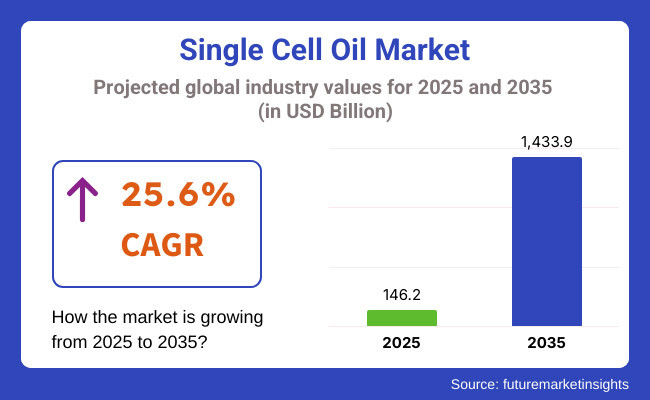

Global single cell oil market in 2023 was USD 93.23 billion. Use of single cell oil in 2024, which would be the global market in 2025 of USD 146.2 billion. Sales globally during the forecast period 2025 to 2035 will increase with a 25.6% CAGR, and it will be a market of USD 1,433.9 billion in 2035.

Single cell oil industry is driven by increased demand for premium, green oils used in drug, food, and cosmetics applications. Single cell oils derived from microorganisms such as yeast, algae, bacteria, and fungi are a premium, green replacement for traditional vegetable oils. Industries and consumers alike are getting greener, which makes single cell oils more sought after for their unique nutritional features and new applications.

Growing health-conscious consumption, primarily vegetable oils containing omega-3 fatty acids and other nutritional elements, is driving the single cell oil applications as functional foods and supplements. Moreover, growing concern towards bio-based and green products and eco-friendly agricultural practice are driving the market growth at a rate much greater than before.

Single cell oil is one of the drivers of growth under sustainability. Single cell oils are a more sustainable alternative to vegetable oils in the way that they can be grown by cultivating with organisms that have high growth rates and they do not require water or land. Single cell oils are produced via closed culture and are thus less susceptible to environment issues of the traditional agricultural production system like global warming and land degradation.

Better technology in the extraction and fermentation process also helped in enhancing the economic value of single cell oils. Even newer technology is under development that will improve yield and reduce cost of production, and hence their applications will grow in most industries.

The below provided table is comparative review of single cell oil world business six-months CAGR differential between base year (2024) and corresponding year (2025). It is proof of significant change in performance and quality of revenue realization behavior, so it gives stakeholders a clear direction of growth pattern during the duration of the year. Half year, H1, is Jan-Jun. Half year, H2, represents Jul-Dec months.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 24.0% |

| H2 (2024 to 2034) | 25.1% |

| H1 (2025 to 2035) | 25.2% |

| H2 (2025 to 2035) | 25.6% |

The company will continue to grow faster in the 2025 to 2035 decade at a CAGR growth rate of 25.3% and also at a higher rate of growth of an increase of 25.9% during the second half of the decade. Reaching the second period, i.e., H1 2025 to H2 2035, CAGR was positioned higher at 25.3% in the first period and stronger at 25.9% in the second period. Industry picked up 20 BPS growth in the first period (H1), and business picked up extra 40 BPS growth in the second period (H2).

It will be triggered by future biotechnology developments, increasing healthcare awareness among consumers, and globalization and sustainable and plant lifestyle movement. In general, the single-cell oil market is heading towards development in technologies and changes in consumption behavior towards healthcare and sustainability. Investors will have to factor in local trend and consumer behavior when trying to negotiate future opportunity in the changing market.

Organized Segment - Multinational Suppliers and Large Innovators, Multinational firms and large biotech firms that dominate the SCO market through massive R&D spending, massive global supply chains, and innovative fermentation technologies comprise this organized segment.

They pursue large-scale production and multi-application uses like nutritional supplements, functional foods, and biofuel alternatives. DSM-Firmenich (Netherlands/Global Reach), As one of the early manufacturers of microbial oils, DSM-Firmenich has developed a portfolio of premium Single Cell Oils that are rich in Omega-3 and Omega-6 fatty acids for use in nutritional supplements, infant nutrition, and pharma.

The company's focus on sustainable fermentation technology lends credibility to its market positioning. Corbion (Netherlands/USA), the global leader in the production of green SCO, Corbion specializes in algae oil knowledge. Its high-purity Omega-3 DHA algal oils are used for food enrichment, aquaculture feed, and animal nutrition in commercial applications.

Fermentalg (France), Global market leader in microalgae oil production, Fermentalg specializes in Omega-3 DHA production for food supplements and functional foods.

Unorganized Segment - Emerging Players and Niche Players, The disorganized segment consists of regional producers, start-ups, and small-scale biotechs having competencies in niche Single Cell Oil uses. They disrupt the market with new product introduction, new fermentation technologies, and green oil recovery processes.

Xiamen Huison Biotech (China), A new player in the fermented oil business, Xiamen Huison is expanding increasingly in nutritional supplements and aquafeed, having experience in DHA and EPA-enriched microbial oils. Qualitas Health (USA/Israel), Microalgae technology startup firm Qualitas Health produces vegan-compliant, nutrient-dense oils for dietary supplement and plant nutrition use.

NBO3 Technologies (USA), One-cell Omega-3 oil concentration emphasis, NBO3 is a pioneer in environmentally friendly, bioengineered oil solutions for pet food and animal feed. Microphyt (France), Emphasizing custom SCOs from marine microalgae for a particular in the cosmetics and well-being industries through anti-aging and skin-enlivening oils.

Increasing Demand for Sustainable & Alternative Oils in Food

Shift: Common traditional vegetable oils like palm oil and soybean oil are progressively becoming associated with deforestation, loss of ecosystem integrity, and gargantuan carbon footprints. Producers and consumers are already looking for deforestation-free sustainable sources.

Regulators in North America and Europe are calling for sustainable procurement of the materials, with plant foods and functional foods now turning towards microbial- and algal-based oils as an alternative. The demand in markets for sustainable lipid sources has been growing 29% year-on-year yearly for food use.

Strategic Response: Cargill headquartered in the United States has been growing its oil business based on fermentation, highlighting sustainable palm oil alternatives for food processing and baking uses. Corbion headquartered in the Netherlands introduced its own algae oils for vegan and dairy-free usage, cementing its leadership position in plant-based butter and cheese segments.

Growing Consumption of Algae-Based Oils in Omega-3 Supplements

Shift: Customers are moving away from fish-based Omega-3 supplements because of overfishing, heavy metal poisoning, and sustainability issues. They are moving towards sustainable, plant-based options. The algae-based Omega-3 (DHA & EPA) supplement market has grown by 24% in 2024 with growing demand from North American, European, and Asia-Pacific vegan, vegetarian, and flexitarian consumers.

Strategic Response: Veramaris (Germany & Netherlands) increases the volume of DHA- and EPA-fortified algal oils for food supplements for eco-responsible consumers. ADM (USA) launched ultra-purity algae oil supplements in collaboration with leading USA and Canadian nutraceutical companies. Xiamen Kingdomway (China) has popularized high-bioavailability algae-based Omega-3 oils to capture Asian opportunities in nutraceuticals.

Expansion of Single-Cell Oil Use in Alternative Proteins & Cultivated Meat

Shift: As alternative protein has been on the rise, companies seek functional lipids that create added texture, mouthfeel, and flavor for cultured and plant-based meat. Traditional plant oils such as sunflower oil and coconut oil don't have multifunctional fatty acid composition, which is found in meat alternatives, and hence there has been increased demand for fermentation- and alga-derived SCOs. This has increased 32% utilization of SCOs in blends for alternative meats in North America and Europe.

Strategic Response: Nature's Fynd (USA) created fungus-derived oil to increase umami taste and fat marbling in alternative meat, having achieved retail partnerships with Whole Foods and Sprouts. Solar Foods (Finland) created microbial oils for cultured meat, which they collaborate with cell-based meat start-ups to liberate taste authenticity. Meati Foods (USA) introduced SCOs into mycelium-based meat alternatives, further inroads into flexitarian and health-oriented consumers.

Single-Cell Oil Production in Environmentally Friendly Pet Food & Aquaculture

Shift: Pet food and aquafeed have been using vegetable oils and fish oil for a long time, but supply chain disruption, price volatility, and sustainability issues are propelling the shift to SCO-based lipid substitutes. Growth in usage of microbial and algal oil has been increasing at 27% annually in pet food and aquafeed, especially in Europe, North America, and Asia-Pacific.

Strategic Response: Veramaris (USA & Netherlands) also commodity-fied algal production of Omega-3 aquafeed for sustainable aquafeed to minimize wild fish oil dependency. ADM (USA) developed fermented single-cell oils for pet food with proteininess of highness, again targeting high-end and sustainable pet nutrition. Alltech (Ireland) brought forward proprietary SCO forms for aquaculture feed, which provides highest composition of EPA & DHA in farmed fish.

Growing Need for Single-Cell Oils in Functional Foods & Beverages

Shift: They increasingly need added-healthy fats foods and beverages with bioactive lipids, Omega-3s, as components of healthy brain function, cardiovascular health, and immune health. SCOs offer a clean-label, ultra-bioavailable means of delivering essential fatty acids, resulting in 30% more usage of SCOs in North American and European functional beverages and plant-based milk alternatives.

Strategic Response: Nestlé Health Science (Switzerland & USA) has integrated algal oils into geriatric and medical nutrition drinks for brain and cardiovascular wellness. Unilever (UK) has introduced single-cell-derived Omega-3-fortified vegetable margarines for sustainable consumers of dairy alternatives. Danone (France) has introduced fermentation-derived lipid ingredients for enhanced fat profiles and nutritional content in plant yogurts.

Growing Regulatory Support & Investments in Fermentation-Based Oil Manufacturing

Shift: Governments and investors are increasingly looking at the feasibility of single-cell oils (SCOs) as a sustainable substitute for traditional oils and fueling positive associations for regulatory policy and additional investment. European and North American regulators are commoditizing microbial fermentation-derived ingredients at an increasingly rapid pace, while Asian-Pacific governments are investing in biomanufacturing to enable local production.

Various oils derived by fermentation have been granted GRAS status by the United States FDA, while the EU Novel Food Regulation is simplifying the approval routes for SCOs as food.

Strategic Response: Perfect Day (USA) raised more than USD 750 million of capital to develop its precision fermentation platform, including the production of microbial lipids for functional foods. Singapore & Netherlands-headquartered Sophie's BioNutrients collaborated with state-funded food-tech accelerators to develop microbial oils for less resource-intensive meat and dairy alternatives.

European regulators collaborated with Royal DSM (Netherlands) to develop a common list of safety factors for yeast and algae-based oils such that products could be approved with greater ease.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of single-cell oil (SCO) through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 27.9% |

| Germany | 18.3% |

| China | 19.6% |

| Japan | 28.8% |

| India | 20.4% |

Growing consumer demand for sustainable, microbial-based oils with functional advantages drives the USA single-cell oil (SCO) market. Due to the rising demand for alternative lipid sources, omega-3-rich oils, and eco-friendly food ingredients, single cell oils are extensively used in nutraceuticals, infant formula, as well as alternative fats for plant based dairy and meat substitutes.

Furthermore, the transition to algal and fungal oils, as substitutes for conventional fish oil and palm oil, increases the demand for high-purity fermentation-derived lipids. There is a good growth for bio based industrial applications in USA market such as lubricants, biofuels and oleochemicals as well.

In addition, government initiatives promoting sustainable food production and sourcing of carbon-neutral ingredients have attracted investment towards manufacturing of single-cell oil for functional nutrition, bioplastics, and clean-label food formulations.

The single -cell oil market in Germany claims the - strongest growth as a result of strict food safety regulations laid down by the EU along with growing consumer demand for non-GMO oils and the move towards sustainable lipids. Demand for fermentation-derived omega-3 and omega-6 oils is growing due to the broadening of functional foods, pharmaceutical excipients, and sustainable biochemicals.

The German sector is now investing in the production of fermented algal oils, bio-based oleochemicals and polyunsaturated fatty acids (PUFA)-rich SCOs, in response to increasing demand for these sustainable lipids across the food, cosmetic and biofuel industries.

Staring the rapidly growing demand of omega-3-rich functional foods, increased production of alternative lipids, and growing investment in microbial fermentation technology, China single-cell oil market is likely to grow aggressively. There is increasing demand for high-efficiency, scalable systems for producing SCO (second generation microalgal biofuel), aimed at producing algae-based DHA/EPA, biofuel-grade oils, and functional lipids.

Chinese producers are concentrating on massive fermentation of algal oils, microbe-derived lipids and PUFA-enriched SCOs for useful and industrial uses, supported by policies from the government for bio-based alternatives to common oils.

Japan’s single-cell oil market is enhanced by the country’s attention to longevity, functional nutrition, and high-quality food-grade lipids. Japanese consumers prefer oils for brain health (DHA and EPA) and metabolic support (DHA) and infant nutrition (ARA) derived from fermentation for these reasons.

High-bioavailability, odor-free, and shelf-stable single-cell oils are in high demand due to Japan's state-of-the-art technology for microbial lipid extraction and nanoencapsulation.

