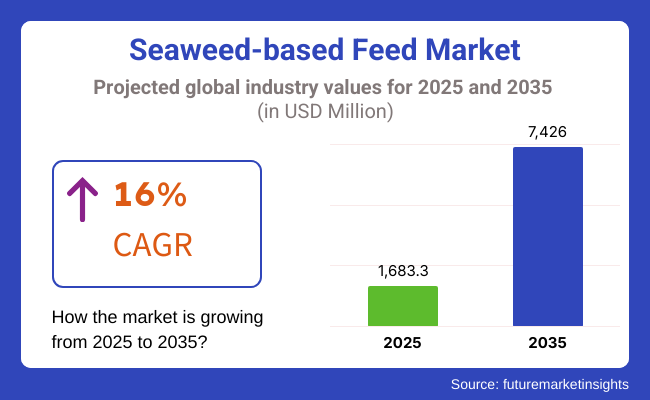

The seaweed-based feed market is estimated to generate USD 1,683.3 million by 2025 and grow above USD 7,426 million by 2035 at a 7% CAGR. Growing awareness of the nutritional benefits of seaweed in terms of improved health and productivity in animals is associated with this growth. Moreover, rising trends for sustainable and natural feed additives are driving the market growth. As livestock producers' preferences change, manufacturers are conducting R&D to provide enhanced products.

Increasing environmental considerations around traditional feed ingredients have driven greater uptake. Seaweed possesses a rich nutritional profile that is abundant in vitamins, minerals, and bioactive compounds, which have been shown to boost livestock health and promote feed efficiency. Research shows that adding seaweed to animals' diets can also mitigate methane emissions from ruminants, furthering goals of global sustainability.

Seaweed-based feed is widely used in the aquaculture sector, as it helps enhance fish growth rates, immune responses, and overall health. In poultry and livestock farming, seaweed-derived additives are used to improve gut health and feed conversion ratio. European and North American markets are the top adopters owing to strict environmental compliance & high demand for organic animal products.

Players have primarily focused on investing in seaweed farming and harvesting techniques. Growing seaweed sustainably creates a secure supply chain while reducing the environmental effects of harvesting wild seaweed. Organizations are pioneering new processing protocols to extract bioactive compounds more economically, contributing to more cost-effective processes. Challenges include raw material price volatility and regulatory uncertainty associated with new feed additives. However, growing research-supported evidence of the potential benefits of seaweed is making the concept more palatable to feed manufacturers and livestock producers alike.

The competitive landscape consists of well-established feed manufacturers, biotechnology companies, and start-ups that aid sustainable agriculture. Joint ventures, mergers, and acquisitions are common as firms seek to grow their product offering and distribution networks. The focus of key players on region-specific formulations as per livestock nutritional requirements is improving their market position.

The seaweed-based feed industry gain strong development as sustainability is being valued. As the livestock sector seeks more sustainable protein sources, and as processing technology will be further advanced, the market will keep growing, providing opportunities for industry and investors in the coming year.

Different end-use segments have varied purchasing criteria for seaweed-based feed. Livestock and aquaculture producers put first on the agenda feed that improves animal health and digestion and reduces the methanogenic fermentation in ruminants. Buyers are more interested than ever in organic, non-GMO, and eco-friendly products, all of which can make purchasing decisions more sustainable.

In contrast, feed manufacturers pay attention only to suppliers that provide high-quality, nutrient-rich formulations that would need to be easily incorporated into existing feed delivery systems. They also need a stable supply chain, documentation, and adherence to regulatory standards for quality and safety purposes. Cost-effectiveness also affects purchasing decisions as customers weigh long-term benefits in terms of feed efficiency against product costs.

Regulatory bodies and sustainability advocates also influence seaweed-based feed. Given the growing recognition of environmental challenges, policymakers and organizations are pushing to promote the use of seaweed-based feed as a more sustainable substitute for traditional feed resources.

Large procurement is increasingly looking into certification for organic production, eco-friendliness, and methane reduction. With technological advancement in the industry, those manufacturers who are significantly involved in research and development for improved processing methods, nutritional enhancement, and sustainable sourcing will be much ahead of the competition. As the need for natural and sustainable feed alternatives increases, the seaweed-based feed market has great potential as the feed market continues to grow.

The seaweed-based feed market has witnessed robust annual growth owing to changing consumer preferences towards sustainable and natural feed additives. It was found that the impressive content of vitamins, minerals, and bioactive elements found in algae propped up both an animal's health and productivity. As a result, the aquaculture and livestock industries adopted this technology more widely. Also, seaweed cultivation's eco-friendly nature, low consumption of fresh water and land, and adherence to sustainable farming contributed to the market growth.

