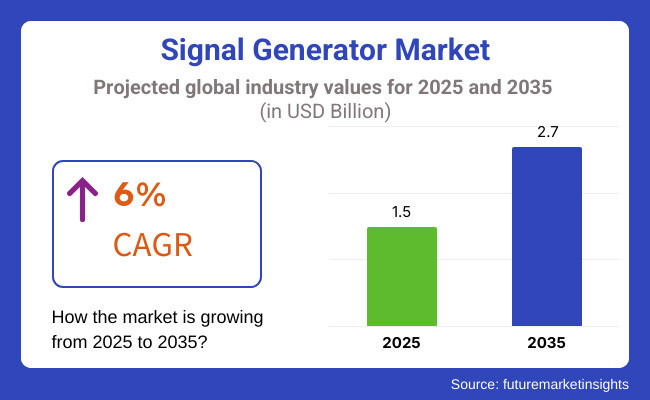

The global signal generator market is set to register USD 1.5 billion in 2025. The industry is poised to reach a 6% CAGR from 2025 to 2035, witnessing USD 2.7 billion by 2035.

The industry is mainly driven by the growth of wireless communication networks, radar and satellite technologies, and by the increase in R&D expenditure on next-generation electronics. They play a key role in mirroring real-world signals, for seamless operation throughout complex RF and microwave circuits. The electronics component decreases in size, which fuels the constant need for smaller-size, and high-frequency product.

This industry entails devices which can generate electronic signal for the purpose of testing, diagnosing, and development in some or all its applications such as telecommunications, aerospace, defense, and electronics manufacturing. Besides, they play an essential role in evaluating wireless communications and radar systems, as well as semiconductor measurements.

The advent of 5G networks, IoT devices, and next-generation navigation systems has led to an increasing demand for high-precision, multi-channel, and software-defined products for performance validation and R&D capabilities in industries.

The industry is experiencing technological innovations, driven by high-speed, software-defined, and multi-function generators that enhance testing capabilities. The integration of AI-based automation with the digital signal processing paradigm is allowing to draw information from signals accurately and efficiently.

The rising development of 5G infrastructure, autonomous vehicles, and space exploration programs further drives the need for these generators that enable high-frequency and broadband test applications.

Some of the largest users of these generators are aerospace and defense, utilizing them to create radar systems, evaluate electronic warfare, and test satellite communications. Semiconductor manufacturers and telecommunication service providers rely on them to evaluate and optimize performance to meet the demands of increasingly complex electronic devices.

The industry is also driven by the increasing complexity of wireless technologies and the expansion of IoT networks, which require manufacturers to develop flexible, cost-effective, and scalable solutions.

The Industry is expected to grow consistently with the continuing development of RF technology, Software engineering instrumentation, and AI-enabled analytics. As speed, precision, and real-time testing techniques take precedence in various industries, these generators will remain a crucial element in today’s electronic design and verification workflows.

Emerging advanced communication and navigation systems ensure that technology will continue to evolve and power the next generation of wireless and electronic systems.

Explore FMI!

Book a free demo

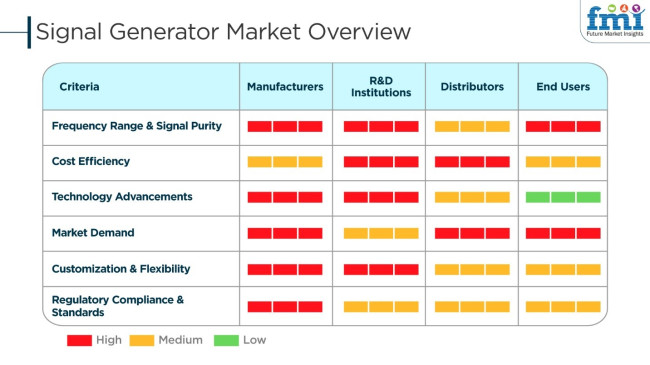

The industry mostly depends on the movement of wireless communication, and aerospace & defense applications, and semiconductor testing. Manufacturers focus on high-frequency preciseness, low-phase noise, and modulation flexibility to meet the demands of complex testing environments.

R&D institutions target customizable generators to facilitate the development of standard wireless signals like 5G, Wi-Fi 7, and beyond. It is the role of distributors to ensure that industries in need of RF and microwave development receive the available cost-effective and expandable solution.

The companies lifting telecom, electronics, and automotive sectors in a big way as end users demand dependable, top-notch performers that these generators come with user-friendly interfaces, wide frequency ranges, and automation capabilities. The main criteria for purchasing decisions include frequency stability, modulation capabilities, scalability, and cost efficiency.

With the increase in demand for advanced radar systems, IoT devices, and high-speed digital testing, businesses are becoming more AI-driven automation, are moving towards a cloud-based calibration, and providing software-defined testing solutions, thus making improvements in accuracy and operational efficiency.

| Company | Keysight Technologies |

|---|---|

| Contract/Development Details | Keysight secured a multi-year contract with a leading telecommunications company to provide high-frequency signal generators for 5G and RF testing applications. |

| Date | March 15, 2024 |

| Contract Value (USD million) | Approximately USD 70 - USD 80 |

| Renewal Period (Approx.) | 5 years |

| Company | Rohde & Schwarz |

|---|---|

| Contract/Development Details | Rohde & Schwarz agreed with a global aerospace and defense contractor to deliver advanced products for radar system testing and electronic warfare simulations. |

| Date | October 10, 2024 |

| Contract Value (USD million) | Approximately USD 80 - USD 90 |

| Renewal Period (Approx.) | 6 years |

| Company | National Instruments (NI) |

|---|---|

| Contract/Development Details | NI expanded its signal generator portfolio through a strategic partnership with a semiconductor manufacturer, focusing on precision waveform generation for chip design validation. |

| Date | October 10, 2024 |

| Contract Value (USD million) | Approximately USD 60 - USD 70 |

| Renewal Period (Approx.) | 5 years |

| Company | Anritsu Corporation |

|---|---|

| Contract/Development Details | Anritsu announced a collaboration with a top-tier research institution to develop high-performance signal generators for quantum computing and next-generation wireless communication research. |

| Date | January 5, 2025 |

| Contract Value (USD million) | Approximately USD 50 - USD 60 |

| Renewal Period (Approx.) | 4 years |

From 2020 to 2024, the industry for these generators was growing steadily as demand rose in the telecommunications, aerospace, defense, and automotive industries. The swift rollout of 5G networks created a surge in demand for high-frequency products for testing and validation purposes. The development of radar and satellite communication technologies also boosted industry growth.

Also, the emergence of IoT and smart devices generated increasing needs for accurate signal generation in R&D and production environments. However, high costs of equipment and complexities in calibration created barriers for small businesses.

From 2025 to 2035, there will be technology breakthroughs in quantum computing, AI, and wireless communication. The 6G technology is under development, and advanced products with high accuracy will be needed. Automation using AI will improve the efficiency of testing, which will decrease time-to-market for electronic devices.

Moreover, growing investments in defense electronics and autonomous vehicle testing will further bring innovation, which will ensure a continued demand for high-performance signal generation solutions.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tolerance to unwanted signals, such as noise and spurious signals, and many others improving precision from RF spectrum tests. | Autonomous AI-enabled compliance assists in spectrum monitoring in real-time, adjusting to frequencies on the fly, and correcting signals dynamically to keep up with changing global regulatory standards. |

| The rollout of 5G networks made high-frequency products increasingly needed for mmWave band and network component testing. | The hybrid AI and signal generator platform enables real-time and autonomous testing of 6G and THz communication toward guaranteeing ultra-fast and interference-free network performance. |

| For distant reconfiguration and high costs, the test engineers favored software-defined products. | AI-enhanced cloud-connected products with predictive self-calibration upgrade accuracy, durability, and adaptive performance under ever-changing real testing environment conditions. |

| Military and defense exploited products primarily in radar testing, electronic warfare simulations, and secure communications systems. | AI-driven and quantum-resistant products reinforce secure military communications, enhanced radar accuracy, and next-gen space communication testing. |

| By providing AI-driven automation in products, human interaction in RF testing has been minimized, leading to improved efficiency and accuracy. | AI-driven, self-optimizing products modify test conditions in real-time, maximizing performance during semiconductor, automotive, and IoT testing based on data analysis. |

| The industry started implementing multi-channel generators for synchronized signal simulation to improve the testing throughput in complex RF environments. | Real-time adaptive signal shaping based on AI and multi-domain signal generation is used to enhance multi-user MIMO, AI-guided waveform generation, and space-time coding applications. |

| Due to their use of highly accurate products for experiments in quantum computing, photonics, and other scientific undertakings of the future, these researchers have been hard at work. | AI-enhanced quantum products bring fidelity to qubit manipulation while enhancing the precision of quantum communication, cryptography, and computing. |

| The products were key in testing automotive radar, Vehicle-to-Everything (V2X) communications, and electronic test power for EVs. | With real-time AI-simulation capability, the products assist with all sensor testing of autonomous vehicles, next-gen powertrain testing of EVs, and cybersecurity assessment of connected vehicles. |

| Compact battery-operated products were in demand by engineers for field testing and mobile RF applications. | AI-enhanced and super-miniaturized products with real-time cloud intercommunication support edge testing for IoT, smart city infrastructure, and space-based communication. |

| Manufacturers devoted their attention to energy-efficient designs and environmentally friendly materials to limit the power use of the high-frequency products under development. | AI enhances power management and advanced techniques for signal modulation to ensure energy-efficient and sustainable high-performance testing solutions across industries. |

The industry has some major threats, such as technical shrinkage, approval from regulatory bodies, supply chain interruption, cybersecurity problems, and industry rivalry. Among the most important threats are the rapid technological leaps in the domains of wireless communication, 5G, and aerospace applications. Companies that disregard R&D and fail to introduce newfangled goods to the industry play a major part in their depreciation in the high-speed sector.

These generators also face regulatory hurdles as they are required to comply with stringent frequency spectrum regulations, electromagnetic interference (EMI) standards, and safety certifications mandated by the governing bodies, including the FCC, CE, and ITU. Noncompliance can lead to the imposition of legal penalties, withdrawals of the product, and being barred from the industry.

Supply chain problems, which are the aftermath of inadequate raw materials, semiconductor deluges, and fluctuating geopolitical scales, can easily stall the production and distribution of these generators. The establishment of sturdy relationships with suppliers, exploration of different sourcing strategies, and promotion of local manufacturing are the key steps needed to address such issues.

As software-defined products are being prescribed increasingly, cybersecurity threats come to mind as one of the first concerns. Data exposure, wrong equipment operations, or poorly designed test results could emanate from unauthorized access or the software being attacked endlessly. The emphasis is on secure firmware updates, employing encryption, and implementation of access control measures.

Finally, fierce industry competition from both big names in the field and fresh industry entrants is the key drive for manufacturers to stand apart. A good way to stay in the battle for industry share is by providing clients with custom-made, high-frequency, multi-functional, and software-integrated generators.

RF (Radio Frequency) products have extensive applications in most industries, especially telecommunications, broadcasting, and electronics testing. They provide high-frequency signals that are required for communication systems testing and development, such as mobile phones and satellite communications equipment.

RF products are greatly versatile and can be used to simulate a vast array of signals, thus playing a fundamental role in testing the performance, reliability, and compatibility of RF components and systems. They are widely applied in research and development, manufacturing, and maintenance of RF equipment.

Test application is the biggest application of products, and this is also because products are key in confirming the functioning, precision, and efficiency of electronic components and systems. The products come in handy for simulating many signals that will be used during actual usage in the system or device to ascertain how well a system can respond under varying situations.

This encompasses signal integrity testing, response to different frequencies, and performance under different modulation schemes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

| China | 9.3% |

| Germany | 8.1% |

| Japan | 8.4% |

| India | 9.6% |

| Australia | 8.0% |

The market growth can be credited to growing demand from the USA industry owing to the usage of sophisticated test and measurement equipment in the defense, aerospace, and telecom industries. High-performance generators are applied to wireless communication, frequency modulation, and radio tests. The demand for 5G equipment, radar, and IoT testing is also driving the industry. FMI forecasts the USA industry to grow at an 8.7% CAGR during the study period.

USA Growth Drivers

| Key Drivers | Details |

|---|---|

| 5G and Wireless Technology Growth | Testing and support by these generators and RF components are included. |

| Aerospace and Defense Technologies | Integration of radar and electronic warfare systems for high reliability and precision. |

| IoT and Semiconductor Testing Growth | The sensors, connectivity modules, and chipsets must be tested on these generators. |

The Chinese industry will grow with massive investment for semiconductor testing, research in 5G, and AI studies. It has the most widespread electronic manufacturing space anywhere in the world. Additionally, the demand for consumer electronics, car radar systems, and aerospace communications boosted the uptake of these generators. Besides this, the expanding semiconductor industry is further escalating market growth.

China's Growth Drivers

| Key Drivers | Details |

|---|---|

| Government Support for Semiconductor Advancement | Policy-friendly are high-frequency test solutions. |

| 5G and IoT Network Evolution | Wireless technology deployments on mega-scale fuel demand. |

| AI-Driven Signal Processing Innovations | AI-leveraged management of RF test innovations to high performance. |

Industrial automation, car radar testing, and high-precision instrumentation propel Germany's industry. Germany, the world's engineering powerhouse, is investing in vehicle protection systems, telecommunication network infrastructure, and IoT technology signal generation technology. The sector also requires high-frequency test equipment to enable efficient and precise manufacturing. FMI has estimated the German industry to grow with an 8.1% CAGR during the forecast period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Automotive Industry Expansion | These generators are required by autonomous cars and advanced driver-assistance systems. |

| Need for RF Test Solution on the Increase | Microwave and millimeter-wave generators are used to gain better measurement. |

| Telecommunication and Satellite Technology | Increased investment in satellite and 5G technology opens up more business opportunities. |

The Japanese industry is ruled by high-frequency test equipment, semiconductor testing, and 5G launches. The technologies are used in Japan's wireless communications research applications, high-speed digital testing, and space guidance applications. Japan's domain of interest in precision engineering and miniaturization of electronic devices leads to the creation of small but high-precision generators.

Japan Growth Drivers

| Key Drivers | Details |

|---|---|

| Breakthroughs in 5G and Communications Technology | The nation heads next-generation wireless network testing based on RF in Japan. |

| Aerospace and Navigation System Design | Satellite and GPS ventures are made possible through miniature generators. |

| Semiconductor and MEMS Breakthroughs | Miniature products allow chip testing and manufacturing through chip verification and production. |

Due to increased investment in 5G infrastructure, RF testing, and semiconductor fabrication, India's industry is fueled by robust growth. The government's 'Make in India' initiative facilitates local production, and digitalization creates a need for efficient generators. Telecommunication network penetration and intelligent devices grow at a higher pace. India's industry will register a 9.6% CAGR during the forecast period, as indicated by FMI.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Assistance by Telecommunication and Defense | Supported local production of RF test equipment. |

| Development of Semiconductor and IoT Industry | Growing use in chipset tests. |

| Development of Automotive and Aerospace Testing | Growth in usage in car radar and avionics system tests. |

The Australian industry is expanding with research and development in defense electronics, telecommunication equipment, and scientific research expenditure. Telecommunication, aerospace, and energy industry markets heavily utilize these generators in measurement accuracy and spectrum analysis. Australian alignment with technological advancements generates innovative RF and microwave signal solution requirements.

Australia Growth Drivers

| Key Drivers | Details |

|---|---|

| Government Defense and Communications R&D Expenditure | Rising expenditure on satellite and radar technologies. |

| IoT and AI Solution Deployment | Rising deployment of automated and test smart devices. |

| High-Accuracy Measurement Device Demand | Test demand at high frequency is driving adoption. |

The global industry is on the rise owing to the increased application for accurate testing and measurement solutions in varied sectors such as telecommunications, aerospace & defense, electronics manufacturing, and automotive. The tremendous growth in 5G technology, radar systems, and IoT applications further fuels the demand for high-performance generators with wider frequency ranges, advanced modulation capabilities, and increased software-defined functionalities.

Leading companies investing heavily in advanced signal generator technologies, such as high-frequency, multi-to-multichannel, and AI-powered waveform synthesis, include Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Tektronix, and National Instruments. Besides that, these companies are upping their stakes in the industry with innovative products, strategic partnerships, and acquisitions.

Specialized and cost-efficient generator solutions for novel applications such as millimeter-wave testing and radar for automotive purposes, helping emerging and niche vendors to get a foothold. As industries keep demanding accuracy, real-time signal processing, and seamless integration into automated test setups, the companies that will remain competitive as the market continues transforming will be those with a strong emphasis on innovation and software, as well as the modular design of test equipment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Keysight Technologies | 20-25% |

| Rohde & Schwarz | 15-20% |

| Anritsu Corporation | 10-15% |

| Tektronix | 8-12% |

| National Instruments | 5-10% |

| B&K Precision | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Keysight Technologies | High-performance RF and microwave products for wireless communication and radar applications. |

| Rohde & Schwarz | Advanced vector products for 5G, IoT, and aerospace testing. |

| Anritsu Corporation | Wideband signal generation solutions for wireless infrastructure and semiconductor testing. |

| Tektronix | Multi-domain products for real-time signal analysis and electronic design validation. |

| National Instruments | Software-defined signal generation solutions for automated test systems and R&D. |

| B&K Precision | Affordable products for education, industrial, and general electronics testing. |

Key Company Insights

Keysight Technologies (20-25%)

Offering RF and microwave signal solutions, Keysight excels in providing high - or no-performance generators, thereby occupying first place in the industry. Likewise, the company's current position is strengthened by an increasing interest in next-generation wireless technologies, including 6G and AI-based test automation.

Rohde & Schwarz (15-20%)

Rohde & Schwarz develops advanced vector signal generation focused on telecommunications and aerospace applications. Continual innovations undertaken by this company on high-frequency signal testing and digital modulation solutions are helping to increase their industry shares.

Anritsu Corporation (10%-15%)

Anritsu provides wideband signal generation solutions for wireless infrastructure and semiconductor testing, and it is continuously extending its capabilities in mmWave and 5G testing solutions.

Tektronix (8%-12%)

Tektronix is engaged in multi-domain products for real-time signal analysis, electronics testing, and research applications. Its flexible signal-generation solutions make it a strong player in R&D and educational institutions.

National Instruments (5%-10%)

National Instruments provides software-defined signal generation solutions that suit fully automated test systems and high-precision R&D environments. Its modular approach increases adaptability in many industry applications.

B&K Precision (4%-8%)

B&K Precision has zeroed in on low-cost products for industrial, educational, and general electronics testing. The company is highly reputed for its reliability and affordability in low-to-mid-range test equipment.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 1.5 billion in 2025.

The industry is predicted to reach USD 2.7 billion by 2035.

India, slated to grow at 9.6% CAGR during the forecast period, is poised for the fastest growth.

Key companies include Keysight Technologies Inc., Rohde & Schwarz GmbH & Co Kg, National Instruments Corporation, Anritsu Corporation, Tektronix Inc., Teledyne Technologies Incorporated, B&K Precision Corporation, Fluke Corporation, Stanford Research Systems, Good Will Instrument Co. Ltd, and Yokogawa Electric Corporation.

The RF (Radio Frequency) signal generators are being widely used.

By product type, the industry is segmented into RF signal generators, microwave signal generators, arbitrary waveform generators, vector signal generators, and other product types.

By technology, the industry is segmented into global systems for mobile phones (GSM), code division multiple access (CDMA), wideband code division multiple access (WCDMA), long term evolution (LTE), and other technologies.

By application, the industry is segmented into designing, testing, manufacturing, troubleshooting, and other applications.

By end-user the industry is segmented into the communications sector, aerospace & defense sector, mechanical industry, chemical industry, healthcare sector, and other end users.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.