The seafood packaging sector is rapidly changing, with changing times bringing new sensibilities in freshness, safety, and sustainability as priorities for companies. Today, consumers and businesses expect high-barrier-these features in tamper-proof, eco-friendly, and waste-minimizing packaging that extends shelf life.

The consumption of seafood is increasing with global regulations becoming stricter; manufacturers now produce recyclable, biodegradable, and vacuum packaging to maintain the integrity of fresh, frozen, and processed seafood.

Companies thus invest in active packaging, modified atmosphere packaging (MAP), and antimicrobial coatings which would insure product quality while at the same time dealing with post-harvest losses. The emerging trends also testify to the transformation of the industry toward lightweight moisture-resistant materials and smart packaging technologies which can provide freshness and traceability in real-time monitoring.

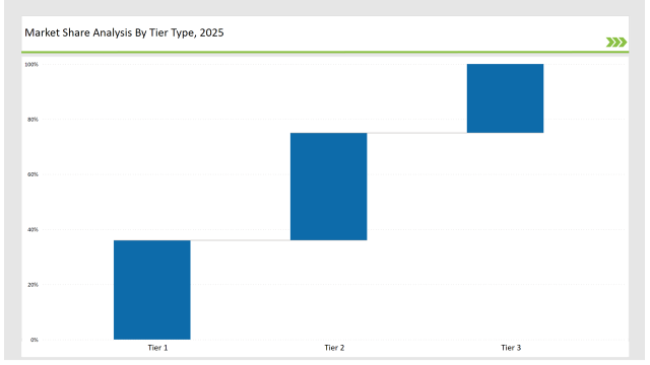

Amcor, Sealed Air, and Berry Global are the tier 1 players, capturing 36% of the market, thanks to their superior high-performance seafood packaging, advanced innovation in materials. Furthermore, most of them have expansive networks across the globe.

Coveris, Mondi Group, and Winpak are some examples of tier 2 companies, disbursing 39% of the market by being cost-effective and flexible, optimizing customized seafood packaging options for different channels of distribution.

Tier 3 consists of regional and niche players for example, biodegradable packaging for seafood, insulated containers, and vacuum sealed innovation, which together hold 25% of the market. These companies do localized production, sustainable materials, and smart packaging technologies.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Berry Global) | 19% |

| Rest of Top 5 (Coveris, Mondi Group) | 11% |

| Next 5 of Top 10 (Winpak, DS Smith, Sonoco, Cascades, Faerch Plast) | 6% |

The seafood packaging market caters to various segments in which freshness, durability, and sustainability remain imperative. Companies offer high-barrier and intelligent packaging solutions as a response to growing demand across the globe. They incorporate antimicrobial coatings to minimize the chances of bacterial contamination so that shelf life can be extended. In addition, manufacturers are investing heavily in lightweight moisture-resistant packaging to further maximize the efficiency of transportation. As a consequence, the firm improves the use of blockchain and digital labeling in the seafood industries for traceability and international safety compliance.

Manufacturers are optimizing seafood packaging with food-grade materials, smart technology, and sustainable solutions. They are integrating high-barrier coatings to improve resistance against moisture and oxygen exposure. Companies are designing resealable packaging to offer convenience and maintain seafood freshness for longer periods. Additionally, firms are adopting digital printing techniques to enhance branding and improve consumer engagement with traceable packaging solutions.

The sustainability approach and food safety measures are changing the face of the seafood packaging industry. AI-assisted quality control, antimicrobial packaging, and intelligent labeling: the new-age solutions to preventing the wastage of a seafood product and promoting its freshness. Ocean-friendly recyclable films to substitute plastic-based packs are being developed by companies. The manufacturers add traceability to smart packaging through QR codes to create transparency for the consumer. At the same time, companies are working on lightweight insulation materials to reduce shipping costs and carbon footprint.

Year-on-Year Leaders

Technology suppliers should focus on automation, high-barrier materials, and active packaging technologies to support the evolving seafood packaging market. Collaborating with food retailers and logistics companies will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Berry Global |

| Tier 2 | Coveris, Mondi Group, Winpak |

| Tier 3 | DS Smith, Sonoco, Cascades, Faerch Plast |

The top manufacturers are focused on improving packaging technologies for seafood using AI for production, high-barrier films, and environmentally friendly solutions. Vacuum-sealing techniques are enhanced to improve freshness and shelf-life. Companies are also developing temperature-sensitive labels that change color to indicate product freshness. Eventually, ergonomics will be improved to facilitate more product handling and storage by end consumers and retailers.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched recyclable high-barrier seafood films in March 2024. |

| Sealed Air | Developed vacuum-sealed skin packaging for seafood in April 2024. |

| Berry Global | Expanded moisture-resistant biodegradable seafood trays in May 2024. |

| Coveris | Released MAP packaging solutions with anti-leak technology in June 2024. |

| Mondi Group | Strengthened flexible, compostable seafood packaging in July 2024. |

| Winpak | Introduced freshness-tracking smart labels in August 2024. |

| DS Smith | Pioneered ocean-safe packaging alternatives in September 2024. |

The seafood packaging market is transforming with the advancement in investments made by different companies on the sustainable materials, smart tracking solutions, and AI innovations. Manufacturers are improving the vacuum-sealing technology to prolong the freshness and shelf life of the product and minimize food wastages. Bacteria growth is prevented and food safety is improved as companies integrate antimicrobial films based on nanotechnology. Biennially treated in conjunction with the changing demands of the consumers toward eco-friendly packaging, companies are enhancing biodegradable materials to suit worldwide sustainability objectives.

The industry will continue integrating AI-driven inspection, recyclable materials, and smart packaging solutions. Manufacturers will refine antimicrobial packaging technologies to improve food safety. Businesses will expand high-barrier films to enhance freshness and reduce food waste. Companies will develop interactive, traceable seafood packaging to provide real-time freshness updates. Digital authentication will improve transparency in seafood sourcing. Additionally, firms will optimize insulation and lightweight packaging materials to reduce shipping costs and environmental impact.

Leading players include Amcor, Sealed Air, Berry Global, Coveris, Mondi Group, Winpak, and DS Smith.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, food safety, smart packaging, and extended shelf-life solutions.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.