricter hygiene regulations and growing endoscopy volumes are pushing hospitals and clinics to replace reusable scopes with safer, single-use alternatives. Medical device manufacturers and healthcare providers offering cost-effective, high-performance disposable solutions stand to gain the most, while traditional reusable scope providers may face declining demand.

Accelerate Innovation in Product DesignInvest in R&D to develop single-use gastroscopes with enhanced imaging, flexibility, and ergonomic features that match or exceed reusable alternatives.

Align Offerings with Regulatory and Hospital Hygiene PrioritiesAdapt product development and marketing strategies to highlight compliance with evolving infection control guidelines and hospital procurement priorities.

Expand Strategic Partnerships and Distribution ChannelsForm alliances with hospitals, ambulatory surgical centres, and OEM distributors to scale global reach, and explore M&A opportunities to strengthen technology and supply chain capabilities.

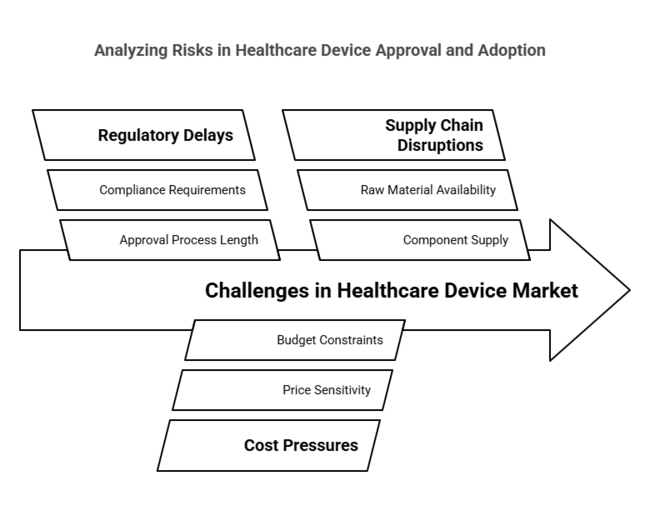

| Risk | Probability - Impact |

|---|---|

| Regulatory delays or pushback on single-use device approvals | Medium-High |

| Cost pressures limiting adoption in price-sensitive healt hcare industri es | High - Medium |

| Supply chain disruptions affecting raw materials or components | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Expand product perfor mance benchmarking | Run feasibility studies comparing single-use vs. reusable scope outcomes |

| Capture hospital procurement insights | Initiate OEM feedback loop on hygiene-driven purchasing trends |

| Strengthen industry access strategy | Launch after market channel partner incentive pilot |

To stay ahead, companies must increase investment on R&D and commercialization efforts focused on high-performance, cost-effective single-use gastroscopes that meet evolving clinical and regulatory standards. With infection control becoming a top priority for healthcare providers, this intelligence shifts the roadmap toward rapid innovation, tighter integration with hospital procurement needs, and expansion into underserved, high-growth industry such as Asia-Pacific and Latin America.

Strategic investments in localized manufacturing, agile supply chains, and bundled service offerings will differentiate leaders from laggards. Now is the time to pivot from legacy device strategies to scalable, disposable solutions that align with the future of minimally invasive care.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across device manufacturers, hospital procurement officers, endoscopy specialists, and regulatory consultants across the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

ROI Perspectives:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Clinicians/Technicians):

Alignment:

Divergence:

High Consensus:

Infection control, time efficiency, and cost management are globally recognized priorities.

Key Variances:

Strategic Insight:

| Country | Regulatory Impact & Certifications |

|---|---|

| USA | FDA 510(k) clearance required; rising focus on infection control after outbreaks. |

| UK | UKCA marking post- Brexit ; MHRA promoting disposables for NHS safety. |

| France | CE marking required; EU MDR compliance; single-use supported in high-risk settings. |

| Germany | CE marking; strict hygiene rules via RKI; eco-friendly disposal gaining attention. |

| Italy | CE certification; regional procurement delays; EU MDR compliance. |

| South Korea | MFDS regulates; KFDA approval needed; tech upgrades supported but no mandates. |

| Japan | PMDA oversees; Shonin approval required; cost sensitivity limits fast adoption. |

| China | NMPA certification; local firms growing under Made in China 2025; price-sensitive industry. |

| Australia-NZ | TGA (AU) and Medsafe (NZ) approvals needed; growing push for safe, sustainable options. |

The most lucrative segment by application from 2025 to 2035 is GERD, projected to grow at a CAGR of 16.3%, the highest among all application categories. Sales in the GERD segment are anticipated to grow due to the rising global incidence of acid reflux and related gastrointestinal disorders. Factors such as sedentary lifestyles, poor dietary habits, rising obesity rates, and increased awareness around digestive health are driving the demand for frequent endoscopic examinations. S

ingle-use gastroscopes are proving particularly valuable in GERD management due to their infection-free design, ease of use, and cost-efficiency for repeat diagnostics. Healthcare providers are also leaning towards disposable solutions to reduce reprocessing time and contamination risks, making GERD a high-demand, recurring-use scenario ideally suited for single-use devices.

Among end users, ambulatory surgical centres emerge as the most lucrative segment, expected to grow at a CAGR of 16.2% from 2025 to 2035. Sales in this segment are anticipated to grow rapidly due to the increasing trend of outpatient diagnostic and surgical procedures. ASCs are gaining popularity for their cost-effectiveness, efficiency, and shorter patient wait times compared to traditional hospitals.

These canters are highly inclined toward using single-use gastroscopes as they align with the need for fast turnover, simplified logistics, and minimal downtime. Additionally, ASCs typically deal with high patient volumes and require infection control to be top-notch, making single-use solutions ideal. The global shift towards decentralized care delivery and value-based healthcare further strengthens the growth outlook for ASCs in the single-use gastroscopesindustry.

United StatesThe sales in the USA is anticipated to grow at a CAGR of 16.2% from 2025 to 2035.The USA leads in early adoption of single-use medical devices due to strong infection control protocols and favourable reimbursement models. Following major endoscopy-related infection outbreaks, healthcare institutions are accelerating the transition to disposable solutions.

The FDA's 510(k) pathway has cleared multiple single-use gastroscopes, enabling faster industry entry. Large hospital networks and outpatient clinics are investing in these devices to reduce scope reprocessing costs and cross-contamination risks. Moreover, presence of key players and ongoing clinical trials focused on performance and cost-effectiveness continue to shape the competitive landscape, making the USA the largest and fastest-growing regional industry.

The industry in the UK is anticipated to grow at a CAGR of 15.1% from 2025 to 2035.The UK is emerging as a promising industry due to NHS-backed infection prevention efforts and post-Brexit regulatory clarity via UKCA marking. Hospitals are increasingly adopting single-use scopes to meet safety benchmarks and mitigate staffing challenges in scope reprocessing. Pilot programs in public hospitals have demonstrated improved workflow efficiency and reduced HAIs (hospital-acquired infections).

Despite budget constraints, demand is expected to grow steadily, especially with government funding directed toward innovation in patient safety technologies. Adoption is higher in tertiary care centres, and distributor partnerships with NHS procurement agencies are boosting accessibility in smaller hospitals and outpatient facilities.

France’s revenue in the single-use gastroscopes industry is anticipated to grow at a CAGR of 14.8% from 2025 to 2035. It is driven by national infection control mandates and EU MDR compliance. Public hospitals, which dominate the healthcare system, are cautiously shifting toward disposable scopes, especially for immunocompromised patients or emergency procedures.

Adoption is currently limited to high-risk departments due to cost considerations, but rising awareness about cross-contamination risks is fostering change. Several procurement frameworks now include single-use devices, and local players are beginning to explore sustainable material alternatives. Additionally, government focus on reducing healthcare-associated infections aligns with increased interest in disposable scopes, though centralized purchasing decisions can delay faster rollouts.

