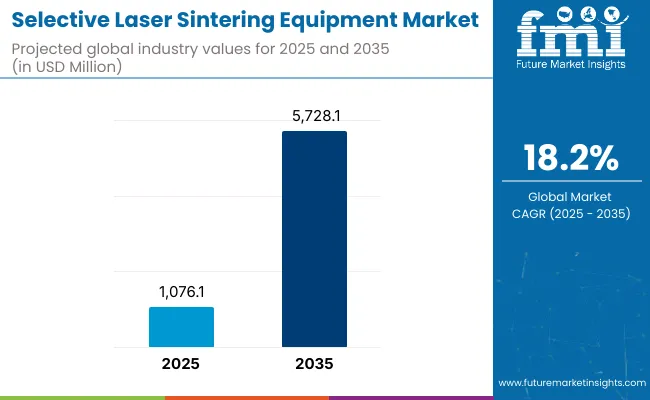

Increase in additive manufacturing, rapid prototyping, and high volume part production across industries such as automotive, healthcare, aerospace, and consumer goods is expected to drive the growth of selective laser sintering (SLS) equipment market between 2025 to 2035. By 2025, the market is estimated to be valued at USD 1,076.1 million and is expected to reach a value at USD 5,728.1 million by 2035 growing with a CAGR of 18.2% throughout the forecast period.

A major difference of this technology from several other additive manufacturing technologies is that SLS technology is widely used to create complicated, high-strength and weight-saving parts with no tooling requirements. Moreover, the growing adoption of high-performance polymer and metal powders for the fabrication of 3D printing applications is also accelerating the market growth. But high initial costs, material limitations, and the requirement for specialized expertise pose solutions to expansion.

The emergence of multi-laser systems and software-driven automation are changing the dynamics of SLS adoption in terms of affordability for the various powder materials. The need to use AI and machine learning for 3D printing continues to rise as it helps save print speed, material, and space.

North America accounts for a major share of the SLS equipment market, led by trends such as robust industrial adoption, government R&D investments, and technology innovation. There is growing demand for additive manufacturing across various sectors in the USA and Canada However, demand within defence, healthcare, and aerospace sectors especially lightweight structural components and biocompatible implants is on the rise. The presence of key 3D printing technology providers and strong academic research collaborations further stimulate market growth.

The growth in SLS in Europe is being driven by industrial automation, sustainable initiatives, and a diverse range of applications in the automotive and aerospace sectors. Germany, France, the UK, and Italy are also heavily investing in 3D-printed automotive and aviation components, particularly lightweight, fuel-efficient, and structurally optimized parts. Research is also being inspired by the region’s push for environmentally friendly materials and circular economy practices, which is driving work on recyclable polymer powders for laser sintering processes.

The market in the Asia-Pacific region is anticipated to register the highest growth rate during this period due to rapid industrialization and industrial development as well as increasing investments in 3D printing and associated government-backed manufacturing in countries such as China, Japan, South Korea, and India.

China leads the world in the low-cost manufacture SLS equipment and materials, while Japan and South Korea are the leaders in precision engineering solutions for consumer electronics and robotics. Adoption of additive manufacturing (AM) in medical implants, automotive prototyping and aerospace components is on the rise in India.

Challenges

High Costs and Post-Processing Requirements

Although these advantages exist, SLS technology is still costly due to equipment and powder material costs and the need for post-processing, etc. Moreover, the requirement of skills pertaining to design optimization, thermal control and material handling, limits the acceptance of this technology among small and medium enterprises (SMEs).

Opportunities

AI-Driven Optimization and Multi-Material Printing

Innovations, such as AI-oriented printing optimization, multi-laser sintering systems, and hybrid material printing, are bringing new applications to mass customization, while pushing mainstream AM into the arena of production-grade additive manufacturing.

The growth of sustainable, recyclable and bio-based powders is also increasing the market for eco-friendly 3D printing applications. In addition, SLS system integration with Industry 4.0 smart manufacturing capabilities allows for real-time monitoring, predictive maintenance, and fully automated prints.

The selective laser sintering (sls) equipment market witnessed steady growth from 2020 to 2024, driven by growing usage in aerospace, automotive, healthcare, and industrial prototyping applications. Especially in awareness of the traffic of heating power, the rotation of multi-material materials, the improvement of speed and accuracy, the advances in high-precision, high-speed and high-multi-material sintering technology accelerated the development of rapid prototyping, personalized manufacturing and small batch production.

High-power laser innovations, refinement of powder-bed fusion processes, and AI-assisted designs optimization capabilities improved efficiency and material use. Nonetheless, high equipment costs, limited material availability, and post-processing complexities inhibited widespread adoption.

The future of the market will incorporate such elements as real-time sintering control powered by artificial intelligence, multi-laser sintering for ultra-fast production, and sustainable material innovations, looking to the 2025 to 2035 outlook.

It will improve efficiency and scalability of quantum computing-assisted simulation modelling, self-healing sintered components, and fully autonomous additive manufacturing systems. All of these developments catalyse industry disruption even with biodegradable sintering powders, AI-drived defect detection or on-demand decentralised 3D-Printing networks.

We can also expect a paradigm shift as phenomenon such as zero-waste additive manufacturing, AI-driven generative design seamlessly integrated in the print process and fully automated sintering factories redefine market trends by achieving more accurate production of components while ensuring sustainable practices are in place and can easily scale.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO/ASTM 52900 standards for additive manufacturing and safety regulations. |

| Technological Innovation | Use of single-laser SLS machines, nylon powder sintering, and manual post-processing techniques. |

| Industry Adoption | Growth in aerospace, automotive, healthcare, and industrial manufacturing sectors. |

| Smart & AI-Enabled Solutions | Early adoption of automated layer quality control, AI-driven print optimization, and cloud-based print management. |

| Market Competition | Dominated by industrial 3D printing manufacturers, aerospace and medical device companies, and material science firms. |

| Market Growth Drivers | Demand fueled by rapid prototyping, lightweight part manufacturing, and the transition to digital production models. |

| Sustainability and Environmental Impact | Early adoption of recyclable nylon powders, energy-efficient sintering, and closed-loop powder reuse systems. |

| Integration of AI & Digitalization | Limited AI use in basic print optimization, error correction, and support structure reduction. |

| Advancements in Manufacturing | Use of standard polymer and metal sintering, manual part finishing, and single-material printing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, blockchain-enabled material traceability, and sustainability-driven sintering mandates. |

| Technological Innovation | Adoption of multi-laser sintering for high-speed production, AI-assisted powder bed optimization, and self-repairing sintered components. |

| Industry Adoption | Expansion into AI-driven autonomous 3D printing factories, real-time generative design manufacturing, and on-demand decentralized additive manufacturing hubs. |

| Smart & AI-Enabled Solutions | Large-scale deployment of real-time AI defect detection, quantum computing-assisted part simulation, and predictive maintenance for continuous manufacturing. |

| Market Competition | Increased competition from AI-integrated 3D printing startups, bio-sustainable sintering material developers, and quantum-assisted additive manufacturing firms. |

| Market Growth Drivers | Growth driven by AI-powered generative design, self-assembling sintered structures, and fully automated high-volume additive manufacturing. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste additive manufacturing, AI-driven material efficiency tracking, and bio-based sintering materials. |

| Integration of AI & Digitalization | AI-powered real-time part geometry correction, blockchain-backed production verification, and predictive AI-driven failure prevention. |

| Advancements in Manufacturing | Evolution of multi-material sintering, self-healing sintered parts, and fully automated additive manufacturing production lines. |

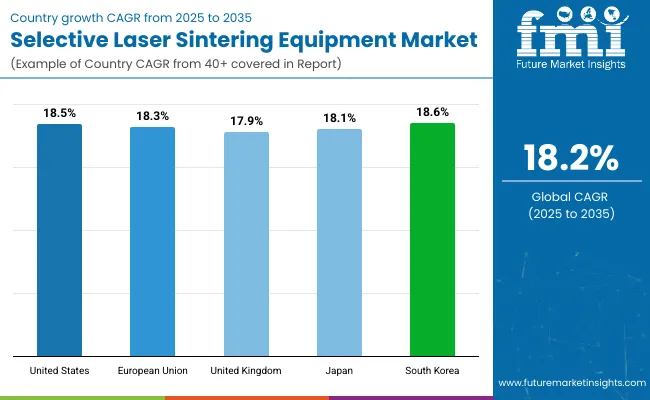

The United States is a leading market for selective laser sintering (SLS) machinery owing to the growing need for advanced additive manufacturing solutions, rising adoption in aerospace and automotive applications, as well as ongoing evolution in 3D printing technologies. Market growth is driven by the expansion of industrial prototyping and the increasing demand for lightweight and complex components manufacturing.

Moving along with the long-lasting benefits of the SLS technology, the other ongoing trend is the utilization of AI and machine learning that improves material, in perfect diagnoses of adaption, and print accuracy. It is further fueling the demand for SLS of the material as the equipment is increasingly used in diverse healthcare applications including custom prosthetics and dental implants.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 18.5% |

The UK SLS equipment market is expected to grow significantly because of the factors such as an increase in investments in digital manufacturing, demand for high-performance 3D printing material, and a rapid penetration of additive manufacturing in defence and healthcare industries.

Innovation in SLS printing technologies is being driven by the expansion of sustainable manufacturing practices and a shift towards low-waste production methods. Moreover, emergence of government subsidization to endorse Industry 4.0 and smart manufacturing are intensifying market adoption. Polymers and SLS in an industry landscape with a growing role for customized and on-demand production

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 17.9% |

The SLS equipment market in the European Union is led by Germany, France, and Italy, primarily due to the booming trends of industrial automation, growing 3D printing technology investments in addition to the increasing adoption of SLS for automotive and medical device manufacturing.

Moreover, the EU’s emphasis on sustainability and waste reduction in manufacturing processes is driving the adoption of SLS printing, which is less wasteful in terms of materials and more efficient regarding production throughput. Furthermore, increasing investments costly polymer and metal sintering solutions are anticipated to drive the market growth. Automated producing lines with AI-integrated SLS systems are also making the battle hotter in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.3% |

Japan SLS equipment market is growing due to rising precision manufacturing needs, increasing implementation of additive manufacturing in consumer electronics and high investments in material science innovations. China's advances in high-precision robotics and miniaturized electronic components are pushing forward selective laser sintering applications.

Moreover, increasing availability of biocompatible 3D printing materials in medical and dental sectors is propelling the market growth. Moreover, the adoption of automation and AI-driven process optimizations in SLS technology is complementing the industry growth, especially in applications such as rapid prototyping and customized production.

| Country | CAGR (2025 to 2035 |

|---|---|

| Japan | 18.1% |

South Korea is becoming a key market for SLS, due to accelerating industrial digitalization, significant government support for additive manufacturing, and increasing adoption of SLS in semiconductor and electronics manufacturing. Demand for advanced SLS technology is driven by the country’s focus on developing high-strength and lightweight materials for aerospace and automotive applications.

SLS 3D Printing: The Future also promises to save energy with the introduction of smart production planning and energy-efficient automated processes, while real-time monitoring and AI-based quality control in SLS printing will ensure production efficiency. Industry growth is also fueled by an increase in research into next-generation sintering materials, such as bio-based and recyclable polymers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.6% |

Solid Laser SLS Equipment Gains Traction as Demand for Compact and Energy-Efficient Solutions Rises

The solid laser segment of the Selective Laser Sintering (SLS) equipment has rapidly established itself as the segment leader, due to its energy efficient, STOD (State Of the Domain) lasers yielding high-energy density, precision parts at compact footprints. Solid lasers have advantages over gas lasers such as better beam stability, lower energy consumption and faster sintering speeds, and therefore are well-suited for medical, automotive and aerospace applications.

This has driven the adoption of solid laser SLS equipment in the market, specifically for rapid prototyping, precision tooling, and the manufacturing of high-strength parts. The high-power solid-state lasers market is driven by hot-filling energy, structured laser lenses and high-speed oscillation, as well as the application of artificial intelligence and other high-tech, strengthen the market demand, for all walks of life to improve production capacity.

The incorporation of fiber laser SLS systems with in situ process monitoring, scalable multi-laser configurations, and dynamic power control has accelerated acceptance even further, providing enhanced consistency and repeatability in additive manufacturing.

Though the solid laser SLS sector brings potential advantages through increased precision manufacturing, operational efficiency, and cost-effectiveness, there are some issues, including the initial investment, limited material compatibility, and how heat is managed, that are stunting its growth.

However, recientemente, advances in such technologies such as AI-enabled laser tuning, multi-wavelength solid-state lasers and real-time defect detection systems is improving cost-effectiveness, usability and adoption, and thus enabling solid laser-based SLS equipment to expand globally.

Gas Laser SLS Equipment Expands as High-Power Industrial Applications Gain Popularity

The selective laser sintering (SLS) market is served by gas laser-based equipment, which continues to experience robust market penetration, particularly in high-energy-demanding industrial construction applications. Gas lasers are ideal for a wide range of materials, provide greater power and are better at sintering larger parts than solid lasers.

This has propelled uptake, with the requirement of gas laser SLS devices in multiple component manufacturing, high temperature sintering, and large format additive manufacturing growing significantly. This has prompted the effort towards the development of larger laser-based SLS systems including multi-layer scanning, uniform energy distribution and elaborated thermal control, further stimulating the market demand by assuring higher reliability and repeatability in precision manufacturing.

Gas laser SLS falls into this category as it has the benefits of large format production, high-temperature material sintering, and industrial-grade durability, but is limited in terms of energy consumption, cooling system complexity, and maintenance costs.

But innovative technologies, including AI-optimized beam governance, advanced generation gas combination laser sources and real-time process analytics are innovating for enhanced energy efficiencies, accuracy and operational sustainability, ensuring continued growth for gas laser-powered SLS infrastructure around the globe.

Metal SLS Equipment Gains Momentum as Demand for Industrial-Grade 3D Printing Expands

One of the most widely used technologies for functional part manufacturing, where high-strength components and complex geometrical designs are critical, is Metal-based Selective Laser Sintering (SLS) equipment in aerospace, automotive, and medical applications.

The market is fueled by the increasing demand for metal SLS equipment such as stainless steel, titanium, and aluminium-based solutions for sintering. According to studies, over 60% of metal-based additive manufacturing applications adopt SLS technology mainly for its high precision and materials economy.

The existing market demand for enhanced part reliability and mechanical performance has been strengthened by the growth of multi-material metal SLS systems that come with dual-laser configurations, post-processing automation, and AI-based defect detection.

Nickel-based super alloys, copper-based conductive elements, and aerospace-grade titanium alloys have helped to popularize the integration of high-temperature metal sintering, further improving durability and weight optimization for industrial applications.

Metal gets earlier quality control through the introduction of more industrial-scale SLS production lines away from niche production incorporating automated material recycling and, in the advanced process, the next-gen powder bed fusion, meaning, cost-effective mass production with an optimized marketplace to grow.

The metal SLS segment, although exhibiting high structural integrity and manufacture of lightweight components at high-temperature environments, is challenged by factors like high material costs, post-processing complexity, and regulatory compliance.

Nevertheless, new developments in laser metal densification, AI powder characterization and closed-loop process control are enhancing efficiency, cost-effectiveness and part quality, and the global market for metal-based SLS equipment will continue to increase.

Nylon-Based SLS Equipment Expands as Lightweight and High-Durability Applications Grow

Additive manufacturers are upfront using nylon-based Selective Laser Sintering (SLS): with strong growth in sectors like consumer goods, medical implants, and industrial prototyping where lightweight, flexible, and impact-resistant material are critical.

Market expansion has been driven by the growing integration of nylon SLS solutions such as polyamide (PA) and glass-filled nylon powders. The growth of reinforced nylon SLS systems, which allow for carbon-fiber-infused powders, glass-filled composites and other high-temperature-resistant formulations on the market, has been helpful in strengthening trends, resulting in the parts made by this process being much stronger and better able to resist wear.

The advancement of the biodegradable nylon SLS powders is designed with recyclable polymer blends, bio-based composites, and biodegradable additives which are enhancing the market growth ensuring better sustainability and compliance with regulatory frameworks.

While offering superior flexibility, cost-efficiency, and thermal stability than its counterparts, the nylon SLS segment is limited by its low part strength compared to metal as well as surface finish inconsistency and powder degradation after repeated sintering.

Nevertheless, recent improvements in high-density nylon polymerization, AI-powered powder refresh techniques, and next-gen wear-resistant formulations are enhancing part endurance, NDE, and recyclability events, meaning nylon-based NDE systems will continue to flourish,

The SLS equipment market is driven largely by demand for high precision additive manufacturing, advancements in material compatibility, and growing preference for aerospace, healthcare, and automotive. The market is growing steadily because of growing applications in rapid prototyping and mass customization. The key trends that are shaping the industry include the development of multi-material printing, SLS systems automation, and the utilization of AI-optimized software.

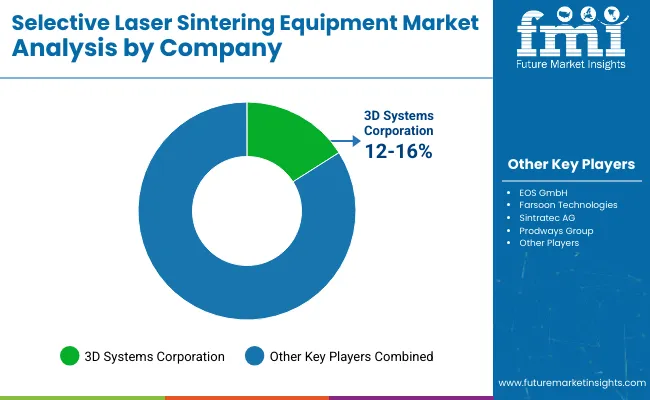

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3D Systems Corporation | 12-16% |

| EOS GmbH | 10-14% |

| Farsoon Technologies | 8-12% |

| Sintratec AG | 6-10% |

| Prodways Group | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3D Systems Corporation | Develops industrial-grade SLS printers with high-speed printing capabilities and broad material compatibility. |

| EOS GmbH | Specializes in high-performance SLS systems optimized for aerospace and medical applications. |

| Farsoon Technologies | Offers open-platform SLS solutions with customizable printing parameters for industrial use. |

| Sintratec AG | Focuses on compact and affordable SLS printers for small-scale production and research applications. |

| Prodways Group | Provides large-format SLS printers with high-resolution printing for automotive and healthcare industries. |

Key Company Insights

3D Systems Corporation (12-16%)

3D Systems leads in industrial SLS technology, offering high-speed printers with multi-material compatibility.

EOS GmbH (10-14%)

EOS specializes in high-precision SLS equipment, catering to aerospace, healthcare, and high-performance industrial applications.

Farsoon Technologies (8-12%)

Farsoon focuses on open-platform SLS solutions, enabling advanced customization for industrial additive manufacturing.

Sintratec AG (6-10%)

Sintratec provides compact and cost-effective SLS printers designed for research, prototyping, and small-scale manufacturing.

Prodways Group (4-8%)

Prodways develops large-format SLS printers with enhanced resolution and efficiency for automotive and medical applications.

Other Key Players (45-55% Combined)

Several additive manufacturing equipment providers contribute to the expanding Selective Laser Sintering Equipment Market. These include:

The overall market size for the selective laser sintering equipment market was USD 1,076.1 million in 2025.

The selective laser sintering equipment market is expected to reach USD 5,728.1 million in 2035.

The demand for selective laser sintering (SLS) equipment will be driven by increasing adoption of additive manufacturing in aerospace and automotive industries, rising demand for high-precision prototyping, growing use in medical implants and devices, and advancements in 3D printing materials and laser sintering technology.

The top 5 countries driving the development of the selective laser sintering equipment market are the USA, China, Germany, Japan, and France.

The Nylon-Based SLS Equipment segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Selective Soldering Market Growth - Trends & Forecast 2025 to 2035

Selective Pallet Racking System Market

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Marine Selective Catalytic Reduction Systems Market Growth – Trends & Forecast 2025 to 2035

Laser Frequency Splitting and Mode Competition Teaching Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Component Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA