As per Future Market Insights analysis, the global service integration and management market is estimated to reach a value of more than US$ 16.4 Bn by the end of 2027 from an estimate of a bit above US$ 6.7 Bn in 2017. It is expected to grow a high CAGR of 9.2% throughout the period of forecast, 2017-2027. The service integration and management market growth can be attributed to increasing deployment of IT and managed services.

Revenue from the market is also increasing due to adoption of new technologies such as big data analytics in order to improve performance and delivery of services on time. Increasing global ICT spending is expected to support the robust growth of the service integration and management market in the years to come.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

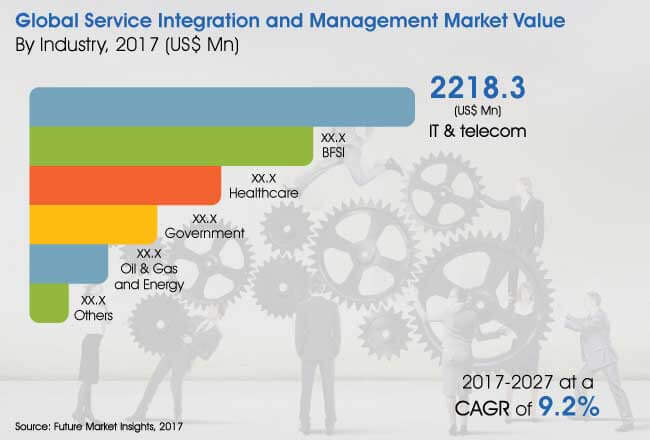

Government and oil & gas segments in the industry category are anticipated to grow at the same pace in the coming years. Both these segments are expected to register a high CAGR of 11.8% throughout the period of assessment owing to increased adoption of service integration and management process in these industries. However, the government segment holds a high market share as of 2017 reflecting a higher market valuation and is likely to advance with this trend in the years to come.

By the end of 2027, the government segment is estimated to reach US$ 2.5 Bn, a market value higher than that of the oil & gas and energy segment. Increasing investment on service integration & management solutions by governments of various countries has pushed the growth of the government segment in this market.

According to the analysis of the research report, the IT and telecom segment in the industry category has been enjoying a lion’s share since 2016. In 2017, this segment reflected a value of about US$ 2.2 Bn and is projected to reach a valuation of more than US$ 4 Bn by the end of the assessment period. This segment, however, shows a comparatively slow growth rate during the period of forecast. The higher revenue generation can be attributed towards the increasing digitalization in business processes worldwide.

Healthcare segment in the industry category is also catching steam and is poised to reflect a higher potential in the coming years. The healthcare segment is projected to grow at a robust CAGR of 10.9% throughout the period of assessment, 2017-2027 and is estimated to reach a value of about US$ 2.8 Bn by the end of the forecasted year from a mere US$ 990 Mn in 2017. This tremendous growth in the healthcare industry segment has contributed to the overall growth of the global service integration and management market.

On the other hand, the BFSI industry segment is the second largest and is valued at US$ 1.5 Bn in 2017. It is anticipated to reach a significant valuation by the end of 2027 owing to a high 8.6% CAGR during the forecast period.

By IT Solutions:

By Enterprise Type:

By Industry:

By Region:

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need

and save 40%!

The service integration and management market are predicted to grow at 9.3% CAGR through 2032.

Sales of service integration and management are likely to exceed a valuation of US$ 26 Bn by 2032.

The adoption of service integration and management is likely to reach a valuation of US$ 11 Bn in 2022.

North America is the key contributor to the service integration and management market.

1. Executive Summary 1.1. Market Overview 1.2. Market Analysis 1.3. FMI Recommendations 2. Market Introduction 2.1. Market Taxonomy 2.2. Market Definition 2.3. Factor Affecting Service Integration & Management 2.4. Market Overview 3. Market View Point 3.1. Macro-Economic Factors 3.2. Opportunity Analysis 3.3. Key Regulation 3.4. Market Evolution 4. Global Market Analysis 2012–2016 and Forecast 2017–2027 4.1. Market Size and Y-o-Y Growth 4.2. Absolute $ Opportunity 5. North America Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 5.1. Introduction 5.2. Regional Market Dynamics 5.3. Drivers and Restraints: Impact Analysis 5.3.1. Drivers 5.3.2. Restraints 5.3.3. Trends 5.4. Market Size –Value (US$ Mn) By Country, 2012-2016 5.4.1. U.S. 5.4.2. Canada 5.5. Market Size - Value (US$ Mn) and Forecast By Country, 2017-2027 5.5.1. U.S. 5.5.2. Canada 5.6. Market Size - Value (US$ Mn) and Forecast By IT Solution 5.6.1. IT Infrastructure Management 5.6.2. Network Management 5.6.3. Compliance & Risk Management 5.6.4. Others 5.7. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 5.7.1. Small & Medium Enterprise 5.7.2. Large Enterprise 5.8. Market Size - Value (US$ Mn) and Forecast By Industry 5.8.1. IT & Telecom 5.8.2. BFSI 5.8.3. Government 5.8.4. Healthcare 5.8.5. Oil & Gas and Energy 5.8.6. Others 5.9. Market Attractiveness Analysis 5.9.1. By Country 5.9.2. By IT Solution 5.9.3. By Enterprise Type 5.9.4. By Industry 5.10. Market Presence (Intensity Map) 6. Western Europe Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 6.1. Introduction 6.2. Regional Market Dynamics 6.2.1. Drivers 6.2.2. Restraints 6.2.3. Trends 6.3. Market Size –Value (US$ Mn) By Country, 2012-2016 6.3.1. Germany 6.3.2. France 6.3.3. U.K. 6.3.4. Spain 6.3.5. Italy 6.3.6. BENELUX 6.3.7. Nordic 6.3.8. Rest of Western Europe 6.4. Market Size –Value (US$ Mn) and Forecast By Country, 2017-2027 6.4.1. Germany 6.4.2. France 6.4.3. U.K. 6.4.4. Spain 6.4.5. Italy 6.4.6. BENELUX 6.4.7. Nordic 6.4.8. Rest of Western Europe 6.5. Market Size - Value (US$ Mn) and Forecast By IT Solution 6.5.1. IT Infrastructure Management 6.5.2. Network Management 6.5.3. Compliance & Risk Management 6.5.4. Others 6.6. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 6.6.1. Small & Medium Enterprise 6.6.2. Large Enterprise 6.7. Market Size - Value (US$ Mn) and Forecast By Industry 6.7.1. IT & Telecom 6.7.2. BFSI 6.7.3. Government 6.7.4. Healthcare 6.7.5. Oil & Gas and Energy 6.7.6. Others 6.8. Market Attractiveness Analysis 6.8.1. By Country 6.8.2. By IT Solution 6.8.3. By Enterprise Type 6.8.4. By Industry 6.9. Market Presence (Intensity Map) 7. Eastern Europe Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 7.1. Introduction 7.2. Regional Market Dynamics 7.2.1. Drivers 7.2.2. Restraints 7.2.3. Trends 7.3. Market Size –Value (US$ Mn) By Country, 2012-2016 7.3.1. Russia 7.3.2. Poland 7.3.3. Rest of Eastern Europe 7.4. Market Size –Value (US$ Mn) and Forecast By Country, 2017-2027 7.4.1. Russia 7.4.2. Poland 7.4.3. Rest of Eastern Europe 7.5. Market Size - Value (US$ Mn) and Forecast By IT Solution 7.5.1. IT Infrastructure Management 7.5.2. Network Management 7.5.3. Compliance & Risk Management 7.5.4. Others 7.6. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 7.6.1. Small & Medium Enterprise 7.6.2. Large Enterprise 7.7. Market Size - Value (US$ Mn) and Forecast By Industry 7.7.1. IT & Telecom 7.7.2. BFSI 7.7.3. Government 7.7.4. Healthcare 7.7.5. Oil & Gas and Energy 7.7.6. Others 7.8. Market Attractiveness Analysis 7.8.1. By Country 7.8.2. By IT Solution 7.8.3. By Enterprise Type 7.8.4. By Industry 7.9. Market Presence (Intensity Map) 8. Latin America Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 8.1. Introduction 8.2. Regional Market Dynamics 8.2.1. Drivers 8.2.2. Restraints 8.2.3. Trends 8.3. Market Size –Value (US$ Mn) By Country, 2012-2016 8.3.1. Brazil 8.3.2. Mexico 8.3.3. Rest of Latin America 8.4. Market Size –Value (US$ Mn) and Forecast By Country, 2017-2027 8.4.1. Brazil 8.4.2. Mexico 8.4.3. Rest of Latin America 8.5. Market Size - Value (US$ Mn) and Forecast By IT Solution 8.5.1. IT Infrastructure Management 8.5.2. Network Management 8.5.3. Compliance & Risk Management 8.5.4. Others 8.6. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 8.6.1. Small & Medium Enterprise 8.6.2. Large Enterprise 8.7. Market Size - Value (US$ Mn) and Forecast By Industry 8.7.1. IT & Telecom 8.7.2. BFSI 8.7.3. Government 8.7.4. Healthcare 8.7.5. Oil & Gas and Energy 8.7.6. Others 8.8. Market Attractiveness Analysis 8.8.1. By Country 8.8.2. By IT Solution 8.8.3. By Enterprise Type 8.8.4. By Industry 8.9. Market Presence (Intensity Map) 9. Asia Pacific Excluding Japan (APEJ) Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 9.1. Introduction 9.2. Regional Market Dynamics 9.2.1. Drivers 9.2.2. Restraints 9.2.3. Trends 9.3. Market Size –Value (US$ Mn) By Country, 2012-2016 9.3.1. China 9.3.2. India 9.3.3. Australia and New Zealand 9.3.4. ASEAN 9.3.5. Rest of APEJ 9.4. Market Size –Value (US$ Mn) and Forecast By Country, 2017-2027 9.4.1. China 9.4.2. India 9.4.3. Australia and New Zealand 9.4.4. ASEAN 9.4.5. Rest of APEJ 9.5. Market Size - Value (US$ Mn) and Forecast By IT Solution 9.5.1. IT Infrastructure Management 9.5.2. Network Management 9.5.3. Compliance & Risk Management 9.5.4. Others 9.6. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 9.6.1. Small & Medium Enterprise 9.6.2. Large Enterprise 9.7. Market Size - Value (US$ Mn) and Forecast By Industry 9.7.1. IT & Telecom 9.7.2. BFSI 9.7.3. Government 9.7.4. Healthcare 9.7.5. Oil & Gas and Energy 9.7.6. Others 9.8. Market Attractiveness Analysis 9.8.1. By Country 9.8.2. By IT Solution 9.8.3. By Enterprise Type 9.8.4. By Industry 9.9. Market Presence (Intensity Map) 10. Japan Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 10.1. Introduction 10.2. Regional Market Dynamics 10.2.1. Drivers 10.2.2. Restraints 10.2.3. Trends 10.3. Market Size - Value (US$ Mn) and Forecast By IT Solution 10.3.1. IT Infrastructure Management 10.3.2. Network Management 10.3.3. Compliance & Risk Management 10.3.4. Others 10.4. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 10.4.1. Small & Medium Enterprise 10.4.2. Large Enterprise 10.5. Market Size - Value (US$ Mn) and Forecast By Industry 10.5.1. IT & Telecom 10.5.2. BFSI 10.5.3. Government 10.5.4. Healthcare 10.5.5. Oil & Gas and Energy 10.5.6. Others 10.6. Market Attractiveness Analysis 10.6.1. By Country 10.6.2. By IT Solution 10.6.3. By Enterprise Type 10.6.4. By Industry 10.7. Market Presence (Intensity Map) 11. Middle East and Africa Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 11.1. Introduction 11.2. Regional Market Dynamics 11.2.1. Drivers 11.2.2. Restraints 11.2.3. Trends 11.3. Market Size –Value (US$ Mn) By Country, 2012-2016 11.3.1. GCC Countries 11.3.2. Turkey 11.3.3. Northern Africa 11.3.4. South Africa 11.3.5. Rest of MEA 11.4. Market Size –Value (US$ Mn) and Forecast By Country, 2017-2027 11.4.1. GCC Countries 11.4.2. Turkey 11.4.3. Northern Africa 11.4.4. South Africa 11.4.5. Rest of MEA 11.5. Market Size - Value (US$ Mn) and Forecast By IT Solution 11.5.1. IT Infrastructure Management 11.5.2. Network Management 11.5.3. Compliance & Risk Management 11.5.4. Others 11.6. Market Size - Value (US$ Mn) and Forecast By Enterprise Type 11.6.1. Small & Medium Enterprise 11.6.2. Large Enterprise 11.7. Market Size - Value (US$ Mn) and Forecast By Industry 11.7.1. IT & Telecom 11.7.2. BFSI 11.7.3. Government 11.7.4. Healthcare 11.7.5. Oil & Gas and Energy 11.7.6. Others 11.8. Market Attractiveness Analysis 11.8.1. By Country 11.8.2. By IT Solution 11.8.3. By Enterprise Type 11.8.4. By Industry 11.9. Market Presence (Intensity Map) 12. Forecast Factors: Relevance and Impact 13. Competition Landscape 13.1. Market Structure 13.2. Market Share Analysis 13.3. Competition Intensity Mapping By Market Taxonomy 13.4. Competition Dashboard 13.5. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments) 13.5.1. Capgemini 13.5.2. HCL Technologies Limited 13.5.3. Oracle Corporation 13.5.4. Wipro Limited 13.5.5. Fujitsu Limited 13.5.6. Cisco Systems, Inc. 13.5.7. Accenture PLC 13.5.8. ATOS SE 13.5.9. ServiceNow Inc. 13.5.10. Capita PLC 13.5.11. Company Snapshot 13.5.11.1. Tata Consultancy Services 13.5.11.2. CGI Group Inc. 13.5.11.3. Quint Group 13.5.11.4. NTT Data Corporation 13.5.11.5. DXC technology 13.5.11.6. Sofigate Oy 14. Global Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027 14.1. Introduction / Key Findings 14.2. Market Size –Value (US$ Mn) and Forecast By Region 14.2.1. North America 14.2.2. Western Europe 14.2.3. Eastern Europe 14.2.4. Latin America 14.2.5. Asia Pacific Excluding Japan 14.2.6. Japan 14.2.7. Middle East and Africa 14.3. Market Attractiveness Analysis By Region 15. Global Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027, By IT Solution 15.1. Introduction 15.2.Market Size –Value (US$ Mn) and Forecast By IT Solution 15.2.1. IT Infrastructure Management 15.2.2. Network Management 15.2.3. Compliance & Risk Management 15.2.4. Others 15.3. Market Attractiveness Analysis By IT Solution 16. Global Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027, By Enterprise Type 16.1. Introduction / Key Findings 16.2. Market Size –Value (US$ Mn) and Forecast By Enterprise Type 16.2.1. Small & Medium Enterprise 16.2.2. Large Enterprise 16.3. Market Attractiveness Analysis By Enterprise Type 17. Global Service Integration & Management Market Analysis 2012–2016 and Forecast 2017–2027, By Industry 17.1. Introduction / Key Findings 17.2. Market Size –Value (US$ Mn) and Forecast By Industry 17.2.1. IT & Telecom 17.2.2. BFSI 17.2.3. Government 17.2.4. Healthcare 17.2.5. Oil & Gas and Energy 17.2.6. Others 17.3. Key Trends / Developments 17.4. Market Attractiveness Analysis By Industry 18. Research Methodology 19. Assumption & Acronyms

Explore Technology Insights

View Reports