The seaweed feed market is forecast to preserve the momentum it has shown from 2025 to 2035. The scale and efficiency of seaweed farming are likely to improve with new technologies. The inclusion of seaweed-based diets in aquaculture is expected to increase, as they aid in the digestion of nutrients in feed while also promoting nutrient absorption and disease resistance in aquatic animals. Moreover, the adoption of seaweed-based feeds is likely to grow within the livestock industry as a feed component to reduce environmental impacts.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments and private sectors funded research in seaweed cultivation and feed applications. | Advanced biotechnologies and sustainable farming techniques will enhance seaweed-based feed production. |

| Seaweed-based feed gained popularity due to its nutritional benefits and methane-reducing properties in livestock. | Widespread adoption of seaweed-based feed in livestock, aquaculture, and pet food will drive market expansion. |

| Limited scalability and high production costs restricted market growth. | Innovations in large-scale farming, automated harvesting, and cost-efficient processing will improve scalability. |

| Regulatory inconsistencies across different regions posed commercialization challenges. | Harmonized global regulations and increased policy support will ease market entry and encourage adoption. |

| Asia-Pacific dominated the market due to traditional seaweed consumption and aquaculture growth. | North America and Europe will experience accelerated adoption due to sustainability initiatives and organic livestock farming. |

| Research focused on seaweed strains with high bioavailability and nutritional content. | Genetic advancements and optimized feed formulations will enhance nutritional value and cost-effectiveness. |

| Rising consumer awareness of sustainable and organic animal feed drove demand. | Integration of seaweed-based feed into carbon reduction programs and eco-friendly certifications will fuel market growth. |

Seaweed is gaining traction in the feed market, given its sustainability and nutritional profile. However, there are several risks that could undermine its long-term viability. Climate change and overharvesting threaten the availability of seaweed, causing price spikes and shortages. Standardization becomes a challenge due to inconsistent raw material quality, which can lead to inefficient feed formulations over time.

Widespread adoption is limited by elevated production and processing costs when extraction and refinement methods are still costly. To improve profitability, companies need to implement advanced, cost-effective processing technologies. There are also regulatory hurdles, as seaweed harvesting, processing, and animal feed formulations are restricted differently from place to place. Compliance with various jurisdictions may slow the market expansion.

Another risk is the lack of awareness among farmers of the benefits of seaweed-based feed. There is a hesitance to move away from commodity-based feeds due to cost and performance concerns. Adoption could be expanded further through targeted education initiatives and partnerships with agricultural bodies.

Moreover, if conventional feed ingredients and other sustainable feed sources, such as insect-based protein, are competitive in the market, they may affect the market share. Research, differentiated products, and market innovation are crucial for companies. By making the right decisions focusing on sustainable sourcing, regulatory approvals, production scale-up, and consumption of marketing with sustainability, firms can achieve long-term sustainability in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.20% |

| UK | 6.80% |

| France | 6.90% |

| Germany | 7.00% |

| Italy | 6.50% |

| South Korea | 7.30% |

| Japan | 7.10% |

| China | 7.40% |

| Australia | 6.40% |

| New Zealand | 6.30% |

The industry is expanding rapidly due to greater sustainability efforts and methane reductions from livestock farming. As climate change becomes an increasing concern, the USA Department of Agriculture (USDA) is encouraging alternative feed solutions that can reduce greenhouse gas emissions.

They are working to develop seaweed-based feed additives to be included in cattle diets, which is spurring their adoption. Growing consumer interest in organic meat and dairy products has also driven livestock farmers to explore alternative feeding options.

Major players in the industry are investing in large-scale production and processing technologies to maximize cost-effectiveness. The field is also changing, with the FDA regulatory framework adapting to enable the commercialization of seaweed-based feed additives.

The industry is turning to sustainable feed options, with seaweed-based feed growing in popularity thanks to its high protein content and methane-busting qualities. UK government agricultural policy supports the adoption of environmentally responsible feed additives to reduce carbon emissions in both the meat and dairy sectors.

Universities such as the University of Cambridge and agricultural companies are working together to create commercial-scale seaweed-based feed products. Moreover, the growth of demand for organic and grass-fed livestock products is also making the market attractive.

As EU guidelines on alternative feed ingredients have progressed, from time to time, there are regulatory challenges to overcome. Market development is anticipated to accelerate due to investments in supply chain infrastructure and large-scale crops.

France's aquaculture and livestock sectors are major drivers for seaweed-based feed uptake. Comprising sustainable animal nutrition practices, the French Ministry of Agriculture is pushing more research and commercialization with marine feed solutions. With a robust seafood industry, France is seeing demand for seaweed-based aquafeed.

The livestock sector is adding seaweed into animal feed to enhance their well-being and digestion, leading to less use of synthetic antibiotics. Focusing on building domestic supply chains, companies in Brittany and Normandy are investing in seaweed farming initiatives. France's focus on lower carbon footprints in agriculture coincides with the rapid adoption of seaweed-based feed products.

Germany's focus on sustainable agriculture and livestock emissions reduction is driving demand for seaweed-based feed products. Leaders of the Fraunhofer Institute and other research organizations are exploring seaweed-based additives in ruminants' diets that can minimize methane emissions while also improving animal health.

Doubling down on this agreement, the German government has now announced subsidies for alternative feed solutions, as well as encouragement for dairy and beef farmers to consider plant-based nutritional additives. Moreover, the aquaculture sector also has been gradually adopting seaweed-derived protein sources to replace conventional fishmeal. European Food Safety Authority (EFSA) regulatory approvals simplify the adoption of novel feed additives. The high-tech processing capabilities of Germany will be especially significant for scaling the production of seaweed-based feed.

Similar initiatives have led Italy's livestock and dairy sectors to integrate seaweed-based feed to achieve greater nutritional efficiency and sustainability. As the organic farming industry continues to grow, farmers are seeking natural feed alternatives to meet EU organic standards.

Milan and Rome have run research institutions investigating the effects of seaweed additives on ruminant digestion and milk production. In particular, the Italian government is promoting marine-based feed solutions in coastal aquaculture farms.

Consumer demand for high-quality, antibiotic-free meat and dairy products is increasing, thus driving the need for functional feed ingredients. Scaling up production remains a challenge, as Italy's seaweed farming industry is still an emerging sector.

Demand for seaweed-based feed solutions is being fuelled by South Korea's aquaculture and livestock sectors. As part of this drive towards sustainable agriculture, the government has funded programs specifically devoted to the development of marine-based feed.

Local research institutions work with each other to commercialize seaweed-based protein sources for fish and poultry feed. Demand for algal-based protein and omega-3 sources for aquafeed is also increasing in South Korea, where seafood consumption is high, Chang said.

The introduction of smart farming technologies in different steps of cultivation and processing has provided added efficiency for seaweed production. South Korea will further promote the plan to develop the seaweed-based feed industry domestically by focusing on importing feed dependency reduction.

MAFF encourages researchers to study seaweed-based nutrition solutions to raise fish and shrimp. As an example, big companies like Marubeni and Nippon Suisan Kaisha are investing in protein sources derived from seaweed for sustainable aquafeed chains. Conventional seaweed cultivation experience from Japan is contributing to the acceleration of R&D in terms of livestock and poultry feed applications.

Some of this interest is also being driven by rising concerns associated with overfishing and the depletion of fishmeal. Japan's emphasis on high-value functional food covers the consumption of animal nutrition, where the market will continue growing.

The fastest-growing market for seaweed-based feed is located in China, where large-scale aquaculture production and government incentives for alternative feed ingredients drive demand. The growing demand for meat in China provides a strong incentive for the livestock industry to find low-cost, sustainable feeding solutions.

The government's five-year plan for agriculture promotes marine-derived protein sources to improve food security. Seaweed-based nutrition is included in animal feeds by some major feed manufacturers, such as New Hope Liuhe, WH Group, etc. Moreover, technology enhancements in the seaweed farming sector are increasing domestic supply and decreasing dependence on imported protein feed sources.

Australia's livestock industry is moving to seaweed-based feed solutions to cut its methane emissions and meet climate action commitments. Research organizations, like CSIRO, are investigating the advantages of using seaweed-based additives to aid in ruminant digestion and enhance feed efficiency.

Sin's strong advocacy has led the Australian government to fund seaweed farming projects to incentivize domestic production. The use of seaweed-derived feed supplements is also gaining popularity in the pet food sector, which widens the market even further. However, scaling up commercial seaweed farming to meet demand is still challenging.

Dairy and livestock industries in New Zealand are focusing on seaweed-based feed in a bid to help animals be healthier and more sustainable. Grass-fed cattle farming is particularly anticipated to embrace this alternative feed, according to the New Zealand Ministry for Primary Industries.

Research is underway into whether seaweed-based multimixes as supplemental feed to cows will put the pedal down on milk production. As export markets for organic meat and dairy continue to expand, sustainable feed solutions will be key drivers of future market growth.

The industry is segmented into Red Seaweed, Brown Seaweed, and Green Seaweed. Of these, Red Seaweed is leading, due to its high protein and amino acid levels making it a great source of feed for livestock and aquaculture. It boosts growth rates, supports gut health, and minimizes reliance on synthetic additives.

Brown Seaweed, a source of alginates and bioactive compounds, has become an effective supplement in ruminant feed, improving digestion and metabolic regulation. It is also known for its immune-boosting abilities and for reducing methane emissions in cattle. Less common but on the rise is Green Seaweed, known for supporting immune responses in poultry and swine. It serves as a compound that acts as a natural growth promoter and is also rich in vitamins and minerals.

Aquaculture still represents the largest consumer of seaweed-based feed, with a sustainable and nutrient-rich diet for fish and shrimp farming. Marine Plants (Seaweed) based feed improves disease resistance in fish, enhances the growth rates, and increases the overall yield. Livestock feed is also growing, especially in dairy farming; seaweed lowers methane emissions, gives better digestion, and increases milk production.

Seaweed-based feed is increasingly being incorporated by poultry farmers looking to increase egg production and improve the overall health of their birds. As pet owners learn about the benefits of seaweed to gut health and its ability to reduce inflammation in animals, adoption is becoming more gradual in the pet food space.

The industry is a dynamic and rapidly expanding market due to sustainability aspects, advancements in animal feed, and changing consumer preferences for environmentally friendly and organic livestock farming products. It is a marketplace of major agricultural feed companies, biotechnology firms, and innovative startups developing nutritional products derived from seaweed.

Product innovation, regulatory compliance, cost-effectiveness, and scalability of production influence competiton. Sustainability and lower impact on the environment are major selling points that prompt companies to invest in seaweed farming solutions, improved processing technology, and new feed formulations.

Market Share of Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Seakura | 12-16% |

| Olmix Group | 10-14% |

| Seaweed Energy Solutions | 8-12% |

| Acadian Seaplants Limited | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | A leader in animal nutrition, incorporating seaweed-based feed into sustainable livestock diets. |

| Seakura | Specializes in organically grown seaweed for high-nutrient animal feed formulations. |

| Olmix Group | Develops algae-based feed additives to improve animal health and productivity. |

| Seaweed Energy Solutions | Focuses on large-scale seaweed cultivation for both biofuel and livestock feed. |

| Acadian Seaplants Limited | Supplies premium marine plant-based feed ingredients to enhance livestock nutrition. |

Key Company Insights

Cargill, Incorporated (18-22%)

As a global leader in animal nutrition, Cargill invests in sustainable feed alternatives, including seaweed-based solutions for improving livestock health and reducing methane emissions in cattle.

Seakura (12-16%)

A pioneer in controlled-environment seaweed farming, Seakura produces high-nutrient, chemical-free seaweed for livestock and aquaculture feed applications.

Olmix Group (10-14%)

Olmix is known for its algae-derived feed additives, which enhance animal immune systems and improve digestion.

Seaweed Energy Solutions (8-12%)

Specializing in large-scale seaweed cultivation, the company integrates its product into renewable energy and livestock feed industries.

Acadian Seaplants Limited (6-10%)

A leader in marine plant-based nutrition, Acadian provides seaweed-based feed solutions that promote growth and gut health in animals.

Other Key Players (30-40% Combined)

Segments include red seaweed, brown seaweed, and green seaweed, with red seaweed dominating due to its high protein content and superior digestibility for livestock and aquaculture.

The industry caters to ruminants, poultry, swine, aquaculture, and others, with aquaculture leading the market owing to the increasing use of seaweed as a sustainable alternative to traditional fishmeal.

North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA), with Europe leading due to strong regulatory support for sustainable feed ingredients.

The industry is expected to generate USD 1,683.3 million in revenue by 2025.

The industry is projected to reach USD 7,426 million by 2035, growing at a CAGR of 7%.

Key players include Cargill, Corbion, Ocean Harvest Technology, Olmix Group, Acadian Seaplants, and The Seaweed Company.

Europe and Asia-Pacific, driven by increasing demand for sustainable aquaculture and livestock feed solutions.

Red seaweed dominates due to its nutritional benefits, high bioavailability, and positive impact on animal health and productivity.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Source, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Source, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ million) by Source, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Source, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA