The global severe asthma treatment market is valued at USD 24.30 billion in 2025. It is expected to grow at a CAGR of 5.1% and reach USD 39.96 billion by 2035. With more people getting asthma and better treatments becoming available, the global industry for severe asthma treatments is expected to grow steadily over the next ten years.

In 2024, the industry for treating severe asthma witnessed significant developments led by the launch of new biologic therapies, rising adoption of digital respiratory healthcare solutions, and heightened patient education. Major drug manufacturers introduced new monoclonal antibody therapies addressing eosinophilic and non-eosinophilic asthma, resulting in better patient outcomes.

This is a steady rise due to more money being spent on healthcare, new biologic treatments, and more people getting asthma. Demand for targeted treatments, specifically monoclonal antibodies, is also fueling industry growth.

Growth will continue to be boosted by new inhalers, targeted treatments, and government policies that make it easier to control asthma. The evolution of novel drug delivery systems as well as the incorporation of digital health technologies in respiratory medicine will also be critical to influencing the direction of the sector in the future.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 24.30 billion |

| Industry Size (2035F) | USD 39.96 billion |

| CAGR (2025 to 2035) | 5.1% |

Explore FMI!

Book a free demo

The industry for treating severe asthma is experiencing steady growth. This is happening because more people are getting asthma, there are better biologic therapies available, and digital health solutions are being used more widely. Companies that make targeted treatments are likely to benefit from this growth.

Conversely, makers of traditional inhalers might encounter challenges, as more patients are leaning toward personalized biologics. Support from regulatory agencies and improvements in healthcare systems in developing countries will help the sector grow even quicker. This trend indicates a significant shift in how severe asthma is managed, focusing on more personalized and advanced treatment options.

Build Biologic Therapy Portfolio

Invest in R&D of next-generation biologics against severe asthma subtypes, such as IL-5, IL-4, and other emerging pathways. Focus on regulatory approvals and clinical trials to expedite segment entry and build a competitive advantage.

Use Digital Health & AI for Personalized Treatment

Align with increasing digital health adoption by embedding AI-based diagnostics, remote monitoring, and smart inhalers into asthma care solutions. Collaborate with technology companies to drive patient adherence and treatment efficacy optimisation.

Enhance Market Penetration Through Strategic Partnerships

Increase global presence by partnering with healthcare providers, payers, and distribution channels, especially in emerging sectors. Pursue M&A with biotech companies that have expertise in precision medicine to enhance innovation and segment leadership.

| Risk | Probability & Impact |

|---|---|

| Regulatory Hurdles for Biologic Approvals | High Probability, High Impact |

| High Treatment Costs Limiting Accessibility | Medium Probability, High Impact |

| Industry Competition from Generic & Biosimilar Drugs | High Probability, Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Accelerate Biologic Drug Development | Expedite clinical trials and regulatory filings for next-gen biologics |

| Expand Digital Health Integration | Initiate partnerships with AI and telehealth firms to enhance remote monitoring solutions |

| Strengthen Industry Access & Affordability | Launch pricing and reimbursement negotiations to improve patient accessibility |

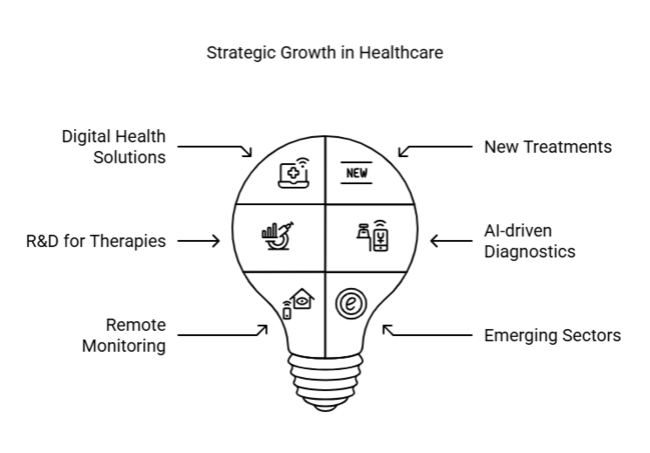

To stay ahead, the company must has expanded digital health solutions and the domestic and worldwide launch of critical new treatments among its current offerings; it will continue to support the growth of the company. As biosimilars and pricing pressures grow, accelerating R&D for next-generation targeted therapies is being viewed as crucial.

At the same time, leveraging AI-driven diagnostics and remote monitoring solutions will continue to improve patient adherence and outcomes. New growth opportunities will open up by making inroads into emerging sectors through alliances with payers and healthcare providers.

Regional Variance

High Variance

Divergent Perspectives on ROI

73% of USA stakeholders viewed biologics as cost-effective long-term, whereas 41% in Japan still relied on high-dose corticosteroids due to lower costs.

Consensus

Biologics: Selected by 66% of specialists due to superior long-term control, despite cost barriers.

Variance

Shared Challenges

87% cited rising drug prices as a major barrier, with biologic costs increasing by 22% over five years.

Regional Differences

Manufacturers

Healthcare Providers

Patients & Insurers

Alignment

72% of global pharmaceutical firms plan to invest in next-generation biologics and combination therapies.

Divergence

USA

66% said state-level insurance mandates (e.g., Medicaid coverage expansion) were a game-changer for biologic adoption.

Western Europe

79% viewed EU Health Strategy 2024 to 2030 as a catalyst for broader biologic reimbursement.

Japan/South Korea

Only 35% felt regulatory changes would significantly alter segment dynamics due to slow adoption rates.

High Consensus

Expanding biologic accessibility, managing rising treatment costs, and improving reimbursement policies are key global challenges.

Key Variances

Strategic Insight

A one-size-fits-all approach will not succeed. Companies must adapt strategies regionally-value-based reimbursement in the USA, sustainable production in Europe, and biosimilar affordability in Asia-to capture growth opportunities.

| Country/Region | Policies, Regulations & Certifications |

|---|---|

| United States |

|

| Western Europe |

|

| Japan |

|

| South Korea |

|

The size of the United States sector for severe asthma treatment is expected to expand at a compound annual growth rate (CAGR) of 5.8% over the 2025 to 2035 period, attributed to improved access to biologics and digital health. The FDA's Biologics License Application (BLA) process continues to govern the sector, ensuring safety and efficacy. Private insurers are also starting to use value-based reimbursement models, which connect the price of drugs to how well they work for patients.

There is also a strong push toward AI-driven diagnostics and remote monitoring solutions that help doctors tailor treatments to each patient and keep track of how well they are following their treatment plans. Also, drug companies are working hard to make next-generation monoclonal antibodies (like IL-4 and IL-5 inhibitors), which will give patients more treatment options. Even though the sector has grown, it does have some problems, such as the high cost of biologic drugs and the strict rules that insures put in place for prior authorization.

The UK's severe asthma treatment sector is expected to grow at a compound annual growth rate (CAGR) of 5.3% over the next ten years. This is because the National Health Service (NHS) is making biologics easier to get through its universal healthcare model. Biologic therapies, like dupilumab and benralizumab, have been approved by the National Institute for Health and Care Excellence (NICE). This means that people with severe asthma will be able to get new treatments and afford them.

The UK government is also investing heavily in AI-driven asthma management, such as smart inhalers and digital monitoring programs. The NHS has set up pilot programs for managing patients remotely, which will make people more likely to follow instructions and cut down on hospital stays.

However, ongoing efforts to contain costs make it hard for some drug companies to set prices, which delays the arrival of high-priced biologics on the sector through tough price.The EU’s own green deal initiative has impacted the UK, with an increasing call for more sustainable inhaler production.

The sector for severe asthma treatments in France will grow at a compound annual growth rate (CAGR) of 5.1%. This is because the government is providing strong healthcare coverage and biologic therapies are becoming more popular. The French social security insurance system seems to put more and more weight on the French High Authority for Health (HAS) when it comes to approving and setting prices for new asthma treatments in order to keep costs down.

France's government is putting money into programs that use AI to keep an eye on patients and run asthma management programs in hospitals. These programs can improve long-term outcomes. Strong public health care system also forces drug companies to raise prices, which stops them from making new drugs.

France's Health and Safety Authority (HAS) requires a strict cost-effectiveness evaluation before a drug can be approved for national reimbursement. Price issues can lead to negotiations before the drug hits the industry.

Germany's sector for severe asthma treatments is expected to grow at a compound annual growth rate (CAGR) of 5.4%. This is because the country spends a lot on healthcare, has great reimbursement policies, and quickly adopts new biologics. The decision by which new drugs and therapies will be available to patients depends on the work of institutionssuch as the Federal Joint Committee (G-BA) and the Institute for Quality and Efficiency in Healthcare (IQWiG).

According to the report, Germany leads Europe in the use of smart inhalers that use AI-based monitoring to enhance treatment plans. The government has also been advocating for sustainable medical devices, consistent with the EU’s Green Deal. However, strict price regulations for pharmaceuticals persist, requiring manufacturers to negotiate and lower prices for national coverage.As the population ages and more people get asthma, there will be a greater need for biologics.

The Italy sector for severe asthma treatments is expected to grow at a compound annual growth rate (CAGR) of 4.9% in 2025 to 2035. In Italy, the Italian Medicines Agency (AIFA) is responsible for negotiating drug prices and protecting asthma treatments from exorbitant prices. Despite the high costs associated with these drugs, biologic therapies are becoming increasingly popular in Italy.

To improve access - including for lower-income patients on the National Health Service, the government is promoting the use of biosimilars. Economic factors and budget enforcement would also constrain the extended availability of premium biologics. The sector is likely to grow slowly because more attention is being paid to cost-effective treatments and the use of biosimilars.

To treat severe asthma in South Korea, nine molecule drugs are competing with each other. The sector is expected to grow at a 4.7% CAGR because the government is investing more in biosimilars and smart inhalers and supporting them more. In South Korea, where the Korean Health Insurance Review & Assessment Service (HIRA) has considerable power over drug pricing and reimbursement, they tend to follow cost-effective alternatives.

As South Korea seeks to cut reliance on expensive biologics, biosimilars are gaining ground. Advanced technologies have come out, but these high-end biologics are still hard to use because of high prices and long wait times for reimbursement. South Korea's sector will likely grow thanks to biosimilars and digital health solutions as the population ages and the number of people with asthma rises.

The sector for severe asthma treatments in Japan is expected to grow at a compound annual growth rate (CAGR) of 4.5%. This is because the population is getting older, the government is funding universal healthcare, and biologic therapies are being used more and more. The Pharmaceutical and Medical Device Agency (PMDA) has a strict approval process that often causes new biologics to come out later than planned. In spite of these challenges, the incidence of asthma in the elderly continues to grow, calling for long-term, effective treatment.

The government is promoting biosimilar use to offset high healthcare expenditures, and biologic affordability thus becomes a central interest for pharmaceutical companies. Japan is behind Western countries when it comes to using smart inhalers, but AI-assisted respiratory monitoring is becoming more popular in city hospitals.

As pollution levels rise and more people develop asthma, along with an increasing number of individuals moving to urban areas, the severe asthma treatment industry in China is anticipated to experience rapid growth. This sector is projected to expand at an annual growth rate of 6.2%.The government of China is heavily investing in local pharmaceutical production to decrease reliance on imported biologics. Biosimilars are getting more competition in the sector because the National Medical Products Administration (NMPA) has sped up the approval process.

China's patient base suffering from severe asthma is among the highest in the world, with its expanding middle class calling for sophisticated treatment alternatives. However, because of lack of money, rural areas still rely on traditional corticosteroids and bronchodilators. Government plans, such as Healthy China 2030, aim to make it easier to treat lung diseases by providing financial support for digital health platforms and smart inhalers.

The landscape for severe asthma treatments in Australia and New Zealand (ANZ) is expected to grow at a compound annual growth rate (CAGR) of 5.0%. The Pharmaceutical Benefits Scheme in Australia and Pharmac in New Zealand make asthma medicines more affordable. This makes the ANZ region very appealing to drug companies. Australia was the first country to use smart inhalers, and the government has supported programs that use AI to track people's adherence to their treatment plans.

The Asthma Australia Initiative keeps working to get people to know about and use advanced treatments like biologics dupilumab and mepolizumab. Cost-containment policies make sure that price talks for new biologics are tough, which limits how much money expensive treatments can make. Accessibility in rural areas is also a problem, but telemedicine is being used to make up the difference in health care.

Growing pollution levels, rising asthma prevalence, and the need for better healthcare infrastructure are expected to boost the severe asthma treatment sector in India at a CAGR of 5.9% in 2025 to 2035. India has one of the highest counts of asthmatic patients in the world, with a little over 30 million cases, a majority of which don't fall under controlled asthma. Air pollution in metro cities like Delhi, Mumbai, Bengaluru, and Kolkata has contributed hugely to the exacerbation of asthma, leading to a higher burden on biologics and smart inhalers.

The Ayushman Bharat (Pradhan Mantri Jan Arogya Yojana) scheme of the government is making it easier for people in rural and semi-urban areas to get specialized treatment for asthma. The Indian pharmaceutical companies closely working to create cost-effective biologics will further streamline the adoption, whereby the growing pass abuse segment will quickly outpace the already FDA-approved monoclonal antibodies by a ratio of 1:4.

The global severe asthma treatment segment in drug class is registering a CAGR of 5.6% in the forecast period 2025 to 2035. The treatment industry for severe asthma is experiencing a transition from traditional anti-inflammatory treatments to sophisticated biologics, particularly monoclonal antibodies (mAbs). Reslizumab and Benralizumab are two of the major biologic drugs that target eosinophilic asthma specifically, lowering the rate of exacerbations and enhancing lung function.

These biologics act by inhibiting IL-5 signaling pathways, blocking the recruitment of eosinophils, which are responsible for most airway inflammation. Biologics are most suitable for those patients who fail to respond to corticosteroids. Yet, their high price and requirement for specialized handling continue to be major deterrents to their universal use in developing countries.

The global severe asthma treatment segment in drug class is registering a CAGR of 5.4% in the forecast period 2025 to 2035. The route of drug administration has a great impact on patient compliance, convenience, and efficacy of the treatment. Oral treatments, for example, leukotriene receptor antagonists, are routinely employed in maintenance of mild-to-moderate asthma. However, their action in severe forms is restricted, thus favoring inhaled and biologic therapy.

Inhaled medications, such as corticosteroids and bronchodilators, form the foundation of asthma treatment. These drugs are administered directly to the lungs, providing rapid relief of symptoms with few systemic side effects. Inhaled medications come in different forms, such as pressurized metered-dose inhalers (pMDIs), dry powder inhalers (DPIs), and nebulizers.

The global severe asthma treatment segment in drug class is registering a CAGR of 5.3% in the forecast period 2025 to 2035. Drug delivery devices have an important role in ensuring optimal treatment effectiveness and patient compliance. Among all the devices, dry powder inhalers (DPIs), metered-dose inhalers (MDIs), and soft mist inhalers (SMIs) are the most popular devices. Dry powder inhalers (DPIs) are especially popular for their coordination-free actuation mechanism, where drug release occurs without needing coordination between drug release and inhalation.

DPIs are extremely effective among patients with sufficient lung function but can be unsuitable for patients with severe airflow limitation. Metered dose inhalers (MDIs) are the most widely prescribed inhalers globally because of their accurate drug delivery, convenience, and simplicity. Soft mist inhalers (SMIs) are a new segment, becoming increasingly popular because of their extended aerosol suspension time, which increases drug absorption in the lungs.

The most prominent organizations in the severe asthma treatment sector are competing with each other based on pricing, innovation, strategic partnerships, and global distribution. The game-changing nature of these products has led leading pharma companies to pay particular attention to high-efficacy, patent-protected monoclonal antibody formulation therapies characterized by a premium price and a targeted mechanism of action like Benralizumab and Reslizumab.

Growth strategies differ from one company to another, but most highlight global expansion and regulatory green lights in lucrative sectors. Accordingly, mergers and acquisitions (M&A) are a key focus area, as companies look to expand their biologics portfolios or bolster their R&D capabilities. Companies are also signing fingerprint deals with biotechnological start-ups in order to accelerate drug development, especially in gene therapy and personalized medicine for nephritic asthma.

Market Share Analysis

Key Developments

Recent innovations include biologic therapies targeting eosinophils, smart inhalers with digital tracking, and personalized medicine approaches to improve patient outcomes.

Biologics offer targeted treatment for severe cases by blocking specific inflammatory pathways, whereas traditional therapies like corticosteroids provide broad anti-inflammatory effects but may have more side effects.

Key factors include healthcare accessibility, insurance coverage, pricing, regulatory approvals, and patient awareness of advanced therapies.

Inhaled therapies remain the first-line option, but subcutaneous and intravenous biologics are gaining traction due to their long-term efficacy and reduced reliance on steroids.

Companies are introducing smart inhalers, patient support programs, affordability initiatives, and educational campaigns to enhance treatment adherence and long-term disease management.

It is segmented into Reslizumab, Benralizumab, and Anti-inflammatory

It is segmented into Oral, Inhaled, Intravenous, and Subcutaneous

It is segmented into Dry powder inhalers, Metered dose inhalers, and Soft mist inhalers

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East and Africa(MEA)

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.