The child-resistant (CR) single dose pouches market is highly competitive and driven by regulatory mandates, safety concerns, and increasing demand for compliance packaging in the pharmaceutical, cannabis, and household chemical industries.

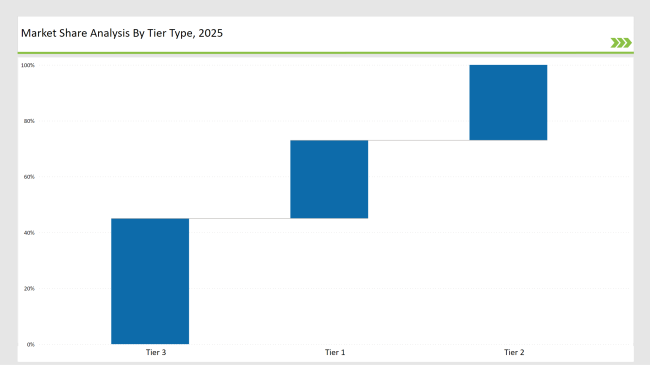

The market consists of Tier 1, Tier 2, and Tier 3 players based on market presence, production capabilities, and innovation strategies. Leading the market are companies like Amcor, ProAmpac, and Constantia Flexibles, collectively holding 28% market share. Their success stems from advanced barrier materials, patented locking mechanisms, and sustainable packaging solutions.

Tier 2 players, including Glenroy, Tekni-Plex, and Huhtamaki, hold 27% of the market, catering to mid-sized enterprises with cost-effective, customizable solutions. These companies leverage specialized materials and innovative printing techniques to meet industry-specific needs.

Tier 3 players, comprising regional manufacturers, niche firms, and private labels, hold 45% market share. They focus on emerging markets and eco-friendly packaging innovations, often targeting startup pharmaceutical brands and cannabis manufacturers. The market is characterized by stringent compliance requirements, sustainability-driven innovation, and evolving regulatory standards.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, ProAmpac, Constantia Flexibles) | 13% |

| Rest of Top 5 (Glenroy, Tekni-Plex) | 9% |

| Next 5 of Top 10 (Huhtamaki, Novolex, Berry Global, Scholle IPN, PPC Flexible Packaging) | 6% |

The CR single-dose pouches market is segmented based on key end-use industries, including:

Vendors offer specialized packaging solutions to meet diverse industry demands:

Manufacturers increasingly integrate recyclable materials, smart authentication, and user-friendly compliance designs to align with industry trends.

This section highlights the companies that made significant advancements in the CR single-dose pouches market in 2025. Key players focused on compliance innovations, sustainable materials, and tamper-evident features to enhance safety standards.

Emerging technologies such as biodegradable films, AI-based tracking, and next-gen locking features drive market differentiation. Companies leveraging regulatory expertise, R&D investment, and strategic partnerships gained a competitive edge.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, ProAmpac, Constantia Flexibles |

| Tier 2 | Glenroy, Tekni-Plex, Huhtamaki |

| Tier 3 | Novolex, PPC Flexible Packaging, regional startups |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Expanded child-resistant film innovations for pharmaceuticals in February 2024. |

| ProAmpac | Launched 100% recyclable CR pouches for the cannabis industry in March 2024. |

| Constantia Flexibles | Developed tamper-proof, anti-counterfeit pouches with embedded security features in April 2024. |

| Glenroy | Introduced eco-friendly, high-barrier laminated pouches for OTC drugs in June 2024. |

| Tekni-Plex | Pioneered multi-layer CR pouches with built-in odor barriers for chemical products in July 2024. |

| Huhtamaki | Invested in low-carbon, plant-based resin pouches for sustainable compliance packaging in August 2024. |

| Novolex | Introduced compostable single-dose pouches for nutraceuticals in September 2024. |

| PPC Flexible Packaging | Launched high-barrier, tamper-evident pouches for pharmaceuticals in October 2024. |

Advancements in sustainability, AI-based authentication, and automation are reshaping the CR single-dose pouches industry. Next-gen locking mechanisms, fully recyclable pouches, and intelligent supply chain monitoring will define the market trajectory in 2025 and beyond.

These are specialized pouches designed to prevent children from easily accessing hazardous or sensitive products, commonly used in pharmaceuticals, cannabis, and chemical packaging.

Regulations such as the USA Poison Prevention Packaging Act (PPPA) and similar global standards dictate safety requirements for child-resistant packaging.

Materials include high-barrier films, recyclable plastics, compostable laminates, and multi-layer structures with tamper-evident seals.

RFID/NFC technology enables tracking, authentication, and real-time monitoring, ensuring regulatory adherence and reducing counterfeiting risks.

Pharmaceuticals, cannabis, household chemicals, nutraceuticals, and personal care industries drive demand for compliant child-resistant packaging.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.