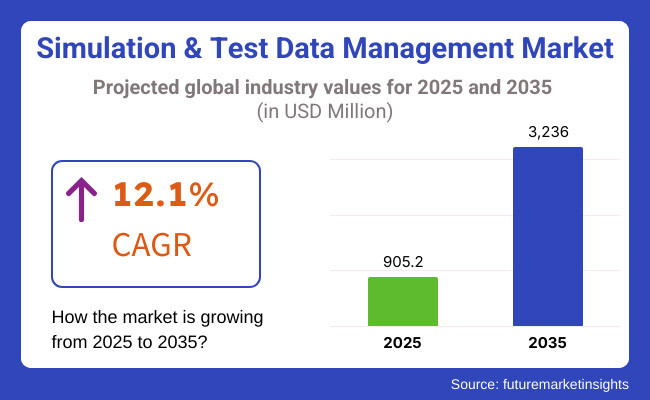

The global Simulation and Test Data Management market is projected to grow significantly, from 905.2 million in 2025 to 3,236.0 million by 2035 an it is reflecting a strong CAGR of 12.1%.

The organizations relying more on external vendors for simulation and test data management, this means that data integrity, security, and compliance are a critical concern across industries including automotive, healthcare and aerospace & defense. How to manage huge amounts of testing data without losing accuracy or leaking sensitive information is a major challenge, necessitating strong data management solutions. Increasing need for advanced solutions to manage data governance, validation and compliance is one of the major driving factors for the market.

Healthcare and aerospace are examples of many industries that are subject to stringent regulatory requirements such as FDA compliance and DO-178C, and therefore require complex test data management capabilities. These solutions assist organizations in simplifying test data storage, retrieval and regulatory reporting.

The rapid digital transformation, businesses are increasingly utilizing tools for simulation and test data to optimize product development, safety testing, and quality assurance. AI, machine learning, and cloud-based testing solutions offer scalability and flexibility for organizations, allowing them to enhance testing processes while minimizing costs and time-to-market. With an increase in the number of cyber threats, ensuring data security has become a foremost priority, especially for institutions working with confidential test data.

To protect intellectual property and mitigate penalty of data breach, solutions providing real-time monitoring, data anonymization, data encryption, and access controls are gaining traction. By continuously monitoring test environments across all levels, vulnerabilities can be detected and addressed before becoming more costly issues.

The North American region accounted for the highest revenue share in the global marketplace owing to the stringent regulatory requirements in the pharmaceutical industry along with the presence of a well-established technology provider offering advanced simulation and test data management solutions. In contrast, other countries, such as India and Australia, are seeing a higher adoption driven by their expanding R&D activity, automotive development and changing compliance regulations. Worldwide investment in automated, secure, and scalable solutions for emerging data environment management will be propelled in 2024 by the increasing requirement for efficient test data management.

Explore FMI!

Book a free demo

| Company | Siemens Digital Industries Software |

|---|---|

| Contract/DevelopmentDetails | Secured a contract with an automotive manufacturer to provide simulation and test data management solutions, facilitating efficient product development and testing processes. |

| Date | June 2024 |

| Contract Value (USD million) | Approximately USD 20 |

| Renewal Period | 4 years |

| Company | ANSYS, Inc. |

|---|---|

| Contract/Development Details | Partnered with an aerospace company to deliver simulation data management tools, enhancing the accuracy and efficiency of engineering simulations. |

| Date | November 2024 |

| Contract Value (USD million) | Approximately USD 18 |

| Renewal Period | 3 years |

Increased adoption of AI and ML-based simulation to enhance testing efficiency

AI and ML is changing the testing efficiency game in many Simulations. Organizations can automate complex simulations using AI & ML algorithms for fashion testing, resulting in increased accuracy and reduced testing cycles. This advancement in technology includes predictive modeling for prediction of problems before they occur in real-world applications.

AI-fueled simulations are able to analyze huge data sets for patterns and outliers and make adjustments in product development proactively. The US Department of Defense has also acknowledged the potential of AI in simulation environments, which can assist with development activities as well as decision-making processes. This program illustrates how AI and ML are playing an increasingly pivotal role in making simulations faster and more reliable, and how solutions built around these areas will support reduced time-to-market and operational costs.

Expansion of digital transformation initiatives in R&D and product development

Digital transformation has been having a major impact on Research and Development (R&D) and product development sectors, which has been leading to adoption of advanced simulation and test data management solutions. By adopting digital technologies, organizations can work more easily together, enable innovation at a faster pace, and make better decisions based on existing data. Researchers can ask discovery questions and accelerate product development and innovation with a completely integrated stream of R&D data sources.

Around the world, governments are pushing digital transformation to support economic growth and the development of technologies. For instance, to develop balanced and comprehensive AI programs and partnerships, the USA government has invested heavily in AI research and development. Such investments underscore the importance of digital transformation in improving the efficiency and effectiveness of both R&D capabilities and product development processes.

