The self-testing market is witnessing substantial growth, led by increasing consumer demand for at-home diagnostic solutions, digital monitoring devices, and a rising focus on preventive healthcare. Self-testing kits are rapidly being adopted for chronic disease management, detection of infectious diseases, and monitoring of reproductive health.

The market expansion is supported by leading players such as F.These are Hoffmann-La Roche AG, Johnson & Johnson, Ascensia Diabetes Care Holdings AG, B Braun and Procter & Gamble Co., among others. This group makes up about 72.9% of the market share with emphasis on innovations in rapid diagnostic technologies, smartphone-integrated self-tests, and AI-driven analytics. Other players include Assure Tech, Bionime Corporation and others who account for another 27.1% market share, mainly for advanced point-of-care testing solutions and personalized health monitoring.

| Attribute | Details |

|---|---|

| Projected Value by 2025 | USD 8,855.3 million |

Mid-tier and emerging players gain ground through self-testing kits affordable, user-friendly, and having high accuracy for multi-disease screening panels along with expansion in their product offerings. Telemedicine and remote monitoring of patients will further change the competitive landscape because manufacturers will pay attention to the connected diagnostic platform and real-time health tracking.

The market access is improved with the help of research into biosensor technology, AI-based interpretation of tests, and smartphone-compatible self-testing solutions by manufacturers. The increased adoption of home-based diagnostics for chronic conditions, infectious diseases, and lifestyle monitoring will be expected to fuel steady market growth.

Explore FMI!

Book a free demo

| Global Market Share | Industry Share (%) |

|---|---|

| Top 3 (Roche AG, Johnson & Johnson, Ascensia Diabetes Care Holdings AG) | 54.3% |

| Top 5 (Roche AG, Johnson & Johnson, Ascensia Diabetes Care Holdings AG, B Braun and Procter & Gamble Co.) | 18.6% |

| Chinese Suppliers (Assure Tech, Bionime Corporation and others) | 12.0% |

| Emerging and Regional Players | 15.1% |

The self-testing market exhibits moderate concentration, with leading players collectively holding approximately 72.9% market share.

The market is divided into digital monitoring instruments, self-testing cassettes, self-testing midstream devices, self-testing strips, self-testing cups, self-testing dip cards, self-testing panels, and others. Digital monitoring instruments are the largest share holding 41.3% of the market as smartphone-integrated glucose meters, blood pressure monitors, and cholesterol testing devices gain popularity.

Integration of AI-powered diagnostics and Bluetooth connectivity in digital monitoring instruments is facilitating real-time tracking of health along with remote consultation, thus further enhancing user experience. Self-testing strips and cassettes are also highly utilized, especially in blood glucose and pregnancy testing kits, for easy, cost-effective, and very accurate testing.

The demand for single-use self-testing kits for minimizing contamination risk is also promoting market growth. Besides, the technology for biosensors has improved the sensitivity and reliability in self-testing panels, making them more adaptable for use in various diagnostic applications such as infectious disease detection and chronic disease management.

Blood glucose testing leads the application segment with a 39.5% market share, driven by the global increase in diabetes prevalence and the growing adoption of continuous glucose monitoring (CGM) systems. Pregnancy & fertility testing and drug abuse testing are also significant segments, driven by the availability of rapid home-testing solutions that offer quick and reliable results.

The increasing demands for at-home screening of colorectal and prostate cancer are widely spreading the scope. Infectious disease diagnostics-the area of diagnostic self-tests also expands the reach with HIV, STD/STI, COVID-19 due to regulatory sanctions and increasing user acceptance of point-of-care products.

Urine and blood samples are predominant, accounting for a 63.2% market share since they are most commonly used for glucose, pregnancy, and infectious disease testing. These samples are easy to collect, inexpensive, and highly reliable, making them the first choice for self-testing applications. Saliva-based testing is becoming popular, especially in drug abuse and COVID-19 diagnostics, due to its non-invasive nature and suitability for frequent monitoring.

Vaginal swabs, stool, and semen samples are also expanding in usage due to at-home reproductive health advancements, gastrointestinal testing kits, and microbiome analysis. Applications in dried blood spot testing also are gaining in adoption for screening chronic disease and infectious disease with less need for laboratory-based sample processing.

Retail pharmacies are at the forefront of the distribution segment, with a 44.8% market share, because of the trust and accessibility associated with them. Online pharmacies are growing rapidly due to the demand for discreet and convenient purchase options, offering doorstep delivery and subscription-based models for self-testing kits.

Digital health platforms are increasingly integrating online pharmacy services, making it easier to use for chronic disease and reproductive health testing. Drug stores and supermarkets/hypermarkets are also important distribution channels, especially in areas where the demand for over-the-counter self-test kits is high, which can take advantage of bulk purchasing and promotional offers. The increasing regulatory acceptance of at-home diagnostics is further building up these distribution channels.

Abbott Laboratories

Abbott Laboratories is one of the largest in the self-testing market and leads in smartphone-connected glucose monitoring and rapid infectious disease diagnostics. Innovations developed by the company have brought forth continuous glucose monitoring technology. It integrates real-time data tracking and AI-driven analytics into diabetes management. Abbott's infectious disease self-tests contain true at-home results of COVID-19 and flu detection kits with minimal user intervention.

The firm is venturing into cholesterol and kidney function self-tests as reinforcement of its preventive focus in healthcare. Its diagnostics segment has reported a phenomenal increase in revenue, hitting USD 13.8 billion in 2022 from only USD 12.2 billion in 2021. Abbott has positioned itself as a beacon of innovation in self-testing, leading the evolution in the way that personalized health care has been taken forward in the last decade and maybe more.

Johnson & Johnson

With operations in Medical Devices and Consumer Health, Johnson & Johnson enjoys an important share of the self-testing market. Consistent diabetes management solutions are thus provided by company products like OneTouch in glucose monitoring among others.

This aside, Johnson & Johnson is at present engaged with many other digital health initiatives as well. In the year 2022, the Medical Devices segment generated USD 31.7 billion for the firm in revenue, while the Consumer Health segment generated USD 7.9 billion. The investment of Johnson & Johnson in digital health technologies has allowed the company to serve more customers in the market of self-testing through integrated solutions that join the patient to the healthcare provider..

Roche AG

Roche AG together with Roche Diagnostics is very active on the market of self-testing, which is moved by the slogan 'Personalised Health Care. For the Cure. Through advanced diagnostics solutions: In point of care testing at its best'. They further optimize their management systems for chronically ill diabetic and infectious patients through self-tests. Roche's digital health integration platform allows easy exchange of data among different diagnostic devices, giving the healthcare provider and patient access to real-time health indicators.

In 2022, the Diagnostics business segment of Roche reported CHF 17.5 billion (approximately USD 18.7 billion USD) in sales with a growth rate of 4% over the previous year. This commitment of Roche to AI-enabled diagnostics and molecular testing at home has led the company into a leading role of change in self-testing and personalized health care.

Ascensia Diabetes Care Holdings AG (Bayer HealthCare)

It sells its blood glucose meters under the brand name CONTOUR. User-centric design and digital connectivity make it easy for the company to create an ecosystem that supports effective diabetes management. Ascensia's products include the CONTOUR DIABETES app, allowing data tracking, sharing insights, and collaboration with healthcare providers.

Bayer acquired Ascensia, in total sum of approximately USD 6.8 billion, as of 2019. Ascensia then became part of the global leader in the business of Bayer- diabetes care, following this acquisition. Within the past year since the acquisition, Ascensia has moved extra miles to further innovation in the products towards improving outcomes for people with diabetes.

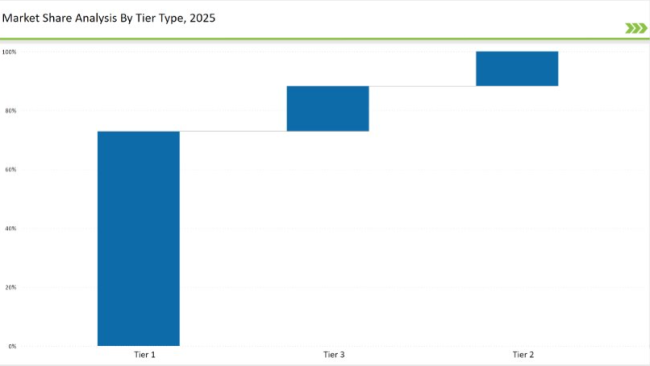

| Tier | Market Share (%) |

|---|---|

| Tier 1 (Roche AG, Johnson & Johnson, Ascensia Diabetes Care Holdings AG, B Braun) | 72.9% |

| Tier 2 (Procter & Gamble Co., ACON Laboratories Inc., ARKRAY Inc. and others) | 11.7% |

| Tier 3 (Church & Dwight Co., Inc., Geratherm Medical AG, Bionime Corporation and other) | 15.4% |

| Company | Unique Initiative |

|---|---|

| Roche | The firm focuses on greater accuracy and user-friendly testing for chronic conditions, such as diabetes or infectious diseases at home. |

| Johnson & Johnson | Innovation in self-testing technologies for Consumer Health and Medical Devices. It also offers remote glucose monitoring with connectivity to smartphones, thus allowing the real-time tracking of diabetes. |

| Ascensia Diabetes Care Holdings | Diabetic care using its CONTOUR® Blood Glucose meters, which come with high precision and Bluetooth capability, allowing in real-time the tracking and managing of the product through mobile apps. |

| BD (Becton, Dickinson and Company) | Products include home-use rapid infectious disease self-testing kits with AI-result interpretation, connectivity to smartphones for real-time monitoring, and all for accuracy and convenience. |

| Quidel Corporation | Improving at-home flu and COVID-19 self-tests with AI-powered result interpretation, improved antigen detection, and integration with mobile apps for remote monitoring and data sharing. |

Investment in AI-Driven and Smart Self-Testing Technologies: The diagnostic systems supplied should be AI integrated, with more accurate tests and real-time tracking of health. The systems should be machine learning-intensive, thereby enhancing the precision of diagnosis while minimizing false positives and negatives, with consistent results. Cloud-based platforms and IoT connectivity will provide remote monitoring and telehealth consultation, making medical care accessible to more healthcare professionals.

Self-testing kits with AI-based capabilities will also enable predictive analytics that can give people an early indication of health risks long before the symptoms begin to show. Therefore, suppliers can make self-testing solutions that engage customers in disease management and transform the market of home diagnostics.

Expansion into Direct-to-Consumer Digital Health Platforms: By providing a seamless integration of e-commerce and telemedicine, it would facilitate wider accessibility and penetration into the market with direct-to-consumer sales, remote consultations, as well as personalized health recommendations prepared based on real-time test results through e-commerce platforms. Self-testing kits will reach a large population as e-commerce platforms provide the home delivery feature of seamless inroads, while subscription-based models ensure constant access to diagnostic tools.

Telemedicine integration further strengthens consumer trust by permitting instant expert consultation and result interpretation. In addition, AI-based health platforms have improved the precision of diagnosis, as well as strengthened patient engagement, which supplies more customized information based on the user history. Digital innovations literally revolutionize the speed at which self-testing moves; at-home testing is handier, more efficient, and socially acceptable.

Regulatory Compliance and Global Market Expansion: Self-test kits must be proven compliant with FDA, CE, and WHO standards to ensure easier approvals and market access and consumer confidence. Compliance regulates the quality, accuracy, and safety that will have to precede mass distribution. Manufacturers who take their validation seriously, run clinical trials, and collaborate with regulatory agencies can look forward to a global leadership position that implies trouble-free logistics in all healthcare markets.

Compliance with international standards also allows for proper integration of self-testing into telemedicine frameworks, which means real-time monitoring of health and medical consultations. As demand rises globally, it is through regulatory compliance that trust will be fostered, accessibility expanded, and self-testing market growth accelerated.

Multi-Disease Self-Testing Kits: Health companies now strive to make monitoring multiple diseases easy while in the safety of one's home. New, combined self-testing kits include tests for diabetes, cholesterol levels, renal functions, and even infections all in a convenient panel.

Innovations use the latest biosensors and AI technologies for greater accuracy while still trying to keep the approach as simple as possible. Instead of having multiple kits, individuals can now obtain a holistic view of their health with one test. With growing awareness and trust in these solutions, more people are likely to adopt them for regular health check-ups.

Self-Testing Reaches Emerging Markets:Expands Health Care: The self-testing kit is now penetrating more areas and reaching more people in developing regions, enabling chronic disease management as well as infection detection early enough. Affordable, easy-to-use self-tests come as a boon to health services that are frequently stretched thin.

Governments and health organizations are collaborating with such initiatives to make the self-testing facility more accessible to people. Digital tools and telemedicine services also come into the play, allowing people in remote areas to have quick, reliable health insights without the need for frequent doctor visits. As more kits become accessible, millions more will be able to take control of their health.

Smart wearables are changing how we track our health: From tracking simple steps, smartwatches and fitness trackers now monitor severe health conditions. Fitted with various sensors, such devices track glucose levels, blood pressure, and even monitor the presence of an irregular heartbeat.

AI-based functionalities enable users to access real-time health insights. More people will be on the lookout for how they can manage their health better; therefore, wearables have become indispensable for personal health management, closing the gap between self-monitoring at home and medical professional advice.

F. These are Hoffmann-La Roche AG, Johnson & Johnson, Ascensia Diabetes Care Holdings AG, B Braun and Procter & Gamble Co., among others command about 77.56% share in the global market.

The global Self-Testing Market represents a sale of USD 8,855.3 million in 2025.

Regional and domestic companies hold nearly 10.44% of the overall market.

Products like Self-testing cassettes, self-testing midstream devices, self-testing strips, self-testing cups, self-testing dip cards, self-testing panels offering significant growth prospects to market players.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Leukocyte Adhesion Deficiency Management Market - Innovations & Treatment Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.