The single portion cosmetic packaging market is witnessing significant growth because of increasing demand for portable, hygienic, and sustainable packaging solutions in the beauty and personal care industry. The single-use and travel-friendly cosmetic formats are favored by consumers based on convenience, controlled dosage, and minimal product wastage.

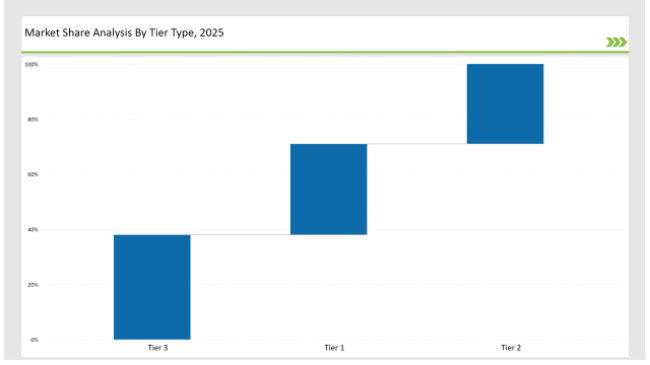

Furthermore, a focus on sustainability has led manufacturers to invest in biodegradable, recyclable, and refillable packaging options. Companies fall into Tier 1, Tier 2, and Tier 3, depending upon market influence and execution strategies.

Leading companies, including AptarGroup, Albéa, and Amcor, collectively hold over 33% of the market. These Tier 1 companies dominate through advanced packaging materials, smart dispensing technologies, and extensive distribution networks. Their focus on eco-friendly packaging solutions has enhanced their market positioning.

Tier 2 players, such as Lumson, Vetroplas, and Quadpack, account for 29% of the market. They specialize in customizable and cost-effective packaging tailored to mid-sized beauty brands seeking differentiation in the competitive landscape.

Tier 3 consists of regional manufacturers, startups, and private labels, contributing 38% of the market share. These companies emphasize agility and innovation, launching compostable sachets, airless dispensers, and refillable single-use pods to meet consumer expectations and regulatory standards.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (AptarGroup, Albéa, Amcor) | 15% |

| Rest of Top 5 (Lumson, Vetroplas) | 10% |

| Next 5 of Top 10 (Quadpack, Silgan, Yonwoo, HCP Packaging, WWP Beauty) | 8% |

The Single Portion Cosmetic Packaging Market serves multiple industries, including:

Companies offer a variety of solutions tailored to industry needs:

Throughout 2024, leading companies in the single portion cosmetic packaging market invested in eco-friendly materials, smart packaging solutions, and AI-driven manufacturing. AptarGroup, Albéa, and Amcor led the market with sustainable, refillable packaging innovations. Lumson introduced high-barrier, single-dose sachets for skincare and cosmetic applications. Vetroplas focused on recyclable airless dispensers to improve product preservation.

Quadpack developed biodegradable pods for waterless beauty formulations, while Silgan expanded its premium, luxury-focused single-use packaging line. Yonwoo and WWP Beauty pioneered digital-integrated packaging with QR codes for enhanced consumer engagement.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | AptarGroup, Albéa, Amcor |

| Tier 2 | Lumson, Vetroplas, Quadpack |

| Tier 3 | Silgan, Yonwoo, HCP Packaging, WWP Beauty |

| Manufacturer | Latest Developments |

|---|---|

| AptarGroup | Introduced refillable single-dose packaging (March 2024) |

| Albéa | Launched biodegradable sachets for cosmetics (April 2024) |

| Amcor | Developed recyclable mono-material cosmetic pouches (May 2024) |

| Lumson | Expanded airless packaging solutions (July 2024) |

| Vetroplas | Focused on eco-friendly dispensers for skincare (August 2024) |

| Quadpack | Developed compostable beauty pods (September 2024) |

| Silgan | Introduced luxury-focused single-dose packaging (October 2024) |

The single portion cosmetic packaging market is shifting towards biodegradable materials, refillable packaging, and AI-driven innovations. Companies are focusing on sustainable alternatives to plastic, driven by evolving global regulations. Customization and luxury design trends are pushing the demand for premium packaging. Smart packaging solutions with digital integration are emerging to enhance customer engagement. The expansion of waterless beauty formulations is leading to new packaging designs.

AI-powered automation is improving production efficiency and reducing waste. Strategic partnerships between beauty brands and packaging suppliers are accelerating innovation. The market will continue to grow as consumer preferences shift towards convenience and eco-conscious products.

It offers hygienic, travel-friendly, and precise dosage solutions, reducing product waste.

The top 10 players hold approximately 33% of the global market.

Common materials include biodegradable plastics, recyclable mono-materials, and refillable packaging options.

Key industries include beauty & personal care, travel & hospitality, pharmaceuticals, and luxury cosmetics.

Emerging trends include ai-driven automation, smart packaging, waterless beauty formulations, and eco-friendly alternatives.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.