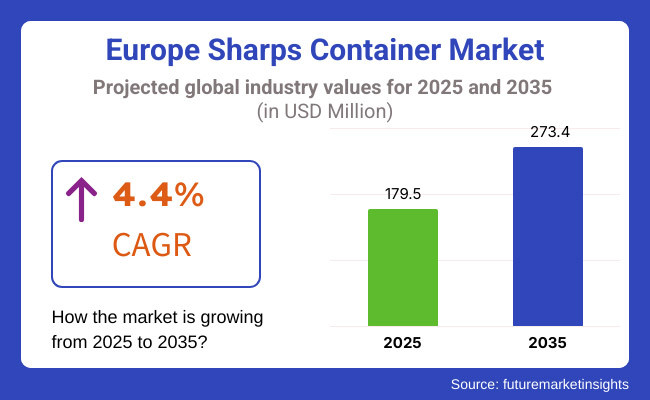

The Europe sharps container market is anticipated to be valued at USD 179.5 million in 2025. It is expected to grow at a CAGR of 4.4% during the forecast period and reach a value of USD 273.4 million in 2035.

A sharps container is a special waste container resistant to punctures for medical disposal such as needles, syringes, scalpels, and lancets for the prevention of possible injury and contamination. Such units are typically located in clinics, hospitals, laboratories, and home healthcare to keep the disposal process safe and in line with regulations.

The requirement of safe and appropriate disposal of medical sharps and puncture-resistant containers aimed for this purpose has given rise to the Sharps Container Market, which comprises manufacturers and suppliers to this end.

The need for such containers is being strengthened by the stricter regulation governing the management of healthcare waste, an increase in the generation of medical waste, an increase in hospital admissions, and a growing awareness about prevention from needlestick injuries.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Gradual increase driven by regulatory enforcement and rising medical waste concerns. | Sustained expansion with stronger emphasis on innovation and sustainable solutions. |

| Stricter enforcement of waste disposal guidelines across healthcare sectors. | Further tightening of policies, integrating environmental sustainability. |

| Slow but steady adoption of smart containers and automated tracking. | Widespread use of IoT-enabled sharps containers for real-time monitoring. |

| Initial steps towards eco-friendly disposal practices. | Strong shift to biodegradable and recyclable materials in container design. |

| Increasing demand from hospitals, clinics, and diagnostic centers. | Expansion to home healthcare, elder care, and public areas. |

| Increased competition from local players with product differentiation. | Big companies actively appropriate small companies in order to access new technologies. |

Sustainability and Eco-Friendly Disposal Solutions

With increasing environmental concerns and stringent regulations, there is a growing demand for biodegradable and reusable sharps containers. Healthcare facilities and waste management firms are, therefore, on a constant lookout for solutions that will reduce the plastic waste problem, along with the necessary compliance to safety standards. The trend is driving innovation in sustainable materials and eco-friendly disposal systems.

Increase in Demand from Home Healthcare and Self-Medication

The growth of home healthcare, owing to an older population and ever-rising incidences of chronic diseases like diabetes has contributed to greater demand for personal-use sharps containers; more and more patients are administering medications such as insulin and biologics in the home setting; these patients require compact, user-friendly, and safe disposal options.

| Attributes | Details |

|---|---|

| Top Usage | Reusable |

| Market Share in 2025 | 64.0% |

According to FMI estimation, the reusable sharps containers segment is set to grow at a market share of about 64.0% by 2025 in the European market. This growth is driven entirely by the increased environmental concerns and stringent regulations which favor policy reforms toward sustainable management of medical wastes. Reusable containers are cost-effective and do not have the environmental expense of single-use disposables, and therefore, they are the first choice in healthcare.

Moreover, investment in reusable containers is a supporting factor enabled by improvements in sterilization technologies and their efficacy to make beneficiaries aware of hygiene standards and protocol in relation to patient safety.

These are the types of sharps containers that healthcare institutions invest mostly in: durable containers that last for multiple sterilization cycles without losing integrity. This goes hand in hand with cost savings for medical facilities in the long run along the line of a greener initiative.

| Attributes | Details |

|---|---|

| Top End Use | Hospitals |

| Market Share in 2024 | 37.0% |

The hospital segment is expected to remain at the forefront of the end-use category, with a market share of approximately 37.0% in 2025. Hospital practices are associated with many medical procedures, leading to significant production of sharps waste. Hospitals should enact rigid waste disposal policies that require the establishment of compliant and reliable sharps containment systems.

The need to prevent needle-stick injuries and infection control in healthcare settings further compels the quality of sharps containers. Health facilities will now prefer using containers with increased safety features such as puncture-resistant designs and tightly holding locks to protect the healthcare specialists as well as patients. Moreover, attaching standardized color coding and labeling schemes onto sharps containers promotes proper separation of wastes and compliance with regulations.

Manufacturers of sharps containers in Europe are led by the prominent global players with state-of-the-art production technologies, and distribution channels. They set the parameters with regard to safety, regulatory compliance, and innovative waste management solutions. This supports the wide adoption of their products across hospitals, thus consolidating their control over procurement channels and supply chains.

The established leaders are constantly upgrading both the design and performance of their products to conform with the stringent regulations imposed by the European authorities, further consolidating their stronghold over this industry. Their differentiation is further supported by integrating "smart" disposal technology and antimicrobial properties in contrast to new entrants. Definitely, their influence is greatly enhanced by forming partnerships and bulk agreements that can sway hospital purchasing decisions.

The companies that have substantial financial backing and extensive production capacity are in full control of the industry dynamics. These companies are currently investing in sustainable materials and recycling activities, regarding them as a potential differentiator in their favor in the eyes of Europe. They have much less room for maneuvers because of their stronghold, making it almost impossible for the smaller competitors to enter.

The regulatory framework is in favor of the established players who possess the acumen to tackle the complex safety and compliance requirements. Their long-term relationships with the healthcare sector have ensured timely introduction and acceptance of fresh methods of disposal systems. Entering into exclusive contracts with governmental and private healthcare establishments for their services only consolidates their hold at the detriment of those, less experienced.

There is steady growth in the Europe sharps container market due to increased generation of medical waste and stringent regulations with respect to safe disposal. As the number of healthcare facilities increases and surgical procedures rise, so does the demand for safe and compliant disposal solutions for sharps. The favoring of reusable and environmentally friendly container solutions by the market is further fueled by environmental and sustainability concerns.

Key players in the markets are Sanypick Plastic SA, Mauser Group NV, Stericycle Inc, and Becton Dickinson and Co., among others. These firms are leaders in competitive product innovation, regulation compliance, and strategic partnership to build market dominance. The market is extremely competitive with firms offering a range of containers that can be used once or reused, each designed to meet a particular requirement from hospitals, clinics, and other medical facilities.

The primary users of sharps containers are hospitals because of the large amount of waste generated from medical procedures. Smaller clinics and specialized healthcare providers also contribute to the demand, especially for relatively compact and easy-to-use containers. The sizes of containers vary, with mid-range ones being the most generally accepted and used, presenting a compromise between capacity and ease of handling.

In Europe, some countries dominate the market, owing to advanced health systems and stringent waste management regulations. To this day, governments and regulatory bodies continue to enforce strict guidelines for sharps disposal, thus promoting the penetration of quality containment solutions. The growing emphasis on sustainability is also forcing manufacturers to come up with newer designs with less damage to the environment.

The Europe sharps container market is expected to be valued at USD 179.5 million in 2025 and reach USD 273.4 million by 2035, growing at a CAGR of 4.4%.

The market is projected to grow steadily due to stricter regulations, rising medical waste, increasing home healthcare adoption, and demand for eco-friendly solutions.

Key manufacturers include Becton, Dickinson and Company, Bondtech Corporations, Daniels - A Mauser Company, Daniels Sharpsmart Inc, GPC Medical Ltd, Henry Schein, Stericycle, Inc, Thermo Fisher Scientific Inc, and Amcor.

The reusable segment is expected to lead in the industry, holding a 64.0% market share in 2025 due to cost-effectiveness and environmental benefits.

The market is segmented by usage into disposable and reusable.

Based on the capacity, the market is segmented into up to 5l, 5l to 10l, and above 10l.

Based on end use, the market is segmented into hospitals, research centres, pharmaceutical companies, and others.

Anti-Counterfeit Packaging Market Trends - Growth & Forecast 2025 to 2035

Antiviral Drug Packaging Market Insights - Growth & Trends 2025 to 2035

Anti-counterfeit Cosmetic Packaging Market Growth - Demand & Forecast 2025 to 2035

Anti-static Foam Packaging Market Growth - Demand & Forecast 2025 to 2035

Aseptic Packaging Equipment Market Trends - Growth & Forecast 2025 to 2035

Anti-Counterfeit Packaging for Food & Beverages Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.