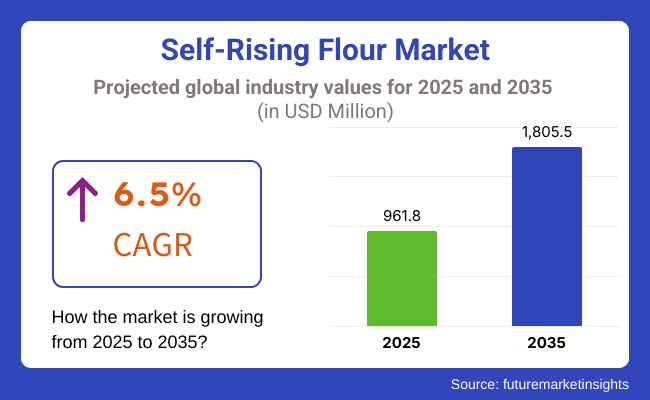

Globally, the self-rising flour market is projected to be valued at USD 961.8 million in 2025 and is expected to reach USD 1,805.5 million by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035. The industry is rising steadily, thanks to the increasing consumer need for convenient baking solutions.

Self-rising flour consists of a mixture of baking powder and salt. It is a simple way to bake that requires no other extra products. The rise of flour purchases in many households, especially those who bake at home and use food services, is a good factor in the growth.

The growth is mainly because of the new home baking trend, which started to become really popular, especially after the pandemic. Consumers want baking ingredients that are simple to use, produce identical outcomes, and do not require the stress of accurate measuring of the components. This flour is used to make biscuits, pancakes, muffins, and other baked goods, so it is a common ingredient in many homes.

The food service sector is also a part of the progress. Restaurants, bakeries, and cafes use more flour in the baking process to make it more effective. In addition, the increase in the demand for pre-mixed and time-saving ingredients in commercial kitchens has also been helpful to the industry. Product innovation has been quite important in shaping the industry situation.

Producers are launching gluten-free, organic, and whole wheat flour based on the health-conscious client's choices. The spread of clean-label and no-GMO trends in foods has spurred manufacturers to come up with a preservative-free and natural option.

However, there are a few challenges, including the changing prices of raw materials and a greater range of other baking mixes as well as pre-made dough available. Also, patronage of the traditional way of baking, which gives them the right to choose which ingredients to use, is an obstacle to flour consumption for some people.

Nevertheless, the marketing opportunity is on the rise, and it is now the best time to go. The addition of new products, such as enriched and fortified flour, will not only attract the consumer but will also expand the industry.

The fast development of e-commerce and the entry of direct-to-consumer brands is making a good turn to the accessibility of flour products. While convenience-seeking baking benefits from the rise of this flour's marketing, it will last for the next years.

Explore FMI!

Book a free demo

There was significant growth from 2020 to 2024, supported by growing home baking trends and rising consumer interest in convenience while cooking. The COVID-19 pandemic was responsible for accelerating home-based baking activities, leading consumers to try their hands at different baking products.

Its convenience factor, which eliminates the need to measure leavening agents separately, made it popular among both novice and experienced bakers. Growth was also supported by the rising popularity of gluten-free and whole wheat variants as consumers became more health-conscious.

Food companies launched organic and fortified flour variants to respond to increasing consumer demand for clean-label and fortified products. Obstacles such as fluctuating wheat costs, supply chain interruptions, and differences in local consumer tastes across regions created roadblocks to consistent expansion.

During the period 2025 to 2035, it is expected that there will be improvements in milling and fortification technologies. High-protein and low-carb versions will find favor with health-aware consumers looking for functional attributes. Supply chain optimization through AI will enhance cost-effectiveness and minimize production waste.

Plant-based foods and flours such as almond and oat-based self-raising flour will increase opportunities. Increased demand for gluten-free and allergen-free products will push manufacturers to increase product portfolios.

Sustainable sourcing, regenerative farming, and biodegradable packs will be priority areas to meet global environmental objectives. Online purchasing and direct-to-consumer sites will increase industry penetration, with product suggestions personalized to customers based on their information driving customer interaction.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand because of home baking culture. | Plant-based and alternative flour trends. |

| Development of gluten-free and whole wheat flour. | Increased high-protein and low-carb flour. |

| Supply chain disruption and unstable wheat prices. | Artificial intelligence supply chain management and lower production waste. |

| Clean-label and fortified product demand. | Greater focus on sustainable sourcing and regenerative agriculture. |

| Limited product variety in gluten-free and allergen-free segments. | Growth in personalized product recommendations via e-commerce. |

Globally, there is an increasing demand for convenience-based baking items. The flour, being pre-mixed with a leavening agent, simplifies the baking process and thus is the favorite among home consumers, bakeries, and food service outlets

This flour is extensively used in cakes, biscuits, and quick breads in the bakery sector to provide uniform texture and volume. The home-use segment is growing as a result of the home baking boom, supported by the demand for convenient, pre-mixed ingredients from consumers.

Restaurants and cafes opt for it for the convenience of time, which produces uniform baking results. Food processing companies also employ this flour in ready-to-bake and frozen-baked products to make production more efficient. As consumers are demanding healthier and gluten-free products, manufacturers are coming up with innovative whole grain, organic, and gluten-free flour products to suit evolving dietary demands.

The growth of global sales is directly tied to the increasing demand for this product not only in the bakery industry but also by household consumers. The successful operation of the businesses, though, is challenged by the stringent food safety regulations, labeling requirements, and ingredient quality standards.

Companies must ensure compliance with the ever-changing regulations, get all needed certificates, and keep all the required information disclosed to the public to maintain both consumer trust and industry access. The problems in the supply chain, such as the seasonal changes in the wheat supply, steep increases in transport expenses, and trade embargoes, have a huge impact on the stability of production and prices.

The climate crisis, poor harvests, and the geopolitical conflict that deprives the countries of wheat import can lead to an unpredictable situation. The business should make use of a different supplier network and finance sustainable agriculture to solve the problem.

Altering consumer habits of preferring gluten-free, organic, and alternative flour brands instead of using this flour presents difficulties for conventional brands. The increase in health-conscious eating and the potential for new types of baking ingredients to be used in competition come with the rise in demand. Corporations have to work through the challenges by producing formulations that include extra nutrients, all grains, and clean labels.

Strengthening the competition between single-product baking mixes and plant flour alternatives has a significant downward effect on pricing and industry positioning. Businesses need to stress brand value and sponsor the flour that comes with the additional advantage of nutrition and shelf stability.

Price fluctuations, unpredictable trade laws, and changing variants of consumer bakers have a direct effect on the industry. Companies that long for an extended period of prosperity need to increase their production efficiency, investigate unexplored territories, and work in cooperation with grocery suppliers and manufacturers to construct products in a timely manner that meets consumers' demands.

| Segment | Value Share (2025) |

|---|---|

| Wheat (By Source) | 72.5% |

The segmentation is by Wheat-based and Corn-based segments, with wheat forming a dominant source. The wheat-based segment will account for approximately 72.5% of the industry value in 2025. Wheat-based flour is widely available, has better baking properties, and is heavily favored by consumers. Wheat-based flour is high in gluten, so it is often used in cakes, biscuits, pancakes, and other bakery tasks because it creates better texture and structure.

King Arthur Baking, Gold Medal, and Pillsbury are some well-known wheat-based products that are made and sold by various producers. Wheat-based flour has helped to boost the segment’s popularity due to the increasing demand for baking with ease of use and the provision of a pre-prepared baking solution.

Corn accounted for approximately 27.5% of the share in 2025, with the fastest-growing segment being consumed. Corn flour is a baking flour that is often used in tortillas, cornbread, and gluten-free items. Consumers favor corn flour over others due to allergies and increasing exposure to health concerns due to gluten.

Bob's Red Mill and Arrowhead Mills also produce Wheat alternatives to suit the increasing demand for natural products and food products free from allergens. The growing demand for clean-label, gluten-free, and ease-of-use baking materials has fuelled the development of these Flour categories worldwide.

| Segment | Value Share (2025) |

|---|---|

| Conventional (By Nature) | 80.3% |

By type, the categorization is into Conventional and Organic, with conventional flour expected to lead with a 2025 share of 80.3% of the total share. The conventional segment dominates as it is affordable, easily available, and generates high demand from commercial bakeries and households. It is also commonly used in cakes, biscuits, pancakes, and other baked goods, providing consistency in quality and cost.

Popular brands such as Gold Medal, King Arthur Baking, and Pillsbury offer regular self-rising flour, as well, for the mass-market baking crowd. Its extended shelf life, as well as lower production costs, also make it the more economical alternative for large-scale manufacturers.

The Organic segment is valued at 19.7% and is gaining momentum with increasing consumer appetite for clean-label and non-GMO as well as chemical-free baking products. As health awareness increases and concerns around pesticide residues build up in conventional commodities, consumers are migrating to organic crops.

Players include Bob's Red Mill, Arrowhead Mills, and One Degree Organic Food's organic self-rising flour, which is made from organically grown wheat wheat or corn. Despite being at a higher price point than conventional flour, the organic segment will continue to show steady growth as consumers approach new products being introduced as more health-conscious and environmentally aware.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 6.0% |

| France | 5.8% |

| Germany | 5.5% |

| Italy | 5.7% |

| South Korea | 6.8% |

| Japan | 6.2% |

| China | 7.0% |

| Australia | 6.2% |

| New Zealand | 6.0% |

The USA is growing owing to increased demand for easy-to-use baking ingredients from consumers. Home baking, which the COVID-19 outbreak has boosted, continues to fuel demand for easy ingredients. Established players such as King Arthur Baking Company and Pillsbury are increasing their product offerings to accommodate organic and gluten-free products and attract consumers who are focusing on their health. Online food retailers also enhanced accessibility, further leading penetration.

Besides, America is also supported by a robust food service industry, with restaurants and bakeries using this flour in their products. With growing interest in home baking, especially among millennials and Gen Z, firms are investing in new marketing campaigns, such as social media marketing and influencer partnerships, to promote these products.

Self-rising flour remains at the core of the UK's bakery culture, deeply entrenched in traditional recipes such as scones and Victoria sponge cakes. The industry keeps on growing steadily as consumers seek premium ingredients that deliver consistent baking quality. Traditionalists such as McDougalls and Allinson's Flour maintain their dominance by placing their focus on premiumization by offering organic and enriched versions to gain over health-conscious consumers.

Success with television cooking programs such as "The Great British Bake Off" has inspired increased domestic baking and demand for this flour. Private labels at food stores and retailers also widen the spread by offering value brands to increasingly widespread customer groups. While consumers weigh convenience versus tradition, there remains room for continued expansion.

France has consumers who balance an appreciation for artisan bread baking with the convenience of pre-mixed ingredients. Although French bread has traditionally been based on traditional types of flour, increased demand for convenience has led to the utilization of this flour. Key leaders Francine and Moulinex are experimenting with organic and specialty blends of flour to respond to changing consumer trends.

Health-led trends are dominating the industry with a growing demand for wholegrain and gluten-free varieties. In addition, greater impact from global baking trends, more especially from the USA and UK, has resulted in further innovation in French domestic kitchens. As supermarkets and specialist food stores further stock up on lines, the French industry for this flour should continue to grow steadily.

Germany is progressing fairly with consumers' demand for functional and alternative baking ingredients. Rye and spelled flour are appreciated in German culture, but the convenience of this flour is grabbing a growing segment of consumers. Large brand names such as Aurora Mühle and Diamant Mehl are launching enriched and fortified variants to grab consumers who are concerned about their health.

The shift towards organic and clean-label items is the key driver, with demand for additive-free flour continually increasing. The trend of accepting international cuisine in Germany, especially British and American-style baking, also contributed to the popularity of the product. The growth of e-commerce sites and health-conscious grocery store chains also underlines industry growth.

While traditional Italian baking involves specialty flour, globalization has facilitated the entry of self-rising flour. Brand leaders such as Caputo and Molino Spadoni are catering to this demand in terms of higher-quality flour, specially made for sweet or savory uses.

The industry is being driven by heightened awareness of home baking as a new and social activity, supplemented by web-based food content and influencer marketing. There are also luxury substitutes for self-rising flour, such as organic and heritage grain, and it has synergy with Italy's emphasis on artisanal and quality ingredients.

South Korea is expanding with the popularity of Western-style baking culture. South Korean consumers increasingly try home-baked foods owing to international dessert trends. Prominent players such as CJ CheilJedang and Samyang Flour Mills launched their offerings, including health-oriented products such as low-gluten and fortified self-rising flour.

Social media and online baking forums are also contributing significantly to growth. Consumers, especially younger generations, are taking up baking as a hobby, fueling demand for ready-to-use ingredients. Increased e-commerce activity has also made self-rising flour more readily available, further facilitating home bakers' access to new recipes.

Japan is experiencing consistent growth as consumers value convenience in baking. Japanese companies such as Nisshin Seifun and Showa Sangyo dominate, providing finely ground flour that is suited to both traditional and Western-style baking.

The social media-driven popularity of home baking and cooking shows has stimulated demand for pre-mix ingredients. Special flour mixes such as matcha and rice flour mixes are also popular in the Japanese industry, as per local demand. Premium and organic quality baking ingredients also stimulate growth.

The Chinese industry is flourishing with urbanization and rising disposable income. Local players such as COFCO and Wudeli Flour Group are improving their portfolios to meet growing consumer demand. Western-style bakeries and domestic home baking have emerged as growth drivers, further supported by the extensive coverage of e-commerce portals such as JD.com and Alibaba, making the product widely available.

Australia is growing as consumers become increasingly keen on home baking and need convenience in the kitchen. Strong domestic brand names such as White Wings and Laucke Flour Mills anchored the industry with an enormous number of self-rising flour products that appealed to shoppers needs. The inclusion of gluten-free and organic offerings has also driven growth as health-conscious consumers buy alternative flour offerings.

The growing demand for television shows on baking, as well as internet videos promoting home-cooked meals, also contributed to the surge in demand. Grocery stores and online stores are following the wave by increasing self-rising flour products. As Australian consumers continue to favor convenience and quality in bakeries, the sales of self-rising flour will continue to grow.

New Zealand shows steady growth due to a well-developed baking culture and an increasing need for easy-to-use ingredients. Local brands such as Edmonds, which have expertise in heritage-style baking brands, dominate the marketplace. People are choosing organic and premium forms of self-rising flour, just as they follow New Zealand's general shift to natural and less processed foods.

The web-based business world is also dominating the rise of accessibility, giving consumers the capacity to shop for a variety of self-rising flour products. Bakery developments and recipe sites have further fueled enhanced experimentation in baking.

Self-rising flour is thereby growing at a steady pace owing to rising consumer interest in convenient baking solutions and the increasing popularity of baking at home. Increased interest in ready-to-use baking ingredients among home bakers, food service providers, and artisanal bakeries provides a demand boost.

The dominating players, Mills, King Arthur Baking Company, Ardent Mills, Conagra brands, and Hodgson, produce already pre-mixed flour formulations with enriched ingredients. These companies tend to focus on innovations in products to stay in tune with changing consumer preferences, such as gluten-free and organic flour.

There are developments with the rising retail availability, the flow of e-commerce, and the development of private label brands. Demand is particularly strong in North America and Europe due to high baking trends. At the same time, the opportunities for growth in the Asia-Pacific and Latin America will increase as urbanization and disposable income increase.

Key strategic factors influencing competition relate to the differentiation of brands through premium ingredients, sustainable sourcing, and packaging innovations. The firms are also involved in promotional campaigns to foster a baking culture targeting recipe collaborations and influencer partnerships aimed toward widening their consumer base and enhancing brand loyalty.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Mills | 20-24% |

| Ardent Mills | 18-22% |

| King Arthur Baking Company | 14-18% |

| Conagra Brands | 10-14% |

| Hodgson Mill | 8-12% |

| Other Players (Combined) | 25-30% |

| Company Name | Key Offerings & Focus |

|---|---|

| General Mills | Offers self-rising flour under the Pillsbury brand, leading in mass-market availability and consumer trust. |

| Ardent Mills | A top wholesale and industrial supplier catering to commercial bakeries, food service, and private-label brands. |

| King Arthur Baking Company | Focuses on premium, organic, and specialty baking flour, leveraging strong brand loyalty and clean-label formulations. |

| Conagra Brands | Sells under brands such as Martha White and White Lily, appealing to southern USA consumers and regional specialty markets. |

| Hodgson Mill | Specializes in whole grain, organic, and non-GMO flours, catering to health-conscious and artisanal bakers. |

Key Company Insights

General Mills (20-24%)

A key leader with strong brand positioning through Pillsbury flour, widely distributed across retail.

Ardent Mills (18-22%)

A dominant supplier for food service and commercial applications, emphasizing customized flour solutions.

King Arthur (14-18%)

It focuses on premium, high-quality flour and is gaining traction among home bakers and organic product buyers.

Conagra Brands (10-14%)

Competes with regional players that produce southern-style baking flours, maintaining a strong heritage brand presence.

Hodgson Mill (8-12%)

Differentiates through whole grain and organic flour offerings, targeting the growing clean-label trend.

The global self-rising flour market is anticipated to expand at a CAGR of 6.5% from 2025 to 2035.

The market is projected to reach approximately USD 1,805.5 million by 2035, driven by increasing consumer demand for convenience-based baking solutions.

The organic self-rising flour segment is expected to witness the fastest growth due to rising consumer preference for clean-label and non-GMO products.

The market is driven by the resurgence of home baking, growing demand for convenience baking ingredients, rising interest in organic and fortified flour, and expansion of online retail distribution.

The dominant players in the market include General Mills, Ardent Mills, King Arthur Baking Company, Conagra Brands, Hodgson Mill, and Bob’s Red Mill.

It is classified as wheatwheat and corn, with wheat-based flour surfacing at the top in baking applications due to its common usage in the industry.

It is segmented into organic and conventional flour, with conventional accounting for the majority owing to its low cost per unit, with organic types also trending, owing to the health-conscious population.

It is segmented as Bakery and Confectionery Products, Noodle and Pasta Manufacturing, which is largely driven by the growing demand for convenience-based cooking.

The self-raising flour is sold directly and indirectly to consumers through various channels, including wholesale markets, online retailers, supermarkets/hypermarkets, and specialty stores, with online gaining favorites due to the pandemic crisis.

Region segments the industry into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and Middle East & Africa.

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Japan Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.