The shrink bundling film industry is evolving with the demand from companies for cost-effective, lightweight, and sustainable secondary packaging solutions. As the applications in food & beverage, pharmaceutical, and personal care sectors grow, manufacturers are concentrating on high-strength films, downgauged products, and green formulations. The trend toward recyclable and biodegradable shrink films is picking up pace as market regulations and consumer pressures push greener packaging solutions.ce

Companies are embracing high-performance resin blends, multi-layer film technology, and smart packaging solutions to enhance durability and efficiency. The industry is shifting towards bio-based shrink films, low-energy seal films, and high-clarity formulations to enhance brand visibility and reduce carbon footprints.

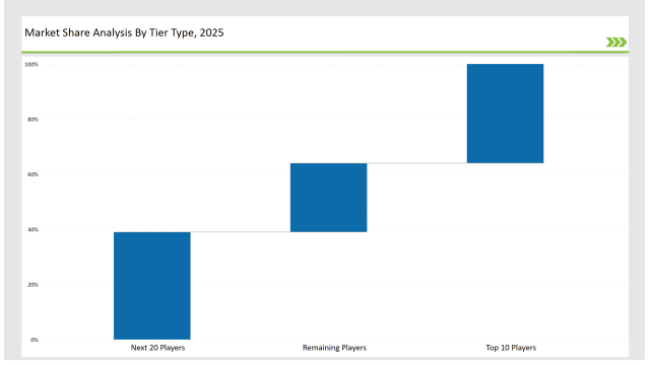

Tier 1 players like Sealed Air, Berry Global, and Amcor have 36% market share due to their strong hold on high-performance shrink films, extensive geographic reach, and investment in green packaging technologies.

Tier 2 players like Coveris, AEP Industries, and Sigma Plastics Group hold 39% of the market through low-cost, high-clarity, and customized shrink bundling films for industries.

Tier 3 comprises local and niche players who are also leaders in compostable shrink films, high-barrier grades, and digitally printed shrink films with a market share of 25%. They focus on localized manufacturing, smart packaging features, and customized bundling alternatives.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Sealed Air, Berry Global, Amcor) | 17% |

| Rest of Top 5 (Coveris, AEP Industries) | 10% |

| Next 5 of Top 10 (Sigma Plastics Group, Plastopil, Bonset America, PolyPak Packaging, Clondalkin Group) | 9% |

The shrink bundling film industry serves multiple sectors where packaging strength, sustainability, and clarity are critical. Companies are developing advanced shrink bundling films to meet evolving consumer demands and environmental regulations.

Manufacturers are optimizing shrink bundling films with enhanced performance, eco-friendly materials, and digital printing innovations.

Cost savings and sustainability are transforming the shrink bundling film industry. Companies are implementing AI-advanced extrusion, downgauged films, and solvent-less printing technology to enhance performance and reduce waste. Companies are developing ultra-thin high-strength films to lower plastic consumption without losing strength. Companies are expanding their portfolio of fully recyclable shrink bundling films to meet stringent environmental regulations. Companies are also deploying bio-based resins and water-based adhesives to improve recyclability and reduce carbon footprints.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainable resin formulations, and smart printing solutions to support the evolving shrink bundling film market. Partnering with food, beverage, and logistics brands will accelerate market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sealed Air, Berry Global, Amcor |

| Tier 2 | Coveris, AEP Industries, Sigma Plastics Group |

| Tier 3 | Plastopil, Bonset America, PolyPak Packaging, Clondalkin Group |

Leading manufacturers are advancing shrink bundling film technology with AI-driven production, sustainable materials, and enhanced performance features.

| Manufacturer | Latest Developments |

|---|---|

| Sealed Air | Launched ultra-thin, recyclable shrink bundling films in March 2024. |

| Berry Global | Developed PCR-content shrink films for sustainability in April 2024. |

| Amcor | Expanded compostable shrink bundling films in May 2024. |

| Coveris | Released moisture-resistant, high-clarity bundling films in June 2024. |

| AEP Industries | Strengthened high-barrier, multi-layer shrink films in July 2024. |

| Sigma Plastics Group | Introduced digitally printed shrink bundling films in August 2024. |

| Plastopil | Pioneered lightweight, low-energy shrink films in September 2024. |

The shrink bundling film market is evolving as companies invest in sustainability, automation, and high-performance materials.

The market will keep on embracing AI-powered production, reusable films, and intelligent packaging technologies. Manufacturers will further develop lightweight shrink film materials to minimize the use of plastic. Companies will embrace bio-based polymers to achieve global sustainability goals.

Businesses will create ultra-thin high-strength shrink films for enhanced material efficiency. Intelligent packaging components will maximize supply chain tracking and brand interaction. Companies will also extend automated extrusion and sealing processes to enhance efficiency and product uniformity.

Leading players include Sealed Air, Berry Global, Amcor, Coveris, AEP Industries, Sigma Plastics Group, and Plastopil.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, lightweight materials, digital printing, and high-barrier shrink film technologies.

The report consists of key materials of shrink bundling film including low density polyethylene, linear low density polyethylene, medium density polyethylene, high density polyethylene, polypropylene, and other plastics.

The market is classified into below 15 microns, 15 to 25 microns, and above 25 microns.

The market is classified into food and beveragecosmetics, personal care and home care, pharmaceuticals, transport and logistics, printing and publishing, and other industrial.

The analysis of the shrink bundling film market has been carried out in key countries North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, The Middle East and Africa.

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Green Packaging Film Market by Product Type, End Use, Material, and Region 2025 to 2035

Automatic Banding Machine Market Insights – Growth & Forecast 2025 to 2035

Market Share Breakdown of Protective Packaging Industry

Market Share Breakdown of Paper-Based Laminate Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.