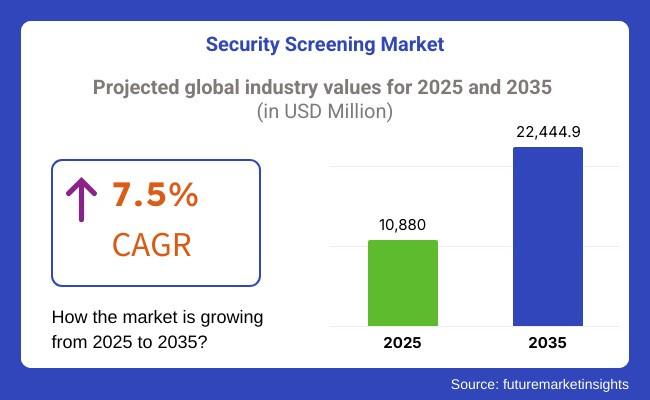

The global sales of security screening are estimated to be worth USD 10,880.0 million in 2025 and are anticipated to reach a value of USD 22,444.9 million by 2035. Sales are projected to rise at a CAGR of 7.5% over the forecast period between 2025 and 2035. The revenue generated in 2024 was USD 10,120.0 million. The industry is anticipated to exhibit a Y-o-Y growth of 7.5% in 2025.

The growing number of terrorist activities, smuggling, and illegal trafficking has increased the need for advanced systems. Governments across the globe are imposing strict security protocols at transportation centers, public facilities, and high-risk areas like airports, government offices, and event spaces.

Security agencies are introducing AI-driven screening technologies, biometric verification, and automated threat detection to enhance security and reduce human error. Additionally, geopolitical tensions and border disputes are encouraging nations to spend on next-generation security technologies.

The need for quick, effective, and accurate threat detection systems has spurred non-stop innovation, propelling the industry forward. As threats evolve, security screening solutions are becoming a central aspect of global counter-terrorism and public safety efforts.

The market encompasses technologies and solutions used to inspect people, baggage, cargo, and infrastructure to detect threats such as weapons, explosives, narcotics, and contraband. It comprises scanning technologies such as X-ray scanners, metal detectors, biometrics, trace explosive detection, and millimeter-wave scanners.

Use of biometric screening technology, face recognition, and artificial intelligence-enabled security systems concerns not only about privacy but also about data safety. Compliance directives from regulatory platforms like the GDPR in Europe and other international data protection legislation severely curtail bulk rollout of the same.

Concern for privacy and misuse is progressively building up in areas of misuse of private data and likely break-in of sensitive biometric information. Public concern regarding the invasion of privacy, particularly when it comes to facial recognition-based screening at airports and other public places, has led to resistance against such solutions.

Ethical concerns, storage threats to data, and the risk of algorithmic bias in AI-driven screening are also issues that challenge the use of technologies, thus presenting a major growth hindrance.

Explore FMI!

Book a free demo

Globally, the industry is chiefly prompted by the ever-increasing need for modern technology in threat detection for a diverse range of applications such as aviation, defense, public areas, and critical infrastructure.

The aviation and transportation sectors focus on detection performance, rapid screening procedures, and the use of AI to identify threats, which makes the security work smoothly without passenger flow delay. In the case of government and defense-related applications, the combination of AI and analytics is the key to preemptive threat handling, although their governing regulations often complicate matters.

Shopping malls, stadiums, and office spaces, as commercial and public areas, focus on low-cost solutions that require fast processing to ensure crowd security. Conversely, industrial and critical assets would have durable features plus extended security that will improve the operation significantly by detecting the possible risks inside.

The growing prevalence of biometric screening, explosive detection systems, and AI-based surveillance is projected to visibly increase sales, making the products available to improve the global security level.

Based on available information, here is a summary of notable contracts and releases for 2024 and 2025

| Company | Contract Value (USD Million) |

|---|---|

| TSA & Smiths Detection | Approximately USD 100 - 120 |

| Leidos | Approximately USD 80 - 95 |

| Rapiscan Systems & EU Border Control | Approximately USD 60 - 75 |

| OSI Systems | Approximately USD 50 - 65 |

In 2024 and early 2025, the industry has seen significant contract activity, with major deals focused on improving airport, border, and cargo security. The TSA’s contract with Smiths Detection, valued between USD 100 - 120 million, highlights the growing investment in advanced CT scanners for aviation security.

