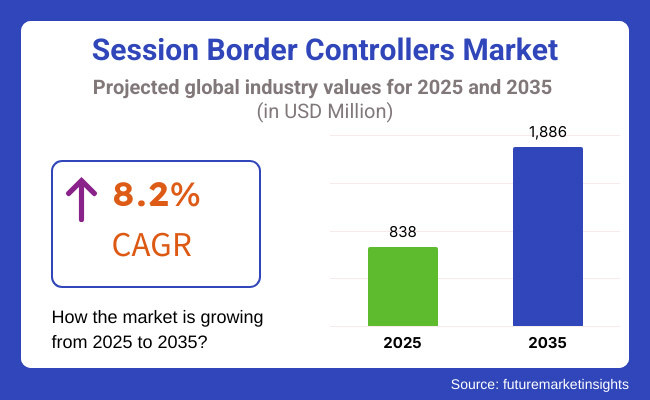

The global Session Border Controllers market is projected to grow significantly, from 838.0 million in 2025 to 1,886.0 million by 2035 an it is reflecting a strong CAGR of 8.2%.

Organizations are looking for secure and seamless SIP-based communication, and this is the reason why the Session Border Controllers (SBC) market is growing. SBCs and associated services are designed to handle security features, interoperability, and policy enforcement across VoIP networks. Both SBC solutions and services provide features (encryption, call routing, and denial-of-service (DoS) protection), but services assist businesses with things like deployment, maintenance, and compliance management. The continued adoption of cloud-based communications and SIP trunking is generating demand, both for SBC hardware and managed services.

Adoption by enterprise size: Another example of enterprise adoption details is that large enterprises have high call volumes, multiple sites and are subject to compliance pressures, which leads to significant use of SBCs. These businesses use SBC with UC platforms and cloud infrastructure to protect their channels of communication. Conversely, SMEs are migrating over to hosted SBC solutions in the cloud so as to minimize infrastructure costs while maintaining secure VoIP communication. The demand for cost-effective, scalable SBC services is increasing market growth across all sizes of businesses.

SBCs are universally used to secure and optimize network traffic, preventing toll fraud, ensuring top-notch service quality for other service providers and industries. Introduction As enterprises increasingly migrate their contact centers to the cloud, session border controllers (SBCs) will need to act as the gatekeepers for security and regulatory compliance related to voice traffic. Moreover, enterprises and corporates launching VoIP, UC, and cloud collaboration tools rely on SBCs to protect from security loopholes and services downtimes.

Regulatory compliance remains a key driver of the market, as changing telecom laws like FCC regulations in the USA or GDPR in Europe must be adhered to with secure call handling, encryption, and lawful interception. BFSI and healthcare enterprises, as well as government agencies, with high compliance requirements need advanced SBC solutions to secure sensitive communications without compromising compliance mandate. Comparative to the leading SBC market, North America dominates due to its strict regulatory policies, high adoption of VoIP, and strong cybersecurity focus, along with the presence of major solution providers in this market.

On the other hand, in emerging markets like India and Australia, growing telecom infrastructures, escalating cloud communication activities, as well as regulatory oversight in digital economies are encouraging the adoption of SBCs in these regions.

Explore FMI!

Book a free demo

| Company | Acme Packet |

|---|---|

| Contract/DevelopmentDetails | Awarded a contract by a leading telecommunications provider to deploy session border controllers, enhancing VoIP security and interoperability. |

| Date | April 2024 |

| Contract Value (USD million) | Approximately USD15 |

| Renewal Period | 3 years |

| Company | AudioCodes Ltd. |

|---|---|

| Contract/Development Details | Partnered with a multinational corporation to implement session border controllers, aiming to improve unified communications and collaboration solutions. |

| Date | September 2024 |

| Contract Value (USD million) | Approximately USD10 |

| Renewal Period | 2 years |

Rising VoIP and SIP adoption drives demand for secure and efficient communication networks

With the future in global communications leaning towards Voice over Internet Protocol (VoIP) and Session Initiation Protocol (SIP) technologies, telecommunications infrastructures have undergone a sea change. According to research on VoIP service market, in 2023 the global VoIP services market was worth roughly USD112.9 billion, with a projected value of USD263.0 billion by 2032, signifying a compound annual growth rate (CAGR) of 9.6%. SIP and VoIP solutions are cost-effective, scalable, and seamless to integrate, so this boom comes as no surprise.

But the move to IP-based communications brings its own challenges in areas such as security and network management. This challenge has led to the development of Session Border Controllers (SBCs) as critical devices for overcoming these challenges, which provide excellent security features such as encryption, authentication, and fraud prevention.

Governments have previously recognized the need for secured VoIP communications, and the Federal Communications Commission (FCC), for example, has issued compulsory guidelines for the rapid provisioning of VoIP 911 services, enabling IP-based Emergency Networks to be made adequately and adequately secure. As more companies embrace VoIP and SIP solutions, the need for SBCs will grow, keeping communication networks secure and effective.

Expansion of Unified Communications (UC) platforms requires secure SIP connectivity

Unified communications (UC) platforms combine multiple communication tools (like voice, video, messaging and collaboration) into a unified system to boost organization efficiency. Session Initiation Protocol (SIP) serves as the backbone of many UC solutions by enabling the initialization, maintenance, and teardown of real-time sessions.

The growing adoption of UC platforms by businesses to enhance efficiency has created a need for secure SIP connectivity. In this context, Session Border Controllers (SBCs) become key by managing SIP traffic, securing it from attacks such as denial-of-service attacks or eavesdropping and allowing interoperability between non-homogeneous systems.

The worldwide SBC market is projected to expand from roughly USD1.2 billion in 2023 to USD2.8 billion by 2032, at a CAGR of 9.8%. This growth is fueled by the increasing implementation of UC platforms across industries. And government agencies, many of which have discovered advantages in integrated communication systems, are implementing UC solutions as well.

The Pentagon, for instance, has detailed plans for private 5G networks that enable next-gen UC and are key to making them secure and interoperable. The role of SBCs will be increasingly important to facilitate secure and efficient SIP connectivity as UC platforms become more prevalent.

Growing demand for 5G-compatible SBCs to support high-speed and low-latency communication

The arrival of 5G technology, there are going to be enviable improvements in communication speeds and latency that will change so many industries and their respective processes. To realize the full potential of 5G, network elements, including Session Border Controllers (SBCs), must be 5G-compliant. Specialized 5G data center-ready embedded and box top computers (SBCs) allow you to deal with high-power data throughput and low-latency processing for mission-critical applications such as telemedicine, autonomous vehicles, and augmented reality.

These SBCs secure session management across complex 5G architectures, including network slicing and edge computing environments, and provide a foundation for 5G mobile services. Secure 5G ecosystems are actively enabled by government initiatives. For example, The Department of Defense has published a strategy supporting the utilization of commercial private 5G networks on military installations and calls for the adoption of Open Radio Access Network (RAN) solutions to improve security and performance.

High implementation costs hinder adoption, especially for small and medium enterprises

The evolution towards direct cloud communication is transforming enterprise voice and the transmission of data, decreasing dependency on conventional SBC architectures. Cloud-based solutions have many organizations migrating from on-premise SBCs to SBCs built into cloud- based communication platforms that provide traffic management, security, and scaling capabilities. UCaaS and CPaaS cloud service providers deliver a voice and video calling with end-to-end encryption, obviating the need for additional SBC infrastructure.

Furthermore, direct cloud peering is growing among MSO and enterprise-level telecom operators with VoIP and SIP trunking services directly connecting to cloud-hosted applications, thus avoiding conventional SBCs. Increasing demand for software-defined networking (SDN) and cloud-native architectures enabling increased flexibility and automation in transport of voice traffic is driving this transition.

Organizations that are using Microsoft Teams Direct Routing, Zoom Phone, and Google Voice are increasingly selecting direct cloud connectivity instead of deploy an SBC for SIP-based communications.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced VoIP security regulations, increasing adoption of SBCs. |

| Cloud Adoption | Enterprises migrated to cloud-based SBCs for cost efficiency and scalability. |

| Security Enhancements | Encryption protocols improved to mitigate VoIP-based cyber threats. |

| Enterprise Communication Evolution | Increased adoption of unified communications platforms accelerated SBC deployment. |

| Market Growth Drivers | Surge in remote work and VoIP traffic spiked demand for SBCs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered threat detection mandates drive real-time security enhancements in VoIP communications. |

| Cloud Adoption | Fully autonomous cloud-native SBCs integrate AI-driven security analytics and automation. |

| Security Enhancements | Quantum-safe encryption standards emerge to prevent next-gen security threats. |

| Enterprise Communication Evolution | Decentralized peer-to-peer VoIP networks reduce reliance on traditional SBC architecture. |

| Market Growth Drivers | Integration with AI-powered voice assistants and real-time analytics fuels market expansion. |

The worldwide Session Border Controller (SBC) market is segmented into three tiers based on vendor capabilities, global presence, and technical expertise. The Tier 1 vendors can be mentioned as the top market players such as Cisco Systems, Oracle Corporation, and AudioCodes, are further dominating the market with their extensive product portfolios and strong partnerships with large enterprises and telecom service providers.

As large companies also have established distribution networks with consistent funding in R&D and acquisition of other companies, market presence only increases. Their solutions ensure SIP trunking with secure network access, enabling large-scale deployments while maintaining secure and efficient communications across multi-device networks.

Tier 2 vendors include companies like Ribbon Communications, Avaya and Huawei Technologies that provide competitive solutions and which excel within particular customer segments. These vendors offer strong SBC solutions that are geared towards enterprises, contact centers, and regional telcos.

They frequently combine SBC features with larger unified communications platforms, which makes them appealing to companies in the midst of undergoing digital transformation. Although they do not control the same market as Tier 1 vendors, their innovations and customer-centric strategies allow them effective access to the marketplace.

Tier 3 vendors like Patton Electronics, Ingate Systems, and Edgewater Networks offer low-cost, niche SBC solutions. TheRemaining3 Can provide secure SIP for small and medium businesses (SMB) and for unique market segments that just don't need (or can't afford) a large infrastructure. While their impact on the market may be limited, they add to the diversity of the industry by emphasizing innovation, affordability, and customization.

The section highlights the CAGRs of countries experiencing growth in the Session Border Controllers market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 12.6% |

| China | 10.6% |

| Germany | 7.2% |

| Japan | 9.2% |

| United States | 8.7% |

With rapidly growing VoIP and SIP-based communications among China enterprise sector, the demand for Session Border Controllers (SBCs) is driven in order to provide secure and seamless connectivity. Relying on the government's promotion of the "China Digital Economy Development Plan", along with the information technology and the digital transformation of enterprises set off by the financial IT anchors, enterprises will specifically use the communication modules of traditional telephones and IP.

The increasing penetration of 5G4 networks in China, which now has more than 3.2 million base stations in 2023, has further fueled cloud telephony and SIP trunking adoption. To ensure high-fidelity voice and video communications, enterprises compete in a game of SBC (session border controller), controlling real-time transmissions of data between networks.

In March 2024 the MIIT (Ministry of Industry and Information Technology) of China released new policies to accelerate the growth of IP-based communication networks with the goal of lowering costs for enterprise users whilst increasing the security base. This action is likely to boost SBC enforcement, especially among multinationals and large companies in China. Moreover, with more cross-boundary enterprises on the rise, the need for secure SIPs has also increased, thereby widening the demand for SBCs. China is anticipated to see substantial growth at a CAGR 10.6% from 2025 to 2035 in the Session Border Controllers market.

The market for Unified Communications (UC) in India is growing at a rapid pace and Session Border Controllers (SBCs) are being increasingly integrated into enterprise networks. The government of India has launched Digital India and the businesses are moving their communication towards cloud-based communication solutions as they help save costs and increase efficiency. It witnessed a 35% surge in UC adoption in 2023 on the back of an increasing requirement for seamless remote collaboration, particularly among IT, BFSI, and telecom sectors. This evolution has led to increased implementation of SBC to manage secure SIP connectivity, mitigate fraud and ensure compliance.

In February 2024, the Telecom Regulatory Authority of India (TRAI) released a set of new guidelines that aimed to simplify SIP based communication while motivating enterprises to upgrade their telephony architecture. This policy fall in line with the increased global requirement for hosted PBX, VoIP and video conferencing solutions, whereby SBCs have a critical role in security and session management. India's Session Border Controllers market is growing at a CAGR of 12.6% during the forecast period.

The adoption of the hybrid work model across the United States has caused the demand for cloud-compatible Session Border Controllers (SBCs) to ramp up. Enterprises are increasingly deploying Unified Communications as a Service (UCaaS) and collaboration solutions such as Microsoft Teams, Zoom and Cisco Webex, resulting in a need for extensive security and interoperability capabilities. As of 2023, 69% of USA

companies reported giving the opportunity for hybrid work and businesses are leveraging SBCs to protect SIP-based communications between remote and on-premise environments Cloud-Based Session Border Controllers: Enabling Secure Remote Access, Encryption, and Traffic Prioritization in Cloud-Based Communication Networks October 2023

In April 2024, the Federal Communications Commission (FCC) issued new cybersecurity guidelines for VoIP service providers, requiring the implementation of more robust security measures to prevent fraud and cyberattacks. As a result, adoption of AI-driven threat detection and real-time monitoring on next-generation SBCs has been accelerated as per these regulations. USA is anticipated to see substantial growth in the Session Border Controllers market significantly holds dominant share of 72.5% in 2025.

The section provides detailed insights into key segments of the Session Border Controllers market. Among these, Aerospace & Defense is growing quickly and making prominent advancements. The Test Data Simulation Software hold dominant share.

The world is undergoing a large scale expansion of CSPs (Communication Service Provider) which has a significant contribution to the increase in the demand for Session border controllers (SBCs). With continued growth in demand for VoIP, SIP trunking, and cloud-based communication services, CSPs แก่้ are adopting SBCs to provide seamless real-time communications that are secure, scalable, and highly optimized for voice and video transmission.

Furthermore, the increasing proliferation of 5G networks across the globe, particularly in countries like the United States, China and India, is driving SBC deployment for the management of low-latency, high-speed communication traffic. In 2023, the worldwide VoIP user base surpassed 1.2 billion, implying the requirement for solutions for security & session management, wherein we can find an extensive utilization of SBCs.

The new telecom policy was passed by the European Union in March 2024 and consisted of cybersecurity measures requiring that VoIP and SIP services operate with more robust network security frameworks. This regulation has led CSPs to implement AI-powered SBCs to thwart cyber threats and maintain compliance. Communication Service Providers grows at a substantial CAGR of 9.4% from 2025 to 2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Communication Service Providers (End User) | 9.4% |

The Session Border Controller (SBC) market share is led by large enterprises in both value and deployment volume. Enterprise SBC They encompass large multi-location operations with complex communication architecture that cannot survive with a low-end SBC, they employ high performance SBC that can suitably provision, terminate, and centralize VoIP, UC and SIP-based networks. BFSI, healthcare, and IT services are the top industries adopting SBCs due to their demand for secure real-time communication and compliance requirements.

According to a report, more than 75% of Fortune 500 organizations implemented SIP-based communication in 2023, further establishing SBCs as a necessary component of end-point management for enterprises.

The Indian Ministry of Electronics and IT (MeitY) in February 2024 have emphasized stringent enforcement of these guidelines on enterprise communication networks, thus driving growth for cloud-based high-capacity SBCs in enterprise segment. Large Enterprise are projected to dominate the Session Border Controllers market, capturing a substantial share of 56.3% in 2025.

| Segment | Value Share ( 2025 ) |

|---|---|

| Large Enterprise (Enterprise Size) | 56.3% |

The competition in the Session Border Controller (SBC) market is intense due to the rising need for secure voice-over-IP (VoIP) and session initiation protocol (SIP)-based communication in diverse businesses. As technology advances and different market players emerge, more organizations are now moving towards cloud-native Session Border Controllers (SBCs), adopting an AI-driven security approach, and are looking to seamlessly integrate with UC platforms.

Competition has been further fuelled by 5G, and hybrid work models leading vendors to quickly improve scalability, network security and regulatory compliance. The rise of open-source alternatives and direct-to-cloud communication solutions presents challenges, compelling traditional SBC vendors to innovate and diversify their services.

Industry Update

The Global Session Border Controllers industry is projected to witness CAGR of 8.2% between 2025 and 2035.

The Global Session Border Controllers industry stood at USD 838.0 million in 2025.

The Global Session Border Controllers industry is anticipated to reach USD 1,886.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.4% in the assessment period.

The key players operating in the Global Session Border Controllers Industry Cisco Systems, Oracle Communications, Ribbon Communications, AudioCodes, Avaya, Metaswitch (a Microsoft company), Nokia, Huawei Technologies, Ericsson, Sangoma Technologies.

In terms of solution, the segment is divided into Session Border Controllers and Services.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise Size and Large Enterprise.

In terms of end user, the segment is segregated into Data Centers, Communication Service Providers, Contact Centers, Enterprises/Corporates and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Semiconductor Substrate Market Insights - Trends & Forecast 2025 to 2035

Hyperscale Cloud Market Trends - Growth & Forecast 2025 to 2035

Endpoint Detection and Response Market Growth - 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Unattended Ground Sensors (UGS) Market Trends - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.