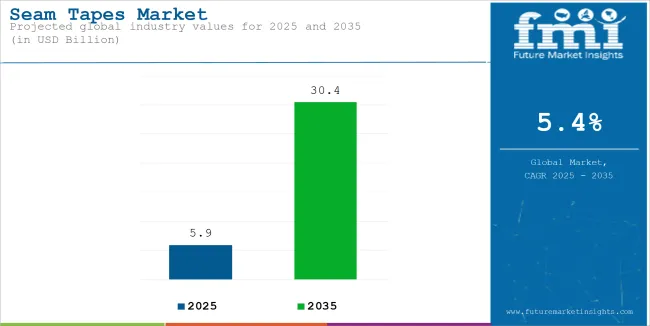

The global seam tapes market is estimated to account for USD 5.9 billion in 2025. It is anticipated to grow at a CAGR of 5.4% during the assessment period and reach a value of USD 30.4 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Seam Tapes Market Size (2025E) | USD 5.9 billion |

| Projected Global Seam Tapes Market Value (2035F) | USD 30.4 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Seam tapes are adhesive strips used to bond textiles and seal seams, preventing water and air from entering. They are commonly applied in outdoor apparel, tents, sportswear, and protective gear, where durability and weather resistance are crucial.

Made from materials such as polyurethane, polyester, and silicone, these tapes offer excellent flexibility and long-lasting performance under harsh conditions. The tapes are typically applied using methods such as heat sealing or ultrasonic bonding, ensuring a secure and durable bond that enhances the overall strength of the product.

These tapes play a critical role in maintaining the integrity of seams, particularly for waterproofing and weatherproofing. By providing a reliable seal, seam tapes help ensure the durability and effectiveness of high-performance products, which are designed to withstand extreme conditions. They are essential in outdoor gear, where protecting the wearer from the elements is necessary while maintaining comfort and flexibility.

As technology advances, eco-friendly materials are being incorporated into seam tapes to meet the growing demand for sustainability in the textile industry. Available in various colors and finishes, they offer both functionality and aesthetic appeal while continuing to evolve for modern applications.

Durability Offered by Polyurethane to Foster Adoption

| Attributes | Details |

|---|---|

| Top Material Type | Polyurethane |

| Market Share in 2025 | 31% |

By material, the market is divided into polyurethane, polyvinyl chloride, and thermoplastic polyurethane. The polyurethane segment is slated to capture 31% market share in 2025.

Polyurethane (PU) seam tapes are the best option since they stand out with their high durability, strength, and resistance to wear and tear. These tapes are ideal for use on outdoor apparel and high-performance gear. Additionally, PU tapes offer excellent waterproofing and flexibility. Thus, they are used in products such as rain jackets, tents, and sportswear to ensure comfort and reliable protection.

Moreover, these tapes are being made with eco-friendly additives and water-based adhesives, thus satisfying the demand for solving environmental issues.

Reliable Bonds Offered by the Product to Increase its Use in Healthcare

| Attributes | Details |

|---|---|

| Top End-use Type | Healthcare |

| Market Share in 2025 | 37% |

By end-use, the market is divided into apparel & footwear, healthcare, automotive, packaging, and others.

The healthcare segment is poised to register 37% market share in 2025.

Seam tapes create sealed joints in medical textiles, reducing the risk of contamination and ensuring sterility in products such as surgical gowns and protective clothing. They also offer a flexible, irritation-free alternative to stitching, enhancing comfort in patient garments, wearables, and medical devices that require long-term use.

Moreover, these tapes provide strong, reliable bonds that withstand the demanding conditions of medical applications, ensuring long-lasting, functional products.

Product’s Suitability for Waterproof Apparel to Expedite Segment Expansion

By application, the market is divided into woven fabrics, non-woven fabrics, waterproofing, and others. Seam tapes are highly used for waterproofing applications as they create strong, reliable seals that prevent water from penetrating seams, making them ideal for waterproof apparel such as rain jackets, tents, and outdoor gear.

Additionally, these tapes maintain their waterproof properties even in extreme weather conditions, ensuring long-lasting protection in outdoor and sportswear applications. They also remain flexible and lightweight, providing protection without compromising the comfort or mobility of the wearer, especially in activewear and outdoor gear.

| Seam Tape Type | Price Range (USD per meter) |

|---|---|

| Polyester and Nylon | USD 0.10 to USD 0.40 |

| Silicone and PU (Premium) | USD 0.50 to USD 1.00 |

| PVC | USD 0.20 to USD 0.50 |

| Heat Sealable and Elastic | USD 0.30 to USD 0.90 |

Pricing Insights:

The growing demand for high-performance tapes in industries such as automotive, sportswear, and outdoor gear is pushing up prices for advanced options including silicone and PU-based tapes.

Factors Affecting Price:

The rising demand for high-performance seam tapes in industries such as automotive, sportswear and outdoor gear is increasing prices for advanced options, such as silicone and PU-based tapes, due to their durability, heat resistance, and specialized features.

Price variations are influenced by factors such as purchase volume (bulk discounts), customizations (e.g., color and pattern), and performance characteristics (e.g., temperature resistance, tensile strength, and waterproofing). These factors lead to a wide price range across different seam tape types based on material and application.

| Region | Imports (USD Million) |

|---|---|

| North America | 50 |

| Europe | 60 |

| Asia-Pacific | 100 |

| Latin America | 10 |

| Middle East & Africa | 5 |

Export-Import Insights:

Asia-Pacific:

Europe:

North America:

Latin America:

Middle East & Africa:

Asia-Pacific leads in imports, with a focus on industrial and textile applications.

Europe and North America are strong players in both imports and exports, particularly for high-performance and specialized seam tapes.

Latin America and Middle East & Africa have lower market activity but show growth potential as demand in these regions increases.

Increasing Demand for Waterproof and Weatherproof Materials to Impel Sales

The seam tapes are mainly driven by the demand for waterproof and weatherproof items, which are mostly visible in the outdoor and sportswear segment.

Customers are looking for goods that can withstand extreme conditions. Thus, there is an increase in the usage of seam tapes in jackets, tents, shoes, and other outdoor products. The growth of adventure sports and outdoor recreation is supporting the need for high-performance, waterproof clothing even more.

Rising Popularity of Technical Textiles to Boost Uptake

The high consumption level of technical textiles in sectors such as healthcare, automotive, and construction is leading the seam tapes market to success. Seam tapes are the best way of achieving water and air-tight stitched seams for the high durability and the dependable operation of those technical textiles.

Some Industries are using tapes for their new high-tech performance products as the rattle of more and more expansion of such textiles is on demand.

High Production Costs May Hamper Demand

The fabrication of seam tapes is usually more arduous as there is a need to use some special materials and advanced manufacturing techniques that may cause the production costs to shoot up.

As a result, the companies are compelled to transfer those expenses to the consumer, who avoids getting seam tapes at a much higher price, thus making it difficult for some of the end-users, especially in price-sensitive industries. Hence, seam tapes have limited applications, mainly because in those situations it is possible to use either cost-effective alternatives or just simpler adhesive solutions.

Increased Demand for Waterproof and Weatherproof Goods

The surge in demand for products made with waterproof and weatherproof material, especially in outdoor gear, automotive, and construction sectors, is a critical factor pushing the seam tapes market further. The use of these special tapes aids in critical moisture protection in garments, tents, and other items that are faced with extreme weather conditions.

Technological Growth in Textile Production

The textile industry has been transformed by new technological solutions, including the development of materials and coatings that can be stitched with tape seams. These innovations not only help fabric products achieve better performance but also make them more demanding for new seam tapes that are long-lasting, adaptable, and protective.

Rising Demand for Eco-friendly Products to Accelerate Uptake

A rapidly rising interest among the public for eco-friendly products is also affecting the seam tapes market. Consumers who are mainly in the textiles, outdoor gear, and sports industries want to use seam tapes that are made of recyclable, biodegradable, or sustainably sourced materials.

This change is a sign of people going for products that reflect their beliefs around sustainability without making them feel as if they are giving up on performance.

Companies are taking the initiative by using adhesives that do not harm the environment, materials that have been upcycled, and new cutting-edge technologies. These strategies have the added advantage of providing long life, waterproofing, and excellent quality while being environmentally friendly. As a result, the market is slowly and steadily moving toward innovative, green solutions.

Major Points:

USA

The USA market is slated to capture 17.9% value share in 2025 owing to strong product demand from the apparel and sportswear industries. The textile industry is encountering strong demand for seam tapes, especially in waterproof and weather-resistant tech clothing and outdoor and sportswear sectors.

As customers are looking for durable and high-performance garments for activities such as hiking and skiing, the requirement for seam tapes is increasing, and athleisure is expanding.

Moreover, technological advancements and innovations are further fueling market growth. Companies in the USA are working on adhesion seam tape technology, spreading adhesives, and creating new eco-friendly options.

India

Indian seam tapes market is poised to account for 6.4% CAGR during the forecast period. The manufacturing growth and export potential of the country is contributing to market growth. The Indian textile sector, which is constantly expanding, has a primary export focus, and seam tapes are among the essential items that ensure the durability and quality of the products.

Moreover, Indian manufacturers have started fully relying on seam tapes, especially in the case of enhanced performance, waterproofing, and sealing, to comply with the rigorous quality standards of the world market.

UK

The sustainability and eco-conscious consumer trends are driving market growth in the country. The UK is slowly embracing the concept of environmentally friendly seam tapes exclusively made of recycled or biodegradable material, which is a direct consequence of consumer demand for such products.

Additionally, policies and programs of the UK government, such as the promotion of sustainable materials in the manufacturing process, are the main forces behind the increased demand for eco-friendly seam tapes.

Germany

The strong automotive sector in Germany sustains the steep market growth of seam tapes, which are used to seal, waterproof, and provide durability in the interiors of vehicles. The German car manufacturers' emphasis on pioneer materials and top-notch production raises the demand for seam tapes, which can stand the test of performance and durability.

The top companies in the market are constantly coming up with new solutions for a diverse range of markets, such as clothing and outdoor, automotive, and construction equipment. Below is the characterization of the leaders in the industry, along with their tactics.

Bemis Associates: The company Bemis is identified with highly efficient adhesive solutions and eco-friendly seam tapes manufactured from recycled materials. With this strategy, the company is focusing both on sustainability and providing versatile products for a variety of applications.

3M: Using its know-how in adhesives and materials science, 3M provides logistic tape for the most recently demanding industries, such as healthcare, automotive, and outdoor gear. Driving factors remain efficiency and adaptability.

Loxy AS: Loxy AS specializes in heat-sealable seam tapes, which are applicable for waterproof and windproof textiles. Their main target is sportswear and protective clothing. They are also keen on the environmental impacts of production.

Sealon: Sealon offers seam tapes for waterproofing and windproofing issues. Like the Loxy AS company, they also invest substantially in R&D to enhance the durability, flexibility, and efficiency of their products.

| Company | Focus Areas |

|---|---|

| Bemis Associates | High-performance & eco-friendly tapes |

| 3M | Durable tapes for diverse industries |

| Loxy AS | Heat-sealable seam tapes for technical textiles |

| Season | Waterproof & windproof seam tapes |

| Regional Manufacturers | Custom solutions for local markets |

These companies are capitalizing on technological advancements and sustainability trends to stay competitive in the growing seam tapes market.

The market for seam tapes is facing a boost with innovative companies concentrating on sustainability and targeted applications. The two leading companies that are actively participating in this recent trend are BastCore and Biov8.

BastCore (USA):

Biov8 (Europe):

By committing to research and development, both firms have found a unique position in the competitive environment.

By material, the market is segmented into polyurethane, polyvinyl chloride, and thermoplastic polyurethane.

By application, the market is segmented into waterproofing, woven fabrics, non-woven fabrics, and others.

By end use, the market is divided into apparel & footwear, healthcare, automotive, packaging, and others.

Based on the region, the market is segmented into North America, Latin America, Europe, South Asia, East Asia, Middle East & Africa, and Oceania.

The market is anticipated to reach USD 30.4 billion by 2035.

By material, the polyurethane segment is slated to witness 31% market share in 2025 and this material is being highly preferred.

Some of the notable product manufacturers include 3M Company, Toray Industries Inc., Himel Corp., and others.

North America, specifically the USA is a key hub for product manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seam Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

De-seamable Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Can Seamer Market

Double Seam Bowl Market

Evaluating Cold Drawn Seamless Steel Pipes Market Share & Provider Insights

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Beverage Can Seamers Manufacturers

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Foil Tapes Market

Nano Tapes Market

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Washi Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Tapes Market Insights – Growth & Demand 2025–2035

Market Share Breakdown of Paper Tapes Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA