As a result, there is a dramatic transformation in the used apparel market by sustainability-conscious consumers, budget-conscious shoppers, and fashion enthusiasts who are in demand of used clothing. It is witnessing this change at such a high scale due to its rapid online resale platforms growth, increasing circular fashion acceptance, and technological innovation through authentication and logistics. Luxury resale, vintage fashion, and other everyday apparel second-hand clothes are getting more mainstream in the whole world.

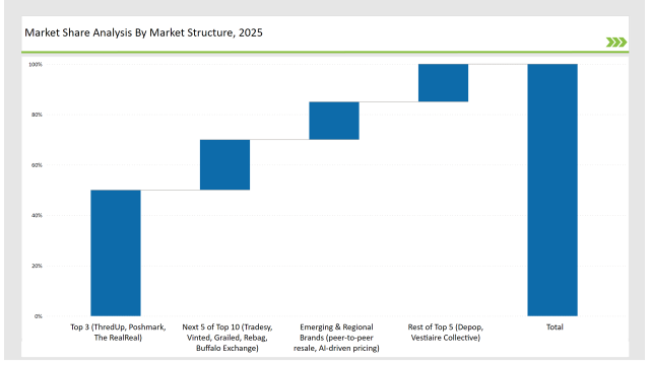

ThredUp, Poshmark, and The RealReal dominate 50% of the market share with their data-driven resale platforms, strategic brand partnerships, and AI-driven pricing algorithms. Independent and regional secondhand retailers account for 30% with curated vintage selections and boutique thrifting experiences. Finally, peer-to-peer resale startups, blockchain authentication, and sustainable upcycling comprise the remaining 20%.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (ThredUp, Poshmark, The RealReal) | 50% |

| Rest of Top 5 (Depop, Vestiaire Collective) | 15% |

| Next 5 of Top 10 (Tradesy, Vinted, Grailed, Rebag, Buffalo Exchange) | 20% |

| Emerging & Regional Brands (peer-to-peer resale, AI-driven pricing) | 15% |

The secondhand apparel market in 2025 is moderately concentrated, with the top players accounting for 45% to 60% of the total market share. Leading platforms such as ThredUp, Poshmark, and The RealReal dominate the segment, while local thrift stores and curated vintage collections add competitive diversity. This market structure reflects strong brand influence while allowing space for sustainable fashion innovations and AI-driven resale authentication.

Online Resale Platforms & Marketplaces are at 60% through AI-driven search, easy interface, and online payment facilities. Brick-and-Mortar Thrift Stores & Vintage Shops stands at 20%, which has the appeal of well-curated secondhand fashion. Luxury Resale Boutiques & Authentication Services make up 15% because it deals in high-end designer resale. Social Media & Peer-to-Peer Resale comprise 5%, since social media applications such as Instagram and Facebook Marketplace are increasing day by day.

Casual & Everyday Apparel dominates at 40%, with mass-market consumers buying second-hand for value and choice. Luxury & Designer Resale is at 25%, with authenticated, pre-owned high-fashion pieces. Streetwear & Hype Fashion is at 20%, with sneaker culture and limited-edition releases. Upcycled & Sustainable Fashion is at 15%, with eco-friendly consumers and fashion-forward creatives.

As demand from customers changed, so did the strategic decisions of market leaders and new entrants in this secondhand apparel business.

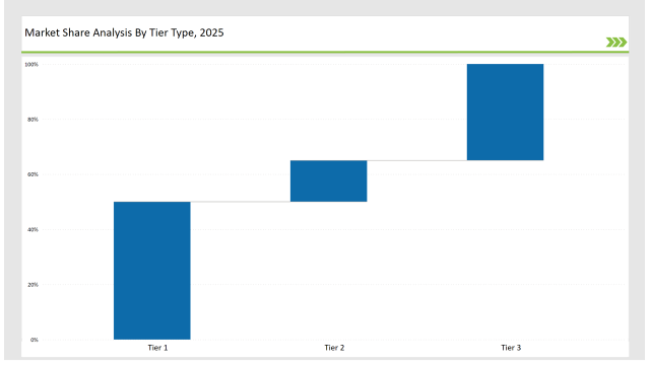

| Tier Type | Tier 1 |

|---|---|

| Market Share (%) | ThredUp, Poshmark, The RealReal |

| Key Drivers | 50% |

| Tier Type | Tier 2 |

|---|---|

| Market Share (%) | Depop, Vestiaire Collective |

| Key Drivers | 15% |

| Tier Type | Tier 3 |

|---|---|

| Market Share (%) | Tradesy, Vinted, Grailed, Rebag, Buffalo Exchange |

| Key Drivers | 35% |

| Brand | Key Focus Areas |

|---|---|

| ThredUp | Resale-as-a-service & fashion brand partnerships |

| Poshmark | Community-driven selling & social commerce |

| The RealReal | AI-based luxury authentication & consignment |

| Depop | Gen Z-focused resale with influencer marketing |

| Emerging Brands | Blockchain authentication & sustainable upcycling |

The secondhand apparel market is going to continue its expansion with AI-powered authentication, sustainability initiatives, and the ever-growing normalization of resale shopping. The companies focusing on smart resale technology, eco-friendly fashion, and social-driven shopping experiences will dominate the market. The future of secondhand apparel is smart, circular, and redefining fashion consumption for the next generation.

Leading players such as ThredUp, Poshmark, and The RealReal collectively hold around 50% of the market.

Independent brands contribute approximately 15% of the market, specializing in vintage and curated thrift fashion.

AI-integrated resale platforms hold about 10% of the market, with expected growth in the coming years.

Online sales represent around 60% of the market, as digital resale platforms continue to dominate.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Mini Refrigerator Market - Product Type, Price Range, Capacity, End-user, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Medical Loupes Market Analysis by Product Type, Lens Type, Application, Sales Channel and Region 2025 to 2035

Driving Protection Gear Market Analysis by Product, Material, Vehicle, Consumer Group, Distribution Channel and Region 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

Residential Hobs Market Analysis - Trends, Growth & Forecast 2025 to 2035

Portable Air Conditioner Market Analysis by Capacity, End Use, Sales Channel and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.