Rising focus on real-time monitoring and predictive analytics in test environments

The simulation and test data management landscape onto its head with the new trend of focused real-time monitoring and predictive analytic of test environments. The ability to monitor processes in real time allows for ongoing oversight of testing, so challenges are addressed as they arise, thus increasing product reliability and safety.

Failures and performance bottlenecks can be predicted using predictive analytics and AI-driven ML, providing scope for preemptive interventions. In the field of defence, the integration of AI-powered simulations has offered greenfield training experiences with practical learnings primarily at smaller costs compared to traditional exercises, making ubiquitous training and strategic plans more effective. Not only does this approach reduce testing cycle time, it maximizes the return on investment and impact of the testing process long-term.

High implementation costs hinder adoption, especially for small and medium enterprises

The growth of the simulation and test data management solutions market is the high cost of implementation. It often involves a significant initial investment, as these solutions need specialized software, high-performance computing infrastructure, and trained personnel. In contrast to big corporates that have deep pockets for digital transformation, SMEs find it challenging to justify the investment, particularly when there is no certainty on roi. The overall cost burden continues with licensing fees for sophisticated simulation software, the expenses of storing data and costs of eventually doing maintenance on the hardware.

Most SMEs are thin on the ground when it comes to margins, so being willing to spend a ton on high-end testing and data management solutions can seem like a far less favourable option. Adoption is further complicated by the need for custom integrations with current IT environment, which typically requires additional expenditure for consulting services and software adjustments.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance requirements in automotive and aerospace drove demand for structured data management. |

| Technological Advancements | AI-enhanced simulations improved accuracy and reduced computation time. |

| Data Integration & Processing | Cloud-based data management solutions became mainstream for enhanced collaboration. |

| Security & Privacy Measures | Increased cybersecurity threats led to enhanced encryption for test data storage. |

| Market Growth Drivers | Growth in autonomous vehicles and IoT increased demand for complex simulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered compliance automation ensures real-time adherence to evolving industry standards. |

| Technological Advancements | Digital twin technology integrates with real-time data streams for hyper-accurate simulations. |

| Data Integration & Processing | Quantum computing accelerates test data analysis, enabling real-time insights. |

| Security & Privacy Measures | Blockchain-based data integrity solutions ensure tamper-proof simulation records. |

| Market Growth Drivers | AI-driven simulation ecosystems dominate industrial R&D, reducing prototype costs. |

Tier 1 Vendors hold the majority of the STDM market due to their size, resources, and customer base. They offer comprehensive solutions that blend with existing systems, implementing end-to-end capabilities that serve large enterprises across diverse industries. This is particularly true given that the Tier 1 vendors are traditionally able to invest more heavily into research and development allowing them to stay at the forefront of technology innovation and development for changing market demand.

The Tier 2 Vendors command a decent share of the market with the providing competitive solutions that serve the needs of mid-size and bigger orgs. They have formed a concentrated business around a particular industry or region, which permits them to offer their customers bespoke solutions that are tailored to their specific market needs.

As a result, they can respond rapidly to market shifts and customer requirements, which frequently results in creative strategies in simulation and test data management: One of the key strategies for Tier 2 vendors to improve on their offerings and increase their market presence is through partnerships and collaborations with other technology providers.

They include Tier 3 Vendors: smaller firms and niche players focusing on particular aspects of simulation and test data management. These vendors focus on innovation within the industry even if they have a smaller market share. Their specialized solutions often fill gaps left by larger providers, offering customizable, flexible options for organizations with unique needs.

Tier 3 vendors can also cover certain geographic markets, offering localized support and services that larger, national organizations may not. Their innovative-driven ethos brings diversity within the market with a plethora of unique solutions available to cater for various customer needs.

The section highlights the CAGRs of countries experiencing growth in the Simulation and Test Data Management market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.8% |

| China | 14.6% |

| Germany | 11.9% |

| Japan | 12.1% |

| United States | 13.4% |

The manufacturing industry in China is experiencing a crucial transformation characterized by accelerated industrial automation and digitalization through digital twin technologies. Such an initiative stems mainly from the government's plans to improve production and rely less on foreign technology. In 2023, China registered a robot density of 470 units per 10,000 employees, outranking Germany and Japan for the first time and standing at third position in the world classification. This wave of automation signals a commitment to modernizing the industrial base of the country.

At the same time, the adoption of digital twin technologies is picking up; the government has made it compulsory to localize the software by 2027. This has motivated the development of indigenous digital twin solutions that enable real-time monitoring and optimization of manufacturing processes.

This convergence further increases the complexity of the data flow creates system-level complexities and demanding data management systems for simulation and test. This has led to a growing need for sophisticated data management solutions that can meet the requirements of automated and digitized manufacturing environments in China. China is anticipated to see substantial growth at a CAGR 14.6% from 2025 to 2035 in the Simulation and Test Data Management market.

The engineering and IT sectors in India are undergoing a paradigm shift towards cloud-based simulation tools, driven by the need for scalable and cost-effective solutions. Government initiatives, including "Digital India" and "Make in India", have contributed significantly to this shift, driving the development of digital infrastructure and accelerating technology adoption among enterprises. In 2025, the Indian government allocated USD 267 million to 'India AI Mission' to improve AI and ecosystem infrastructure.

This commitment to integrating advanced technologies into different industries is evident from this investment made by the nation. Cloud-based simulation tools provide organizations the flexibility and scalability to shorten product development cycles and enhance innovation without a large capital expenditure upfront.

Hence, for Indian companies to stay on top of the international competitiveness, there is a rising need of Cloud-based simulation solutions that will easily fit into an existing workflow and give Indian companies the flexibility to compete globally. India's Simulation and Test Data Management market is growing at a CAGR of 15.8% during the forecast period.

The growing need for regulatory compliance in the United States is driving the demand for secure test data management solutions. Sectors like healthcare, finance, and defense face strict data security laws, requiring comprehensive systems to handle and protect confidential information.

As such, the government has pushed for compliance with regulatory standards, highlighted data sovereignty, emphasized data security and undertaken initiatives to adopt beneficial cloud use while adhering to regulations.

As proven by recent reviews, cloud computing in relation to data sovereignty can be very spicy. Thus, organizations are now focused on tool-based test data management solutions that can not only ensure compliance but also provide extra security measures against data theft.

This continues the pattern of USA consulates and embassies implementing more robust secure data management systems in order to keep up with the changing regulatory framework in the USA is anticipated to see substantial growth in the Simulation and Test Data Management market significantly holds dominant share of 79.2% in 2025.

The section provides detailed insights into key segments of the Simulation and Test Data Management market. Among these, Aerospace & Defense is growing quickly and making prominent advancements. The Test Data Simulation Software hold dominant share.

More and more aerospace and defense companies are integrating simulation and test data management solutions into their businesses to improve operational efficiency and align with competitive pressures. This is driven by the increasing need for advanced modeling and simulation tools, which can help accurately model complex systems and scenarios as an alternative to expensive physical prototypes and live testing.

Digital engineering and virtual simulation are recognized tools by the USA Department of Defense (DoD) as vital for modern warfare. DoD 2023 Data, Analytics, and AI Adoption Strategy highlights the importance of robust data management and simulation capabilities that enable better informed decision-making and operational readiness.

Developed post the publication of the DoD 2020 Strategy for Data and Artificial Intelligence, this strategy articulates how the Department can leverage advanced data analytics and AI to deliver operational superiority and critical warfighting capabilities, while emphasizing the crucial role that test and simulation data management play in realising these objectives.

That the DoD remains focused on upgrading its digital infrastructure reflects the rapid increase in the use of advanced simulation tools across aerospace and defense sectors. Looking ahead, advanced simulation and test data management solutions will be imperative as these sectors evolve, catapulting the organizations that adopt them to new innovations enabling them to continue leading the industry based on technological superiority. Aerospace & Defense grows at a substantial CAGR of 14.8% from 2025 to 2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Aerospace & Defense (Industry) | 14.8% |

Test data generation software became the major contributor making up the highest share in the simulation and test data management market in terms of value over the period of time. This advantage is largely due to the software's capability to produce accurate and dependable virtual models, allowing organizations to perform extensive testing without physical prototypes.

These types of capabilities are invaluable in sectors, such as automotive, electronics, and high-tech industries, where ever-faster iterations and faster time-to-market is critical.

Test data simulation software enables organizations to simplify development processes, cut costs, and improve product quality owing to their flexibility and scalability. With a significant focus on digital transformation across industries and these industries looking to optimize their testing methodologies with smart test data simulation software, the dominance of test data simulation software to the end result is expected to further strengthen the position in the market. Test Data Simulation Software are projected to dominate the Simulation and Test Data Management market, capturing a substantial share of 42.3% in 2025.

| Segment | Value Share ( 2025 ) |

|---|---|

| Test Data Simulation Software (Solution) | 42.3% |

The global Simulation and Test Data Management Market Competitive Landscape for each chapter, including the following companies. Business turns their goal to innovation, automation, and AI-driven solutions to improve efficiency and minimize testing costs. It is a highly competitive market where players are distinguished on the basis of scalability, cloud integration, and real-time data analytics. Key challenges for market participants continue to be regulatory compliance, cyber security concerns and integration into existing IT ecosystems.

Industry Update

The Global Simulation and Test Data Management industry is projected to witness CAGR of 12.1% between 2025 and 2035.

The Global Simulation and Test Data Management industry stood at USD 905.2 million in 2025.

The Global Simulation and Test Data Management industry is anticipated to reach USD 3,236.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.2% in the assessment period.

The key players operating in the Global Simulation and Test Data Management Industry K2View, DATPROF, Avo iTDM, Informatica Test Data Management, CA Test Data Manager, Delphix, IBM InfoSphere Optim Test Data Management, Parasoft Virtualize, Tonic, Bitwise Test Data Management.

In terms of solution, the segment is divided into Testing Systems, Test Data Simulation Software and Services.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise Size and Large Enterprise.

In terms of Industry, the segment is segregated into Healthcare, Aerospace & Defense and Automotive.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.