Similarly, Leidos and Rapiscan Systems have secured strategic agreements aimed at integrating AI-based threat detection and automated screening in key transportation hubs. These contracts underscore the global push toward more efficient and technologically advanced security solutions to enhance threat detection capabilities across critical infrastructure.

Between 2020 and 2024, there was steady growth due to rising global travel, growing security threats, and technological advancements in screening. Advanced X-ray scanners, metal detectors, and biometric systems were implemented by airports, government buildings, and public places to improve threat detection and passenger flow efficiency. AI-powered image recognition and automated threat detection improved accuracy and reduced false alarms.

The COVID-19 pandemic has driven demand growth for contactless screening technology like facial recognition and thermal imaging. Due to challenges like high installation costs and privacy, manufacturers focused on improving scanning speed, accuracy, and user-friendliness. In the period 2025 to 2035, screening driven by artificial intelligence, multi-sensor fusion, and hand-held security solutions will drive growth.

AI-driven systems will enable real-time threat detection and adaptive screening by passenger behavior and risk profiles. Multi-sensor fusion combining X-ray, millimeter-wave, and chemical detection will enhance accuracy and broaden threat detection.

Handheld, portable screening systems will enable simple deployment in congested and off-grid locations. Blockchain-secured identity verification and biometric authentication will provide security and passenger flow. Energy-efficient design and sustainable materials will support environmental goals and reduce operating costs.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter security measures were implemented globally due to increasing geopolitical tensions and heightened terrorism threats. Aviation, border security, and public infrastructure saw expanded screening requirements. | AI-driven, automated, and biometric-based screening becomes mandatory at high-risk locations. Governments drive for touchless, frictionless screening technology to improve efficiency and minimize passenger hassle. |

| The emergence of AI-augmented threat detection, computed tomography (CT) scanners, and real-time data analytics improved the accuracy of screening. Machine learning-based implementation of anomaly detection increased threat detection. | Quantum computing and AI-powered security analytics refine real-time threat assessments. The growth of smart security ecosystems combines blockchain for secure information sharing and compatibility across various screening systems. |

| The increase in air travel after the pandemic resulted in increased investments in checkpoint automation, facial recognition, and baggage scanning equipment to handle increased passenger traffic. Border control employed advanced scanning technologies for the detection of illegal contraband. | Automated airports use biometric boarding, AI-powered scanning tunnels, and sophisticated passenger risk profiling. Border security employs drones and autonomous screening checkpoints to enhance surveillance and minimize human intervention. |

| Increasing concerns over mass events, sports events, and concerts led to enhanced screening by the use of millimeter-wave scanners and facial recognition. Crowd monitoring based on AI was integrated into event security measures. | AI-based mass surveillance and screening are applied in public spaces in smart cities. Contactless and non-intrusive security checkpoints take the place of conventional physical screenings to optimize high-traffic event management. |

| Escalation in international trade and smuggling issues prompted heightened deployment of non-intrusive inspection (NII) equipment, X-ray scanners, and chemical trace detectors at ports. | Ports use AI-based predictive analytics to scan goods in real time. Supply chain security is strengthened by digital twin technology through modeling of potential security vulnerabilities and optimization of screening protocols. |

| Facial and fingerprint recognition technologies were applied in airports, border control, and corporate access control systems. AI-driven behavioral analytics enhanced anomaly detection. | AI-driven biometric systems provide near-instant authentication with iris and gait recognition. Secure multi-modal authentication that integrates facial recognition with voice biometrics is used for sophisticated security applications. |

| Initial investments in energy-efficient scanners and AI-driven threat detection lowered operating costs and enhanced sustainability. However, widespread sustainable uptake remained in check. | Green screening technology, including energy-efficient X-ray scanners and AI-driven software optimization, reduces carbon emissions. Governments initiate green security infrastructure development incentives. |

| Pandemic-related supply chain bottlenecks impacted scanner manufacturing, adding cost and deployment time. Firms localized production to minimize reliance on global supply chains. | Robust, AI-based supply chain strategies facilitate uninterrupted manufacturing and deployment of screening devices. 3D printing on-demand facilitates fast manufacturing of screening parts, diminishing supply chain weaknesses. |

| Elevating global security threats, an increase in air travel, and government mandates sped up the adoption of screening technology. Spending on AI-based solutions and biometric screening grew. | Expansion of smart cities, AI-driven predictive security measures, and the need for autonomous security solutions drive growth. Security-as-a-service (SaaS) models emerge, enabling flexible security infrastructure adoption across industries. |

At a global level, there are several challenges of regulatory compliance, privacy problems, cybersecurity dangers, and the exceptionally high costs of the necessary equipment to run them smoothly. Worldwide governments enforce stringent security rules and data protection laws, and failing to comply with these laws may lead to legal fines and loss of reputation.

Cybersecurity threats are the actual danger, with connected screening systems being targets for hacking and data breaches. Infiltration into facial recognition databases or baggage screening systems without permission can compromise security and cause financial losses.

The limited use of advanced detection equipment such as X-ray machines and explosive detection systems in the developing regions is due to the high cost of these devices. The other factors are maintenance and the technical issue of obsolescence, which needed to decrease costs in the long term through the assignment of funds for renewal and enhancement.

Tier 1 Companies like Smiths Detection Group Ltd., Leidos Holdings Inc., and OSI Systems, Inc. are categorized as Tier 1 due to their expansive global operations, extensive product offerings, and dominant shares. These corporations provide a wide range of screening solutions, including X-ray scanners, metal detectors, CT-based imaging systems, and biometric verification technologies, catering to sectors such as aviation, border security, and critical infrastructure.

Their strong research and development capabilities drive continuous innovation, enabling them to adapt to emerging threats and regulatory requirements. Additionally, their well-established global distribution networks and strategic partnerships with governments and security agencies enhance their ability to deploy and maintain advanced solutions effectively across multiple regions.

Tier 2 Companies like 3DX-RAY Ltd., Teledyne Technologies Inc., and Analogic Corporation are classified as Tier 2 due to their strong presence and expertise in specialized technologies. These companies focus on developing advanced imaging, sensing, and detection solutions tailored for specific applications, such as portable X-ray scanners, computed tomography (CT) security systems, and high-resolution imaging for threat detection.

Their investment in cutting-edge technologies, such as AI-based threat detection and automated screening, positions them as key players in niche industries. While they may not have the same global reach as Tier 1 companies, their ability to innovate and provide customized security solutions enables them to remain competitive in the evolving security landscape.

Tier 3 Companies like Astrophysics Inc., Gilardoni S.p.A., Vanderlande Industries B.V., and Westminster International Ltd. are categorized as Tier 3 due to their specialized focus on certain segments or regional security needs. These companies develop tailored solutions, such as baggage screening systems, cargo inspection scanners, and screening services for critical infrastructure.

While they may have a limited global presence compared to Tier 1 and Tier 2 companies, they maintain a strong foothold in their respective industries by offering cost-effective, high-performance security solutions. Their focus on regional compliance, customer-centric innovations, and specialized security applications makes them key contributors to the broader industry.

| Countries | CAGR |

|---|---|

| The USA | 7.8% |

| The UK | 6.5% |

| France | 6.2% |

| Germany | 7.0% |

| Italy | 5.8% |

| South Korea | 6.8% |

| Japan | 7.1% |

| China | 8.5% |

| Australia | 6.0% |

| New Zealand | 5.5% |

The USA is growing at a CAGR of 7.8% over the forecast period. Innovation is led by American companies incorporating sophisticated technologies such as biometrics and artificial intelligence into screening machines. USA companies spend heavily on R&D to create high-performance screening machines that comply with stringent federal and state regulations.

Local brands like Rapiscan Systems are leaders in developing and installing next-generation screening technology. Investors drive the growth by financing projects to improve security facilities at airports, transportation hubs, and key government buildings. Pro-activeness in response to emerging threats drives the growth, and firms innovate to offer quick, effective, and economical solutions.

The American industry is adopting data analytics and digitalization to improve threat detection to be accurate, make operations seamless, and reduce delays, developing a fertile ground for sustained technological development and customer-driven solutions.

Firms actively engage with technology startup firms and research institutions to spur innovative breakthrough screening technologies. Enhanced public-private partnerships and enhanced government expenditures strengthen the overall security infrastructure. Urban areas are evidence of quick modernization of infrastructure, and strong regulatory support ensures security standards are not compromised.

The focus for manufacturers is efficiency and sustainability as they create systems that can keep up with changing threats. Players focus on local as well as global projects to ensure that innovation and growth are the primary drivers. This thriving ecosystem provides a competitive platform where quality, reliability, and superior capabilities continue to raise new industry standards.

The CAGR of the UK from 2025 to 2035 is 6.5%. British companies formulate a competitive environment by embracing digital innovations and creating improved screening technologies. British companies spend money on new equipment that integrates traditional screening with cutting-edge digital analysis. World-famous companies such as Smiths Detection are founded here and have set high standards when it comes to offering integrated solutions to airports, stadiums, and government buildings.

The sector is supported by a strong regulatory system that calls for top-notch performance and security standards. The British industry aggressively seeks strategic alliances on a competitive basis, and producers drive technology limits to enable screening systems to respond to emerging security threats rapidly. The rapidly evolving environment supports a culture of rapid innovation, and investment in next-generation sensors and threat analysis based on data drives high growth.

Stakeholders are interested in increasing operational efficiency using smart analytics and cloud monitoring technologies. A research focus and cooperation enable British companies to bring innovative products that meet both domestic and international standards. Improved border protection, growing air transport, and growing public security issues test producers to strive towards sophisticated but user-friendly products.

Government-backed schemes financing technology advancement and stimulating security research also fuel the industry. This strategic emphasis stimulates the UK's leadership in security technology and lays a strong foundation for the future growth.

Over 2025 to 2035, France is expected to grow at a CAGR of 6.2%. French firms direct innovation and technical prowess toward providing cutting-edge screening solutions that integrate digital imaging, sensor fusion, and real-time threat assessment. Local brands such as Thales drive the creation of customized solutions for high-density public spaces, transport hubs, and mass gatherings.

French players focus on quality and accuracy through strict regulatory compliance and affordability. Active engagement of local producers, along with government incentives and substantial investment in infrastructure, pushes towards slow growth. Firms lead efforts to replace traditional screening systems with intelligent technology that raises detection levels and improves efficiency. France is focused on human-centric design and the smooth incorporation of new technology into current security systems.

The country's focus on technological excellence encourages manufacturers to employ sophisticated data analysis and machine learning for threat prediction and risk evaluation. Pilot programs for new screening technologies at key transportation hubs are funded by private and public sources, supporting an environment that encourages innovation.

French engineering and design tradition offers the ideal platform to tackle changing security issues in a timely manner, with the ability to implement newer technologies quickly. Ongoing technological advancements in system interoperability and efficiency drive the industry, and France has become a focal region for the development of global screening technologies.

Over 2025 to 2035, Germany is expected to grow at a 7.0% CAGR. German firms utilize their engineering accuracy and expertise, which are globally famous, to create robust screening solutions. Firms such as Rohde & Schwarz lead product innovation, creating systems that combine sophisticated sensor technology and real-time analysis. German manufacturers vigorously compete to improve quality and reliability with the implementation of stringent EU and national standards.

The economy is underpinned by collaborative industrial alliances and an entrepreneurial culture that encourages constant product innovation. German industries pursue a visionary strategy by introducing advanced scanning technology at airports, rail terminals, and border crossings in response to the growing demand for total security. This dynamic strategy leads to systems providing rapid threat detection and low false alarms, which is in line with the country's focus on operational excellence.

Companies invest in cutting-edge research facilities that investigate developments in sensor technology, digitalization, and automation. Solid home economy foundation and concentration on quality drive investments into screening hubs.

Enterprises cooperate with tech companies to complement their portfolios by adding cloud computing and big data analysis, lowering operation costs while maximizing efficiency. This supports growth in the marketplace and boosts Germany as an international source of advanced security solutions. Manufacturers continue to dominate product durability, user-driven design, and high performance, keeping the industry responsive and adaptable to new security threats.

Italy's CAGR from 2025 to 2035 is expected to be 5.8%. Italian manufacturers combine innovative design with technology innovation to create screening systems that meet varied security needs. Businesses seek to develop small, slender, and elegant devices ideal for airport, public building, and border crossing point applications. Local players like ItalGuard Technologies are at the forefront of using innovative technology that fuses local handiwork with sophisticated digital means.

The demand in the local industry fuels the growth by prioritizing energy efficiency, ergonomics, and simple integration of intelligent sensors. Domestic companies pride themselves on providing tailor-made products that meet the unique needs of local and local security agencies. The industry relies on a heritage of design excellence and can sustain product durability and performance through partnerships with technology startups.

The industry sustains steady expansion as producers replace existing systems with updated technology. Italian enterprises continuously participate in cooperative research activity with universities and industry specialists in order to achieve peak screening performance and system response.

Customer experience emphasis and product versatility enable the sector to align with changing operating and regulatory demands. Investment in digitalization, intelligent analytics, and integrated control systems leads to better threat detection and better user interfaces. This strategy keeps the Italian security screening sector competitive regionally and globally, blending innovation, design allure, and high performance to provide cutting-edge solutions.

South Korea is expected to grow at a CAGR of 6.8% over the forecast period. South Korean firms aggressively use cutting-edge technology in screening equipment, fueling the growth using advances in sensor technology, automation, and artificial intelligence-driven analytics. Domestic players such as Hanwha Techwin innovate through the provision of compact yet high-performance screening equipment to suit the demands of busy transport points, government institutions, and commercial zones.

The market is an expression of the country's aspiration for technological superiority and accelerated digitalization. Domestic producers invest in producing devices that are precise in threat detection, minimize false alarms, and optimize security procedures.

A visionary regulatory framework and strong government support further encourage investments in sophisticated security infrastructures. Companies align their strategy with global standards while making product modifications to address local security needs, emphasizing performance as well as dependability.

The industry is propelled by immense R&D investments that aim to combine intelligent analytics and hardware solutions. Domestic companies partner with research institutions and tech firms to create futuristic systems that come equipped with machine learning and Internet of Things (IoT) connectivity. Growth in urbanization and heightened public security issues fuel demand for future-proof screening technologies in transport and key infrastructure.

The players in the industry invest in modular and scalable solutions that can easily adjust to evolving security risks. With cross-industry collaboration between the public and private sectors to create safety features, the changing nature of the industry fuels ongoing product enhancement and development, further positioning South Korea as the leader in ground-breaking technologies.

Over 2025 to 2035, Japan is expected to grow at a CAGR of 7.1%. Japanese companies leverage their precision engineering and robotics expertise to provide screening systems that are fast and accurate. Local players like NEC Corporation and other technology leaders innovate relentlessly by combining intelligent imaging sensors, robots, and smart software into security systems.

The industry draws strength from the depth of Japan's technology base and its emphasis on close quality control. Local producers consistently develop systems in a bid to streamline airport security processes and events within urban environments so that threats can be detected faster and safety upgraded. Reliability, efficiency, and simplicity are values that make companies achieve local regulatory standards.

The country invests in robust R&D initiatives that integrate robotics with artificial intelligence and sensor technology. This emphasis leads to systems that improve operation effectiveness and minimize the potential for human error while conducting threat analysis. Japanese manufacturers strongly collaborate with technology startups and research institutions to make their products always cutting-edge.

The emphasis on cyber-physical integration, data analytics, and automation enables the development of security solutions that are not only adaptive but also resilient. Firms leverage cutting-edge technologies to provide end-to-end solutions that constantly evolve against emerging threats, solidifying Japan's leadership in security screening.

The Chinese security screening market will grow at a CAGR of 8.5% over the forecast period. Chinese firms propel fast growth through the adoption of cutting-edge technologies and rationalized production at scale. Domestic leading brands like Hikvision are moving ahead with the roll-out of intelligent cameras, AI-enabled analytics, and sophisticated sensor networks into security screening technology.

There is a high growth as companies concentrate on low-cost, high-volume production, meeting domestic and international demand. The wave of urbanization, increasing transportation infrastructure, and increasing focus on public security drive investment in advanced screening equipment.

Home-grown companies stress technology convergence and interoperability for screening equipment to rapidly respond to changing security risks. Aggressive R&D expenditure is the strength behind the industry's capacity for introducing disruptive innovations based on speed, accuracy, and reliability.

The government finances modernization initiatives and infrastructure upgrades that integrate next-generation screening technology in key airports, railroad terminals, and public areas. Companies take advantage of the nation's sophisticated digital environment and strong manufacturing capacity to reduce costs and enhance product quality.

The competitive environment propels ongoing innovation in system design and performance, and companies invest in the implementation of big data analytics and cloud computing into their offerings. With the industry reacting to mounting security challenges, Chinese companies have established new standards for innovation and operational excellence. This dynamic marketplace positions China as a focal point for the innovation and export of advanced security screening technologies.

Australia is expected to grow at a CAGR of 6.0% over the forecast period. Australian firms wholeheartedly adopt innovation by incorporating advanced technologies like digital imaging, intelligent sensors, and automated screening equipment into their product lines. Local rivals like SafeGuard Australia drive expansion by emphasizing clean, intuitive solutions for dealing with the specific security needs present in crowded transit points, airports, and border checkpoints.

The industry grows steadily as operators upgrade antiquated systems and invest in secure facilities. Australian manufacturers emphasize product reliability, fast threat detection, and ease of integration with existing security. Robust state support, in addition to increased public awareness of security, spurs investments in the latest screening technology. Businesses further gain from coherent rules of regulation and incentives for R&D of cutting-edge security technology.

The industry capitalizes on domestic engineering and digital technology skills to import systems that manage city and country security challenges. Industry players actively partner with technology companies and research institutions to roll out intelligent analytics and IoT-enabled devices that enhance performance and lower operating expenses.

Workforce development and technology refresh investments enable strong ecosystems to address changing customer needs and regulatory requirements. This vision-driven strategy enables Australian businesses to leverage new opportunities, push export boundaries, and dominate cutting-edge security screening technologies.

New Zealand is expected to grow at a CAGR of 5.5% during 2025 to 2035. The industry in New Zealand gains momentum gradually as domestic businesses create niche screening solutions for airports, seaports, and border terminals. New local brands like KiwiSecure Innovations start innovations that integrate conventional screening practices with innovative digital features.

The market specializes in minimalistic designs and budget-friendly solutions that suit small-scale and large security projects. Domestic producers seek to upgrade installed bases to obtain upgraded safety solutions, including intelligent sensors and analytics to enhance detection effectiveness.

Businesses tenaciously pursue new practices that combine cloud-based monitoring and automated threat evaluation into security screening processes. Industry players emphasize customer-focused solutions tuned to regional issues to ensure international standards of security.

Synergy, by virtue of robust local technical competence, government policies, and partner alliances, propels a buoyant environment for security technology innovation. As New Zealand continues to strengthen its reputation as a secure source of adaptable and dependable screening technologies, the market stands poised to capitalize on future innovations in a changing global security environment.

| System | Share (2025) |

|---|---|

| X-Ray Screening Systems | 26.1% |

The industry is predominantly characterized by the use of x-ray screening systems, which occupied a 26.1% share in 2025 owing to the large-scale deployment of these devices at aviation checkpoints, border security terminals, and critical infrastructure protection facilities. Systems used for this purpose offer high-resolution imaging to detect weapons, explosives, narcotics, and other contraband, ensuring adherence to international security measures.

Airports are the largest adoption segment, and regulatory bodies, including the TSA, IATA, and ICAO, impose comprehensive screening protocols. Advancements in dual-energy X-ray technology and computed tomography (CT) scanning that can more effectively identify threats are also driving demand.

Explosive Trace Detectors accounted for 18.4% of the market in 2025 as they are increasingly used for the detection of trace explosives on persons, baggage, and cargo. These devices are ubiquitous, found in airports, government buildings and border checkpoints amid increased fears about terrorism and smuggling.

To enhance aviation security, regulatory bodies such as the USA Department of Homeland Security (DHS) and the European Civil Aviation Conference (ECAC) call for the implementation of ETD.

The increasing acceptance of powered and handheld ETD devices is primarily due to innovative solutions by leading manufacturers like Smiths Detection, Rapiscan, and Bruker, which integrate machine-learning powered detection algorithms to deliver more accurate and efficient results. The increasing use of ETDs in military, defense, and law enforcement is also fueling rapid growth, especially as governments channel funds into automated and AI system-based solutions for security screening.

| Application | Share(2025) |

|---|---|

| Airports | 41.3% |

With the increasing global air passenger traffic, new types of security threats find themselves growing its extensive set of regulatory requisites; the airport security screening segment is observed to capture the largest share of 41.3% in 2025.

To enhance safety and operational efficiency, regulatory authorities (i.e., TSA (USA), IATA and ICAO) require full-body scanners for the screening of passengers, advanced screening techniques like computed tomography (CT) scanners for the screening of checked bags and artificial intelligence (AI) powered automated screening lanes.

Due to time-consuming conventional X-ray screenings leading to increased passenger wait times, airports, including Heathrow, JFK, and Dubai International, have turned towards advanced security infrastructure investments in next-generation scanning solutions to better balance the imperative of lowering passenger wait times while further boosting detection accuracy. The importance of airport security is only set to increase with the increasing implementation of biometric authentication and AI-driven threat detection systems such as facial recognition and behavior analysis.

Border security screening will represent 29.6% of the total segment in 2025 and achieve a CAGR of 7.7% against all security screening markets. Increasing cross-border trade, migration, and geopolitical tensions are fueling investments in X-ray cargo scanners, Non-intrusive inspection (NII) systems, and biometric verification technologies.

Governments worldwide, from USA Customs and Border Protection (CBP) to the European Border and Coast Guard Agency (Frontex), are introducing AI-optimized monitoring and automation to help keep borders safe through threat Identification systems.

The Security Screening Market is expanding at a rapid rate because these governments have adopted AI-powered threat detection, automated screening, and biometric authentication technologies in transportation hubs and critical infrastructure facilities. Rising global security threats and stricter regulatory mandates have increased demand for advanced X-ray systems, millimeter-wave scanners, and real-time analytics solutions in airports, border control, and high-security locales.

Major players in the domain include Smiths Detection, Leidos, Rapiscan Systems, Nuctech, and L3Harris Technologies-all being well entrenched by comprehensive portfolios within security screening, AI imaging innovations, as well as strong government contracts. Incoming players would focus mostly on biometric authentication, machine learning-based anomaly detection, and compact mobile screening solutions to gain some share in the competition.

Advancing 3D CT scans and AI heightening object recognition, as well as the threat assessment platforms integrated into the cloud would make the evolutionary market. The development of automated screening lanes, remote security monitoring, and non-intrusive inspection technologies would advance efficiencies alongside passenger throughput.

The strategic aspects driving competitive actions include compliance with the matrix of ever-changing security regulations, proliferation into important, at-risk public spaces, and integrated AI and IoT-enabled security systems. Any firm investing in next-generation detection capability, cybersecurity integration, and collaborative partnerships with regulatory agencies has strategic potential. They would park themselves in a competitive nook within this vibrant security-actioned landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Smiths Detection Group Ltd. | 20-25% |

| Leidos Holdings Inc. | 15-20% |

| Rapiscan Systems | 10-15% |

| Nuctech | 8-12% |

| L3Harris Technologies | 5-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Smiths Detection Group Ltd. | Leading provider of airport baggage screening, explosive detection systems, and AI-powered threat detection. |

| Leidos Holdings Inc. | Specializes in automated security checkpoints, real-time AI-based screening solutions, and government security contracts. |

| Rapiscan Systems | Focuses on baggage and cargo screening, people screening, and radiation detection solutions. |

| Nuctech | Develops X-ray imaging, baggage scanning, and advanced trace detection technologies. |

| L3Harris Technologies | Provides high-speed explosive detection systems, perimeter security, and AI-driven scanning solutions. |

Key Company Insights

Smiths Detection Group Ltd. (20-25%)

Industry leader in threat detection using AI, explosives screening, and aviation security solutions.

Leidos Holdings Inc. (15-20%)

The company leads in automated checkpoint solutions and AI-based screening solutions and specializes in government security and border protection contracts.

Rapiscan Systems (10-15%)

Rapiscan is engaged in baggage, cargo, and radiation detection solutions for airports and border security.

Nuctech (8-12%)

Nuctech leads the industry in baggage scanning, cargo inspection, and trace detection technology, mainly in Asian markets.

L3Harris Technologies (5-10%)

L3Harris offers explosive detection, perimeter protection, and swift screening technologies for government agencies and transport hubs.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 10,880.0 million in 2025.

The industry is predicted to reach a size of USD 22,444.9 million by 2035.

Key companies include Smiths Detection Group Ltd., Leidos Holdings Inc., OSI Systems, Inc., 3DX-RAY Ltd., Teledyne Technologies Inc., Analogic Corporation, Astrophysics Inc., Gilardoni S.p.A., Vanderlande Industries B.V., and Westminster International Ltd.

China, slated to grow at 8.1% CAGR during the forecast period, is poised for the fastest growth.

X-ray screening systems are among the most widely used security screening systems.

By system, the market is segmented into X-ray screening systems, explosive trace detectors, electromagnetic metal detectors, liquid scanners, and biometric systems (face recognition, voice recognition, fingerprint recognition, and iris recognition).

By application, the market includes airports, government buildings, border checkpoints, educational institutes, private office buildings, malls, and others.

In terms of region, the market spans North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.