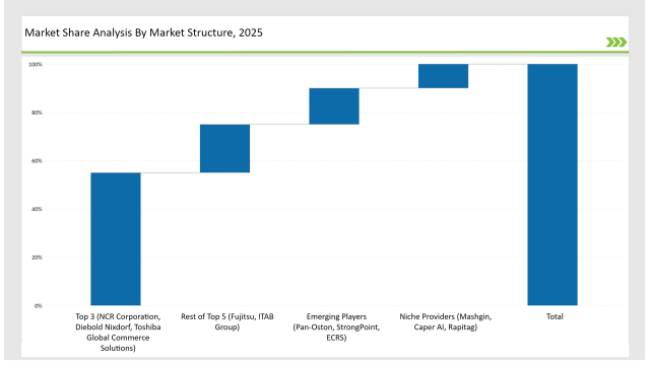

The Self-Checkout Systems market is expanding rapidly as retailers enhance operational efficiency, improve customer convenience, and reduce labor costs. The growing adoption of contactless payment methods and AI-driven checkout technologies fuels market growth. Major players such as NCR Corporation, Diebold Nixdorf, and Toshiba Global Commerce Solutions lead the market, collectively holding a 55% share by offering innovative AI-powered kiosks and seamless payment integrations.

Second-tier players, including Fujitsu and ITAB Group, capture 20% market share by developing hybrid checkout solutions that combine self-service with staff-assisted options. Emerging providers such as Pan-Oston, StrongPoint, and ECRS account for 15%, delivering cost-effective and industry-specific self-checkout solutions. Niche vendors like Mashgin, Caper AI, and Rapitag hold 10%, focusing on AI-driven, scan-free, and RFID-based self-checkout systems that push automation to the next level.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (NCR Corporation, Diebold Nixdorf, Toshiba Global Commerce Solutions) | 55% |

| Rest of Top 5 (Fujitsu, ITAB Group) | 20% |

| Emerging Players (Pan-Oston, StrongPoint, ECRS) | 15% |

| Niche Providers (Mashgin, Caper AI, Rapitag) | 10% |

The Self-Checkout Systems market is moderately concentrated, with top vendors influencing pricing and technology trends. High initial investment costs and integration challenges create entry barriers for new players.

The Self-Checkout Systems market is segmented into Portable Self-Checkout Devices and Stationary Self-Checkout Kiosks.

The market is also divided based on payment methods into Cash-based Self-Checkout Systems and Cashless Self-Checkout Systems.

Key Trends Shaping the Future of Self-Checkout Systems Market

AI Helps Streamline the Checkout Process

AI plays an integral role for retailers in the self-checkout experience due to the need to improve operational efficiency, reduce the risk of errors, and increase the prevention rate of theft. AI-based computer vision recognizes items without requiring barcode scanning, shortening transaction times. AI-powered systems can detect discrepancies in order placements, spotting mis-scanning and shoplifting attempts. Retailers reduce shrinkage and offer a seamless experience at checkout with smart self-checkout solutions.

Frictionless Shopping Introduced to Consumers

As shoppers become accustomed to faster, more convenient and friendlier experiences, leading retailers have been forced to adopt various self-checkout systems. These systems allow customers to skip queues and perform transactions independently. Shoop and Geere are responding to the rules of the game changing, where retail models requiring large, unnecessary layers of compromises are fading (like cashier-free shopping in Amazon Go, etc.). Retailers who adopt self-checkout solutions have shorter lines, less agitated customers, and a more efficient store.

And recently, these shifts to smart vending and unattended stores are expanding beyond just restaurants and convenience stores.

Retailers fuel demand for self-checkout systems by implementing them in smart vending machines, micro-markets, and unattended stations. Automated retail setups are also being used in airports, train stations, corporate offices and even university campuses to give consumers around-the-clock purchasing convenience. Providers leverage advanced self-service towers with touchless and AI-based interfaces for enhancing consumer engagement and decreasing operational costs.

Retailers Adopt Mobile And Contactless Payments

Mobile wallet (MW), QR code payments, NFC-enabled cards and biometric authentication Retailers are upgrading all terminals to enable contemporary payment methods for customers. Given the prevalence of post-pandemic and contactless environments, consumers are demanding digital payments over cash. Retailers ease transactions and augment profitability by merging self-checkout technology with digital payment methods including Apple Pay, Google Pay and regional wallets.

Retailers Customize and Scale Self-CheckoutDθνιαVTD Solutions

Retailers utilize modular and configurable self-checkout systems that are tailored to their store sizes, layouts, and operational requirements. Peek & Read Miniature Self-Service Kiosks for Small Retailers Small retailers are adopting compact self-service kiosks equipped with user-friendly interfaces, while large supermarkets are implementing hybrid self-checkout stations that merge staffed and automated lanes. This flexibility allows retailers of all types to adapt to shifting consumer demand while driving business efficiency.

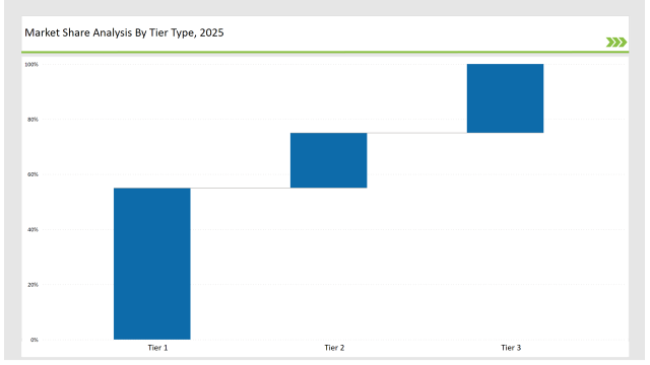

| Tier | Tier 1 |

|---|---|

| Vendors | NCR Corporation, Diebold Nixdorf, Toshiba Global Commerce Solutions |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | Fujitsu, ITAB Group, Pan-Oston |

| Consolidated Market Share (%) | 20% |

| Tier | Tier 3 |

|---|---|

| Vendors | StrongPoint, ECRS, Mashgin, Caper AI, Rapitag |

| Consolidated Market Share (%) | 25% |

| Vendor | Key Focus |

|---|---|

| NCR Corporation | Enhancing AI-driven fraud detection and computer vision checkout. |

| Diebold Nixdorf | Expanding modular self-checkout solutions for retailers. |

| Toshiba Global Commerce Solutions | Integrating IoT monitoring for real-time kiosk performance tracking. |

| Fujitsu | Developing RFID-enabled self-checkout systems for seamless transactions. |

| ITAB Group | Strengthening hybrid self-checkout solutions for cash-preferred markets. |

| Caper AI | Advancing smart cart technology for scan-free checkout experiences. |

The future of Self-Checkout Systems lies in AI-powered automation, biometric authentication, and seamless omnichannel integrations. Retailers are increasingly investing in AI-driven loss prevention, real-time checkout analytics, and blockchain-enabled self-checkout tracking for greater security and transparency.

NCR Corporation, Diebold Nixdorf, and Toshiba Global Commerce Solutions control 55% of the market.

Companies like Pan-Oston, StrongPoint, and ECRS hold 15%.

Niche vendors such as Mashgin and Caper AI hold 10%.

The top 5 vendors control 75% of the market.

Automotive AI Chipset Market Trends – Growth & Forecast 2025 to 2035

Payroll and HR Solution and Services Market by Solution, Enterprise Size, Region from 2025 to 2035

Magnetic Flow Meter Market Analysis by Product Type, Components, Technology, Application and Region - Trends, Growth & Forecast 2025 to 2035

Hardware Security Module Market Analysis by Type, Application, Sales Channel, Industry and Region - Trends, Growth & Forecast 2025 to 2035

AR VR Software Market Trends - Growth & Forecast 2025 to 2035

Autocollimators Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.