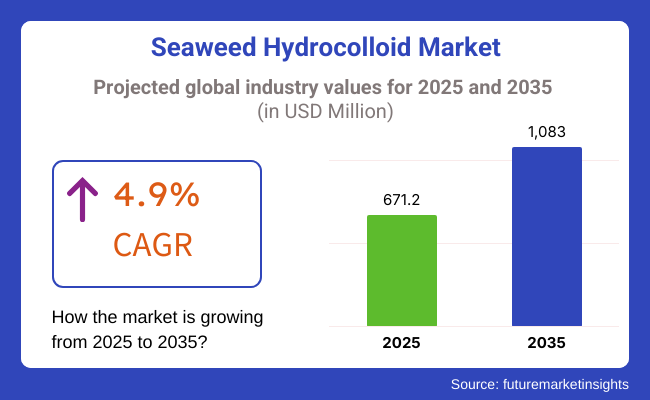

The seaweed hydrocolloid market is projected to reach USD 671.2 million by 2025 and is expected to grow to USD 1083 million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.9% over the forecast period. The global food and beverage industry is witnessing a rise in demand for natural and clean-label ingredients, which consequently propels the growth of this market.

The sustainability of seaweed hydrocolloids is favorable owing to their origin from renewable marine resources, while their attributes as versatile, functional polymers have made them popular in the food, pharmaceutical, and biomedical industries.

One of the key factors driving the growth of the seaweed hydrocolloids market is the increasing demand in the food and beverage industry. These natural hydrocolloids are widely utilized as thickeners, gelling agents, and stabilizing agents in a diverse range of food products, responding to the increasing consumer demand for the use of natural substances instead of synthetic food additives.

Moreover, rising consumer awareness about the health benefits associated with seaweed hydrocolloids is positively influencing the addition of these ingredients to functional foods and nutraceuticals. In addition, the increasing demand for plant-based and vegan diets is also driving the adoption of seaweed hydrocolloids, as they provide natural and sustainable alternatives to animal-based ingredients.

In addition to food applications, seaweed hydrocolloids are increasingly used in the pharmaceutical and personal care industries. Nevertheless, significant barriers to market growth remain, including high production costs, weaknesses in supply chains, and competition from alternative products.

Seaweed hydrocolloid yield can be costly to harvest and process, decreasing profit margins, while external factors such as natural disasters, climate change, or geopolitical issues can disrupt the seaweed supply chain. Moreover, the market share of seaweed hydrocolloids is impacted by the availability of substitute products.

Geographically, the Asia-Pacific region has been the leading market owing to the seaweed applications in countries like Japan, China, and South Korea. Due to clean-label and natural product trends, the North American and European regions are the quickest-growing areas.

To cater to changing consumer needs, key industry stakeholders are focusing on sustainable sourcing, technologically advanced extraction technologies, and product innovations. The market is characterized by the presence of well-established and new players that focus on mergers, acquisitions, and collaborations for product and market expansion.

As the demand for natural and functional ingredients continues to grow, the seaweed hydrocolloid market is expected to witness significant growth. Ongoing developments in processing technologies coupled with increasing applications are anticipated to give rise to lucrative opportunities for market players in the upcoming years.

Buyers prefer hydrocolloids that support clean-label trends, which means naturally sourced, non-GMO, and vegan-friendly ingredients. Supplier selection is influenced by factors such as cost-effectiveness, formulation ease, and stability properties under various processing conditions.

Based on their emulsification, moisture-retaining characteristics, and bioactive components, seaweed hydrocolloids are increasingly used by pharmaceutical and personal care companies. Hydrocolloids are important to drugs for controlled drug release, while for cosmetics, they are natural stabilizers and skin conditioning agents.

Such buyers value consistency in terms of purity, safety, and functionality. Regulatory compliance is a key consideration, as companies are required to meet high standards for ingredient approval. Sustainability advocates and regulatory bodies prefer suppliers that adopt environmentally friendly seaweed harvesting and processing methods.

With the increasing demand for natural and functional ingredients in food products, businesses that prioritize sustainable sourcing, cutting-edge extraction methods, and novel applications will position themselves favorably for future growth. Hydrocolloid market: The seaweed hydrocolloid market is to generate robust growth driven by clean-label trends and widespread use across various sectors.

The seaweed hydrocolloid market experienced significant growth from 2020 to 2024, driven by the food industry's demand for natural thickeners, gelling agents, and stabilizers. The functional properties of hydrocolloids, including carrageenan and agar (from red seaweed), make them indispensable in dairy, meat, and confectionery products. The market was also boosted by the trend for clean-label and plant-based products as consumers looked for foods that have natural ingredients.

The seaweed hydrocolloid market is expected to continue growing from 2025 to 2035. Advancements in extraction methods and responsible sourcing should improve product quality and supply stability. Demand for seaweed hydrocolloids in plant-based and clean-label products will also likely help boost the market. Furthermore, the rising awareness regarding the health advantages of seaweed consumption is projected to increase the use of hydrocolloids in functional food items.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The seaweed hydrocolloid market experienced steady growth, driven by increasing demand in the food and beverage industry for natural additives. | The market is projected to continue its expansion, with advancements in sustainable seaweed farming and processing technologies enhancing production efficiency. |

| Applications were primarily in food and beverages as gelling agents, thickeners, and stabilizers. | Applications are expected to diversify into pharmaceuticals, cosmetics, and biotechnology sectors, leveraging the functional properties of seaweed hydrocolloids. |

| Asia-Pacific dominated production, accounting for a significant share of global supply. | Asia-Pacific is anticipated to maintain its leading position, with North America and Europe experiencing increased adoption due to rising health consciousness and demand for natural products. |

| Challenges included environmental concerns and regulations on seaweed harvesting. | Emphasis on sustainable sourcing and cultivation practices is expected to address environmental challenges and support market growth. |

| Research focused on optimizing extraction processes and expanding applications in various industries. | Innovations in biotechnology and sustainable aquaculture are projected to enhance production methods and application development. |

| Consumer awareness of health benefits associated with natural hydrocolloids contributed to market demand. | Growing consumer preference for clean-label and plant-based products is likely to drive further market expansion. |

| Investments in seaweed farming initiatives increased, reflecting a trend toward sustainable sourcing. | Continued investments in sustainable practices and regulatory support are expected to bolster market growth. |

The demand for seaweed hydrocolloids is growing as they are used as a thickening and gelling agent in food products, pharmaceuticals, and cosmetics. However, various risks could threaten its stability. The large reliance of this category on natural seaweed sources makes this market vulnerable to environmental factors like ocean pollution, climate change, and overharvesting. Profitability can be affected by supply shortages and price swings. To protect this supply in the long term, sustainable harvesting practices and regulated seaweed farming are essential.

Regulatory hurdles, too, present an impediment. Harvesting and processing of seaweed are subject to location-specific policies, which also can delay market development. Adherence to food safety and environmental laws is a key to consumer confidence as well as regulatory signoff.

Another risk is competition from synthetic hydrocolloids and other plant-based alternatives. With the rise of alternative sources of oils, a lot of food and cosmetic manufacturers are looking for economical replacements with similar performance. This demands ongoing studies and technological developments for seaweed-derived hydrocolloids to stay competitive.

There are also challenges associated with the standardization of the product since the chemical composition can vary depending on the type of algae used, which directly influences the properties of the hydrocolloid obtained. Utilizing advanced processing techniques to maintain product quality standardization is crucial to building industry credibility. Companies need to step up their sustainable sourcing, smart processing, and regulatory compliance and investments to reduce the risks in the long run and position themselves competitively.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.20% |

| UK | 6.80% |

| France | 6.90% |

| Germany | 7.00% |

| Italy | 6.50% |

| South Korea | 7.30% |

| Japan | 7.10% |

| China | 7.40% |

| Australia | 6.40% |

| New Zealand | 6.30% |

The industry is projected to witness the growth of seaweed hydrocolloids over the forecast period 2018 to 2026. The shift in consumer preference for clean-label and plant-based ingredients is leading food manufacturers to use carrageenan, agar, and alginate in dairy, bakery, and meat alternatives.

Seaweed hydrocolloids are also harnessed by the cosmetics and pharmaceutical industries for their gelling and thickening properties. Meanwhile, sustainable seaweed farming investments and use in biodegradable packaging are driving industry growth. The FDA's approval of hydrocolloids as food additives also drives the market.

In the United Kingdom, the demand for natural food thickeners and emulsifiers is increasing, which is driving the seaweed hydrocolloid market. Growth in the demand for plant-based diets and vegan-friendly products is helping to propel the use of seaweed-derived hydrocolloids in dairy alternatives, meat substitutes, and gluten-free products.

The cosmetics sector is also introducing the use of seaweed-derived components in skincare and hair care products because of their hydrating and anti-inflammation qualities. The necessity of sustainable supply and the reduction of synthetic additives is increasing the adoption of seaweed hydrocolloids from government initiatives. However, challenges still exist for scaling up production at cost-effective rates.

France is one of the top markets for seaweed hydrocolloids, primarily due to the strength of the country's dairy and confectionery sectors. Carrageenan and alginate are common in desserts, ice creams, and cheeses due to their stabilizing and texturizing functions.

Seaweed hydrocolloids are more common in the pharmaceutical and nutraceutical industries in products used in capsules, gels, and dietary supplements. The French government's promotion of sustainable aquaculture encourages domestic seaweed farming and offers less reliance on imports. Moreover, French luxury cosmetic brands include marine-extracted compounds in their gourmet skin care products.

Germany's seaweed hydrocolloid market is growing, driven by the country's emphasis on food innovation and clean-label ingredients. Demand for seaweed-based thickeners and stabilizers in the functional food and beverage sector is being driven, in particular, by dairy alternatives, sports drinks, and nutritional supplements.

The cosmetic industry is incorporating seaweed-derived bioactive compounds into skincare and anti-aging products. Germany's strong biotechnology sector is also aiding R&D along seaweed processing and extraction techniques to make them more effective and sustainable. Supportive government initiatives towards sustainable food packaging solutions using seaweed-based biodegradable films also call for market growth.

Seaweed hydrocolloids earn demand from Italy's food and beverage sector, especially in the production of gelato, pasta sauces, and processed meat. These are frequently found in uses such as stabilizers and emulsifiers and carrageenan and alginate. Seaweed extracts are also being included in the cosmetic industry now due to their soothing and moisturizing effects.

Seaweed is used in personal care goods. Homegrown hydrocolloid production - a type of viscous substance derived from seaweed - is benefitting from Italy's coastal seaweed farming efforts and offers some hope of reducing reliance on imported sources. The increasing consumer interest in natural and organic food products is also accelerating the adoption of hydrocolloids.

The Korean seaweed hydrocolloid industry is a burgeoning business driven by the country's robust seafood and food processing industries. Generally used to make Korean soups, jellies, or seafood-based dishes, agar, and carrageenan are common in traditional Korean cuisine.

The cosmetics sector has been another major engine, with K-beauty brands using seaweed-based hydrocolloids in moisturizers, masks, and serums. Japan, for example, has government-backed marine biotechnology research programs that promote innovation in seaweed extraction and processing techniques that ultimately lead to more cost-effective production of hydrocolloids. Growing demand for plant-based and functional food products is expected to boost market growth further.

Japan has a long history of seaweed eating and is one of the largest markets for the hydrocolloids from seaweed. Both agar and carrageenan are commonly used in traditional Japanese desserts, dairy products, and ready-to-eat meals.

Seaweed-based hydrocolloids find their way into dietary supplements and medicinal gels in the pharmaceutical and nutraceutical industries. Japan's cosmetics industry is also tapping seaweed-derived components in anti-aging and skin-rejuvenating formulations. Advances in technology are improving the extraction efficiency of seaweed processing, enabling greater domestic production and export potential.

China is a major producer and consumer of seaweed hydrocolloids, and coastal seaweed farms are crucial in hydrocolloid supply chains. The food, pharmaceutical, and textile industries widely use agar and alginate. The increasing trend of veganism has led to a growing demand for plant-based food products, which has led to a rise in the application of carrageenan in dairy substitutes, plant-derived meat products, and functional and high-performance beverages.

Government encouragement for sustainable aquaculture is generating large-scale seaweed cultivation in China. Moreover, advances in biopolymer technology are paving the way for the development of seaweed-based biodegradable materials for use in packaging.

The Australian hydrocolloid-based boom is being fueled by the country's growing interest in sustainable food ingredients and nutrition based on marine produce. Demand for natural thickeners and stabilizers in the food processing industry, especially in dairy alternatives & organic food products.

Government support for seaweed farming is enhancing domestic supply chains and curbing reliance on imports. According to many salons, beauty and personal care companies are increasingly adding seaweed extracts to cosmetics because of their hydrating and anti-inflammatory properties. Market opportunities were created through seaweed-based, biodegradable plastics investments.

New Zealand's interest in sustainable farming and marine resources is driving demand for seaweed hydrocolloids. One of the main consumers is the dairy industry, which uses carrageenan and agar in yogurts, cheeses, and dairy-free alternatives. The pharmaceutical and nutraceutical industries are embedding seaweed hydrocolloids into gel capsules, wound dressings, and dietary supplements, too.

Marine Research Institutions within New Zealand are developing advanced extraction methods, providing solutions to improve hydrocolloid quality and efficiency. Another factor that promotes growth within the market is the growth of plant-based and functional foods.

The industry is segmented into Agar, Carrageenan, and Alginate. Carrageenan retains the most significant share owing to its gelling, thickening, and stabilizing features when utilized in food applications for processing dairy and meat. It also improves texture and lengthens shelf life. Alginate has a high absorption capacity, providing moisture for the wound healing process, and its demand is rising significantly in wound care and pharmaceuticals.

Alginate is also increasingly being used in dental impressions and drug delivery. Agar is transfiguring in microbiology and plant tissue culture since it provides a steady development medium for bacterial cultures and botanic propagation. Its natural gelling is seeing its use in anything from confectionery to vegan desserts more widespread.

Seaweed hydrocolloids were employed prominently in dairy and meat products, which are both the largest segments, as well as in confectionery due to their thickening and stabilizing capabilities. They enhance the mouthfeel of ice creams, sauces, and processed meats. Another major consumer of hydrocolloids is the pharmaceutical industry, which uses these components in drug formulation and controlled release systems to enhance efficacy and patient compliance.

Hydrocolloids are also used in cosmetics to act as emulsifiers and stabilizers in skin and hair care cream formulation. This trend is gaining momentum across various sectors as the demand for plant-based and clean-label components increases, solidifying their position as eco-friendly alternatives to traditional synthetic additives.

The industry is transforming the landscape of alternative sweeteners as consumer awareness of health and wellness issues continues to grow, along with regulatory restrictions on sugar and increasing demand for natural, low-calorie substitutes. Sweet plant-based proteins, such as monellin, thaumatin, brazzein, and miraculin, have developed an increased interest in the industry due to their respectful sweetness and significant functional potential.

A series of advances in precision fermentation, new extraction methods, and growing regulatory acceptance drive the competition in this market.

For instance, key players are entering into strategic collaborations with leading food and beverage companies to strengthen their market existence. The firms that are able to scale production efficiently, maintain the product’s stability, and exploit its clean-label appeal will assume a leading position in the new market. Market leadership will be determined by innovation and cheap production methods as consumers move toward healthier diets.

Major Market Players

| Company Name | Estimated Market Share (%) |

|---|---|

| FMC Corporation | 18-22% |

| CP Kelco | 14-18% |

| DuPont (IFF) | 12-16% |

| Cargill, Incorporated | 10-14% |

| W Hydrocolloids, Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| FMC Corporation | Supplies carrageenan and alginate solutions for food, pharma, and cosmetics. |

| CP Kelco | Specializes in high-performance hydrocolloids for texture and stability applications. |

| DuPont (IFF) | Develops seaweed-derived functional ingredients for plant-based food innovations. |

| Cargill, Incorporated | Focuses on sustainable seaweed sourcing for thickening agents. |

| W Hydrocolloids, Inc. | A leading supplier of carrageenan for dairy and meat applications. |

Key Company Insights

FMC Corporation (18-22%)

A leading supplier of alginate-based solutions, FMC serves food, pharmaceutical, and industrial markets.

CP Kelco (14-18%)

Specializes in natural hydrocolloid innovations, focusing on texture, gelling, and stabilization.

DuPont (IFF) (12-16%)

A major player in food and beverage hydrocolloids, leveraging seaweed-based emulsifiers.

Cargill, Incorporated (10-14%)

Invests in sustainable seaweed sourcing and processing, catering to clean-label trends.

W Hydrocolloids, Inc. (6-10%)

A carrageenan-focused manufacturer, serving dairy, meat, and plant-based food industries.

Other Key Players (30-40% Combined)

Carrageenan, agar, and alginate

Food & beverages, pharmaceuticals, cosmetics, and others.

North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

The industry is expected to generate USD 671.2 million in revenue by 2025.

The market is projected to reach USD 1,083 million by 2035, growing at a CAGR of 4.9%.

Key players include Cargill, CP Kelco, DuPont Nutrition & Health, Gelymar, Algaia, and Agarmex.

Asia-Pacific, driven by high seaweed cultivation, technological advancements, and increasing demand for hydrocolloids in food and personal care products.

Carrageenan dominates due to its widespread application in dairy, meat products, and plant-based alternatives for its gelling and stabilizing properties.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Function, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Function, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: East Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: East Asia Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: South Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 57: South Asia Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 59: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: Oceania Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 67: Oceania Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Function, 2018 to 2033

Table 69: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Function, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Function, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 23: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Function, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Source, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Function, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Function, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Function, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Source, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Function, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 108: Europe Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Source, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Function, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Function, 2023 to 2033

Figure 124: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: East Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: East Asia Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 142: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 152: South Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 153: South Asia Market Value (US$ million) by Function, 2023 to 2033

Figure 154: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 168: South Asia Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 182: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Function, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ million) by Source, 2023 to 2033

Figure 182: Oceania Market Value (US$ million) by Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ million) by Function, 2023 to 2033

Figure 184: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: Oceania Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 198: Oceania Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 202: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Function, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: Middle East and Africa Market Value (US$ million) by Source, 2023 to 2033

Figure 222: Middle East and Africa Market Value (US$ million) by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ million) by Function, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 225: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 227: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: Middle East and Africa Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 231: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 233: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 234: Middle East and Africa Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 235: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 236: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 237: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 238: Middle East and Africa Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 239: Middle East and Africa Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 233: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Seaweed-Based Anti-Aging Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Protein Market - Size, Share, and Forecast Outlook 2025 to 2035

Seaweed Packaging Market Insights - Demand and Growth Forecast 2025 to 2035

Seaweeds Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Seaweed-based Feed Market Analysis by Feed Type, Livestock Application, Sustainability Impact, and Regional Forecast from 2025 to 2035

Market Share Breakdown of Seaweed Flavor Manufacturers

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fermented Seaweed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Commercial Seaweed Market Size, Growth, and Forecast for 2025 to 2035

Brown Commercial Seaweed Market Size and Share Forecast Outlook 2025 to 2035

Processed Eucheuma Seaweed Market

Hydrocolloid Tapes Market Size and Share Forecast Outlook 2025 to 2035

Gum Hydrocolloid Market Analysis by Product Type, Source, and Region through 2035

Analysis and Growth Projections for Food Hydrocolloids Business

USA Food Hydrocolloids Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA