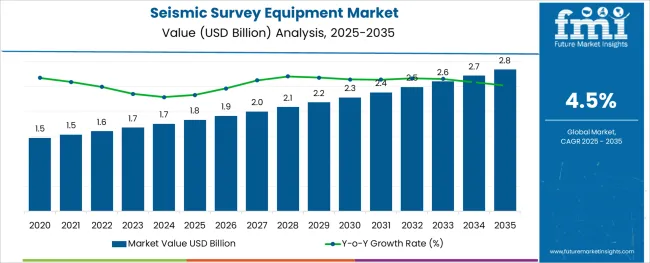

The Seismic Survey Equipment Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

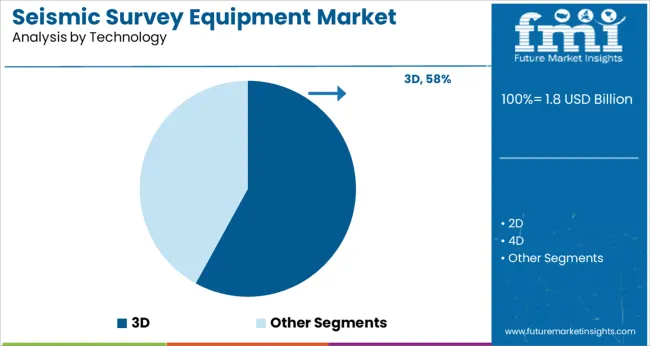

The market is segmented by Component, Technology, Location, and Industry and region. By Component, the market is divided into Hardware, Software, and Services. In terms of Technology, the market is classified into 3D, 2D, and 4D. Based on Location, the market is segmented into Onshore and Offshore. By Industry, the market is divided into Oil & Gas and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

As per the Global Seismic Survey Equipment Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the value of the Seismic Survey Equipment Market increased at around 4.3% CAGR. With an absolute dollar opportunity of USD 2.8 Million, the market is projected to reach a valuation of USD 2.3 Billion by 2035.

The key revenue drivers which affect the Seismic Survey Equipment demand include growing investment in risk management and the need for modern land survey equipment.

It is projected that the advantages of using electronic tools when conducting land surveys will expand the market. One of the most efficient methods for investigating rocks and subsoil is seismic surveying. It is well-suited for looking for underground mineral deposits, oil, and water. Subsoil depth, site study, geotechnical features, groundwater exploration, and hydrocarbon and coal exploration are typical uses for seismic studies. With the technical advanced, the market will soon have the opportunity to create terrestrial laser scanners with land survey equipment.

The demand for global seismic survey equipment is being driven by its usage in hydraulic fracturing for environmental research. The fracking fluid contains chemicals, and the flow back water is contaminated. The need for seismic exploration equipment is predicted to rise as a result of the necessity to measure dangers in gas exploration.

One of the biggest risks associated with hydraulic fracturing is earthquakes, Seismic surveys produce a CAT scan of the Earth's subsurface using reflected sound waves. This investigation is carried out to find groundwater, look for landfills, and assess how the region will tremble in the event of an earthquake. Monitoring of induced seismicity is crucial during hydraulic fracturing, and the operator should maintain a proper log. Injecting backwater into deep wells necessitates monitoring as well. The market for seismic survey equipment is driven by the two main concerns for induced seismicity.

The market growth for seismic survey equipment is also rising as a result of rising urbanization and industrialization activities accelerating. The urban population will account for 56.15% of the total population by the end of 2024, according to World Bank statistics. Additionally, the requirement for oil and gas firms to boost their production volume is growing due to the rising global demand for energy, particularly for oil and gas. In order to meet the anticipated demand for seismic exploration services, these companies are concentrating on discovering new reserves.

The key factors which are propelling Seismic Survey Equipment sales are an increase in demand from the oil and gas sector and marine surveys. Throughout the projection period, it is anticipated that the oil and gas industry will continue to dominate the market. The recent slump in the oil and gas industry has had a significant effect on the market for geophysical equipment and services. After mid-2020, the oil and gas market began to revive, and it really took off in 2020. The price of oil was USD 75 per barrel in 2020. To fulfill the rising demand for oil and gas on a worldwide scale, investors are anticipated to invest in the exploration of unconventional deposits.

In 2020, the world consumed 4662.1 and 3309.4 Million tonnes of oil equivalent as fuel according to the report of British Petroleum. In a carbon-constrained environment, it is anticipated that demand for lithium-ion batteries, and solar and wind energy storage systems will increase. This factor is also anticipated to fuel a significant increase in demand for a broad range of minerals and metals. The necessity to discover new hydrocarbon sources is crucial and valuable due to the oil and gas resource’s constant depletion.

The instrumentation for land-based or maritime surveys typically consists of a towed transmitter, several geophones, and a variety of tools like water cannons, air guns, sparklers, boomers, and chirping devices.

As a result, it is anticipated that the need for geophysical services in the oil and gas sector would rise. Seismic technology is anticipated to be extensively utilized in the mining and oil and gas sectors. As a result, it is anticipated that during the forecast period, there will be an increase in demand for geophysical equipment and services.

The factors restraining the growth of the Seismic Survey Equipment Market include that several local businesses provide rental and leasing options for ground equipment, forcing direct end users to buy their own tools. As some end users only require the equipment for a brief time, leasing and renting land surveying equipment is an economical choice that also saves on maintenance costs. The market for surveying equipment is further constrained by a lack of experienced labor and technical expertise needed to run the machinery and its software. Oil & Gas businesses have decreased their investments globally as a result of factors like the downturn in oil prices, which is also impacting the market expansion.

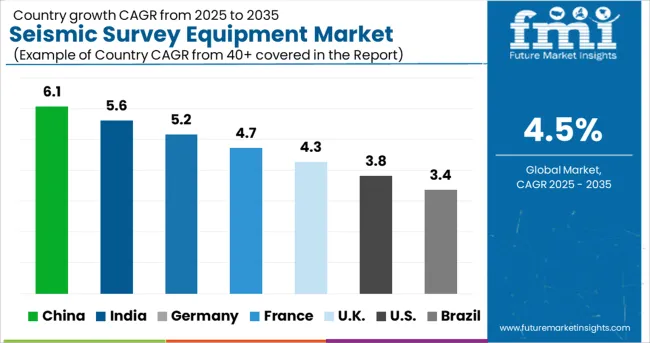

During the projection period, the market in the Asia Pacific is expected to be the largest for Seismic Survey Equipment. The Asia Pacific is anticipated to experience the fastest growth. This development is linked to China's expanding usage of small unmanned aerial vehicles (UAVs) for oil and gas exploration, mining inspection, and construction assessment. The market for seismic survey equipment is also being driven by rising government investments in smart city initiatives. Besides, the market is also being propelled as a result of the growing use of 3D laser scanners in India.

After the Asia Pacific, North America is expected to be the highest revenue-generating region. Investments in exploration efforts are the key factors for this.

The number of geophysical surveys being conducted in the USA is rising, which is helping to expand the market in this country. The amount of oil produced in Mexico has decreased. To solve this, the government launched energy reforms in 2014 to eliminate PEMEX, the state oil and gas company 75 - years monopoly. Over the past few years, the Mexican government has made a number of blocks available for exploration. After numerous bids for blocks, 70 oil and gas operators entered the nation as a result of the mining sector's deregulation. Due to this, there is now greater demand for geophysical equipment to carry out various tasks. Therefore, during the projected period, these factors are anticipated to present lucrative avenues for the expansion of the geophysical equipment and services market.

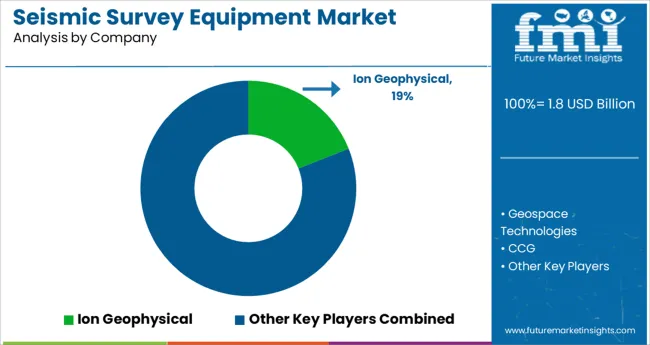

The USA is expected to account for the highest market of USD 2.8 Million by the end of 2035. It is expected to be projected to have an absolute dollar growth of USD 141.4 Million. The country’s large market is also being supported by the presence of multinational companies in the country such as Geostuff, Baker Hughes, Throop Rock Bit, Geospace Technologies, Ion Geophysical, and Wireless Seismic, Inc.

The highest used component in Seismic Survey Equipment Market globally is hardware. Demand growth for Hardware as a Component for Seismic Survey Equipment was recorded at 4.3% from 2020 to 2024, while it is expected to grow at a CAGR of 3.8% from 2025 to 2025. Due to advancing equipment technology and an increase in global oil and gas exploration activity, the hardware sector held the largest market share.

Equipment for seismic surveys includes different seismic sources, such as:

3D Technology is the most widely utilized technology of Seismic Survey Equipment. Demand growth for 3D technology was recorded at 4.4% from 2020 to 2024, while it is expected to grow at a CAGR of 4% from 2025 to 2025. As oil and gas businesses employ 3D seismic technology to resolve issues and minimize uncertainties in exploration, development, and production operations, demand for this technology has grown. Additionally, the method is used to obtain more precise photographs of geological features. Additionally, it speeds up the process of gathering, analyzing, and interpreting data. Companies can invest in new oil and gas deposits as 3D imaging gives a clear representation of the earth's surface.

Players in the market are constantly developing improved analytical solutions as well as extending their product offerings. The companies in the Seismic Survey Equipment market are focused on their alliances, technology collaborations, and product launch strategies. The Tier 2 Players in the market are targeting to increase their Seismic Survey Equipment market share.

Some of the recent developments in the Seismic Survey Equipment market are:

The global seismic survey equipment market is estimated to be valued at USD 1.8 billion in 2025.

It is projected to reach USD 2.8 billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are hardware, software and services.

3d segment is expected to dominate with a 58.0% industry share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.