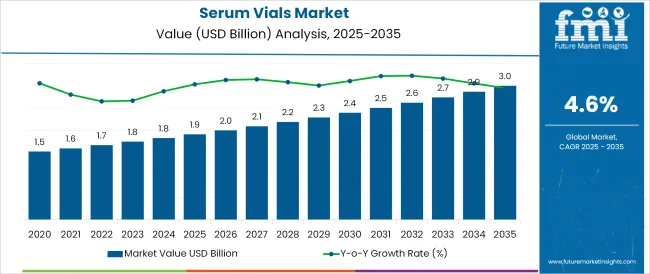

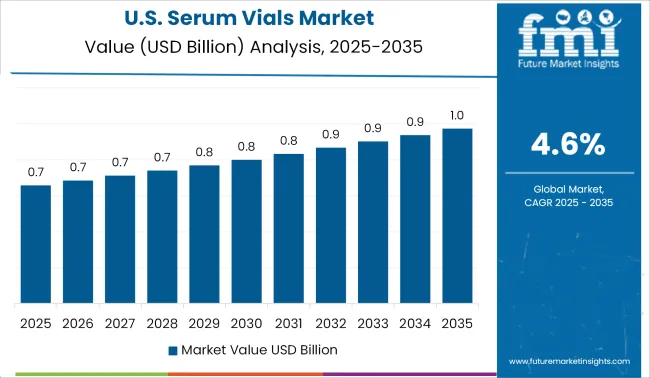

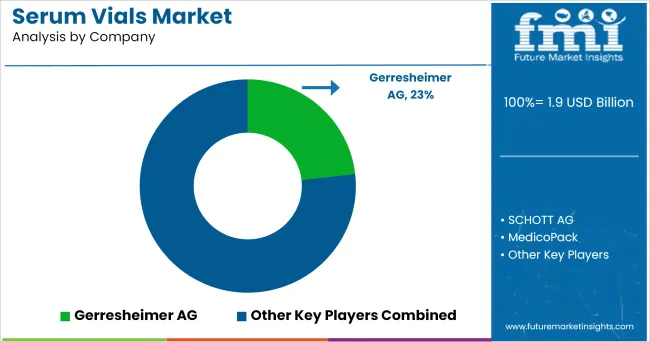

The Serum Vials Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The serum vials market is witnessing consistent growth, fueled by the expansion of biopharmaceutical manufacturing, heightened focus on vaccine and injectable drug delivery systems, and stricter regulations on storage safety and sterility. These vials play a crucial role in preserving the integrity of sensitive liquid formulations, where container interaction and leakage risks must be minimized.

Regulatory standards from agencies such as the FDA and EMA have heightened demand for precision-engineered vials with tight sealing and high thermal and chemical stability. Innovations in glass surface treatment, dimensional consistency, and freeze-drying compatibility are further driving product adoption across clinical and commercial stages.

The industry is also benefiting from growing investments in life sciences, where small-volume, contamination-resistant packaging is central to product integrity. As pharmaceutical supply chains modernize and globalize, demand for high-quality, standard-compliant serum vials is expected to remain robust.

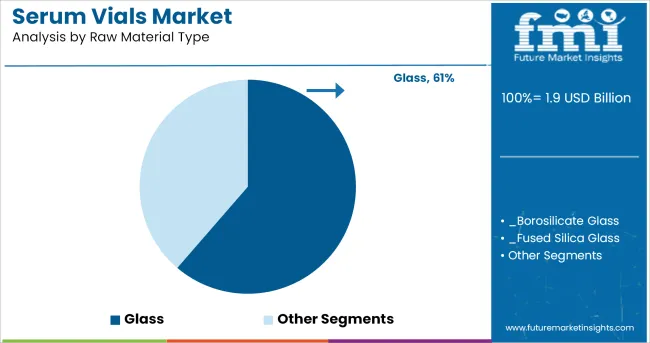

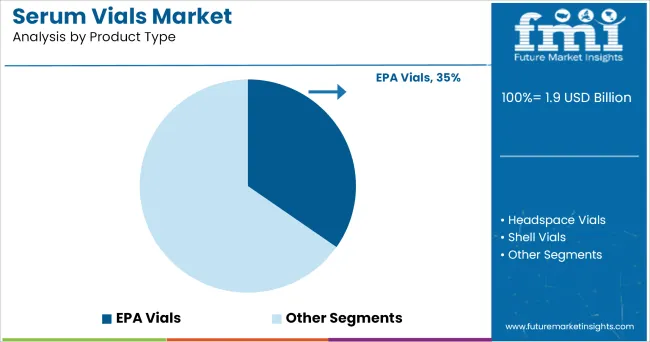

The market is segmented by Raw Material Type, Product Type, Storage Capacity, and End-User and region. By Raw Material Type, the market is divided into Glass, Borosilicate Glass, Fused Silica Glass, and Plastic. In terms of Product Type, the market is classified into EPA Vials, Headspace Vials, Shell Vials, Tubular, Molded, and Screw Neck.

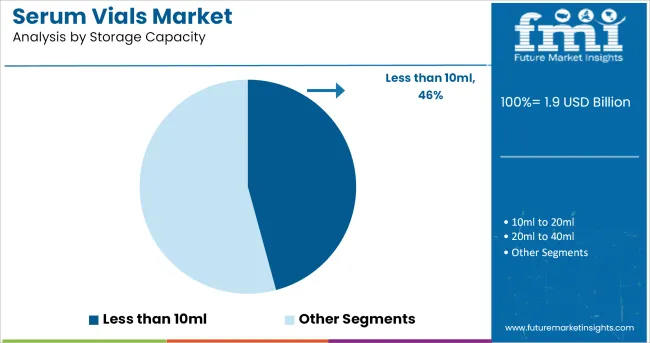

Based on Storage Capacity, the market is segmented into Less than 10ml, 10ml to 20ml, 20ml to 40ml, and 40ml and above. By End-User, the market is divided into Pharmaceuticals, Healthcare and Hospitals, Chemicals, Industrials, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass is expected to account for 61.3% of the total revenue share in the serum vials market by 2025, making it the leading raw material segment. This dominance is being driven by the material’s superior chemical resistance, non-reactivity, and barrier properties, which are essential for preserving the stability of biological formulations.

Glass vials are widely preferred in pharmaceutical and laboratory environments due to their compatibility with sterilization processes, including autoclaving and dry heat. The ability of borosilicate and Type I glass to withstand extreme temperature variations without compromising structural integrity reinforces their usage in freeze-dried and cold-chain applications.

Additionally, regulatory compliance requirements for parenteral packaging have solidified glass’s position as the benchmark material in both clinical and commercial drug supply. Continued investment in defect-free glass vial production and automated inspection technologies further supports the reliability and scalability of glass-based serum vial solutions.

EPA vials are projected to represent 34.7% of the serum vials market revenue by 2025, establishing them as the leading product type segment. This leadership is attributed to their robust specifications for purity, cleanliness, and chemical resistance, which align with analytical testing and sample preservation requirements.

EPA vials are manufactured under tightly controlled conditions to minimize trace-level contamination, making them suitable for critical pharmaceutical and environmental testing applications. Their use in storing and transporting volatile substances and liquid reagents has increased significantly due to their precision neck finishes and leak-proof closure compatibility. These features are vital in maintaining sample integrity and supporting traceability in high-stakes laboratory procedures.

As regulatory agencies demand tighter control over sample handling and storage environments, adoption of EPA-standard vials continues to grow within quality assurance, R&D, and chemical testing workflows.

Serum vials with a storage capacity of less than 10ml are forecast to lead the market with a 45.8% revenue share in 2025. This segment’s growth is driven by the rising prevalence of high-potency, low dosage therapies and personalized medicine, which necessitate smaller, precise dosage formats. Low capacity vials are ideal for single-use administration and batch testing, helping reduce waste and prevent cross-contamination.

Their compact size also facilitates cost-effective cold chain logistics, which is essential for biologics and temperature-sensitive formulations. The segment’s leadership is further supported by increased usage in diagnostic reagents, injectable biologics, and vaccine components, where contamination control and dosing accuracy are critical.

Manufacturers are also prioritizing innovations in small-volume vial design to accommodate lyophilization and ensure compatibility with advanced filling and sealing lines. With growing global demand for injectable drugs and diagnostic accuracy, the less-than-10ml category is expected to maintain its leadership across clinical, laboratory, and commercial supply chains.

They are versatile and also recyclable and used to store medicines with the right quantity due to the available capacity of the vial such as less than 10ml and others. The major factor for soaring the demand is for maintaining the quality of medicine for a prescribed period.

Due to the leak-proof property by using a screw or cork will further secure the medicine inside the vial for the transportation of the medicines. As previous vials of plastic or aluminum glass do not impart the flavors into the medicines stored in the vial and thus provide escalation in the imposition of the vials.

Numerous players in the pharmaceutical industries and testing laboratories have prospered on the back of state-of-the-art facilities. The demand is so much that they are expanding their product portfolio that conforms to ISO 15378 GMP Standards.

The rise in the demand for pharmaceutical products in this pandemic will surely gargantuan the demand for the vials for the storage of vaccines and samples of the strains. Strides in pharmaceutical packaging have boosted the trend of adopting eco-friendly materials.

The demand from the healthcare and hospital due to the increase in the consumption of vaccines, biopharmaceuticals, and insulin will provide ample amount of growth. Hence the market witness the backdrop of the chromatography market in various industries including biotechnology, life science, chemical, F&B, and pesticides.

Researchers need ready to use vials and serum vials for their laboratory work. Some of the regulations compromise United States Pharmacopeia, European Pharmacopeia standards, and British Standard BS1679. A growing arrogation for vials for pharmaceutical, healthcare, and hospital and laboratory work will propel the market towards healthy growth.

Regionally, North America has been a remarkably lucrative market. a part of their revenue generation is supported by the presence of numerous globally prominent pharmaceutical packaging manufacturers. The growing focus on the safety of medications that patients take is also bolstering the regional prospects, especially in the USA

Furthermore, in near future a sizable economic growth is expected in developing countries such as India, China, ASEAN, etc. with growing applications of serum vials in drugs storage and sample collection will drive the overall growth of the market in the Asia Pacific region.

As the developing region Asia Pacific shows healthier outcome in the field of pharmaceutical and medical sector. In the near future the overall Asia Pacific region would conquer the market by its own in terms of market value which would then make a steady growth over the period of time.

Some of the leading manufacturers and suppliers of Serum Vials include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators, and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global serum vials market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the serum vials market is projected to reach USD 3.0 billion by 2035.

The serum vials market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in serum vials market are glass, borosilicate glass, fused silica glass and plastic.

In terms of product type, epa vials segment to command 34.7% share in the serum vials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Positioning & Share in the Serum Bottles Market

Serum Separating Tubes Market

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Facial Serum Market Forecast and Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Crimp Neck Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Free Eye Serum Market Analysis – Growth & Demand 2024-2034

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA