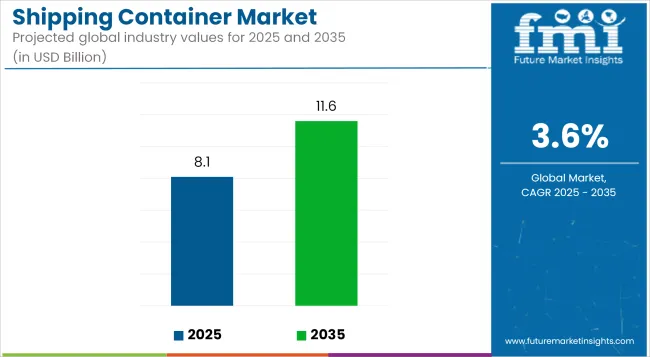

The shipping container market is projected to grow from USD 8.1 billion in 2025 to USD 11.6 billion by 2035, registering a CAGR of 3.6% during the forecast period. Sales in 2024 reached USD 7.8 billion. Growth has been driven by increased containerization across global trade routes and growing demand from inland logistics and intermodal transport systems.

| Attributes | Description |

|---|---|

| Estimated Global Shipping Container Market Size (2025) | USD 8.1 billion |

| Projected Global Shipping Container Market Value (2035) | USD 11.6 billion |

| Value-based CAGR (2025 to 2035) | 3.6% |

Major ports have invested in smart container monitoring, and demand for specialized reefer and tank containers has also surged. Rising trade between Asia-Pacific and Africa has contributed to expansion, while digital tracking innovations and automated handling equipment have strengthened operational scalability.

In June 2024, on the back of continued strong container market demand and the disruption caused by the ongoing crisis in the Red Sea, A.P. Moller - Maersk A/S now also sees signs of further port congestions, especially in Asia and the Middle East, and additional increase in container freight rates.

In the past month, the container transport market has entered a new phase driven by the disruptions from the ongoing crisis in the Red Sea and the ripple effects on global supply chains. While demand for container transport remains strong, supply has been negatively impacted by missed sailings, longer routes, equipment shortages, and delays leading to increased congestion across several key ports in Asia and the Middle East.

More capacity than expected will be needed to resolve these issues and stabilize the global supply chain. This has led us to reassess the outlook for the remainder of the year and upgrade our financial guidance” said Vincent Clerc, CEO of Maersk.

Emphasis has been placed on circular design, lightweight container materials, and RFID integration for transparent tracking. Innovations in collapsible containers and smart sensor-embedded units have become critical for optimizing space utilization and real-time condition monitoring.

These solutions have been rolled out not only to reduce empty haulbacks but also to meet compliance with carbon footprint regulations. Newer product lines are incorporating corrosion-resistant alloys and low-VOC coatings. Partnerships with port authorities have enabled the piloting of solar-powered units and modular designs tailored for last-mile rail distribution.

The global shipping container market is expected to benefit from trade normalization post-disruption and investments in global infrastructure. As global logistics chains mature and multimodal transport integration rises, demand is likely to rise for standard dry containers as well as reefer and tank variants.

Market players are adopting predictive analytics, cloud inventory systems, and container pooling models to reduce costs and boost availability. The increased participation of developing countries in global exports is expected to drive container demand across agriculture, pharmaceuticals, and consumer electronics.

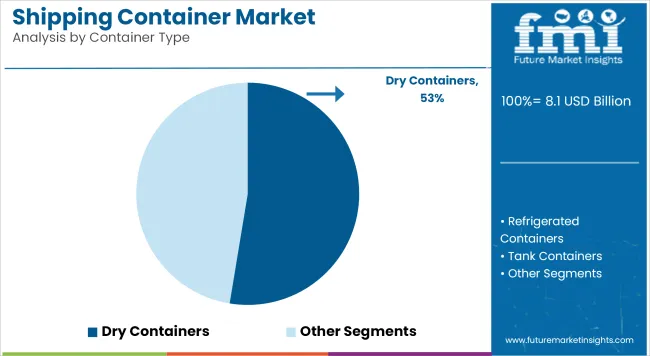

The market is segmented based on container type, size, end-use industry, and region. By container type, the market includes dry containers (standard), refrigerated containers (reefers), tank containers, open top containers, flat rack containers, high cube containers, and special purpose containers.

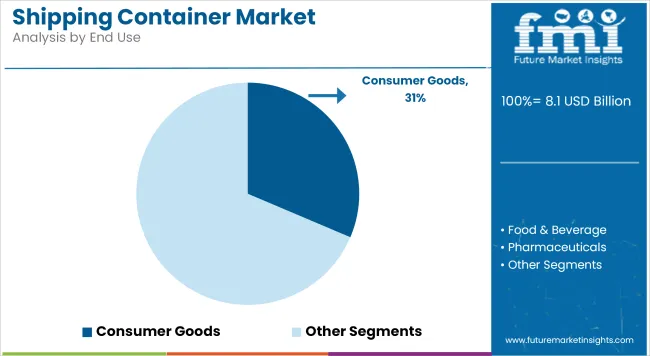

In terms of size, the market is categorized into 20-foot containers, 40-foot containers, 45-foot containers, and others. By end-use industry, the market comprises food & beverage, pharmaceuticals, chemicals, oil & gas, automotive, consumer goods, and industrial equipment. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Dry containers have been projected to hold 52.6% of the total shipping container market by 2025, primarily due to their widespread use in transporting general cargo. These containers have been standardized across major ports, enabling compatibility with a variety of cargo handling systems.

Cost efficiency, structural strength, and ease of loading have contributed to their dominance. Both 20-foot and 40-foot formats have been widely adopted in multimodal transport. General merchandise, textiles, packaged goods, and electronics have been routinely transported using dry containers across maritime, rail, and road modes. The use of ISO-standard steel containers has streamlined global shipping processes and supported container pooling strategies. Dry containers have also been preferred for bulk commodities when bagged or palletized. They have offered security, protection from weather, and lower pilferage rates.

Rapid e-commerce expansion and cross-border trade have increased the demand for dry containers among freight forwarders and third-party logistics providers. Container leasing firms and logistics integrators have invested heavily in refurbishing and maintaining large dry container fleets. Smart container tracking and asset management tools have been integrated to enhance operational visibility.

Dry containers have also been retrofitted with air vents, liners, and desiccant systems for moisture-sensitive cargo. Future demand for dry containers is expected to rise with increased global trade flows, supply chain diversification, and port infrastructure upgrades. Automated container handling terminals and modular logistics parks have supported container turnaround efficiency.

Cost-effective design and rapid deploy ability have made dry containers the most accessible format for exporters and small businesses. Environmental upgrades in coatings and sustainable materials are being explored to reduce lifecycle impact.

The consumer goods industry has been estimated to account for 31.4% of the global shipping container demand in 2025, driven by its broad range of products and constant supply chain movements. Dry containers have been primarily used to transport packaged electronics, apparel, appliances, household items, and other finished goods.

Year-round demand from both emerging and mature economies has ensured high container turnover. Port-to-door delivery models have supported their extensive usage. Retail brands and contract manufacturers have utilized containers to move inventory between distribution centers, warehouses, and retail outlets.

Lean inventory practices have benefited from just-in-time container deliveries enabled by standardized logistics protocols. Container-based intermodal freight solutions have ensured cost savings over long-distance supply chains. Tracking and data analytics tools have enhanced inventory transparency and responsiveness.

E-commerce fulfillment centers have increasingly depended on containerized imports for high-volume, SKU-diverse shipments. Reverse logistics and returns handling have also been managed more efficiently using container loads. Consumer demand for fast delivery and variety has pressured companies to optimize container space and cycle time.

Reusable and collapsible container solutions have been piloted for last-mile and intercity movement. Going forward, digital transformation in supply chain operations and greater automation in container unloading will enhance operational agility for consumer goods companies.

Retailer consolidation and Omni channel logistics networks will further elevate container utilization. Sustainability mandates are prompting the exploration of low-emission transport methods paired with reusable container designs. The container shipping industry is expected to remain closely tied to the growth trajectory of consumer goods demand.

Continuous Expansion of Global Trade

Global trade expansion is the major supporting factor for the shipping container industry. Developing inter-connected economies enlarges the need for adequate transportation solutions to move goods between countries.

To suffice this, trade agreements between countries result in cross-border transactions. This trend is more pronounced in emerging markets, where industrialization and urbanization are driving the demand for containerized shipping.

Rapid Growth of E-commerce

The e-commerce boom has dramatically changed the scope of logistics. Consumers who increasingly demand fast, reliable delivery of their products are forcing organizations to invest in containerized shipping solutions to address such demands. The growth in online shopping is highly reflected in small parcel shipments that normally use shipping containers for bulk transport to distribution centers.

Technological Innovation

Technological advancements drive the shipping container market forward. Logistics automation and digitalization have evolved to introduce smart containers with the Internet of Things devices facilitating their monitoring and tracking in real-time.

This will improve supply chain transparency and security, increasing efficiency in these operations. Other design improvements and better use of materials for containers ensure that they have a longer service life and are more sustainable, aligned industry-wide towards environmentally conscious practices.

Fluctuations in Raw Material Prices

One of the major restraining factors for the shipping container market is the volatility in the prices of raw materials, specifically steel. Shipping containers are mainly made of steel, and any change in the price of steel directly affects the manufacturing cost. Geopolitical tensions, trade disputes, and changes in global demand can cause unpredictable price changes in the steel market.

Moreover, raw material prices can become challenging for manufacturers to shift their pricing strategies at appropriate times along with maintaining production costs.

In such cases, higher raw material prices may result in higher shipping container prices and thus reduce demand from price-sensitive logistics companies. The generalized price volatility also interferes with long-term planning and investment in new production of containers, affecting the overall growth of the shipping container market.

Adoption of Smart Container Technology

A critical trend witnessed in the shipping container market is the uptake of smart container technology. Smart container involves applying advanced tracking and monitoring systems on shipping containers, such as loT devices and RFID tags.

These technologies allow the real-time monitoring of conditions within the container, such as temperature, humidity, and location. This is particularly useful for transporting sensitive goods including foods and pharmaceuticals. The trend is driven by e-commerce and supply chain efficiency. Companies are trying to learn more about visibility throughout the shipping process to ensure prompt deliveries and losses.

Smart containers provide logistics providers with the capability to optimize routes, manage inventory efficiently, and quickly respond to any problem during transit.

Additionally, the integration of data analytics with smart container technology gives businesses the ability to understand shipping patterns and operational efficiencies. Such data-driven decision-making further enhances the resultant decision-making processes while predicting eventual supply chain disruptions.

The Rise of E-Commerce: Transforming the Shipping Container Market

The rapid surge in e-commerce is transforming the shipping container industry. Given the rising ease of online purchasing, consumers now have access to products from around the world. Thus, as more and more people shop through the Internet, this digital market revolution has never seen such increased demand for cost-effective and scalable shipping.

Additionally, e-commerce firms rely heavily on shipping containers today for their products' smooth and cost-effective transportation. Shipping containers have been indispensable for the warehousing and movement of goods from the manufacturers to distribution centers and, eventually, the consumer's doorsteps.

Increased online shopping requires an extensive network of containers along with a solid transport infrastructure for speedy and dependable shipping services.

The USA is expected to achieve a CAGR of 2.4 % in the forecast period. The USA shipping container market is gaining momentum due to various interrelated factors.

Booming international trade scenario has notably encouraged the growth as the country continues heavy imports and exports, which requires well-functioning logistic services. And yet, in parallel, rapid growth in e-commerce is increasing reliance on shipping. More people are shopping online, while most online traders seek fast shipping as they require a timely transport of products to consumers.

India shipping container is poised to experience a CAGR of 4.9 % till 2035. The Indian shipping market is heavily on the road to growth influenced by several interwoven factors.

The e-commerce industry is very rapidly expanding while generating a major demand for efficient transportation solutions, so online retailers should have reliable and safe methods through which goods transported can reach vast distances. However, the growth of international trade fuels the increase of online shopping thereby demanding standardized methods of transportation from one country to another to get goods moved.

UK is poised to attain a CAGR of 2.1 % from 2025 to 2035. The UK shipping container market is growing at a notable rate, influenced by several significant factors. E-commerce has emerged as a significant growth driver because it has greatly increased the demand for efficient logistics solutions. Business houses are in search of dependable ways to transport goods quickly and securely to consumers. This shift in consumer dependable ways to transport goods quickly and securely to consumers.

This shift in consumer behavior requires a strong supply chain, which relies heavily on shipping containers for the movement of products. Along with these investments in port infrastructure and logistics capabilities, operational efficiency has improved significantly as turnaround times have been reduced and containerized cargo has been handled more effectively.

China is expanding to grow at a CAGR of 4.7 % from 2025 to 2035. The shipping container market in China is growing robustly, driven by a combination of factors that enhance its pivotal role in global trade. As the world's largest exporter, China's extensive manufacturing base generates a high demand for containerized transportation, facilitating the efficient movement of goods both domestically and internationally.

The Belt and Road Initiative by the government further increases this growth by enhancing trade connectivity with partner countries, thereby increasing container traffic. The shipping container market in China is growing robustly due to a combination of factors that enhance its pivotal role in global trade. Being the largest exporter in the world, China's extensive manufacturing base generates a high demand for containerized transportation, allowing the goods to be transported easily both domestically and internationally.

Japan’s CAGR is expected at 3.2% till 2035. The shipping container market in Japan is growing due to several interrelated factors that make it more important in global trade.

Being one of the world's leading economies, Japan largely depends on its export-driven model, especially in sectors such as automobiles, electronics, and machinery, which require efficient containerized shipping for international distribution. The country's strategic geographic location in the Asia-Pacific region positions it as a vital hub for trade routes, facilitating substantial container traffic.

The shipping container market size in Germany will grow at around 4.2 % CAGR by 2035. Germany is witnessing a massive growth propelled by a few factors. It is one of the largest economies in Europe, serving as an important transit point for international trade due to its geographical position at the nexus of many of Europe’s leading trade routes.

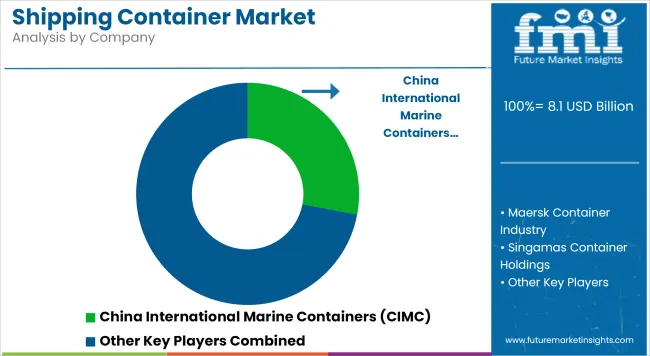

The competitive landscape of the shipping container market is comprised of established global players and new companies that are redefining the industry through innovation and strategic growth initiatives. Market leaders include A.P. Moller-Merks, COSCO shipping Lines, and China International Marine Containers, which have the experience and global network to improve the efficiency of operations.

Maersk, on the other hand, is heavily investing in making its logistics integrated with advanced technology to make better container handling and increase transparent supply chains. COSCO promotes sustainability by creating eco-friendly solutions in the making of containers through the reduction of environmental impact when demand for green solutions in logistics becomes increasingly high. Other than those giants, Hapag-LIoyd, CMA CGM, and Singamas container holdings, among others, are slowly but surely competing in the markets.

Hapag-Lloyd is committed to quality and safety, and its containers meet very stringent international standards, which enhance customer trust. CMA CGM is exploring innovative designs for its containers to improve durability and security to cover a broad spectrum of cargo needs.

Several startups are now emerging in the shipping container market, exploiting new strategies to create niches for themselves and fulfill the emerging demands of the industry. Here are a few notable examples:

Container xChange: This is an online marketplace for shipping containers. This connects buyers and sellers globally, with its major growth strategy: vetting its members to establish a transparent trading environment that minimizes risks involved with container transactions

Packfleet: Packfleet is a startup focused on sustainability in logistics, running a carbon-neutral courier service to change the way the city delivers. Packfleet’s strategy for growth relies on sustainable actions, such as electric vehicles and optimized delivery routes, minimizing their carbon footprint. This company appeals to environmentally conscious consumers and businesses that position it at the forefront of sustainable shipping solutions.

Flexport: Flexport is a technology-driven freight forwarder that combines data analytics and software solutions to make shipping easier. The growth strategy for the company relies on giving visibility and control over the supply chain so that businesses can better manage logistics.

In terms of size, the market is segmented into up to 20 feet and More than 20 feet.

In terms of end-user, the market is segmented into food and beverages, consumer goods, healthcare, industrial products, and logistics and transportation.

In terms of container type, the market is segmented into storage containers, refrigerated containers, and tank containers.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, and Middle-East and Africa.

The shipping container market is predicted to reach USD 8.1 billion by 2025.

The shipping container market is predicted to reach USD 11.6 billion by 2035.

The prominent companies in the shipping container market include CXIC Group Containers Company Limited, China International Marine Containers (CIMC), Triton International Limited, and others.tt.

India is likely to create lucrative opportunities for the shipping container market.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA