Shrink wrapping machines business is growing with organizations seeking efficient, safe, and esthetically pleasing packaging solutions. Increasing demand from food & beverages, pharmaceutical, personal care, and industrial companies has forced suppliers to develop fast-speed, automatic, and eco-friendly shrink wrapping solutions. Organizations are integrating smart sensors, quality control by artificial intelligence, and energy-efficient heat sources to offer better performance along with lower costs and waste.

Manufacturers are making shrink wrapping machines more efficient with smaller sizes, advanced sealing technology, and environmentally friendly shrink films to meet evolving regulatory and environmental demands. The industry is shifting towards completely automated, high-accuracy shrink wrapping machines to maximize packaging efficiency and reduce labor costs.

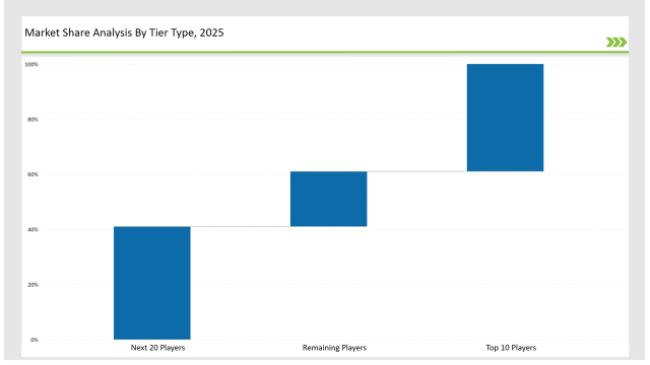

Tier 1 players, including Sealed Air, Krones, and Barry-Wehmiller, dominate 39% of the market with their high-performance packaging machines, huge R&D investments, and global supply chains.

Tier 2 players, including Texwrap Packaging, Douglas Machine, and Plexpack, hold 41% of the market with their cost-effective, customized, and industry-specific shrink wrapping solutions.

Tier 3 consists of regional and niche players who focus on small, energy-efficient, and specialty shrink wrapping machines with a 20% market share. They focus on localized production, high-speed automation, and green material integration.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Sealed Air, Krones, Barry-Wehmiller) | 19% |

| Rest of Top 5 (Texwrap Packaging, Douglas Machine) | 10% |

| Next 5 of Top 10 (Plexpack, Duravant, Eastey, Polypack, Smipack) | 10% |

The market for shrink wrapping machines serves multiple industries where tamper-evident, safe, and high-speed packaging is a necessity. Companies are developing sophisticated solutions to meet the growing need for automation and sustainability.

Producers are upgrading shrink wrapping machines with cutting-edge high-speed automation, eco-friendly materials, and state-of-the-art sealing technology. They are including AI-based defect detection monitoring systems to enhance quality control. Organizations are also developing modular shrink wrapping machines to deliver increased flexibility in production lines. Businesses are also adding sophisticated heat distribution techniques to improve sealing efficiency and reduce power consumption.

Shrink wrapping machines are undergoing transformation with the introduction of automation and sustainability. Companies are implementing AI defect detection, ultra-thin shrink films, and green heating technologies to enhance the packaging performance and reduce carbon footprints. Hybrid approaches to packaging, marrying shrink wrapping and protective packaging, are currently in demand to extend the shelf life of products. Various manufacturers are trying to commercialize recyclable shrink films in compliance with global environmental regulations. Furthermore, companies are also considering IoT-enabled shrink wrapping machines for predictive maintenance and real-time monitoring.

Technology suppliers should focus on automation, digital monitoring, and sustainable packaging materials to support the evolving shrink wrapping machines market. They should enhance machine connectivity with IoT-enabled tracking for improved operational efficiency. Additionally, suppliers must develop high-speed wrapping solutions that maintain precision while minimizing material waste. Partnering with e-commerce, food & beverage, and pharmaceutical companies will accelerate adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sealed Air, Krones, Barry-Wehmiller |

| Tier 2 | Texwrap Packaging, Douglas Machine, Plexpack |

| Tier 3 | Duravant, Eastey, Polypack, Smipack |

Leading manufacturers are advancing shrink wrapping technology with AI-powered quality control, sustainable films, and high-speed automation. They are integrating machine learning algorithms to optimize film application and reduce material waste. Additionally, manufacturers are developing high-speed, energy-efficient heat tunnels to enhance sealing quality while lowering power consumption.

| Manufacturer | Latest Developments |

|---|---|

| Sealed Air | Launched fully automated AI-driven shrink wrapping in March 2024. |

| Krones | Developed energy-efficient shrink wrap solutions in April 2024. |

| Barry-Wehmiller | Expanded tamper-evident shrink wrap technology in May 2024. |

| Texwrap Packaging | Released compact, high-speed shrink wrappers in June 2024. |

| Douglas Machine | Strengthened high-speed automated shrink bundling in July 2024. |

| Plexpack | Introduced biodegradable shrink films in August 2024. |

| Duravant | Pioneered IoT-enabled shrink wrapping for predictive maintenance. |

The shrink wrapping machines market is evolving as companies invest in digital monitoring, AI-driven defect detection, and high-barrier shrink films. They are developing smart shrink wrapping systems with touchless automation to enhance operational efficiency. Additionally, manufacturers are integrating RFID tracking systems to streamline inventory management. Businesses are also optimizing compact, high-speed machines to cater to the growing e-commerce sector.

Manufacturers will make greater use of AI-based quality checks, solvent-free adhesives, and total automatic shrink wrapping lines. Companies will make ultra-thin shrink films more efficient to reduce material usage without reducing strength. Companies will expand predictive maintenance using IoT-based shrink wrap systems.

Digital printing will govern custom-made shrink wraps for branding. Additionally, companies will enhance energy efficiency with cutting-edge heating parts to reduce power consumption. Companies will develop modular machine designs to accommodate multiple packaging sizes and reduce cut-over time. Manufacturers will also use biodegradable shrink films to assist in global sustainability efforts.

Leading players include Sealed Air, Krones, Barry-Wehmiller, Texwrap Packaging, Douglas Machine, Plexpack, and Duravant.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include automation, sustainability, high-speed performance, and digital monitoring.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.