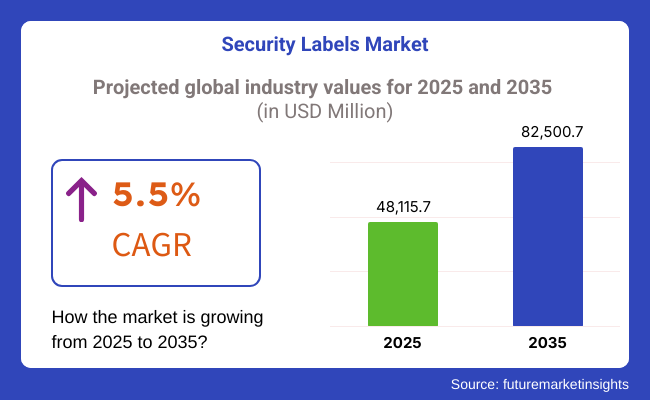

The global sales are estimated to be worth USD 48,115.7 million in 2025 and are anticipated to reach a value of USD 82,500.7 million by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. The revenue generated in 2024 was USD 45,590.0 million. The market is anticipated to exhibit a Y-o-Y growth of 5.5% in 2025.

The increasing occurrence of counterfeit products in industries like pharmaceuticals, electronics, food & beverages, and luxury items is a major growth driver for the industry. Counterfeit products not only cause revenue loss to manufacturers but also pose huge health and safety hazards for end-users.

To fight this menace, manufacturers are progressively employing security labels with high-end authentication technologies, including holograms, tamper-evident seals, and RFID tracking. Governments across the globe are also implementing more stringent anti-counterfeiting laws, driving demand for security labeling solutions even higher.

Growing consumer awareness of product authenticity and safety is compelling brands to invest in high-security labeling technologies to ensure product integrity and customer confidence in a competitive industry.

The rapid development of e-commerce and global supply chains has increased the demand for these labels to provide real-time tracking, traceability, and authentication. With the rise in online shopping, counterfeiting has become a way of life, necessitating proper security solutions to protect consumers and brands.

Labels combined with QR codes, RFID, and NFC technology allow product authentication, monitor shipments, and deter illegal distribution. Furthermore, companies are also investing in blockchain-based tracking solutions to improve transparency and trust. As the complexity in supply chains increases with multiple geographies, these labels are now critical to enable compliance, manage inventory, and ensure product authenticity, and hence, the industry is growing.

Counterfeiting issues, rising regulatory demands, and advancements in smart label technologies are central drivers for growth. Furthermore, the expansion of e-commerce and globalization has increased the demand for secure packaging and tracing. There is a continuous transformation with digital authentication innovations and blockchain-based tracking solutions strengthening security and transparency across sectors.

Explore FMI!

Book a free demo

Globally, the industry is undergoing a massive expansion due to the surge in counterfeit protection, product authentication, and regulatory compliance across a plethora of industries like retail, pharmaceuticals, electronics, and logistics.

In the retail & FMCG segment, security labels act as the most critical technical means to protect the brand from counterfeiting, tamper evidence, and theft. Moreover, these labels are the most effective method in the packaging of drugs against tampering, regulatory requirements, and counterfeiting measures, which ultimately restore the patient's health.

Tamper resistance, RFID-based anti-counterfeit, and product integrity are the main significances of these labels. Electronics manufacturers go for customization, branding, and counterfeit protection. Thus, they have adopted barcode and RFID technologies, enabling them to not only trace the products but also increase the brand value of their products.

At the same time, the logistics and transportation sectors are making use of long-lasting adhesive labels in the form of supply chain tracking, inventory management, and anti-theft devices. When enterprises identify products with intelligent standards of authentication technology, it can be expected that there will be a greater expansion of the industry.

| Company | Estimated Contract Value (USD Million) |

|---|---|

| 3M | USD 120 - 150 |

| Avery Dennison Corporation | USD 80 - 100 |

| CCL Industries | USD 50 - 75 |

| UPM Raflatac | USD 40 - 60 |

| Tesa SE | USD 150 - 180 |

From 2020 to 2024, the security labeling industry grew steadily, with increasing concern regarding counterfeiting, product authenticity, and supply chain authenticity. Pharmaceuticals, food and beverages, electronics, and luxury items used tamper-evident labels, RFID labels, and hologram stamps to enhance product security and outsmart counterfeiting.

E-commerce growth also drove demand for secure packaging to avoid theft and unauthorized access. Producers incorporated QR codes and NFC technology into these labels to provide real-time monitoring of products and customer verification; with such high production costs and the technical complexity of maintaining regulatory compliance, technological innovation for smart labeling enhanced security and traceability.

Blockchain monitoring, green label content, and artificial intelligence-based authentication will propel expansion between 2025 and 2035. Artificial intelligence-based labels will track tampering and counterfeiting in real-time, increasing supply chain transparency.

Blockchain technology will enable open, secure product authentication from manufacturing to the point of delivery. Biodegradable and sustainable labeling materials will enable environmental compliance and objectives. Smart labels with embedded sensors and dynamic QR codes will provide instant product status reporting and authentication, building consumer trust and brand integrity.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased regulatory requirements for anti-counterfeiting measures across pharmaceuticals, food, and electronics. FDA, EU, and other authorities tightened compliance regulations. | Stronger serialization and traceability legislation by governments. Growth in digital tax stamps and blockchain authentication redefines high-risk sector compliance (pharma, spirits, and high-end items). |

| RFID-backed labels for real-time traceability. Designing tamper-evident and holographic labels for enhanced authentication. QR codes and NFC tags were used extensively for consumer engagement. | AI-powered smart labels with dynamic encryption support offered enhanced security. DNA-based and nanotechnology-backed labels offer ultra-high-level authentication. Blockchain and IoT-supported advanced labels facilitate real-time global tracking and authentication. |

| E-commerce growth fueled the demand for anti-counterfeit labels to fight counterfeiting. End-to-end visibility solutions through serialization solutions were gaining traction. | AI-driven logistics and intelligent authentication labels become the norm. Expanded usage of machine-readable labels to automatically track, glitch-free, and prevent counterfeiting. |

| Serialization and track-and-trace solution application for compliance with drug authentication (e.g., DSCSA, FMD) requirements. Complete usage of tamper-proof security tags on vaccines and medical devices. | Intelligent and digital labels with embedded sensors monitor temperature, humidity, and tampering in real time. AI- and blockchain-based labels become a must for drug authentication. |

| Growing application of these labels for brand protection in food, drinks, and cosmetics. Holographic and UV-printed labels became prevalent in high-value consumer products. | Smart authentication labels become the standard for premium brands. Smart packaging with real-time monitoring and consumer interaction increases brand transparency. |

| Escalation in counterfeited parts created the need for the use of unique identification (UID) labels. Tamper-evident labels were required on costly electronics and vehicle components. | Smart labels based on artificial intelligence to detect counterfeit parts. Labels based on quantum encryption protect against sophisticated counterfeiting attacks. |

| Use of biodegradable and recyclable materials for labels in early stages. Phased introduction of non-toxic adhesives and inks. | Completely sustainable, plastic-free labels are the new standard. Recycling technology powered by AI facilitates smart label recovery and reuse. |

| RFID and NFC-tagged labels enhanced inventory tracking and authentication. Supply chain disruptions triggered investment in label traceability solutions. | AI and blockchain-based labels provide real-time authentication and fraud detection. Decentralized supply chains leverage smart labels for end-to-end visibility. |

| An increase in counterfeiting, stringent regulatory environments, and growth in e-commerce drove security label demand. Growing brand and consumer awareness spurred adoption. | The worldwide trend toward AI, blockchain, and intelligent supply chain solutions drives demand. Sustainability-driven innovations fuel transformation. |

There are several risks, such as crypto, regulatory compliance, price of raw materials, and technological improvements. Given the increase in the number of product counterfeiting and fraud, companies have to consistently carry out research and development to integrate the latest technologies such as RFID, holograms, and tamper-proof labels and always be one step ahead of the counterfeiters.

There is a requirement to comply with some standards from strict regulations in such sectors as pharmaceuticals, food, and consumer goods. Failure to comply with the rules may lead to issues such as product recall, legal repercussions, and reputation loss. Companies have an obligation to ensure that they obey the new regulations regarding how to label products across the world.

Another risk that companies face is the changes in raw material prices, which include paper, adhesives, and specialty inks. The increase of costs and delays in production can be attributed to the disrupts of supply chains that occur because of things such as geopolitical conflicts or climate change.

The birth of digital authentication technology is both a threat and a chance of opportunity. Companies that depend only on conventional labels might encounter the risk of being outdated, while those that embrace smart labels and blockchain verification can keep a leading position.

Tier 1 companies like 3M Company, Avery Dennison Corporation, and CCL Industries Inc. are categorized as Tier 1 due to their expansive global operations, comprehensive product offerings, and significant shares in the industry. These corporations provide a wide range of security labeling solutions, including tamper-evident labels, holographic labels, and RFID-enabled labels, catering to diverse sectors such as pharmaceuticals, consumer goods, and electronics.

Their strong research and development capabilities enable continuous innovation, allowing them to adapt to evolving demands and maintain a competitive edge. Additionally, their robust distribution networks and strategic partnerships enhance their ability to serve a global clientele effectively.

Tier 2 Honeywell International Inc., UPM Raflatac, Tesa SE, and Brady Corporation fall into Tier 2, characterized by their established industrial positions and specialized security labeling solutions. These companies focus on specific industries or technologies, offering tailored products such as tamper-evident seals, void labels, and barcode labels.

Their expertise in particular niches allows them to address unique customer requirements effectively. While they may not have the same global reach as Tier 1 companies, their dedication to quality and innovation ensures they remain competitive in their chosen markets. Their ability to provide customized solutions positions them as valuable partners for businesses seeking specialized security labeling options.

Tier 3 Zebra Technologies Corporation, Covectra, Inc., and Mega Fortris Group are considered Tier 3 companies, often operating as niche players or regional specialists within the industry. These companies concentrate on specific geographic areas or industry segments, offering products like RFID labels, holographic labels, and tamper-evident solutions.

Their deep understanding of local dynamics and regulatory requirements enables them to provide highly customized services. Although they may have a smaller share compared to Tier 1 and Tier 2 companies, their agility and specialized knowledge allow them to effectively meet the unique needs of their clients, fostering strong customer relationships and loyalty.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| France | 3.8% |

| UK | 4.2% |

| China | 6.4% |

| India | 6.2% |

The growing regulations in various industries, such as pharmaceuticals, food & beverages, and electronics, drive the USA market. The USA Drug Supply Chain Security Act (DSCSA) requires serialization and track-and-trace solutions, which has driven a huge demand for tamper-evident and authentication labels. Furthermore, increasing cases of counterfeiting and theft from supply chains are driving the business to use advanced security labeling technologies like RFID and QR code-enabled labels.

The United States e-commerce field is experiencing sustainable expansion, which boosts demand for fat and secure packaging and marking guaranteeing product honesty. In the country, security label manufacturers have continued to innovate by leveraging technologies such as NFC-enabled labels and blockchain authentication.

The concentration on brand protection and consumer safety has made these labels a vital element of the supply chain in various areas. The USA industry is expected to expand at a 4.4% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Stringent regulatory compliance. | The Drug Supply Chain Security Act (DSCSA), which was enacted in 2013, creates serial numbers and track-and-trace measures to prevent counterfeit pharmaceuticals from entering the supply chain. |

| Rising Counterfeit Concerns | The high incidence of counterfeit electronics, luxury goods, and medicines drives the demand for security labels. |

Rising concerns regarding counterfeit goods, especially in luxury products, pharmaceuticals, and food & beverage segments, are driving the growth of the French security labels industry. Strict anti-counterfeiting laws have been implemented in France to protect luxury brands and consumers alike. French luxury brands use holographic and tamper-evident labels to avoid product replication.

Moreover, organizations within the wine and spirits industry utilize authentication labels to confirm product authenticity and prevent counterfeiting. The country's robust industrial base, added to the booming field of digital authentication solutions such as blockchain and smart labels, only serves to fuel the usage of these labels in the region. The France market is expected to expand at 3.8% CAGR during the forecast period, according to FMI.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Strict anti-counterfeiting regulations | Regulations protect luxury brands, pharmaceuticals, and high-value goods from counterfeiting. |

| Growing Luxury Goods Industry | Advanced labels are applied to counterfeiting in industries such as high-end fashion, cosmetics, and wines for authentication. |

A growing UK market is mainly driven by regulatory enforcement and end-users, including pharmaceutical, e-commerce, food & beverages, etc. The UK government has strict laws about labeling for consumer health as well as deterring counterfeiting. Serialization and tamper-proof labeling are especially important to the pharmaceutical industry to comply with safety regulations.

The UK e-commerce industry has grown rapidly, resulting in the need for effective anti-counterfeiting measures to fight fraud and black market selling. Tamper-evident and authentication labels are in growing demand in online retailing, logistics, and consumer electronics. Holographic and smart labels are also used by luxury brands and premium food manufacturers to ensure brand integrity. The UK industry will grow at a 4.2% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Strong Government Regulations | There are stringent laws to stop counterfeiting drugs, food , and electronics. |

| Expanding E-Commerce Sector | E-commerce retailers are paying for tamper-proof labeling to prove the product is real. |

Demand for anti-counterfeiting solutions and regulatory compliance has increased significantly in China, driven by the country's substantial manufacturing base and the worldwide growth of counterfeit goods. There is an active counterfeit sale for pharmaceuticals, counterfeited consumer electronics products, and counterfeited automotive parts in the country, fueling the use of authentication labels.

To ensure supply chain security, the government has strictly monitored the track-and-trace of pharmaceutical products. Another big driver is China's booming e-commerce industry, where counterfeit goods are a chronic problem.

These labels help online marketplaces and logistics companies verify the authenticity of products and improve supply chain transparency. Also, sectors such as high-end fashion and liquor are adopting RFID-based and NFC-based tags to eliminate counterfeiting. FMI anticipates China's industry to grow at a 6.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Clampdown on Counterfeit Products | In pharmaceuticals and electronics, strict regulations mandate serialization and authentication labeling. |

| E-Commerce Expansion | In order to curb product fraud and unauthorized reselling, online retailers use security labels. |

The industry's growth can be attributed to the recent surge in industrialization, stringent enforcement of regulations, and the growth of the e-commerce industry. Counterfeiting in pharmaceuticals, FMCG, and consumer electronics is driving the growth in the adoption of authentication labels and tamper-proof packaging solutions. The Indian government requires track-and-trace labeling for pharmaceutical exports to help block fake drugs from being incorporated into global supply chains.

The e-commerce sector is thriving, and the country needs an efficient labeling solution that provides assurance of the product's authenticity and safe delivery. Moreover, consumers are becoming increasingly aware of brand protection, which is driving manufacturers to spend money on advanced security labeling.

As multinational companies are extending their presence in India, the requirement for digital authentication solutions, including QR codes and holographic labels, is also on the ascent. The Indian industry is expected to expand at 6.2% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| A Government-Mandated Track-and-Trace | Serialization is needed to ensure pharmaceutical exports are not counterfeit drugs. |

| Rising Counterfeit Concerns | Increasing demand due to high instances of counterfeit FMCG, electronics, and apparel. |

| Material Type | Share (2025) |

|---|---|

| Plastic | 27.6% |

On the basis of the material, the plastic segment is projected to capture a 27.6% share in 2025 on account of its sturdiness, flexibility, and resistance against environmental factors like moisture, warmth, and chemicals. Plastic-based labels (such as polyester, polypropylene, and vinyl) offer more adhesion and durability, making these labels suitable for pharmaceutical, food & beverage, logistics, and electronics industries.

Often used as a general form of anti-counterfeiting or brand protection, plastic security labels can be combined with RFID tags, holograms, and tampering-proof seals to help identify products and provide supply chain traceability. Pharma companies, for instance, use serialized QR-coded plastic labels to comply with global track-and-trace mandates.

Despite growing sustainability concerns, biodegradable and recyclable plastic labels are on the rise. Plastic labels will continue to gain in popularity as plastic labels, environmentally conscious counterparts. Avery Dennison and 3M invest in environmentally sustainable means of working with plastics.

The leading segment in 2025 was paper, with a 39.2% share, concentrated on the need for sustainable and economical labeling solutions. Mainly used for food packaging as well as retail, pharmaceuticals, and logistics, where eco-friendly and tamper-evident solutions are preferred, paper-based security labels are unique, highly branded, and costly.

Rising environmental regulations and consumer demand for biodegradable packaging are leading companies to develop advanced features in high-security paper labels, including watermarks, security printing, and tamper-proof seals. In fact, increasing demand for track-and-trace paper labels in compliance with government mandates in the pharmaceuticals and taxation sector will be pushing the industry, so their demand will be on top and trending.

| Product Type | Share (2025) |

|---|---|

| Radio Frequency Identification | 46.8% |

The RFID segment will dominate, with a share of 46.8% in the market in 2025. This ability makes them popular as RFID must be transported and transmitted wirelessly (using radio waves), and RFID security labels are primarily manufactured for logistics, retail, pharmaceuticals, and similar materials.

Several businesses are investing in RFID-enabled security labels to help reduce counterfeiting, increase supply chain visibility, and provide native theft protection. For instance, Walmart and Amazon use RFID systems to track inventories, helping reduce stock losses and operate more efficiently. Pharmaceutical companies even employ RFID security labels to help trace the provenance of their products and comply with track-and-trace regulations.

In 2025, the EAS segment holds 35.4%, mainly due to end-user adoption in retail stores, libraries, and warehouses for theft prevention. These labels, commonly placed on merchandise, set off alarms when their unauthorized removal is detected at store exits.

EAS labels are used by retail giants like Target, Best Buy, and Zara in anti-shoplifting systems that decrease inventory shrinkage by up to 60%. Even with RFID technology growing, EAS labels continue to be an affordable security option for businesses that want to prevent losses without needing additional infrastructure investments.

The security labels market witnessed rapid growth owing to the industries that increasingly adopt advanced authentication, anti-counterfeiting, and traceability solutions. Newer product tampering and counterfeiting issues, along with security in the supply chain, are a few of those reasons that influence the increasing demand for various kinds of programmable, RFID-enabled labels, tamper-evident seals, and holographic security in different sectors such as pharmaceuticals, food and beverage, electronics, and logistics, among others.

There is a dominance by prominent players such as Avery Dennison, 3M, CCL Industries, and Honeywell, with their comprehensive product portfolios, innovative smart-labeling features, and extensive global reach. UPM Raflatac, Tesa SE, and Brady Corporation focus on security labeling for specific industries to compete in this segment with mid-sized players; meanwhile, emerging providers and local manufacturers focus on viable and tailored offerings to offer their products for adoption.

Digital authentication, blockchain-based tracking, and AI-powered counterfeit detection developments are a part of the transformation. Cloud-based verification platforms with real-time tracking are integrated into companies to increase visibility throughout their supply chains. Alongside these, the concerns regarding sustainability also favor the development of eco-friendly security labels and recyclable materials.

Strategic factors affecting competition include innovation, compliance with regulatory requirements, cost optimization, and partnerships with industry players. Such developments will ensure investment in next-generation security labeling solutions, sustainable materials, and digital authentication for the firms to sustain competitiveness in emerging dynamics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Avery Dennison Corporation | 20-25% |

| 3M Company | 18-22% |

| CCL Industries Inc. | 15-20% |

| Honeywell International Inc. | 10-15% |

| UPM Raflatac | 5-8% |

| Other Companies (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avery Dennison Corporation | A global leader in RFID and tamper-evident labels, focusing on supply chain transparency and authentication solutions. |

| 3M Company | Specializes in holographic security labels, covert marking solutions, and track-and-trace technologies for anti-counterfeiting. |

| CCL Industries Inc. | Offers customized smart labels, digital authentication solutions, and high-security polymer-based labels. |

| Honeywell International Inc. | Develops barcode-integrated security labels, digital serialization solutions, and industrial-grade security tracking systems. |

| UPM Raflatac | Focuses on sustainable and eco-friendly security labeling solutions, including biodegradable tamper-proof labels. |

Key Company Insights

Avery Dennison Corporation (20-25%)

Avery Dennison is a global leader in RFID technology, offering security labels and track-and-trace solutions. Its firm holds the market with state-of-the-art authentication technologies for retail, healthcare, and logistics.

3M Company (18-22%)

3M holds a place in holographic and covert-security labeling, extensive applications built on cutting-edge materials and authentication technologies that back efforts to fight counterfeiting.

CCL Industries Inc. (15-20%)

CCL specializes in creating dynamic security solutions for all segments through its high-security polymer labels and digital authentication technologies.

Honeywell International Inc. (10-15%)

Honeywell incorporates an enhanced supply chain advantage through its barcode tracking, digital serialization, and AI-backed security labeling offerings.

UPM Raflatac (5-8%)

UPM Raflatac meanwhile offers eco-friendliness and sustainability on their security labels due to the demand for green packaging solutions.

Other Key Players (20-30% Combined)

In March 2024, Resource Label Group, LLC, a comprehensive provider of packaging and label solutions, including flexible packaging and pressure-sensitive labels, made significant advancements in the security labels market. However, specific details of these developments were not disclosed.

The industry is slated to reach USD 48,115.7 million in 2025.

The industry is predicted to reach a size of USD 82,500.7 million by 2035.

Key companies include Murata Manufacturing Co., Ltd., Qorvo, Inc., Skyworks Solutions, Inc., TDK Corporation, TAIYO YUDEN Co., Ltd., WISOL, Kyocera Corporation, TST, SHOULDER Electronics Limited, and CETC Deqing Huaying Electronics Co., Ltd.

China, slated to grow at 6.4% CAGR during the forecast period, is poised for the fastest growth.

Radio Frequency Identification (RFID) is among the most widely used security label segments.

The market is segmented by product type into barcodes, holographic labels, radio frequency identification (RFIDs), electronic article surveillance (EAS), near-field communication (NFC), and others (QR codes, etc.).

By material type, the market includes plastic, polyester, vinyl, PP, others, foam (EPS), foil, and paper.

In terms of pattern type, the market is categorized into VOID, checkboard, destructible, and other customized patterns.

By application, the market includes bottles & jars, boxes & cartons, bags & pouches, and other containers (IBCs, drums, etc.).

By end-use industry, the market includes the food & beverage industry, healthcare & pharmaceutical industry, chemicals & fertilizers industry, electrical & electronics industry, personal care & cosmetics industry, and others (homecare, etc.).

In terms of region, the market spans North America, Latin America, Europe, the Middle East and Africa, and East Asia.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.