The sales in Germany is expected to increase at a CAGR of 15.3% during the period 2025 to 2035.Germany is experiencing significant growth, benefiting from its high standards in infection control and patient safety.The Robert Koch Institute has issued stronger hygiene guidelines, urging hospitals to reach for disposable scopes instead of reusable ones.

But many early adopters are the private hospitals and diagnostic canters, while cost is still a limiting factor in public healthcare. German manufacturers are actively engaged in developing CE-marked innovations focused on eco-friendliness. There is particularly high interest in ambulatory care and emergency departments, where turnaround time and safety is paramount. Regional healthcare clusters are trialing waste management solutions that solve environmental problems associated with disposables as well.

The industry in Italy is anticipated to grow at a CAGR of 14.5% from 2025 to 2035.Italy’s growth is somewhat restrained due to procurement complexity and a fragmented public health system. Nonetheless, infection prevention initiatives and EU-backed digital health investments are creating pathways for adoption of single-use gastroscopes. Southern regions, which face challenges in maintaining sterilization infrastructure, are more open to disposable solutions.

The private sector is also contributing to growth, particularly in high-volume diagnostic clinics. CE certification ensures streamlined access, but adoption is still gated by cost-sensitivity in government-run hospitals. Manufacturers targeting this industry need to focus on economic justifications and environmental packaging to appeal to both clinical and administrative decision-makers.

South Korea’s landscape of these gastroscopes is anticipated to grow at a CAGR of 16.5% from 2025 to 2035. The country is among the fastest-growing industries in Asia for single-use gastroscopes, driven by its high-tech healthcare infrastructure and rapid digital adoption. Major hospitals are investing in robotic and AI-enhanced endoscopy suites, with single-use scopes integrated into these systems for infection control.

Government incentives supporting smart hospital upgrades indirectly favour disposable scope adoption. Moreover, KFDA's streamlined approval process enables quicker industry entry for international brands.

South Korean consumers also value hygiene, and this cultural factor influences healthcare policy and procurement. Key private hospitals in Seoul are pioneering single-use implementation as part of broader strategies to reduce HAIs and improve workflow efficiency.

Sales in Japan is anticipated to grow at a CAGR of 13.7% from 2025 to 2035. The country’s growth is slower compared to its Asian peers, mainly due to cost-consciousness and the dominance of reusable scopes in local hospitals. While the PMDA has approved a few single-use gastroscopes, adoption is currently limited to specific high-risk use cases.

Older demographics and increasing endoscopy demand may push hospitals to adopt hybrid workflows using both reusable and disposable scopes. However, widespread adoption remains constrained by high per-unit costs and a cultural preference for durable equipment. Private sector-led innovation and education campaigns on infection risks may eventually shift sentiment, especially in urban areas. Pilot programs in large Tokyo hospitals are underway.

China’s revenue of the industry is anticipated to grow at a CAGR of 17.4% from 2025 to 2035. The country represents the most lucrative growth opportunity due to a large patient base, improving hospital infrastructure, and local manufacturing strength under the "Made in China 2025" initiative.

Major Tier 1 hospitals are testing single-use scopes to meet infection control standards, especially in gastroenterology units with high throughput. The NMPA has approved a growing list of local and international products, leading to increased competition and price drops.

Domestic firms are innovating with cost-effective, disposable designs to meet rural and urban needs. Government support for medical modernization and growing investor interest in medtech further accelerate this industry's growth trajectory.

Australia-New ZealandSales in Australia-NZ are anticipated to grow at a CAGR of 15.6% from 2025 to 2035.Australia and New Zealand are seeing balanced growth, backed by strong healthcare systems and infection control standards.

The Therapeutic Goods Administration (TGA) and Medsafe have approved several single-use gastroscopes, paving the way for broader clinical adoption. Public and private hospitals are adopting disposables to reduce sterilization bottlenecks and align with sustainability mandates.

Demand is especially strong in remote or regional clinics where reusable scope logistics are more challenging. There’s also an emerging preference for hybrid models-using reusable scopes in controlled settings and disposables in high-risk cases. Procurement is increasingly aligned with value-based healthcare, encouraging long-term investment in safe and efficient devices.

In 2024, the single-use gastroscopesindustry saw strong competition among top players like Boston Scientific, Olympus, PENTAX Medical, Fujifilm, and Ambu A/S, who focused on innovation, regulatory approvals, and product expansion. Boston Scientific acquired Apollo Endosurgery to boost its GI portfolio, while Olympus gained FDA approval for its EVIS X1 system and GIF-1100 scope.

PENTAX received CE certification for its i20c video endoscope series, enhancing imaging standards. Fujifilm India expanded its product line with ClutchCutter and FlushKnife, and Ambu A/S secured 510(k) clearance for its a Scope Gastro, entering the sterile single-use segment. These strategies reflect a strong push for safer, advanced endoscopic solutions.

Market Share Analysis

Boston Scientific Corporation

Estimated Share: ~22-26%Dominates with FDA-cleared single-use gastroscopes, emphasizing cost efficiency and hospital partnerships.

Ambu A/S

Estimated Share: ~18-22%Leads in pure-play disposable endoscopy, scaling production in 2024 to meet USA demand.

Olympus Corporation

Estimated Share: ~15-19%Shifts focus from reusable to single-use scopes, launching new models in Europe and Asia.

Medtronic

Estimated Share: ~10-14%Expands GI solutions with hospital trials for its single-use gastroscope in Q1 2024.

FUJIFILM Holdings Corporation

Estimated Share: ~8-12%Targets cost-sensitive industries with competitively priced disposable scopes in India and Latin America.

HOYA Corporation (PENTAX Medical)

Estimated Share: ~7-10%Invests in AI-integrated disposable scopes, focusing on outpatient clinics.

KARL STORZ SE & Co. KG

Estimated Share: ~5-8%Leverages legacy in endoscopy to enter the disposable industry with hybrid reusable/disposable designs.

OBP Medical Corporation

Estimated Share: ~3-6%Gains traction with compact, single-use gastroscopes featuring built-in LED illumination.

Cook Medical

Estimated Share: ~2-5%Focuses on niche applications, such as pediatric single-use gastroscopy.

the industry is segmented into GERD, chronic gastritis, gastric ulcers, barrett'sesophagus and others

the industry is divided into hospitals, ambulatory surgical canters, specialty clinics and diagnostic canters

the industry is segmented into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East and Africa (MEA)

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033by End User

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 04: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 05: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 07: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 08: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 09: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 10: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 11: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 12: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 13: South Asia & Pacific Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 14: South Asia & Pacific Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 15: South Asia & Pacific Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 16: Western Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Western Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 18: Western Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033by End User

Table 19: Eastern Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 20: Eastern Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 21: Eastern Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033by End User

Table 22: Central Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 23: Central Asia Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 24: Russia & Belarus Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 25: Russia & Belarus Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 26: Balkan & Baltic Countries Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 27: Balkan & Baltic Countries Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 28: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 29: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Application

Table 30: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Figure 01: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Application

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by End User

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Region

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 13: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 14: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 15: North America Market Value Share, by Application (2023 E)

Figure 16: North America Market Value Share, by End User (2023 E)

Figure 17: North America Market Value Share, by Country (2023 E)

Figure 18: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 19: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 20: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 21: USA Market Value Proportion Analysis, 2022

Figure 22: Global Vs. USAGrowth Comparison

Figure 23: USA Market Share Analysis (%) by Application, 2023 & 2033

Figure 24: USA Market Share Analysis (%) by End User, 2023 & 2033

Figure 25: Canada Market Value Proportion Analysis, 2022

Figure 26: Global Vs. Canada. Growth Comparison

Figure 27: Canada Market Share Analysis (%) by Application, 2023 & 2033

Figure 28: Canada Market Share Analysis (%) by End User, 2023 & 2033

Figure 29: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 30: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 31: Latin America Market Value Share, by Application (2023 E)

Figure 32: Latin America Market Value Share, by End User (2023 E)

Figure 33: Latin America Market Value Share, by Country (2023 E)

Figure 34: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 35: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 36: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 37: Mexico Market Value Proportion Analysis, 2022

Figure 38: Global Vs Mexico Growth Comparison

Figure 39: Mexico Market Share Analysis (%) by Application, 2023 & 2033

Figure 40: Mexico Market Share Analysis (%) by End User, 2023 & 2033

Figure 41: Brazil Market Value Proportion Analysis, 2022

Figure 42: Global Vs. Brazil. Growth Comparison

Figure 43: Brazil Market Share Analysis (%) by Application, 2023 & 2033

Figure 44: Brazil Market Share Analysis (%) by End User, 2023 & 2033

Figure 45: Argentina Market Value Proportion Analysis, 2022

Figure 46: Global Vs Argentina Growth Comparison

Figure 47: Argentina Market Share Analysis (%) by Application, 2023 & 2033

Figure 48: Argentina Market Share Analysis (%) by End User, 2023 & 2033

Figure 49: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 50: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 51: East Asia Market Value Share, by Application (2023 E)

Figure 52: East Asia Market Value Share, by End User (2023 E)

Figure 53: East Asia Market Value Share, by Country (2023 E)

Figure 54: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 55: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 56: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 57: China Market Value Proportion Analysis, 2022

Figure 58: Global Vs. China Growth Comparison

Figure 59: China Market Share Analysis (%) by Application, 2023 & 2033

Figure 60: China Market Share Analysis (%) by End User, 2023 & 2033

Figure 61: Japan Market Value Proportion Analysis, 2022

Figure 62: Global Vs. Japan Growth Comparison

Figure 63: Japan Market Share Analysis (%) by Application, 2023 & 2033

Figure 64: Japan Market Share Analysis (%) by End User, 2023 & 2033

Figure 65: South Korea Market Value Proportion Analysis, 2022

Figure 66: Global Vs South Korea Growth Comparison

Figure 67: South Korea Market Share Analysis (%) by Application, 2023 & 2033

Figure 68: South Korea Market Share Analysis (%) by End User, 2023 & 2033

Figure 69: South Asia & Pacific Market Value (US$ Million) Analysis, 2017 to 2022

Figure 70: South Asia & Pacific Market Value (US$ Million) Forecast, 2023 to 2033

Figure 71: South Asia & Pacific Market Value Share, by Application (2023 E)

Figure 72: South Asia & Pacific Market Value Share, by End User (2023 E)

Figure 73: South Asia & Pacific Market Value Share, by Country (2023 E)

Figure 74: South Asia & Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 75: South Asia & Pacific Market Attractiveness Analysis by End User, 2023 to 2033

Figure 76: South Asia & Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 77: India Market Value Proportion Analysis, 2022

Figure 78: Global Vs. India Growth Comparison

Figure 79: India Market Share Analysis (%) by Application, 2023 & 2033

Figure 80: India Market Share Analysis (%) by End User, 2023 & 2033

Figure 81: Indonesia Market Value Proportion Analysis, 2022

Figure 82: Global Vs. Indonesia Growth Comparison

Figure 83: Indonesia Market Share Analysis (%) by Application, 2023 & 2033

Figure 84: Indonesia Market Share Analysis (%) by End User, 2023 & 2033

Figure 85: Thailand Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Thailand Growth Comparison

Figure 87: Thailand Market Share Analysis (%) by Application, 2023 & 2033

Figure 88: Thailand Market Share Analysis (%) by End User, 2023 & 2033

Figure 89: Philippines Market Value Proportion Analysis, 2022

Figure 90: Global Vs. Philippines Growth Comparison

Figure 91: Philippines Market Share Analysis (%) by Application, 2023 & 2033

Figure 92: Philippines Market Share Analysis (%) by End User, 2023 & 2033

Figure 93: Malaysia Market Value Proportion Analysis, 2022

Figure 94: Global Vs. Malaysia Growth Comparison

Figure 95: Malaysia Market Share Analysis (%) by Application, 2023 & 2033

Figure 96: Malaysia Market Share Analysis (%) by End User, 2023 & 2033

Figure 97: Vietnam Market Value Proportion Analysis, 2022

Figure 98: Global Vs. Vietnam Growth Comparison

Figure 99: Vietnam Market Share Analysis (%) by Application, 2023 & 2033

Figure 100: Vietnam Market Share Analysis (%) by End User, 2023 & 2033

Figure 101: Rest of ASEAN Market Value Proportion Analysis, 2022

Figure 102: Global Vs. Rest of ASEAN Growth Comparison

Figure 103: Rest of ASEAN Market Share Analysis (%) by Application, 2023 & 2033

Figure 104: Rest of ASEAN Market Share Analysis (%) by End User, 2023 & 2033

Figure 105: Australia & New Zealand Market Value Proportion Analysis, 2022

Figure 106: Global Vs. Australia & New Zealand Growth Comparison

Figure 107: Australia & New Zealand Market Share Analysis (%) by Application, 2023 & 2033

Figure 108: Australia & New Zealand Market Share Analysis (%) by End User, 2023 & 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 110: Western Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 111: Western Europe Market Value Share, by Application (2023 E)

Figure 112: Western Europe Market Value Share, by End User (2023 E)

Figure 113: Western Europe Market Value Share, by Country (2023 E)

Figure 114: Western Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 117: Germany Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Germany Growth Comparison

Figure 119: Germany Market Share Analysis (%) by Application, 2023 & 2033

Figure 120: Germany Market Share Analysis (%) by End User, 2023 & 2033

Figure 121: France Market Value Proportion Analysis, 2022

Figure 122: Global Vs France Growth Comparison

Figure 123: France Market Share Analysis (%) by Application, 2023 & 2033

Figure 124: France Market Share Analysis (%) by End User, 2023 & 2033

Figure 125: Spain Market Value Proportion Analysis, 2022

Figure 126: Global Vs Spain Growth Comparison

Figure 127: Spain Market Share Analysis (%) by Application, 2023 & 2033

Figure 128: Spain Market Share Analysis (%) by End User, 2023 & 2033

Figure 129: Italy Market Value Proportion Analysis, 2022

Figure 130: Global Vs. Italy Growth Comparison

Figure 131: Italy Market Share Analysis (%) by Application, 2023 & 2033

Figure 132: Italy Market Share Analysis (%) by End User, 2023 & 2033

Figure 133: BENELUX Market Value Proportion Analysis, 2022

Figure 134: Global Vs BENELUX Growth Comparison

Figure 135: BENELUX Market Share Analysis (%) by Application, 2023 & 2033

Figure 136: BENELUX Market Share Analysis (%) by End User, 2023 & 2033

Figure 137: Nordics Market Value Proportion Analysis, 2022

Figure 138: Global Vs Nordics Growth Comparison

Figure 139: Nordics Market Share Analysis (%) by Application, 2023 & 2033

Figure 140: Nordics Market Share Analysis (%) by End User, 2023 & 2033

Figure 141: UK Market Value Proportion Analysis, 2022

Figure 142: Global Vs. UK Growth Comparison

Figure 143: UK Market Share Analysis (%) by Application, 2023 & 2033

Figure 144: UK Market Share Analysis (%) by End User, 2023 & 2033

Figure 145: Eastern Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 146: Eastern Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 147: Eastern Europe Market Value Share, by Application (2023 E)

Figure 148: Eastern Europe Market Value Share, by End User (2023 E)

Figure 149: Eastern Europe Market Value Share, by Country (2023 E)

Figure 150: Eastern Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 151: Eastern Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 152: Eastern Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 153: Poland Market Value Proportion Analysis, 2022

Figure 154: Global Vs. Poland Growth Comparison

Figure 155: Poland Market Share Analysis (%) by Application, 2023 & 2033

Figure 156: Poland Market Share Analysis (%) by End User, 2023 & 2033

Figure 157: Hungary Market Value Proportion Analysis, 2022

Figure 158: Global Vs Hungary Growth Comparison

Figure 159: Hungary Market Share Analysis (%) by Application, 2023 & 2033

Figure 160: Hungary Market Share Analysis (%) by End User, 2023 & 2033

Figure 161: Romania Market Value Proportion Analysis, 2022

Figure 162: Global Vs Romania Growth Comparison

Figure 163: Romania Market Share Analysis (%) by Application, 2023 & 2033

Figure 164: Romania Market Share Analysis (%) by End User, 2023 & 2033

Figure 165: Czech Republic Market Value Proportion Analysis, 2022

Figure 166: Global Vs. Czech Republic Growth Comparison

Figure 167: Czech Republic Market Share Analysis (%) by Application, 2023 & 2033

Figure 168: Czech Republic Market Share Analysis (%) by End User, 2023 & 2033

Figure 169: Central Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 170: Central Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 171: Central Asia Market Value Share, by Application (2023 E)

Figure 172: Central Asia Market Value Share, by End User (2023 E)

Figure 173: Central Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 174: Central Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 175: Russia & Belarus Market Value (US$ Million) Analysis, 2017 to 2022

Figure 176: Russia & Belarus Market Value (US$ Million) Forecast, 2023 to 2033

Figure 177: Russia & Belarus Market Value Share, by Application (2023 E)

Figure 178: Russia & Belarus Market Value Share, by End User (2023 E)

Figure 179: Russia & Belarus Market Attractiveness Analysis by Application, 2023 to 2033

Figure 180: Russia & Belarus Market Attractiveness Analysis by End User, 2023 to 2033

Figure 181: Balkan & Baltic Countries Market Value (US$ Million) Analysis, 2017 to 2022

Figure 182: Balkan & Baltic Countries Market Value (US$ Million) Forecast, 2023 to 2033

Figure 183: Balkan & Baltic Countries Market Value Share, by Application (2023 E)

Figure 184: Balkan & Baltic Countries Market Value Share, by End User (2023 E)

Figure 185: Balkan & Baltic Countries Market Attractiveness Analysis by Application, 2023 to 2033

Figure 186: Balkan & Baltic Countries Market Attractiveness Analysis by End User, 2023 to 2033

Figure 187: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 188: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 189: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 190: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 191: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 192: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 193: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 194: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) by Application, 2023 & 2033

Figure 198: GCC Countries Market Share Analysis (%) by End User, 2023 & 2033

Figure 199: Kingdom of Saudi Arabia Market Value Proportion Analysis, 2022

Figure 200: Global Vs Kingdom of Saudi Arabia Growth Comparison

Figure 201: Kingdom of Saudi Arabia Market Share Analysis (%) by Application, 2023 & 2033

Figure 202: Kingdom of Saudi Arabia Market Share Analysis (%) by End User, 2023 & 2033

Figure 203: Türkiye Market Value Proportion Analysis, 2022

Figure 204: Global Vs. Türkiye Growth Comparison

Figure 205: Türkiye Market Share Analysis (%) by Application, 2023 & 2033

Figure 206: Türkiye Market Share Analysis (%) by End User, 2023 & 2033

Figure 207: North Africa Market Value Proportion Analysis, 2022

Figure 208: Global Vs North Africa Growth Comparison

Figure 209: North Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 210: North Africa Market Share Analysis (%) by End User, 2023 & 2033

Figure 211: South Africa Market Value Proportion Analysis, 2022

Figure 212: Global Vs. South Africa Growth Comparison

Figure 213: South Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 214: South Africa Market Share Analysis (%) by End User, 2023 & 2033

Figure 215: Israel Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Israel Growth Comparison

Figure 217: Israel Market Share Analysis (%) by Application, 2023 & 2033

Figure 218: Israel Market Share Analysis (%) by End User, 2023 & 2033

Infection control protocols and regulatory pressure are accelerating the shift from reusable to single-use gastroscopes.

The industry is projected to grow at a CAGR of 15.6% between 2025 and 2035.

Hospitals and ambulatory surgical canters, especially in North America and Europe, are leading adoption.

Firms are focusing on innovation, regulatory alignment, and partnerships to expand global reach.

The single-use gastroscopes industry is expected to reach USD 966.7 million by 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA