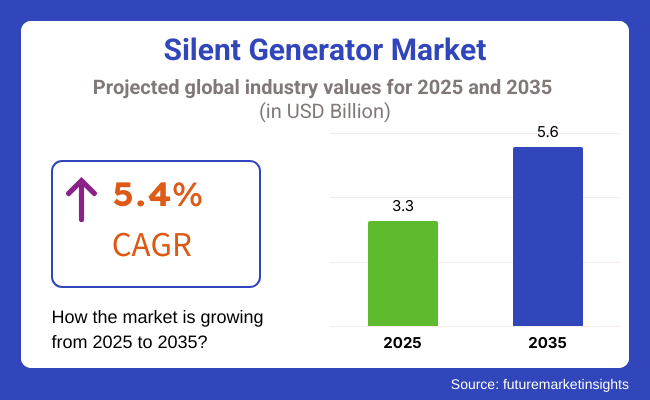

As per FMI analysis, the market is expected to reach USD 3.3 billion in 2025 and grow to approximately USD 5.6 billion by 2035, at a CAGR of 5.4% throughout the forecast period. This is a result of the growing noise pollution regulatory framework, the problem of the frequent power outages, and the need for the power supply to be guaranteed in urban areas.

Moreover, with the increasing shift to off-grid energy solutions, the demand for the generators has continued to grow while the investments in 'smart' infrastructure have additionally proven that companies require these generators. The switch to hybrid and conventional generators is at a stage where resellers are selling low emission, fuel-saving and inverter-based models that comprehend both the latest demands of law and the preference of the consumer.

The rapid advancement in city areas and the cranking up of the essential infrastructure being it houses, stores, and manufacturing plants push the silent generator market to grow. The rise of the silent generator market is attributed to various primary drivers like the heightening demand for continuous power supply, the acceleration of urban life and innovation in noise reduction technologies.

With power failures happening frequently along with a growing dependency on electrical power, the generators that are nearly invisible to the human eye have turned into a must for households, businesses, and industries. The fact that they can work with the lowest possible noise is a huge advantage for their utilization in hospitals, hotels, offices, or data centers where a quiet environment is mandatory.

The implementation of stringent noise pollution regulations was the other driving force in the growth of this market especially in urban places where traditional generators are banned due to their very high noise level. Moreover, the telecom sector on the rise of silent generators used in automated constructions as well as duty off-grid locations has accelerated demand.

The increase in hybrid generators, which is the combination of battery storage with fuel-based generation, is making production more effective and less toxic, consequently, it is more appealing to eco-friendly customers.

Improvements in fuel efficiency and alternative energy resources, for instance, biogas and solar-hybrid generators, are also responsible for the advent of such vehicles in the market. Besides, the burgeoning investment in infrastructure development, particularly in developing countries, is what is fueling the sales of these backup power solutions. With the focus on energy security and completely noise-free operations, it is very likely that the silent generator market will continue to expand over the next few years.

Explore FMI!

Book a free demo

Between 2020 and 2024, the silent generator market showed steady growth, driven by increasing power demands, urbanization, and noise-free backup solutions. Rising concerns over noise pollution in residential areas, hospitals, and commercial spaces fueled the adoption of quiet, fuel-efficient generators. Besides, insufficient grid power in emerging countries, industrialization, and rising data centers kept market demand constant.

Government policy emphasis on improving power infrastructure, T&D expansion, and sustainable power solutions continued to influence the industry. Subsequently, low-emission, fuel-flexible, and AI-optimized generators emerged as trends in residential, industrial, healthcare, and smart city applications. Between 2025 and 2035, technological innovation and sustainability are poised to drive the market expansion.

Hydrogen fuel cells, solar-integrated backup systems, and battery storage options replace generators that work on diesel. Stringent environmental regulations will boost low-carbon and hybrid generator model adoption. As smart grids expand, generators will seamlessly integrate into decentralized energy systems, ensuring continuous and green power supply.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased power consumption as a result of urbanization and industrial growth fueled silent generator uptake in residential, commercial, and data center use. | Microgrids and decentrally powered networks are working enablers of energy efficiency. |

| Governments spent on power grid upgrade but power outages and grid collapse in emerging economies continued to fuel backup generator demand. | Smart grid implementation, load control through AI, and battery storage systems yield less of the need as a traditional generator does, thereby, boosting, in turn, the adoption of electrolytic and hybrid silent generators. |

| Old power grids and T&D infrastructure in emerging economies were so wasteful that they could not help frequent power outages, which have now prompted industries to depend on more silent diesel and gas generators. | Next-gen T&D infrastructure with AI-based predictive maintenance and digital monitoring reduces grid failures, promoting low-noise, and energy-efficient backup power solutions such as fuel cell-powered generators. |

| Thegenerators that were mostly available were either diesel or gas-powered; however, hybrids were beginning to be installed in some off-grid sites and smart homes. | Expansion of hybrid silent generators (solar + battery + fuel cell) for grid-independent power. Growth in hydrogen-powered silent generators for low-carbon, high-efficiency backup power. |

| Modifications in noise-barrier casings, intelligent inverters, and long-distance monitoring had a good part to play in the effectiveness of generators. Growth was also seen in IoT-based performance monitoring. | AI-driven real-time diagnostics, machine learning-based fuel optimization, and self-regulating noise control systems enhance generator performance. Rise of solid-state battery-integrated generators. |

| Silent generators were an essential spare power source in hospitals, IT parks, and data centers since these places required high power reliability. | Battery-integrated silent generators, hydrogen fuel cell backup systems, and AI-driven predictive maintenance solutions dominate critical power infrastructure applications. |

| The growth was primarily spurred by the increase in power outages, the urban population growth, and the increase in commercial areas. The preference to produce less noisy, fuel-saving generators also saw demand rise. | Market expansion driven by AI-powered smart backup systems, net-zero emission goals, and decentralized energy networks. Adoption of low-maintenance, noise-free, and emission-free power solutions accelerates. |

Availability of hybrid generators with lithium-ion battery integration: These generators collect excess energy, store it in batteries, and use it when there is low demand, thus reducing fuel consumption and noise levels.

The introduction of graphene-based batteries is another area of research focused on this improvement, which some of the advancements in energy density, charging time, and battery life all fall under. Of course, batteries enhanced with graphene can charge five times faster than the traditional lithium-ion batteries. Graphene could be used in batteries designed for fast power restoration in critical situations.

Silent generators, which boast advanced sound reduction capabilities, are now being outfitted with AI-driven active noise cancellation (ANC) systems that analyze surrounding noise before producing counter-frequency waves to minimize sound output. AI-enabled real-time loading adjustments can further optimize generator performance by automatically calibrating the machine output as per the demand. This is especially useful in hospitals where low noise levels are important to provide adequate patient care.

As emission control laws get stricter, hydrogen fuel-cell-powered generators are entering the stage as a zero-emission solution. These generators only produce water vapor as a byproduct, operating much quieter. Japan, Germany and South Korea, among others, are pouring millions into hydrogen infrastructure to facilitate clean energy transitions.

Moreover, IoT-enabled sensors are also being integrated into generators to enable remote monitoring and tracking of real-time parameters such as fuel consumption, vibration levels, and noise output. Applying AI to Data for Predictive Maintenance Geolocation sensor data can be processed with AI to predict equipment failures, with the goal of scheduling preventive maintenance tasks ahead of time to minimize downtime and cuts costs.

Demand for compact, soundproof generators is rising in our urban sections because of noise regulations. Generators for hospitals, commercial buildings, and residential buildings must contain multi-layered enclosures and vibration-dampening mounts to ensure that noise levels remain at or below 50-55 dB (A).

Solar hybrid generators are emerging as they utilize a combination of solar panels, battery storage, and fuel-based power source to optimize efficiency. India, Australia and certain countries in Africa have tax benefits and subsidies for renewable energy solutions which makes these systems cost- effective for the off grids. These systems are generally 40-60% fuel saving systems.

| Region | Trend |

|---|---|

| North America (USA & Canada) | High demand for low-emission, hybrid generators to comply with EPA noise and emission standards. |

| European Union (EU) | Strict EU Stage V regulations encourage the adoption of hydrogen fuel-cell and solar hybrid generators. |

| China | Investments in industrial generators for manufacturing and urban power backup solutions. |

| Japan | Earthquake-silent generators with AI auto-restart. |

| India | Rural electrification projects can adopt solar hybrid generators with government subsidies. |

| Middle East (UAE, Saudi Arabia) | Increasing demand for silent diesel generator for hot climate applications with advanced cooling systems |

| Africa (South Africa, Nigeria) | Demand for off grid solar generators is rising due to the frequent power outages. |

The three-phase generators are the ones ruling the market; they are efficient and handle heavy power needs. Such generators are highly useful in industries, commercial areas and infrastructures where the uninterrupted power supply (UPS) is an imperative.

Because they provide more balanced power distribution and lower transmission losses, three-phase generators are commonly used in buildings, hospitals, data centers, and enterprises. They are also particularly well-suited for urban areas that are sensitive to noise because they generate less noise than conventional diesel generators

These generators provide power for HVAC systems, elevators and critical IT infrastructure in corporate offices and high-rise buildings. The increasing use of three-phase generators in noise-sensitive locations and urban areas is anticipated to further propel demand.

Since these uninterruptible power supplies are used in mid-sized manufacturing facilities, hospitals, retail establishments, and corporate offices, the 100kVA to 499kVA range is the most in-demand among the various power ratings.

These generators are ideal for continuous and standby applications because they combine the greatest features of both fuel efficiency, power output, and noise reduction. This range of electricity is used by life-support systems, diagnostic equipment, and emergency lighting in hospitals and other medical facilities to prevent operational interruptions.

Similar to this, these generators are used by telecom towers and data centers to protect IT infrastructure and stop data loss during blackouts. Also, their ability to comply with noise pollution standards gives further credence to their use in urban areas, rendering this power range ideally suited to today's commercial & industrial uses.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7% |

| UK | 6.9% |

| Germany | 6.8% |

| Japan | 6.8% |

| South Korea | 6.7% |

The USA market is growing because there is greater demand for standby power in health, telecommunications, and data center fields. Extreme climate conditions in terms of hurricanes and winter storms would result in blackouts and consequently provide support for standby power solution demand.

Also, augmented demands for backup power at homes through increasing number of households as well as house office outlets raised residential demands. FMI is of the opinion that the USA silent generator market is set to register 7% CAGR during the study period.

Growth Factors in the USA

| Key Factors | Details |

|---|---|

| Industrial Demand | Sectors like healthcare and telecommunications require uninterrupted power supply. |

| Infrastructure Development | Ongoing urban expansion and construction activities demand reliable power sources. |

| Residential Growth | Rising smart home adoption and remote work drive demand for home backup power. |

Tight noise controls and the transition to clean power sources are driving the UK market for quiet generators. The commercial sector, including hotels, hospitals, and venues, is more and more using quieter backup power options to comply with noise pollution laws.

The country's old power infrastructure and the transition to clean energy sources have also driven demand for secure backup power. FMI is of the opinion that the UK industry is set to experience 6.9% CAGR during the forecast period.

Growth Factors in the UK

| Key Factors | Details |

|---|---|

| Noise Regulations | Government policies promote the adoption of quiet power solutions. |

| Urbanization | Densely populated areas require low-noise backup power. |

| Renewable Energy Transition | Increased reliance on renewables necessitates stable power backups. |

Germany's market is growing due to expansion of commercial buildings, industrial automation, and data centers. Low-emission, fuel-efficient generators are preferred due to stringent environmental requirements.

Uncertain trends in solar and wind power, two of the largest contributors to renewable power, have also fueled backup power system demand to maintain the reliability of the grid in mission-critical environments. FMI is of the opinion that the German industry is set to expand at 6.8% CAGR during the forecast period.

Growth Factors in Germany

| Key Factors | Details |

|---|---|

| Sustainability Initiatives | Emphasis on eco-friendly and energy-efficient power solutions. |

| Industrial Growth | Expanding data centers and automation industries drive demand. |

| Energy Transition | Reliance on renewable energy increases demand for backup power. |

The seismic vulnerability of Japan to typhoons, earthquakes, and other natural disasters has generated enormous demand for silent and dependable power backup equipment. Commercial and industrial facilities are adopting advanced generator technologies to reduce downtimes during power outages.

Densely populated urban areas and stringent noise control regulations also drive the application of quiet generators in residential and commercial settings. FMI is of the opinion that the Japanese market is set to witness 6.8% CAGR during the study period.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| Disaster Preparedness | Frequent earthquakes and storms increase backup power demand. |

| Advanced Technology | Innovations in energy storage and noise reduction enhance efficiency. |

| Urban Density | High population density necessitates low-noise power solutions. |

South Korea's dynamic industrialization and urbanization necessitated quiet generators, particularly for high-technology manufacturing and business parks. Green energy alternative requirements and master urban plans created the demand for low-noise, low-fuel backup power alternatives.

Increasing awareness of the instability of the grid and unplanned outages continue to drive demand for reliable backup solutions. FMI is of the opinion that the South Korean market is expected to register 6.7% CAGR during the forecast period.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Industrial Expansion | Growth in manufacturing and tech industries increases power needs. |

| Urban Development | Smart city initiatives require silent and efficient power solutions. |

| Grid Reliability Issues | Increasing demand for stable backup power due to unexpected blackouts. |

The market growth is steadily rising due to the increasingly large demand for uninterrupted power supply in various sectors such as healthcare, telecommunications, and manufacturing. This demand is at its peak in certain regions with an unstable power supply or outages occurring frequently.

Furthermore, the expanding manufacturing sector, especially across the Asia-Pacific, has raised the need for power solutions that are not only reliable, whereas; the technological advancements have also given rise to generators that are very efficient and quiet, these attributes have in turn stimulated the market growth.

The market players include Cummins Inc., Rolls-Royce Holdings, Atlas Copco AB, Generac Power Systems, and Honda Motor Co., Ltd.; these companies are on product innovations, partnerships, and geographical expansions to better their market presence. For instance, in January 2021, Cummins Inc. launched its QG 2800i and 2500i RV inverter generators that are aimed at the recreational vehicle market and are 60% quieter than classical generators.

Similarly, in November 2020, Rolls-Royce announced investments worth up to USD 13.9 million to expand its power systems business unit, including a new R&D building and the expansion of its manufacturing plant in Minnesota, USA. Such initiatives show how currently, the companies in the market are vehemently investing in research and development, putting forth advanced, quieter, and more efficient power solutions that are adapted to the ever-evolving needs of consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cummins Inc. | 14-16% |

| Caterpillar Inc. | 12-14% |

| Kohler Co. | 10-12% |

| Generac Holdings Inc. | 8-10% |

| Atlas Copco AB | 6-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cummins Inc. | Provides low-noise diesel and gasoline-powered generators for industrial and commercial use, utilizing advanced acoustic enclosures. |

| Caterpillar Inc. | Manufactures soundproof diesel and hybrid generators in emphasis on fuel efficiency, emissions compliance, and use outdoors in harsh conditions. |

| Kohler Co. | Expert in silent standby generators for home and business backup power, providing low vibration and improved soundproofing. |

| Generac Holdings Inc. | Creates inverter-based and silent hybrid generators that meet home, small business, and event power requirements. |

| Atlas Copco AB | Provides super quiet portable and industrial generators, ideal for construction, telecom towers, and emergency power usage. |

Cummins Inc.

Cummins Inc. is a global leader in generator manufacturing, offering low-noise diesel and gas generators for commercial, industrial, and residential power solutions. The company integrates advanced noise-reducing enclosures and vibration isolation systems, ensuring quiet operation in sensitive environments like hospitals and data centers. Cummins also invests in hybrid generator technology to improve fuel efficiency and environmental sustainability.

Caterpillar Inc.

Caterpillar Inc. produces silent diesel and hybrid generators, emphasizing fuel efficiency and emissions compliance. The company designs rugged and durable soundproof generators for construction, mining, and heavy industrial applications. Caterpillar’s advanced sound attenuation technology ensures quiet operation, even in high-power output models.

Kohler Co.

Kohler Co. specializes in residential and commercial standby generators, offering low-vibration, soundproofed units with automatic backup power features. The company focuses on innovative engine technology, noise reduction, and long-term durability, making it a key player in the premium home backup generator segment.

Generac Holdings Inc.

Generac Holdings Inc. is a leader in inverter and hybrid generators, targeting homeowners, small businesses, and outdoor event power needs. The company’s quiet generator technology includes variable-speed engines and smart power management systems, ensuring low noise levels while maximizing fuel efficiency. Generac has expanded into battery-integrated generator solutions for off-grid and hybrid energy applications.

Atlas Copco AB

Atlas Copco AB supplies super silent portable and industrial generators, designed for construction sites, telecom towers, and emergency backup power. The company’s acoustic enclosures and high-performance muffler systems minimize noise emissions, ensuring compliance with strict urban noise regulations. Atlas Copco also offers diesel and hybrid generators, integrating smart monitoring and remote control features.

Other Key Players

The estimated market valuation for 2025 is USD 3.3 billion.

The market is estimated to reach USD 5.6 billion by 2035.

Rolls-Royce Holdings, Atlas Copco, Generac Power Systems, Honda, Mahindra Powerol, Kirloskar Oil Engines Ltd. (KOEL), Multipurpose Inc., Greaves Cotton Ltd., Yanmar, Huu Toan Corporation, and Himoinsa are the key companies.

Three-phase generators are widely used.

The USA slated to grow at 7% CAGR during the study period, is expected to be a key growth hub.

In terms of sound level, the market is divided into silent and super silent.

By type, the market is classified into portable and stationary.

With respect to phase, the market is divided into single phase and three phase.

With respect to power rating, the market is classified into upto 25kVA, 25kVA-49kVA, 50kVA-99kVA, 100kVA-499kVA, and above 500kVA.

By fuel, the market is divided into diesel, natural gas, and others.

By application, the market is divided into standby and peak and prime mover.

By end user, the market is divided into residential, commercial, and industrial.

The regional segmentation of the generator market includes North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Carbon Capture and Storage (CCS) Market Growth - Trends & Forecast 2025 to 2035

Swellable Packers Market Growth – Trends & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

CNG Tanks Cylinders Market Growth - Trends & Forecast 2025 to 2035

Green Building Materials Market Analysis by Type, Application, End-user and Region: Forecast for 2025 and 2035

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.