In the case of India, its single-cell oil market is opening up as interest in edibles other than traditional oils leads to stronger demand and supply opportunities for slower-coveted heart-healthy lipid sources, boosted by government-supported initiatives that capitalize on sustainable bio-based food ingredients. SCOs are increasingly used in functional nutrition, fortified dairy alternatives, and biofuel formulations.

Given the favorable government policies for clean energy and alternative lipid sources, Indian manufacturers are working on cost-effective, high-yield, and sustainable microbial fermentation processes for both domestic and export supply.

| Segment | Value Share (2025) |

|---|---|

| Nutraceuticals & Functional Foods (By Application) | 74.3% |

The segment of nutraceuticals and functional foods holds the leading position in the market, owing to the increasing demand for omega-3-rich single cell oils in dietary supplements, functional foods, and biofortified dairy alternatives. For heart health and brain health, consumers are gravitating towards lipid sources that have high bioavailability, are plant-based and are non-GMO.

Due to increasing demand of sustainable and allergen-free oils, manufacturers are targeting fermented algae-derived oils, fungal lipids and PUFA-rich SCOs as ingredients in functional food formulations.

It is projected to account for an estimated 74.3% value share in 2025, and North America and Europe are anticipated to be key growth markets for functional nutrition and plant-based dietary supplements.

| Segment | Value Share (2025) |

|---|---|

| Biofuels, Personal Care & Industrial Applications (By Application) | 25.7% |

As the demand for biofuels, sustainable cosmetics and personal care, and biodegradable lubricants is skyrocketing, the market is rapidly sweeping into bio-based single-molecule (SCO) formulations for renewable energy, skincare and bio-plastic uses. However, as industries shift to greener, more sustainable alternatives, SCOs are becoming a renewed interest as multi-use, high-performance ingredient candidates in many industries.

Demand has been further augmented through the rising deployment of polyunsaturated fatty acids (PUFAs)-fortified single-cell oils (SCOs) in superior performance lubricant, bio-based commercial paints, and speciality chemistry applications. These bio-derived oils not only have improved functional properties, but also constitute the best substitutes for petroleum-based lipids found in industrial and consumer products.

As industrial sectors continue to seek high-purity bio-based replacements, fermented, non-GMO single-cell oils can expect strong demand. Moreover, the development of microbial fermentation technology allows for the scalability and efficiency of SCO production, promoting its wide application in industry.

Asia-Pacific and North America are registering high demand, and this segment would be worth a value share of 25.7% in 2025. Soaring government policies and consumers’ increasing knowledge of green innovations are backed by the emergence of bio-based energy alternatives and green industrial uses in these markets.

Single-cell oils are an emerging market segment, where competition among key players is high, using advanced fermentation processes, increasing yields of microbial strains being developed, as well as increasing applications in sustainable food and biofuel sectors. This led to investments in precision fermentation, non-genetically modified lipid production and high-omega PUFA formulations.

The industry players mentioned in the report are DSM, Corbion, ADM, Cargill, BASF, which have profound knowledge of microbial lipid extraction, fermentation-derived omega oils, and sustainable industrial uses. Several companies have increased their North American and European production plants to meet growing demand for functional and bio-based oils.

Leverage portfolio synergies: We are entering into mutually exclusive partnerships with food manufacturers, investing in precision lipid fermentation and creating new high-bioavailability DHA/EPA oil blends. Manufacturers are also focusing on production with a low carbon footprint and renewable oil extraction methods.

For instance:

The market includes various microorganisms used in production, such as bacteria, yeast, microalgae, and fungi, each contributing to different applications and product formulations.

The industry finds applications in diverse sectors, including bio-fuel feedstock, fish oil substitutes, functional oils, animal feed, infant formula, pharmaceutical products, and aquaculture, highlighting its broad utility.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global single cell oil industry is projected to reach USD 146.2 billion in 2025.

The industry is forecasted to grow at a CAGR of 25.6%.

Key players include DSM, Corbion, ADM, Cargill, and BASF.

Major industries include nutraceuticals, functional foods, biofuels, and personal care.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 10: North America Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 16: Latin America Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 22: Europe Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 28: Asia Pacific Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Litre) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Micro-Organisms, 2018 to 2033

Table 34: MEA Market Volume (Litre) Forecast by Micro-Organisms, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Litre) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 9: Global Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 27: North America Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 45: Latin America Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 63: Europe Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Micro-Organisms, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Micro-Organisms, 2018 to 2033

Figure 99: MEA Market Volume (Litre) Analysis by Micro-Organisms, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Micro-Organisms, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Micro-Organisms, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Litre) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Micro-Organisms, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA